The Growing U.S. Water Crisis

Western U.S. water shortages caused by mega droughts combined with under investment in the industry threaten a crisis unless desalination technologies improve or fresh water is used more efficiently.

- California is in the middle of a 20 to 50-year drought cycle and underground aquifers are being depleted

- Water poses risks to industries ranging from agriculture to high-tech manufacturing, which face potential disruption if they lose access to secure water supplies

- Solutions include reuse/recycling of municipal and industrial waste water, desalination and smart meters

Western U.S. water shortages caused by mega droughts combined with under investment in the industry threaten a crisis unless desalination technologies improve or fresh water is used more efficiently, according to a board adviser speaking at Nomura Greentech’s Sustainable Leaders Summit.

California is a microcosm of developments in the U.S. and over the last five years, long term structural drought - part of a 20 to 50-year drought cycle - has plagued the Western states, the expert said at the summit, held under the Chatham House Rule.

The water in Lake Mead reached such low levels last year that it was dangerously close to being unable to run hydropower turbines while the Colorado river has lost 20% of its flow since 2000.

The risks are particularly acute because groundwater, which takes hundreds if not thousands of years to fill up underground aquifers, is being depleted at a much faster rate than it is being recharged, she said.

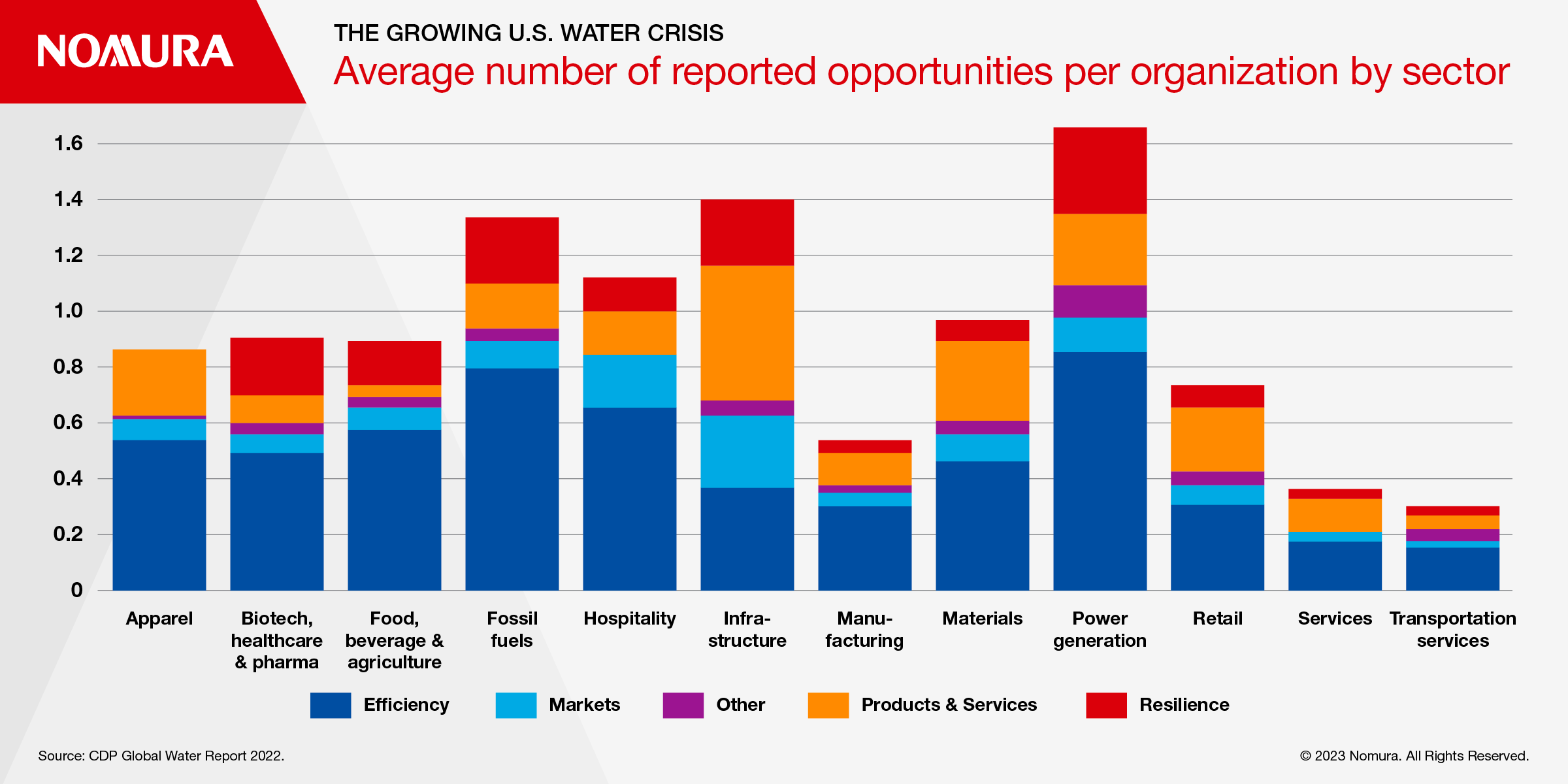

Water poses physical, reputational, and regulatory risks to many business sectors, and industries ranging from agriculture and food production to high-tech manufacturing face potential disruption if they lose access to adequate clean water supplies, said the adviser.

Arizona restricted home building in Phoenix over fears of water shortages, while drought cost the California agricultural industry about $3 billion in 2021-22, and water risks are starting to impact the semiconductor industry which needs billions of gallons of ultra-pure water a year in its production facilities. As water becomes scarcer, more expensive or harder to obtain in required quality, it threatens the viability of operations in water-stressed regions.

The board adviser also warned of growing risks from shale drilling in the Permian basin, which produced about 23 billion barrels of wastewater in 2022. Fracking one barrel of oil can produce 10 times the amount of water but it’s highly saline and contaminated and the process of disposing of the waste water via underground wells contributes to seismic activity, which could disrupt future drilling unless safer disposal solutions are harnessed.

Reputational risks are increasing as well, as companies face public rebuke for overusing or polluting water supplies. Coca Cola has set ambitious water replenishment goals after being criticized over its water usage and wastewater disposal methods including causing induced seismicity.

Water appears to be at the stage clean energy was 20 years ago and while the risks are clear, the opportunities may be even greater for those who take action with some estimates suggesting there is a $1trn market opportunity in water infrastructure and technology, she said.

There are several areas ripe for investment and innovation:

- Municipal water distribution infrastructure which leaks 20-30-% of water globally, along with smart metering and sensors to cut waste

- Water reuse/recycling including municipal and industrial wastewater from oil and gas and agri runoff

- Water-tech like AI to improve leak detection, sensors for contamination monitoring, more efficient membranes and energy recovery for desalination

- Storm water capture and recharge projects to directly combat problems like drought

- Watershed protection and natural infrastructure for filtration

- Water-rights trading schemes and ecosystem service incentives

She also cited specific solutions including Los Angeles exploring potable reuse, which means treating municipal wastewater. The California city is looking at taking Hyperion, one of the largest wastewater sewage treatment plants in the world and treating it to a level where it can be close-looped back into the utility system.

For waste water that cannot be fully recycled, options include treating the water to a sufficient level where it can grow range grass and become a carbon sink or using it in non-consumptive crops such as growing cotton.

For household consumption, the board adviser explained that it is starting to be accepted wisdom that utilities companies need to work together, for example by modifying a smart meter to read the water and gas meters to create efficiencies.

On the investment side, water pricing needs to reflect its true value which will drive efficiency and unlock private capital.

With urgent action to manage demand, boost supply sustainably, and allocate usage more efficiently, it is possible to turn one of the biggest climate threats into one of the greatest business opportunities.

Download a PDF of the full whitepaper

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.