UK Outlook 2020

How will the UK fair amongst some Brexit clarity, will 2020 be the year of recovery?

- We think growth will recover in 2020 largely because we are going to see some benefit from an improvement in the global backdrop.

- We are also expecting some of the Brexit uncertainty of 2019 to disappear.

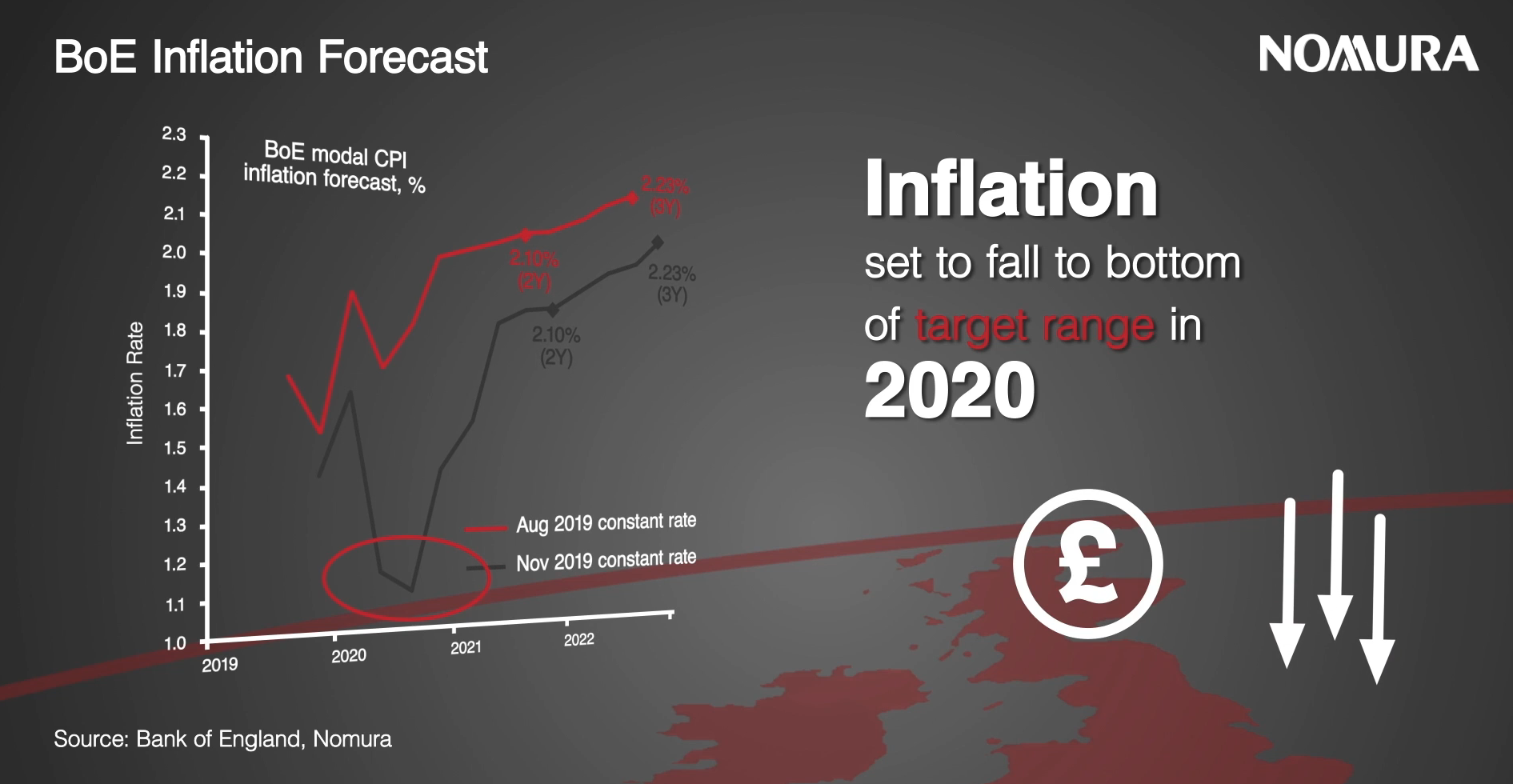

- The BoE is predicting inflation to fall as low as 1%, but we believe it will head back up to its target rate of 2% by the end of the year.

With a conservative majority lifting some of the weight off Brexit uncertainty, combined with a halt to the global economic slowdown, we are expecting economic growth to return to the UK by the end of the year. However, we must first move through a slump whereby the BoE is predicting inflation to fall as low as 1%.

The BoE is an inflation- targeting central bank and tries to achieve a inflation target rate of 2% at all times, so the fact that we have weak economic growth and inflation falling well below its target in the near term, means the bank may well need to cut interest rates to see us through this period of trouble.

"Economic growth is running at its lowest rate for quite some years. We think that growth will recover in 2020, largely because we are going to see some benefit from an improvement in global backdrop, but also because we are going to see some Brexit uncertainty disappear."

If we are right and inflation does recover back to target and economic growth does return to the UK, then the BoE might find itself thinking about raising interest rates by the end of 2020 or the start of 2021. However this will not be a swift increase, but to use their own words 'in a gradual, unlimited fashion'.

For a more in-depth analysis of our 2020 forecast, read our full outlook here.

Contributor

George Buckley

Chief UK & Euro Area Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.