The great decoupling: are Asian central banks breaking from the Fed?

Asian central banks are yet to follow the Fed’s rate hiking cycles even though many Asian policy rates are at historically low levels. But this could start to change.

In the Fed rate hiking cycle of 1994-1995, five of the eight Asian central banks, excluding Japan, followed suit. The second cycle in 1999-2000 saw three of these banks hiking rates. By the end of 2004-2006, the third hiking cycle, which lasted 25 months, all eight central banks had hiked.

However, in the current Fed hiking cycle, this has not been the case, despite the low Asian policy rates. In fact, the central banks of India and Indonesia have cut rates further. Why has Asia decoupled? Here are six possible factors:

1. Low inflation

It could continue as global market competition, automation and so-called ‘Amazonification’ intensify, in line with Asia’s rising technology penetration rates.

2. More flexible exchange rates

This has been a clear pattern in Asia, and it gives its central banks more leeway to have monetary policies that are independent from the Fed.

3. Tighter macroprudential policies

Rather than hiking interest rates, Asia has heavily deployed these tools to contain credit and property market booms.

4. The European Central Bank (ECB) and Bank of Japan (BoJ) still in quantitative easing (QE) mode

Amid a slow Fed hiking cycle, this could sustain the global hunt for yield and strong capital inflows to Asia, keeping liquidity flush.

5. Tail risks

Asia is the most exposed region to a China setback, North Korea or US protectionism. Asia’s central banks may want to take out insurance by keeping rates low.

6. Debt overhang

The large build-up of private domestic debt in Asia may have lowered central banks’ willingness to hike over fears of triggering a wave of credit defaults.

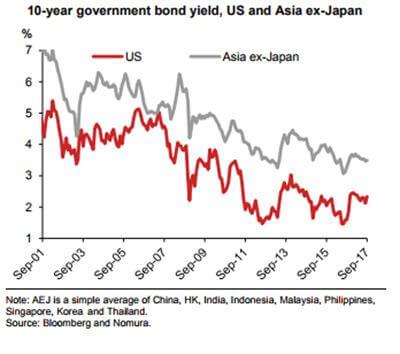

Asia’s historically low bond yields suggest that these factors are largely priced in. However, with stronger and more synchronized global growth, some of these factors could start to fade, such as low inflation as well as the ECB and BOJ in QE mode. The recent rise in oil prices could spread to other commodity prices and lift headline Consumer Price Index inflation which, with mostly adaptive inflation expectations in Asia, could over time cause core inflation to creep. If this occurs, and if Asia’s central banks remain on hold, perhaps due to tail risks and debt overhang, bond markets may start perceiving them as falling behind the curve.

Read the full report here for the updated forecasts for each country.

Contributor

Rob Subbaraman

Head of Global Macro Research

Young Sun Kwon

Senior Economist Korea, Taiwan and Hong Kong

Sonal Varma

Chief Economist, India and Asia ex-Japan

Euben Paracuelles

Week Ahead Podcast Host and Chief ASEAN Economist

Yang Zhao

Chief China Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.