Urbanization and Population Growth to Drive Waste Recycling Opportunities

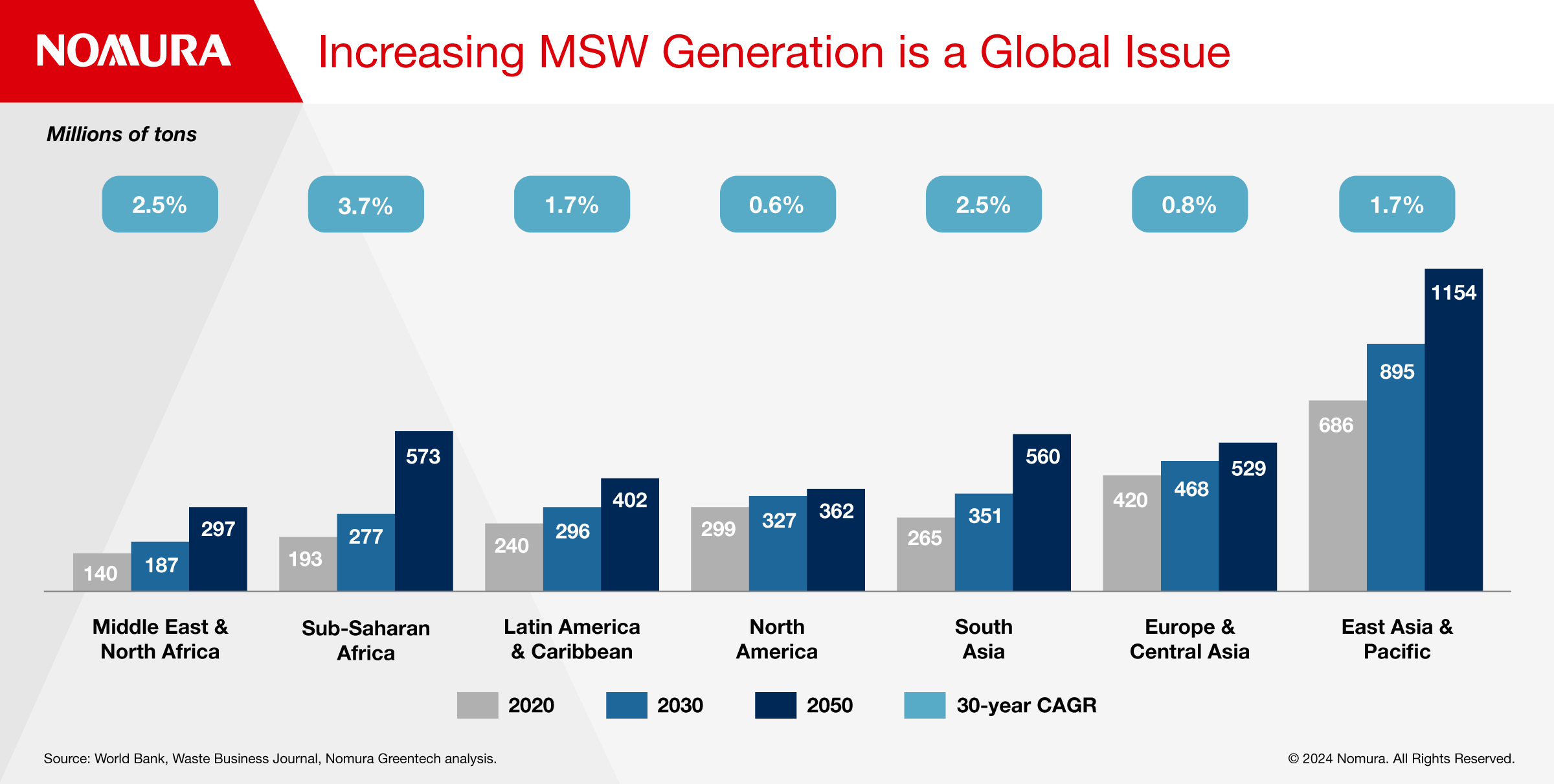

Global annual waste generation is expected to jump to 3.9bn tons by 2050

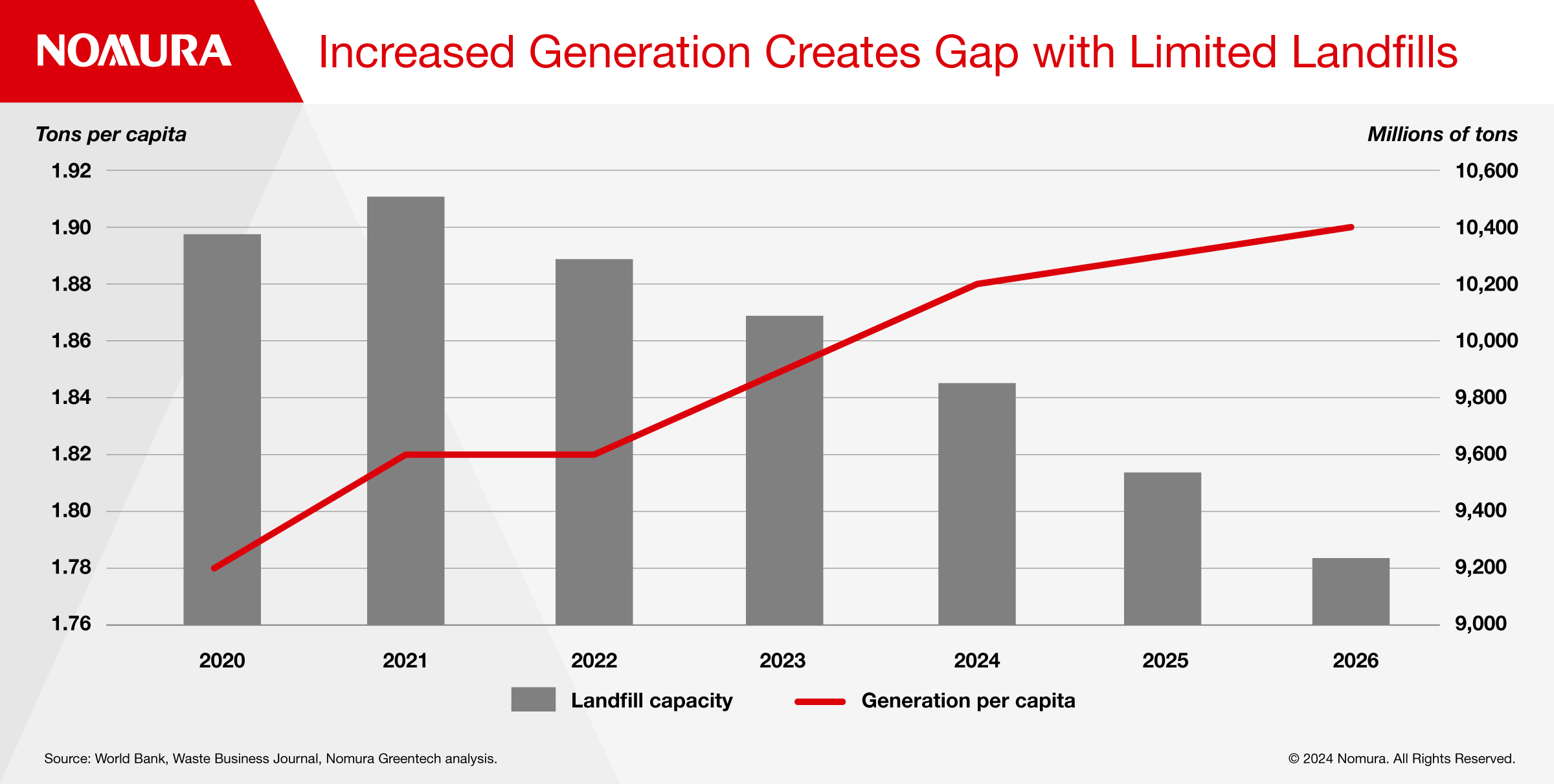

- Growth in waste generation in absolute terms and per capita is driving demand for circularity in disposal

- Decreasing landfill capacity in the US will drive a need for increased recycling

- Extended Producer Responsibility rules are a long-term growth driver; key learnings for other geographies to be gained from Europe as an early mover

A growing population of city dwellers, a shortage of landfills, and regulatory forces are driving opportunities in waste recycling technologies, according to executives at Nomura Greentech’s Sustainable Leaders Summit.

Global annual waste generation is expected to jump to 3.9 billion tons by 2050 compared to 2.2bn tons in 2020. While most of the increase is being led by regions with high population growth, the US share is also set to increase and represents the largest amount of waste per capita.

Since the 1990s, total landfills in the US have decreased from about 6,500 to 1,800 today. That reduction in capacity is creating a need for increased diversion of recyclable materials. Long permitting processes and increasing NIMBYism means adding enough additional landfill capacity to meet increased demand is challenging, driving the need for innovative disposal alternatives, the CEO of a waste services company said at the summit, held under the Chatham House Rule.

One executive cited Long Island in New York State as an example of an area where all landfills and incinerators will be shut in the next five years with a plan to export waste to Ohio, which is not a sustainable long-term solution.

The good news is that such landfill policies are driving technological and other solutions to improve recovery yields for plastics and metals.

The waste company CEO explained that organizing the collection and sorting of municipal waste is more efficient if landfill is prohibited. He said that ‘vending machine style’ recycling will be coming to the US and will eventually become mandatory across different states to address the challenge of glass and plastic bottles ending up in landfill.

He gave the example of Germany where plastic bottles are returned to the supermarket and deposited in a vending machine with the customer being reimbursed for recycling.

“You can’t imagine the business opportunity that this represents,” the CEO said. “In this case, the machine reads the barcode on the bottles it receives and can tell if that particular brand is using PVC in which case, it pays out less as a credit, it can measure the quality of the PET bottle.”

He explained that the machine also incorporates a shredder to create more space for extra bottle deposits compared to conventional recycling systems, while also reducing transportation costs.

The CEO explained that supermarkets in Europe are starting to connect instore recycling with fuel points and grocery discounts to incentivize further recycling. They also use software solutions that link recycling to payment processing like PayPal.

Diverting organics and recyclables from landfills decreases carbon emissions, energy usage and depletion of natural resources, enabling waste companies to reduce labor costs and increase the quality of recyclable commodities.

Regulatory drivers are also playing an increasingly important role in waste management. The Extended Producer Responsibility system (EPR) puts the onus on producers to reduce their environmental impact and manage their product across its entire life cycle especially for take-back, recycling and disposal. Under a collective EPR system, producers can pay a fee to assign partial or full responsibility to third parties.

The EU is introducing a new EU Packaging Regulation in late 2024 to provide enhanced obligations such as mandatory recycling targets and empty space ratio limits of 40% to ensure oversized boxes aren’t used for small items. The US has a State-led approach to waste management and only six US states have active EPR or similar packaging laws in place, but other states are expected to drive an expansion of the rules in the coming years

Despite these tailwinds, an executive who invests in the sector explained that he was reticent to back new entrants in the US market as he sees a risk that incumbent waste management companies with the supply chains in place could better compete.

But he said he had confidence in other aspects of the business such as securing 12-year minimum offtake agreements with petrochemicals companies

Another executive said that the “tipping point is to get a major municipality to buy in and say ‘we’ve got a problem we don’t know how to solve and waste management companies are not invested in solving this problem because it’s a total shift for them. We recognize that so we need a new partner.’”

The executive added that another challenge for the sector concerns technology validation at scale, moving from 10 tons of recycling capacity today to 400 tons.

“It’s interesting because the big oil and gas companies of the world will pay anything but can’t get the scale or volume they need.”

The executive participants also debated how to drive behavioral change among consumers to embed a culture of recycling.

The waste management CEO explained that a trial is underway in Houston with people in different neighbourhoods being requested to put plastic bottles with all other plastics in a single recyclable bag. He said that initial results of this simpler system had been positive.

Another participant said that The Recycling Partnership conducted a study that showed there are only two ways to drive consumer change: incentives or social stigma. Consumers need to be paid, penalized or stigmatized for being the outlier among their neighbors.

Download a PDF of the full whitepaper

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.