US 2022 Economic Outlook: Strong but Slowing Growth, Elevated Inflation and Policy Normalization

We expect strong but slowing growth, elevated inflation and accelerated Fed policy normalization

- We expect economic activity to remain strong in 2022, but expand at a slower pace relative to 2021.

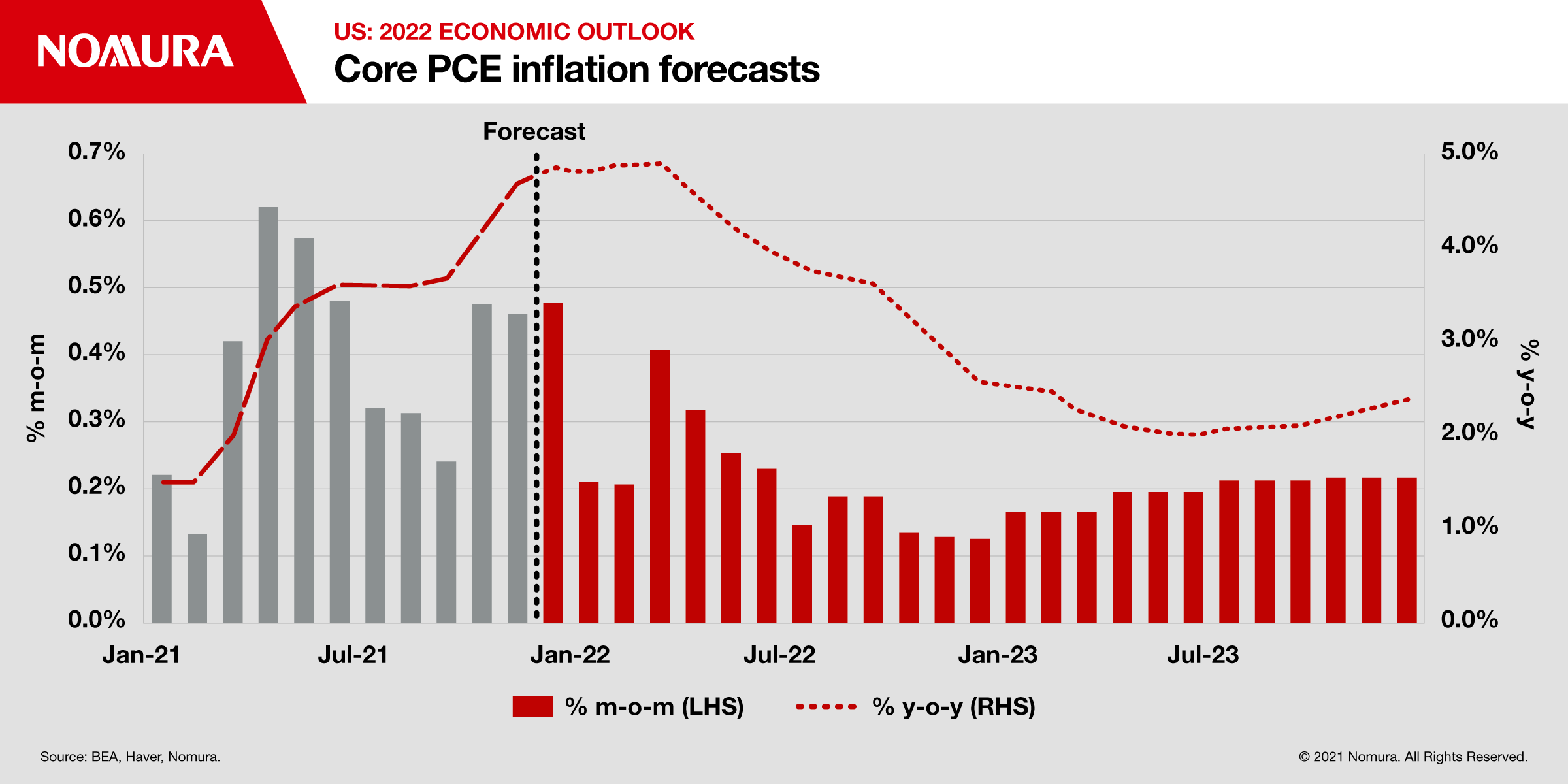

- Our forecast anticipates a slowdown in monthly core inflation in the next year despite short-term volatility due to the Omicron variant and healthcare policy changes.

- However, should elevated monthly inflation persist, the Fed’s long-held narrative of abating price pressures may ultimately collapse, resulting in a faster and longer hiking cycle.

- Against that backdrop, we believe the FOMC will implement an accelerated pace of normalization in 2022. We expect four rate hikes in 2022, with liftoff in March, along with balance sheet normalization announced in July and implemented in August.

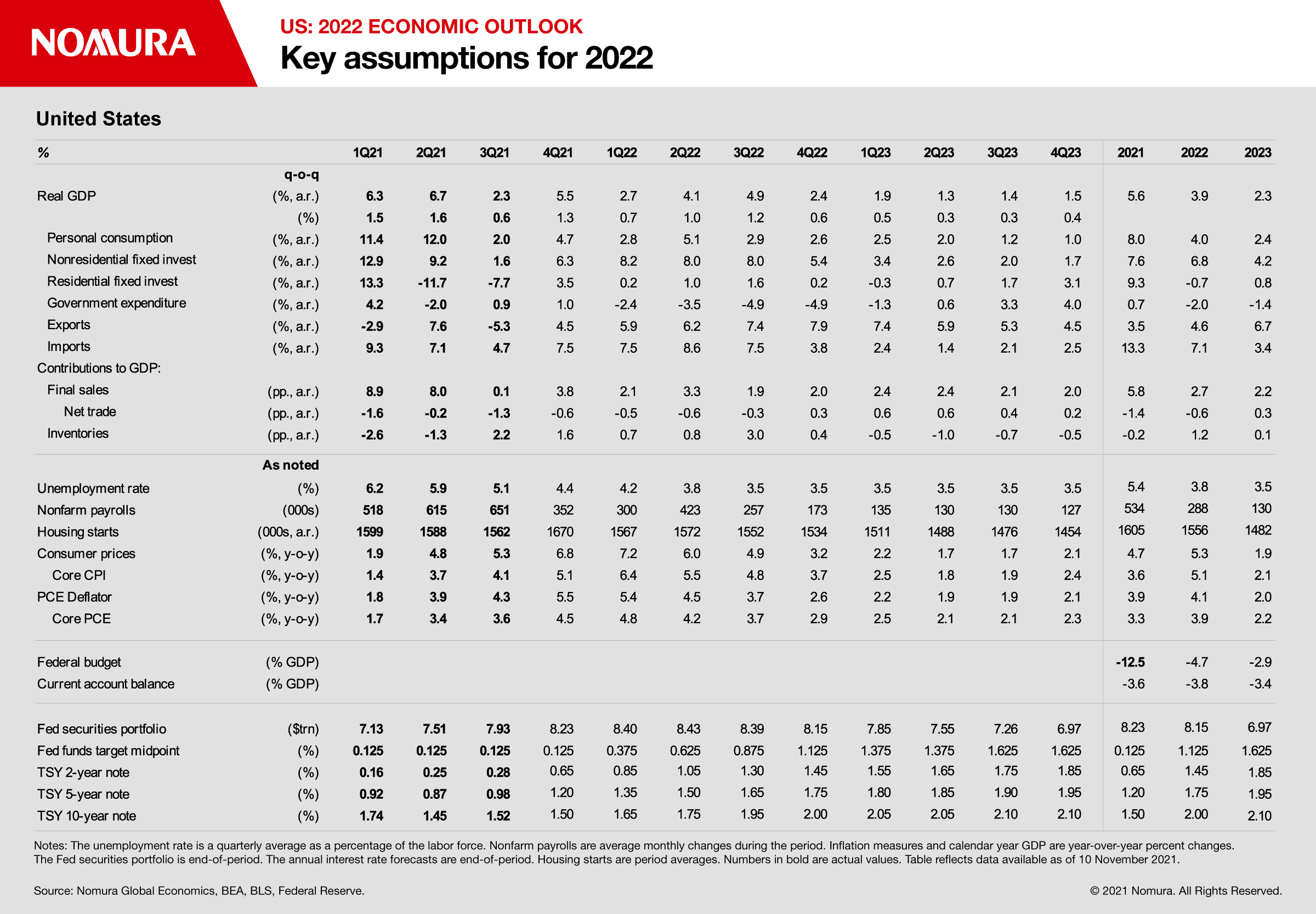

We expect economic activity to remain strong in 2022, but expand at a slower pace relative to 2021. We believe the US economy faces an inflation inflection point in 2022. Our forecast anticipates a slowdown in monthly core inflation in the next year despite short-term volatility due to the Omicron variant and healthcare policy changes. However, should elevated monthly inflation persist, the Fed’s long-held narrative of abating price pressures may ultimately collapse, resulting in a faster and longer hiking cycle. The labor market recovery should continue with the unemployment rate falling to 3.5% by mid-2022.

Against that backdrop, we believe the FOMC will implement an accelerated pace of normalization in 2022. We expect four rate hikes in 2022, with liftoff in March, along with balance sheet normalization announced in July and implemented in August. As the FOMC approaches a broad range of neutral rate estimates, we expect them to slow the pace of rate hikes to two per year in 2023 and 2024 before reaching a terminal rate of 2.00-2.25%.

The outlook for the pandemic and growth

The US enters another COVID wave, but with lockdowns unlikely

The latest COVID surge is likely to weigh on near-term service activity and NFP growth, but we expect that impact to begin to reverse in Q2 2022. However, the inflationary impact of Omicron could be longer lasting as the recovery in supply chains, labor supply and normalization of goods consumption are delayed, helping to keep the Fed hawkish. Omicron-induced supply constraints could also slow inventory recovery.

Resilient consumer spending from excess savings supporting GDP growth

We expect real GDP growth to moderate to 3.9% y-o-y (3.5% Q4/Q4) in 2022 and 2.3% y-o-y (1.5% Q4/Q4) in 2023. Despite waning fiscal support, elevated personal excess savings will likely support personal spending, which should rise by 4.0% and 2.4% y-o-y in 2022 and 2023, respectively. Personal consumption has remained strong after the expiration of enhanced unemployment benefits and distribution of stimulus payments. We think three factors explain robust growth: excess savings, increased wealth due to higher asset valuations and easing household financial conditions.

While we see upside risks to our consumer spending outlook, there are a few potential countervailing factors. A sharp correction in asset prices and higher interest rates, as monetary policy normalization continues, may dampen consumer sentiment. In addition, the recent broadening of inflationary pressures, including higher rent, energy and food prices, might continue to diminish consumers’ purchasing power, although strong wage increases may boost consumers’ future income. Finally, an emergence of more vaccine-resistant virus variants could slow the COVID-sensitive services recovery

The BFI outlook depends on supply chain normalization and inventory rebuilding

We expect robust growth in business fixed investment (BFI) of 6.8% in 2022 and 4.2% in 2023. Inventory rebuilding will likely add 1.2pp to real GDP growth in 2022, although significant uncertainty remains around supply chain normalization. Within BFI, we expect strong increases in equipment spending and intellectual property, but a more gradual recovery in nonresidential structures.

Given the pandemic revealed vulnerabilities of complex global supply chains and just-in-time inventory management, firms might raise comfortable levels of inventories, posing upside risk to our inventory investment forecast. Strong incentives for inventory buildup should support economic growth, even after final demand starts to moderate.

In addition, easier lending standards and accommodative financial conditions should support overall investment spending. In particular, corporate credit spreads remain very low despite the increased uncertainty posed by the Omicron variant. Continued economic recovery with high utilization should improve business confidence to expand capacity.

External demand and US net exports – import growth is likely to outpace exports

The strong domestic growth outlook suggests import growth will continue to outpace exports in 2022, leading to a 0.6pp drag from net exports. Export growth should catch up as the external growth outlook improves and domestic demand wanes further in 2023.

The external environment will likely remain less accommodative in 2022, as the slowdown in global output growth amid record supply delays weighs on demand for US goods and services. As the latest COVID-19 surge continues to subside in Asia, there are some signs of a pickup in regional activity, but growth momentum in China is slowing. In addition, the accelerating COVID surge across Europe and the escalation of targeted restrictions on social activity in some areas suggest downside risk.

Housing market normalization continues, albeit slower than we expected

We expect home price appreciation (HPA) growth to normalize gradually in 2022 amid resilient demand and limited housing supply after double-digit growth in 2021.

Inflation’s moment of truth

2022 inflation will be critical for the Fed; we expect a gradual slowdown

The path of monetary policy depends critically on the course of inflation. In particular, if monthly core inflation does not moderate in H12022, the Fed’s upcoming hiking path may need to be steeper and with a higher terminal rate than we expect. As a result, we believe inflation faces a moment of truth in H1 2022.

The medium-term inflation outlook faces upside risks

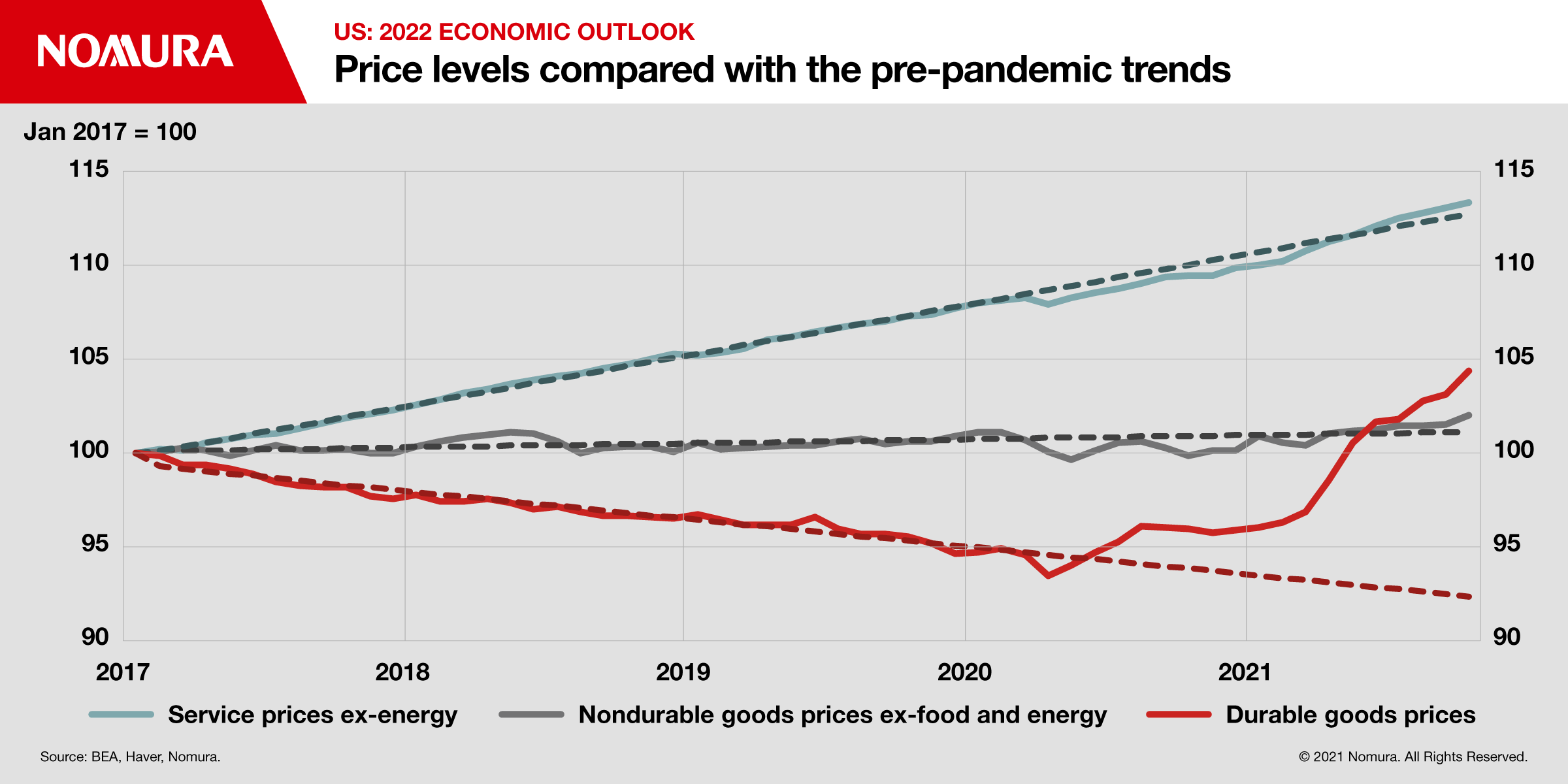

We see medium-term upside risks to the inflation outlook, particularly from rent and imputed owners’ equivalent rent (OER). Strong housing demand and domestic migration have exacerbated imbalances in housing markets, raising both home prices and rents. As a result, many private measures of rent inflation have accelerated strongly.

Some areas of downside risk for inflation in 2022

Although we see net upside risk to our inflation forecast, there are some downside risks. The aforementioned healthcare price changes, including drug prices through public health insurance, could drive down inflation more than we expect. In addition, we see significant uncertainty around the timing and magnitude of our expected reversal of durable goods price increases as supply chains normalize.

Fed policy will continue to adapt

Key assumptions for policy and risks

In 2022, we expect the Fed to conclude net asset purchases in mid-March with the first rate hike at the March FOMC meeting, followed by three additional rate hikes during the year (June, September, December). In addition, we expect the FOMC to announce balance sheet runoff at the July meeting, effective August.

As the FOMC approaches a broad range of neutral rate estimates, we expect them to slow the pace of rate hikes to two per year in 2023 and 2024 before reaching a terminal rate of 2.00-2.25%. However, should inflation prove more persistent than we expect, we believe the Fed may need to hike rates to a higher terminal rate relative to our expectations, potentially into restrictive territory. Conversely, if financial conditions tighten substantially in reaction to rate hikes and balance sheet runoff, the pace of rate hikes may become slower than we expect.

We expect the 10yr US Treasury yield to reach 2.00% by end-2022 as concern over the Omicron variant fades and the Fed remains on track to continue policy normalization.

For more information, read the full report here

Contributor

Aichi Amemiya

Senior US Economist

Robert Dent

Senior US Economist

Kenny Lee

US Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.