Risk of BOJ taking Rates Further into Negative Territory and Investment Strategies

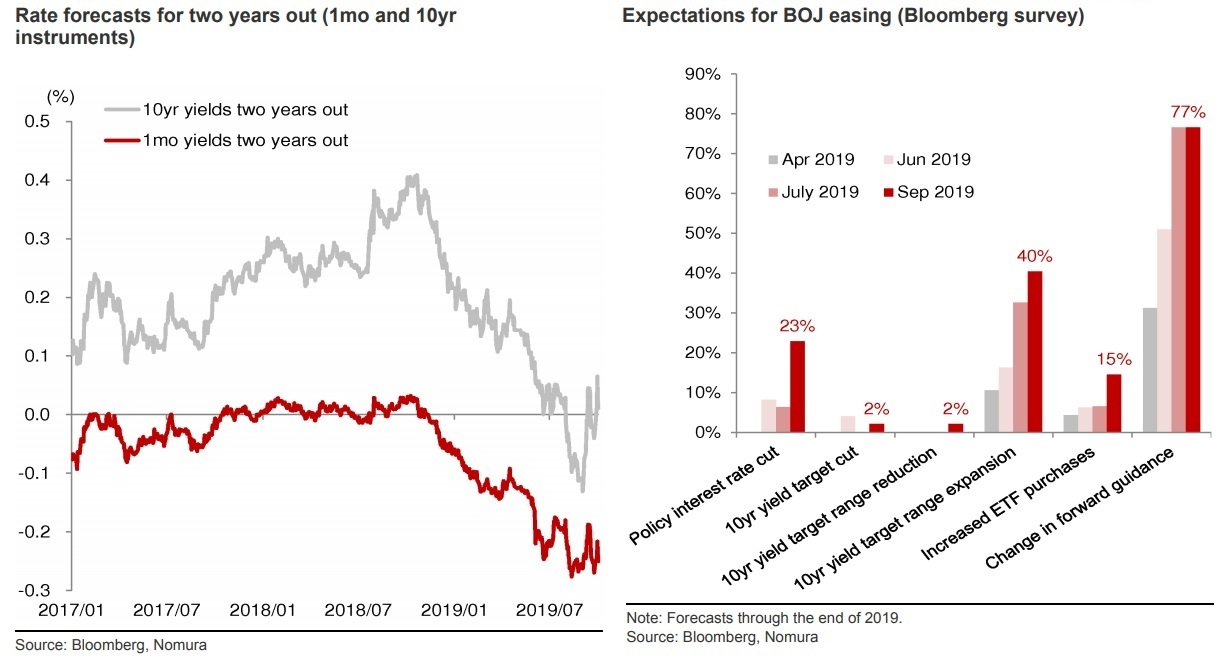

- Expectations are growing that the BOJ will decide to further loosen monetary policy.

- BOJ Governor Haruhiko Kuroda has publicly indicated that any shift towards further monetary easing by the BOJ will likely be aimed mainly at lowering short-term and medium-term interest rates.

- It could be argued that the BOJ is now likely to be in less of a hurry to ease its monetary policy because its dovish communications have already led the recovery and stabilization of USD/JPY.

Bank of Japan (BOJ) Governor Haruhiko Kuroda has indicated in speeches and interviews with the media that any shift towards further monetary easing by the BOJ will likely be aimed mainly at lowering short-term and medium-term interest rates. At the same time, the BOJ is making clear that it intends, via its daily market operations, to put the brakes on the fall in super-long interest rates, and the Japanese Government Bond (JGB) yield curve has indeed steepened recently. The financial markets seem to have responded in the way that the BOJ has been hoping, with the USD/JPY market stabilizing and bank stocks no longer underperforming. The financial markets seem to have responded in a way that the BOJ has been hoping, with the USD/JPY market stabilizing and bank stocks no longer underperforming.

However, it could also be argued quite convincingly that the BOJ is now likely to be in less of a hurry to ease its monetary policy because its dovish communications have already led the recovery and stabilization of USD/JPY.

That said, we think the October monetary policy meeting will attract more attention than its meetings over the past few months. In particular, it now looks possible that the BOJ might choose as an easing option the taking of its policy interest rate further into negative territory, even though we and the market had previously regarded this as highly unlikely in view of the market’s negative reaction after the BOJ announced its negative interest rate policy (NIRP) in January 2016.

In this report we set out (1) the reasons why the BOJ has made communications that have raised market expectations of a rate cut, (2) the reason why we think it is wise to be skeptical about the likelihood of further easing in October, (3) interest rate strategies in preparation for a deepening of NIRP, (4) the USD/JPY market’s likely reaction if the BOJ decides to take interest rates further into negative territory and a suggested investment stance in view of this, and (5) the equity market sectors that we think are likely to benefit from a deepening of NIRP and the possibility that the BOJ might adjust its purchases of ETFs.

Is the market ready for a rate cut?

In order to stave off a rapid flattening of the yield curve, the BOJ would need to let financial markets think that a rate cut could actually happen, and a situation like this is arguably unfolding right now. USD/JPY has been fairly stable, but the BOJ's stance at its July and September monetary policy meeting reveals a willingness to let the market think that further easing may be in the offing. This makes us think that the BOJ could potentially go through with further easing even with USD/JPY at a higher level than what we initially thought would be required for action.

Despite Kuroda's "more positive" stance on further easing, our main forecast scenario still pictures policy being left unchanged

We have four reasons for thinking this, each of which we will explore in more detail in this section: (1) the communications coming out of the BOJ recently concerning the possibility of further easing and the means by which it might be executed can be interpreted as components of the Bank's publicity strategy; (2) that publicity strategy has itself been exceptionally effective in the time since the Bank's introduction of forward guidance in July 2018; (3) the Bank's need to rely on this publicity strategy arguably reflects a growing acknowledgement within the BOJ that it is almost out of policy options and not able to do much to address the adverse side effects of its massive monetary easing; and (4) even if the informal USD/JPY trigger line for additional easing by the BOJ is higher now than it once was, it looks unlikely as of now that fundamentals will fall into a pattern that would cause USD/JPY to fall to that level.

Yen rate strategies to prepare for a BOJ rate cut

We think purchasing medium-term bonds may be a more effective hedge against a BOJ rate cut than purchasing super-long term JGBs. Overnight index swap (OIS) has more yield downside (at all maturities) than JGBs or interest rate swaps. At maturities of 10 years or less, interest rate swaps have more yield downside than JGBs and, for super long-term maturities, JGBs have more yield downside than interest rate swaps.

From a medium- to long-term perspective, interest rate receiver swaps may be a more effective hedge against rate cuts than OIS receiver swaps. Interest rate receiver swaps are also superior to OIS receiver swaps in terms of liquidity. We therefore recommend that investors seeking to hedge against BOJ rate cuts using a relatively liquid instrument use JPY interest rate receiver swaps for periods of ten years or less and JGBs for super long hedging periods.

If after a BOJ rate cut, 20yr JGB ASW weakens to around 0bp, we would see this as an opportunity to buy 20yr JGB ASW on weakness; if it rallies beyond -10bp, we would see this as an opportunity to sell and lock in gains.

Forex: "Kuroda put" strategy likely to be effective until October BOJ monetary policy meeting

In addition to the next BOJ monetary policy meeting, there are many other event risks for the USD/JPY market in October. In particular, the question of whether a decision will be reached to avoid or postpone tariff hikes at the Cabinet-level talks between the US and China scheduled to be held on October 10-11 is in our view more important than the BOJ's October monetary policy meeting for the short-term outlook for the USD/JPY market. Even if the talks do not prevent tariff hikes, we cannot rule out the risk that the yen might strengthen to around USD/JPY of 105. However, we see the prospect of a "Kuroda put" effect, where growing expectations of further monetary easing by the BOJ prevent the yen from strengthening, and see a possibility of buying on weakness at USD/JPY of around 106.

Potential revision in ETF purchases

Our results suggest that if the BOJ sets in motion further monetary easing in the shape of "deepening + steepening," we are more likely to see improved performance in the financial sector and in sectors that benefit from the weaker yen. We note that another potential monetary easing measure the BOJ may adopt is to reduce its purchases of ETFs tracking the Nikkei 225.

For a breakdown of each researches, read our full report here.

Contributor

Takashi Miwa

Chief Japan Economist

Yujiro Goto

Head of FX Strategy, Japan

Yusuke Miyairi

FX Strategist, Economist

Takenobu Nakashima, Ph.D

Senior Rates Strategist, ABS/MBS Analyst

Yunosuke Ikeda

Head of Macro Strategy, Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.