US: 2021 Economic Outlook: Searching for normal

- Despite near-term drag from the pandemic, vaccine distribution in 2021 should result in accelerating economic recovery, particularly for social consumption.

- The Fed will likely remain on hold at least through 2023 while waiting to taper asset purchases until 2022 given persistently below-target inflation and recovering labor markets.

- Policymaking in Washington D.C. will likely be constrained by partisanship, making a modest infrastructure bill the most likely successful legislative initiative under the incoming Biden administration.

The global pandemic in 2020 delivered an unprecedented shock to the US economy, affecting almost every aspect of daily activity. We believe the US economy in 2021 will be characterized by a search for normalcy, in both economic activity and policymaking. With vaccine distribution now underway, and a significant portion of the population likely to be vaccinated by Q2 2021, a rebound in social consumption should help bolster growth towards the middle of the year.

President-elect Biden’s victory in November, combined with better-than-expected performance for down-ballot Republicans, suggests a strong voter appetite for more normal and predictable policymaking out of Washington as opposed to sweeping institutional change.

Stronger growth, bolstered by social consumption, progress towards full employment, and below-target inflation

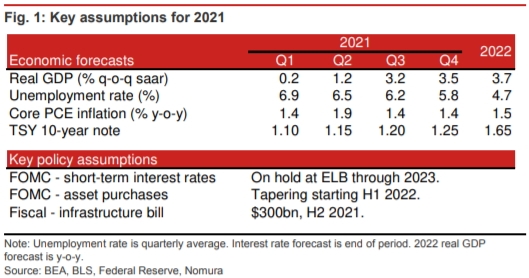

Against that backdrop, we expect real GDP growth to rebound in 2021, rising 3.0% y-o-y (2.0% Q4/Q4) after declining 3.5% y-o-y (2.3% Q4/Q4) in 2020. We expect the rebound in 2021 to be bolstered by growth in personal spending, which should rise 4.5%, and a solid 14.7% increase in residential investment. Nonresidential business fixed investment should accelerate in 2021, rising 3.8%, but the recovery will likely be more gradual given persistent uncertainty over the outlook for commercial structures investment.

As significant fiscal stimulus enacted in 2020 begins to wane, and because finances for state and local governments likely remain bleak, we believe real government spending will be a weak spot for the economy, declining 3.8% during 2021. Moreover, a relatively stronger rebound in imports over exports should result in a notable drag from net exports during the year.

The labor market should continue to make progress towards full employment, but at a slower pace relative to the faster-than-expected recovery in 2020. We believe the unemployment rate will decline only 0.3pp to 6.4% by mid-2021 before a sharper decline over H2 2021, reaching 5.7% by the end of the year. However, we believe policymakers will need to broaden their view of labor market conditions beyond the unemployment rate and developments in labor force participation will become increasingly important.

Given the disproportionate impact on renters during the pandemic and ongoing rental market imbalances, we expect decelerating rent inflation to weigh on overall core PCE inflation, keeping it below the Fed’s 2% target through 2021 (and 2022), aside from a transitory increase in Q2 due to base effects. We expect long-term inflation expectations to rise gradually over the forecast horizon due to the Fed’s new inflation framework.

Policymaking from the Fed and Washington

The Fed’s new strategy of flexible average inflation targeting (AIT) and our expectation of persistently below-target inflation and a slower labor market recovery will likely help keep the FOMC’s target for short-term rates at the effective lower bound at least through 2023. In 2021, we expect more attention to be given to the Fed’s asset purchases. We believe the Fed’s new qualitative outcome-based guidance (QOG) will result in the Fed keeping net purchases of Treasury securities and MBS constant through 2021 before gradually beginning to taper in 2022. The Fed’s focus will likely remain on ensuring that a sudden rise in long-term rates does not constrain the economic recovery.

Under President-elect Biden, policymaking in Washington should normalize and become more predictable. However, a likely divided government may significantly constrain the expansive agenda Biden proposed during his campaign. We expect an infrastructure agreement to be one area of bipartisan cooperation, most likely totaling $300bn and reached sometime during the middle of the year. Some aspects of the Trump era, including strained US-China relations, are likely to persist given widespread bipartisan sentiment for taking a strong stance against China. Overall, however, we believe the Biden administration will seek a much more traditional, transparent and predictable approach to policymaking.

For more information, please see our full report here

Contributor

Lewis Alexander

Chief US Economist

Aichi Amemiya

Senior US Economist

Robert Dent

Senior US Economist

Kenny Lee

US Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.