Sustainable Finance in Singapore: A Blueprint for the Region

Singapore’s public sector has spearheaded efforts to create a green financial centre

- Earlier this year Singapore announced an action plan to make the city-state carbon-neutral from 2050.

- Key measures include boosting the markets for green debt and making company disclosures more transparent.

- Singapore is launching an international carbon trading exchange as a joint venture with DBS Bank, Standard Chartered, and Temasek Holdings.

Singapore has accelerated efforts to position itself as a green finance hub for the South East Asian region by promoting green bonds, encouraging transparency and creating a carbon exchange.

Since the 2015 Paris Agreement and the establishment of the UN’s Sustainable Development Goals (SDGs), interest in green finance has exploded worldwide. In Singapore, one of Asia’s leading international financial centers, efforts have been led by the public sector.

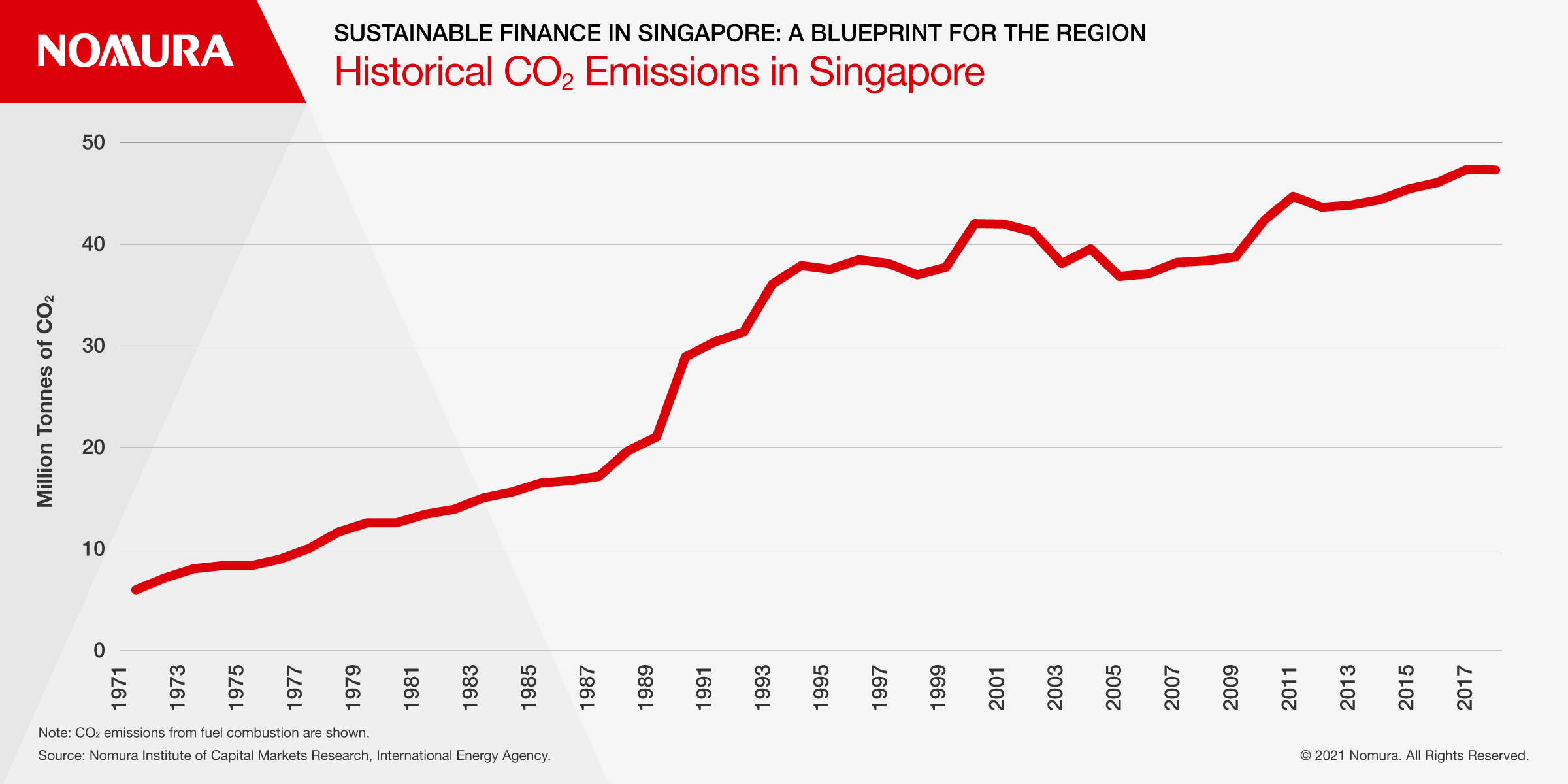

Emissions have been on the rise, increasing from 6.1 million tonnes of CO2 in 1971 to 47.4 million tonnes in 2018 . Last year, the Singapore government announced that its greenhouse gas emissions would peak at 65 million tonnes in 2030, halving to 33 million tonnes by 2050, and aiming for net zero emissions thereafter.

Earlier this year, the government released the Singapore Green Plan 2030, an environmental strategy to be implemented by the end of this decade to reach carbon neutrality from 2050 onwards. The main pillars of the plan are nature-rich cities, sustainable living, energy reviews, a green economy, a resilient future, and green government.

We analyse the measures being developed by the Monetary Authority of Singapore (MAS), the city-state’s central bank and financial regulator, to achieve this target.

Environmental Risks

1. Navigating Risks

In December 2020, MAS published the environmental risk management guidelines for banks, insurers and asset management companies to strengthen the role of the financial sector in promoting the transition to an environmentally sustainable economy.

In terms of governance, it outlined that the Board of Directors should approve the framework and policies for continuously evaluating and managing environmental risks, specifically the risk appetite framework; and to confirm that management has expertise to navigate environmental risks.

The Green Finance Industry Taskforce (GFIT), was formed to take responsibility for managing the environmental risks of each financial institution. MAS plans to conduct stress testing on individual firms by the end of 2022 to assess climate related risks.

2. Disclosing Climate-Related Information

MAS recognizes the need to improve the quality and consistency of climate-related information. Reliable and comparable disclosures are essential for more effective risk management, and leads to effective capital allocation to environmentally sound operations.

MAS expects all banks, insurance companies, and asset management companies in Singapore to disclose climate related information annually in accordance with the Recommendations of Task Force of Climated-related Financial Disclosures (TCFD) from June 2022.

In parallel with the MAS and GFIT efforts, the Singapore Exchange (SGX) will promote the disclosure of climate-related information by listed companies. Since 2016, SGX has required listed companies to submit annual sustainability reports under the “Comply or Explain” approach.

Developing Green Finance Solutions and Markets

MAS considers that the expansion of financial instruments is necessary to promote the development of green finance solutions and markets in Singapore.

1. Green Bonds

The MAS introduced the Green Bond Grant Scheme in 2017 to promote green bonds in the domestic market. Now called the Sustainable Bond Grant Scheme, it has been expanded to include social, and sustainability linked bonds (bonds for general purposes aligned to company sustainability targets).

Singapore issued over S$11 billion of Green Social and Sustainability Bonds (SDG bonds) between 2017-2020, of which about S$8.6 billion was issued after 2019, according to MAS data, highlighting growth of the market. Most of the SDGs bonds issued to date have been by foreign issuers, including the Indian Renewable Energy Development Agency, and Star Energy Geothermal, a power producer in Indonesia. Singapore issuers include major banks like DBS Group and, OCBC Bank.

The Singapore government announced its inaugural green bond issuance plan as part of the Green Plan 2030, and revealed that it had identified projects worth up to S$19 billion. This includes the construction of Tuas Nexus, the first integrated water treatment facility in Korea, managed by entities including the Public Utilities Board of Singapore.

2. Green Loans

Green loans and sustainability linked loans are also on the rise. Total disbursements from 2017 to 2020 was over S$22.5 billion, of which approximately S$19.4 billion has been disbursed since 2019, according to MAS data. Major projects in 2020 included a S$1.95 billion green loan to M+S, a real estate developer, and a €30 million sustainability linked loan to PSA Marine, a Singaporean port operator.

MAS launched the Green and Sustainability Linked Loan Subsidy Scheme (GSLS) in January 2021. MAS will bear the costs to be paid to third parties when domestic and foreign companies obtain an assessment of the environmental impact and sustainability of the business for which loans are to be used and in the development of a framework for the loans. Loans are required to be at least S$20 million with a minimum term of 3 years, and maximum subsidy of S$100,000 per loan.

For banks wishing to develop a loans framework, subsidies are capped at up to 60% of costs, or S$120,000, while costs for establishing a framework for SME and personal loans are capped at up to 90%, or S$180,000. BNP Paribas, OCBC Bank and United Overseas Bank have already introduced frameworks for green and sustainability linked loans. The deadline for the GSLS is the end of 2023.

3. Green Funds

MAS has shown a firm commitment to improving its investment capabilities in green products, including research stewardship, investment policy, and portfolio management functions. It launched the US$2 billion Green Investments Programme in November 2019 to promote green funds, which invest in environmentally friendly companies and assets. As the first initiative under the program, MAS invested US$100 million in a green bond fund launched by the Bank for International Settlements (BIS) in September 2019. MAS also outlined plans to outsource some of its reserves to asset managers as part of its efforts to manage climate-resilient foreign reserves and in June 2021 it entrusted US$1.8 billion to 5 asset management companies which will establish a sustainability hub for Asia Pacific in Singapore and introduce new thematic funds for ESG.

In Singapore, an increasing number of institutions have signed the Principles for Responsible Investment. At the end of July 2021, there were 47 PRI signatories, comprising 39 asset managers, 7 service providers, and 1 asset owner.

International Carbon Trading

MAS has set a goal of making Singapore a carbon hub to complement decarbonization efforts in Asia. SGX, one of the world’s major commodity trading venues, announced in May 2021 that it would establish an international exchange to trade carbon credits on a voluntary basis in a joint venture with DBS Bank, Standard Chartered and Temasek. Carbon credits are defined as the amount of greenhouse gas emission reductions that can be converted into value and traded. When companies reduce emissions, they purchase carbon credits to make up for the amount they cannot reduce despite their efforts. This is called carbon offsetting.

The carbon exchange, called Climate Impact X (CIX), is slated to launch by early 2022. CIX will use satellite monitoring, machine learning and blockchain technology to improve the transparency and quality of carbon credits. An independent expert group of non-governmental organizations and research institutions may advise on the quality of carbon credits. CIX will initially focus on carbon credits generated from nature-driven climate change actions which will help reduce greenhouse gases and support biodiversity. It will offer two platforms: Carbon Exchange and Project Marketplace.

Carbon Exchange will allow high-quality carbon credits to be traded on a large scale under standardized contracts, with multinational companies and institutional investors as the main buyers. The Project Marketplace deals with high quality carbon credits generated from specific projects, with small and medium-sized businesses as the primary buyers.

CIX is in discussion with several global tech companies, including Singapore-based ride-hailing app giant Grab, which announced plans to launch various initiatives in ASEAN countries to reduce greenhouse gas emissions. This includes purchasing carbon credits from the Singapore-based carbon exchange AirCarbon for a wildlife sanctuary conservation program in Cambodia.

Singapore has established itself as one of the leading international financial centers in Asia, and can further enhance its position with the successful development of sustainable finance through a broad range of initiatives being spearheaded by the public sector.

DOWNLOAD THE FULL PDF HERE

Contributor

Yohei Kitano

Senior Analyst, Financial and Capital Markets in Asia NICMR

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.