The Covid-19 Crisis will Accelerate the Adoption of ESG Policies

Demand for sustainable finance solutions and products will accelerate beyond pre-crisis expectations.

- As the world recovers from COVID-19, investors will not lose sight of Sustainability, the trend of ESG issues will become more central to investing and business decisions will accelerate; this is already occurring.

- The proof is in: companies with stronger ESG records generate alpha; they outperform their peers and have less volatility and downside risk.

- Three issues prevent most boards from acting on ESG risks: misunderstanding the risks, assuming the risks are long dated, inability to question management’s approach to risk mitigation.

The near term will remain turbulent as the world struggles to contain the COVID-19 health crisis and restart its economic engine.

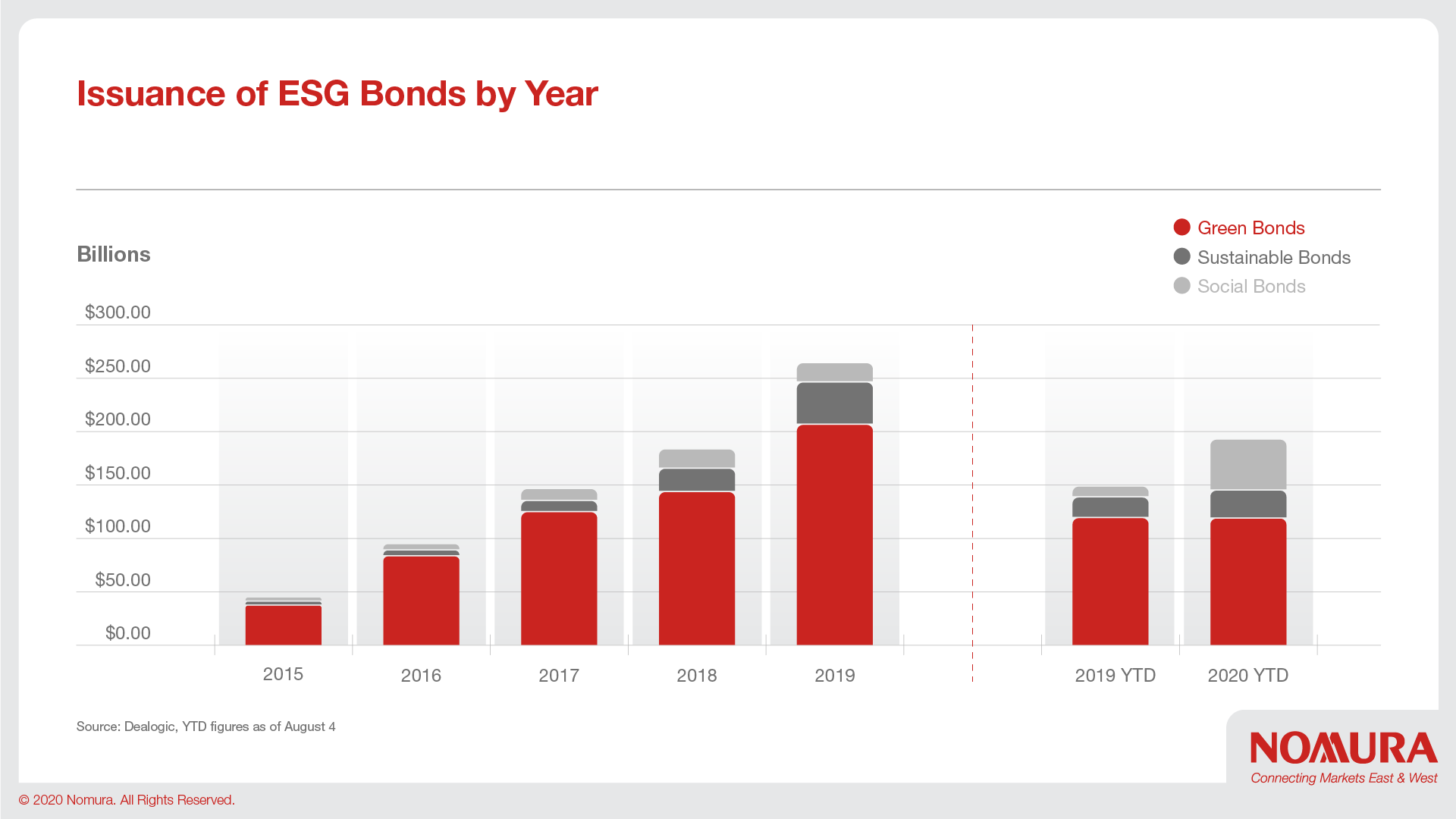

Yet, as the pandemic recovery progresses, looking back, this crisis will be seen to have greatly accelerated the trend of ESG criteria becoming central to all investment decisions. Corporate Boards and management teams will intensify their focus on ESG issues as investors increasingly allocate capital with an ESG lens. Most relevant to our business, demand for Sustainable Finance solutions such as Green Bonds, Private Equity Impact Investments, Renewable Infrastructure Project Equity, Infrastructure and Power Hybrid Finance and other sustainable finance products will accelerate beyond pre-crisis expectations. Green Bonds are the most established Sustainable Finance product and have shown explosive growth YTD and over recent years [1].

The positives of ESG investing had been fully shown pre crisis. In 2018, a study found that firms with stronger ESG records outperformed their peers on 3-year returns, experienced less future earnings volatility and were less likely to go bankrupt [2]. Recent academic peer review studies have reaffirmed this. Said succinctly by BlackRock, “financial research across market cycles supports our view that sustainable strategies do not require a return tradeoff, have important resilient properties, and can offer investors better risk-adjusted returns.”[3].

The market evidence is in, and disclosure regulation is coming. Investors’ commitment to ESG won’t change, it will just become more focused on quantifiable measures and hard data. In the EU, regulation will drive increased adoption of substantial ESG policies by companies. The EU has issued Sustainable Finance directives outlining new climate benchmarks, an EU-wide sustainable taxonomy and enhanced disclosure regulations. The disclosure regulation, which goes into effect on March 10, 2021, will have a forcing effect on investor behavior, as it requires institutional investors and asset managers doing business in the EU to incorporate sustainability risks into their investment decision-making processes[4]. In the US, the Sustainability Accounting Standards Board (“SASB”), and the UK’s Task Force for Climate-related Financial Disclosure (the “TCFD”) are in regular dialogue with the EU to harmonize standards, and will soon deliver comparative hard-metric corporate disclosure to investors.

Climate Change and the COVID-19 Pandemic

We do not believe that investors will lose sight of Sustainability, the “E” of ESG, as a priority. As Bill Gates has noted, climate change and the COVID-19 pandemic alike require innovation and science and the world working together. Getting through the current pandemic together will set a promising precedent for global cooperation.

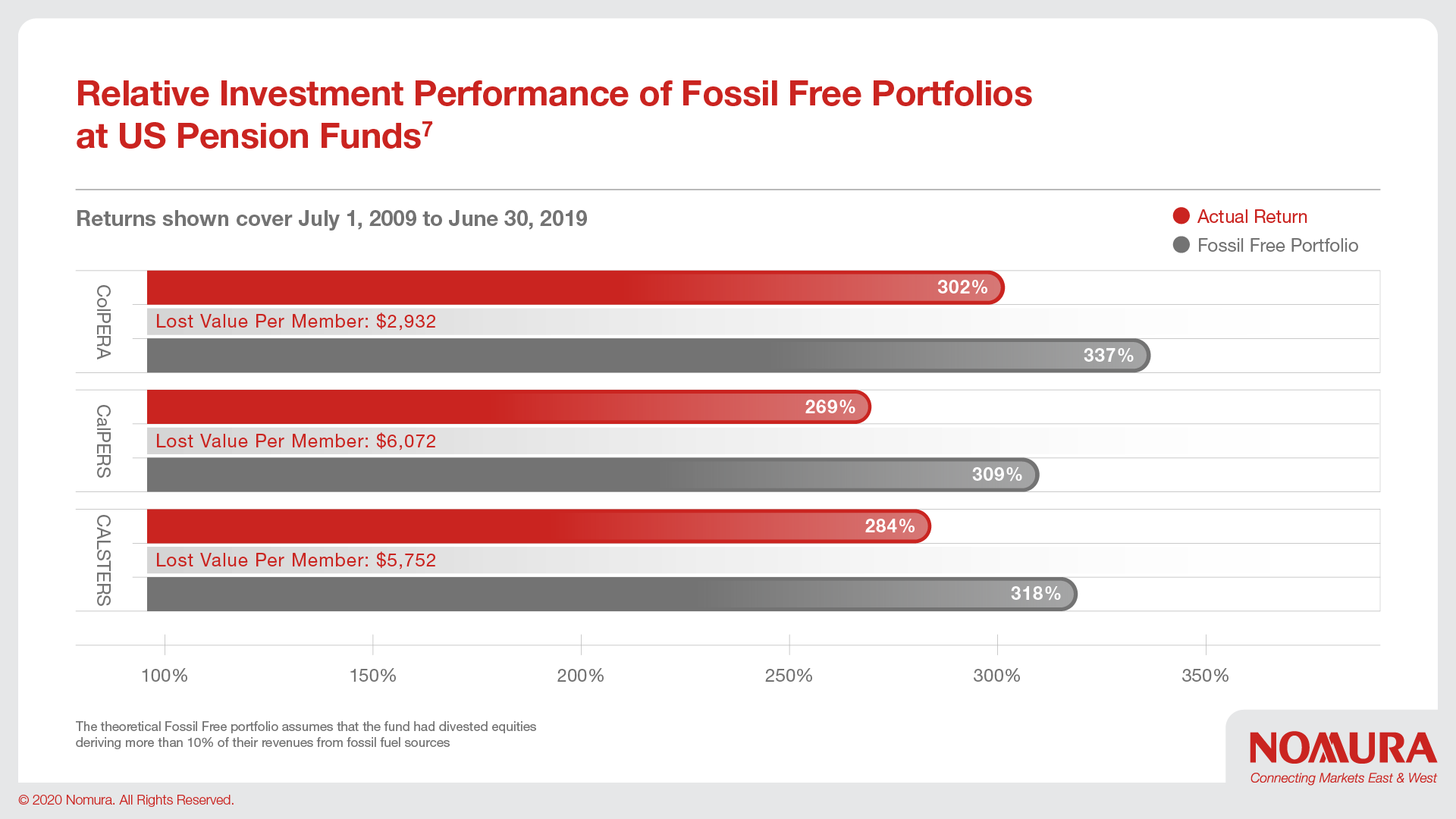

The collapse of oil prices is a big positive for Sustainable Finance, in our view. At $35 per barrel, 75% of global oil and gas projects don’t return their cost of capital[5]. Oil and gas investors are looking at a low return, high risk, and high carbon investment. Over the past 10 years, investing in oil and gas has significantly underperformed market indices, and investing in coal has been even worse[6]. After suffering a wave of coal bankruptcies, the US is likely to suffer significant bankruptcies among US fracking companies[7].

The current economic crisis will invariably influence people to become more risk- averse, and renewable energy projects (wind and solar farms) are a safe haven compared to high carbon energy. Renewable energy projects function as fixed income alternatives, with reliable, steady cash flows, and represent safe harbor investments in periods of market volatility. We believe that the market forces driving sustainable finance will accelerate because the COVID-19 crisis makes it clear that all people live on one planet in a deeply interconnected way. Climate change, the loss of biodiversity, industrial agriculture, deforestation - these forces harm all of us. There is no place on the planet to run to, just as there is no place to avoid the health and economic consequences of COVID-19.

The Value of Social Brands

The most important Social metrics are still being discussed and debated by regulators and investors, but investor belief in the importance of Social metrics has increased dramatically in recent years. According to the PRI, 50% of ESG investors now claim that a company’s Social track record impacts share performance within three years, compared to only 20% who held the same belief in 2017[8]. As Social criteria becomes more central to investors, a company’s brand will increasingly incorporate its human capital, organizational culture, diversity, and values. Already, certain companies are known as leaders in Social matters, ranking above their peers on ESG measurements from MSCI, and they attract deeply loyal customers and employees by virtue of their superior Social brand[9].

In the west, the COVID-19 health crisis has elicited different reactions from different companies. Some companies have put their employees first[10]. Social values and programs focused on diversity, gender pay equality, family programs, access to healthcare, re-training, and many others, form the foundation of employer – employee trust and loyalty. The value of a high Social brand among employees, as well as customers, continues to increase. 86% of millennials would consider taking a reduction in compensation to work at a company whose mission aligns with their values, and the cost of replacing one employee is between 10% and 30% of the employee's annual salary[11].

Governance in Strategic Management

With respect to Governance, there is a well- developed set of standards which are widely used by investors. The biggest differentiator in Governance is that many Boards are short term focused and ignore risks related to macro shocks - climate, ESG, global interdependence, or others. Three main barriers prevent most Boards from prioritizing ESG risks in the boardroom (1) a misunderstanding of how ESG issues create fundamental business risks, (2) a mistaken belief that these risks will only materialize in the long term, and (3) a lack of experience and knowledge of how to question management and how to evaluate the company’s strategy for dealing with these risks[12].

Public companies with strong ESG policies create positive alpha (share price plus dividend returns) versus their industry peers. A 2016 Harvard Business School study identified a positive relationship between high performance on material ESG issues and significant financial outperformance[13]. As David Blood, the Co-Founder with Vice President Al Gore of Generation Investment Management says, “We are not sure if the outperformance of best in class ESG company stocks is due to correlation, or causation... Maybe the management teams who prioritize ESG are also the most capable of delivering superior financial returns.... Either way, we believe the connection is clear[14].”

Transition to a Truly Sustainable Society

The purpose of the investment of capital is to create well-being, to create wealth in the true sense. This will become more and more relevant to investors. We believe COVID-19 will cause all of us, as customers, employees, suppliers and investors, to look at how companies impact the well-being of the world, both at the local community level and at the global level. The ESG measurement system will increasingly be an important criteria by which we evaluate companies. Investors do well when companies do well. Those investors and companies which prioritize ESG criteria will benefit, and will contribute to a more sustainable society for all of us.

-

Notes, Sources and References

-

[1]

Dealogic data from Jan. 1, 2015 to August 4, 2020; Green Bond Instruments sorted by type, volumes in millions of US dollars.

-

[2]

Robert G. Eccles and Svetlana Klimenko,“The Investor Revolution”, Harvard Business Review, May-June 2019 issue; Bank of America Merrill Lynch, ABCs of ESG, 2018.

-

[3]

Sustainable Investing: a ‘why not’ moment.” BlackRock Investment Institute, May 2018.

-

[4]

Ashurst, The Heat is on Asset Managers: EU Steps up on Sustainable Finance, January 7, 2020.

-

[5]

Wood Mackenzie, How will the Oil Price Crash Hit the Upstream Sector?, March 20, 2020.

-

[6]

Corporate Knights’ report published in 2019 analyzes that there would be $19 billion of investment gains across CalSTRS, CalPERS and PERA’s retirement funds over a 10-year time horizon if the funds had divested of fossil fuel investments. (350.org, New Study Shows Oil, Coal and Gas Investments Drove over $19 billion in Losses for Major Pension Funds, November 5, 2019)

-

[7]

Prior to the oil price crash, banks had already written off as much as $1 billion in reserve-based shale loans. With oil at $30 per barrel, some shale companies will be unable to repay lenders and support dividend programs. “(Shale Drillers are Staring Down Barrel at Worst Oil Bust Yet, ”Bloomberg, March 9, 2020)

-

[8]

Credit Suisse Equity Research, COVID-19 Puts the Spotlight on “S” in “ESG,” March 30, 2020.

-

[9]

Chief Executives for Corporate Purpose (CECP), What Counts: The S in ESG, February 2017.

-

[10]

Companies like Nestle and Unilever are paying full salaries to part-time and full-time employees affected by COVID-19, offering benefits like cash advances and generous sick leave arrangements. “(Nestle Staff to Get Full Salary for Three Months where COVID-19 Halts Work, ”Reuters, March 26, 2020)

-

[11]

Ceres, Running the Risk: How Corporate Boards Can Oversee Environmental, Social and Governance (ESG) Issues, November 2019.

-

[12]

Refer to note 11.

-

[13]

Refer to note 3; Subsequent research, including Lars Kaiser's “ESG Integration: Value, Growth and Momentum, “Journal of Asset Management, January 25, 2020, found additional evidence of the financial effectiveness of ESG integration

-

[14]

Based on personal conversation with the author.

Contributor

Jeff McDermott

Global Co-Head of Investment Banking at Nomura Holdings

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.