Time for the National Pension Service to escape “home bias”

- What is the National Pension Service (NPS)?

- What does asset allocation do?

- How will the NPS become more ambitious in accelerating its allocation shift to overseas assets?

The National Pension Service (NPS) is Korea’s social security reserve fund. It was created in 1988 to support the retirement benefits of its citizens and has evolved into a global institutional investor with total assets under management of KRW618trn (37% of GDP) as of October 2017. In 2013, the government estimated NPS assets would surge to KRW2561trn in 2043. However, given Korea’s aging population, this is likely to drop over time. Therefore, over the next 15 years, the NPS will have the opportunity to maximize its investment returns, as we expect the fund’s size to expand significantly – without any outflow pressures until 2033, when total benefits are expected to start exceeding total contributions.

Asset allocation ultimately determines the long-term investment performance of any pension fund. We see five reasons why the NPS will become more ambitious in accelerating its allocation shift to overseas assets, particularly equities:

1) The need for sustainably higher investment returns

We believe the NPS can enhance its long-term financial sustainability by further increasing its investment returns, which can also help reduce the government’s rising future fiscal burden, as Korea will have the fastest ageing society in the world over the next 30 years.

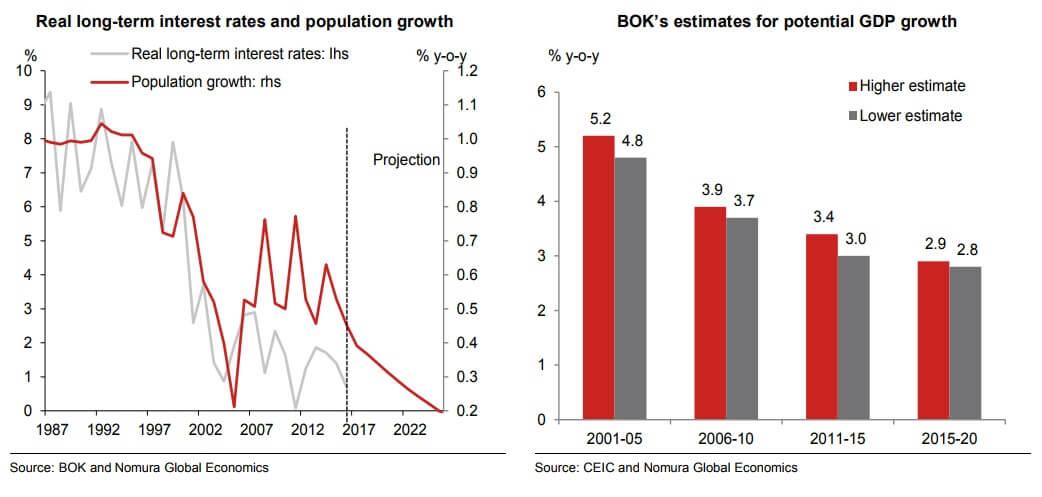

2) Declining real interest rates

Korea’s demographic changes suggest that its real long-term interest rate will continue to trend lower and thus, the NPS will need to reduce its allocation to domestic bonds. As the population ages and population growth slows, labor supply becomes scarce relative to capital, which drives up wages relative to the rate of return on capital. This means the marginal product of capital will fall and the real interest rate will decline.

3) To hedge macro, asset meltdown and geopolitical risks

Korea’s economy has become heavily dependent on one sector: semiconductors. This sector will benefit from the global memory super cycle, as memory demand for cloud, artificial intelligence and smartphones should increase structurally. However, this also suggests there are oversupply risks. One way the NPS can hedge such risks is by increasing its allocation to overseas equities, which can help reduce Korea’s “asset meltdown” risks. From a geopolitical perspective, if a military conflict were to occur, the KRW would experience substantial selling pressure. Thus, we believe the best hedging strategy against such geopolitical risk would be for the NPS to increase its allocation to overseas assets without foreign exchange (FX) hedging.

4) To ease KRW appreciation pressure

In this era of globalization, Korea’s relative demographic position is relevant to the country’s current account. The total dependency ratio gap between Korea and advanced economies suggests Korea’s current account surplus is sustainable until 2040. Despite this large surplus, FX reserves have increased only modestly since 2012, having been recycled mostly into overseas portfolio investments by Korean institutional investors, including the NPS. Therefore, the large current account surplus in the absence of the Bank of Korea’s heavy FX intervention should allow NPS to increase its allocation to overseas assets without disrupting the local FX market.

5) Contribution to the Korean financial sector’s global competitiveness

A higher allocation by the NPS to overseas assets could also contribute to the country’s financial services sector. With NPS entrustments indirectly creating jobs at asset management companies in Korea, the higher dividend and interest income from overseas assets will more than offset the additional management costs to the NPS.

See our simulation by reading the full report here.

Contributor

Young Sun Kwon

Senior Economist Korea, Taiwan and Hong Kong

Minoru Nogimori

Economics Analyst, Asia

Craig Chan

Global Head of FX Strategy

Albert Leung

Asia Rates Strategist

CW Chung

Head of Research, Korea and Pan-Asia Tech / Semiconductors Research

Jim McCafferty

Head of Asia ex-Japan Research

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.