Does eFX still require a human touch?

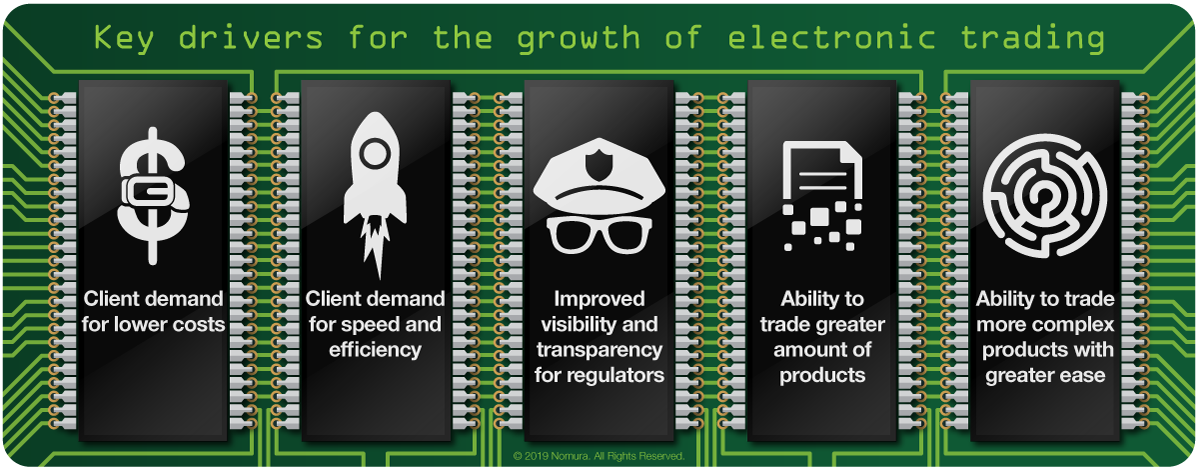

Client demands for speed and efficiency, coupled with regulatory pressure for transparency, will continue to drive the growth of electronic trading, including trading of more complex products

- To keep abreast of a rapidly changing market and create a culture of continuous improvement that benefits clients, eFX teams must include technologists, quant developers and experienced e-sales professionals

- Innovations including artificial intelligence and distributed ledger technology such as Blockchain could transform the FX market

- While advanced technology will add value for clients, relationships and the personal touch will continue to be important

The FX market has undergone profound changes in the past two decades as electronic trading has steadily broadened its reach. Beginning with the most commoditised markets – G10 spot – FX on electronic platforms has come to include a significant proportion of the forwards, swaps and, most recently, non-deliverable forwards (NDFs) and options markets.

The change has been possible because of developments in new technology – it is not coincidental that the emergence of electronic FX trading took place against the backdrop of a massive growth in internet use. Now new technology, such as artificial intelligence (AI) is poised to write the next chapter in the development of the FX market.

The drivers for the growth of electronic trading have not just been technological. Customer demands for lower costs, improved visibility and control, and greater trading, booking and settlement efficiency continue to increase.

To a large extent, these imperatives have been reinforced by a steady stream of regulations that place an ever-greater emphasis on transparency. In particular, by requiring market participants to prove quality of execution, and source (and document) multiple prices before transacting, MiFID II has hastened the adoption of electronic trading. Few traders want to source five FX prices on the telephone and then document them to ensure an electronic audit trail and demonstrate transaction cost analysis.

The eFX approach

A broadening range of clients – ranging from retail investors to global macro hedge funds – increasingly turn to electronic trading in preference to voice trading. Fast-growing markets such as emerging Asia FX, including NDFs, will continue to gravitate toward electronic trading; there are clear opportunities for banks with the appropriate technology and a footprint that bridges East and West.

To take advantage of these opportunities, banks must accept that technology increasingly drives FX, build the right infrastructure and cultivate a new mindset and culture.

Banks need to reassess their entire product and channel strategy in order to align their offering to the needs of clients and prospective clients. Structural changes are a crucial part of this shift. IT can no longer be a silo but instead must become a core part of the wider eFX team, which should also include quant developers and experienced e-traders. It is the interaction of this diverse team that creates a culture of continuous improvement that benefits clients.

A diverse and knowledgeable eFX team can help a bank connect with clients – by building its algo product, developing APIs to link it to clients’ systems, and optimising reach via multi-dealer platforms. But it can also provide critical insights into developments in the eFX and technology worlds that will help banks to understand and anticipate both clients’ and the business’s requirements in the future.

As well as having an eFX team, banks must accept the need to invest in technology and adopt an open-minded approach to innovation and partnerships. Innovations, including distributed ledger technology (DLT) and AI and machine learning, are likely to play an important role in the FX market in the future. For instance, Nomura has entered into a joint venture and created a new AI-based software company called “Aim2”. Initially, the AI solution has been deployed in Nomura’s rates business but it will be rolled out to FX in the near future. The solution will also help Nomura create bespoke client solutions by effectively pricing client flow and managing risk.

The way FX is traded will evolve as a result of these technologies and market developments. Settlement times could change, for instance. The majority of FX spot currency pairs still settle on a T+2 basis, which looks out of step in today’s world. DLT could facilitate a move to real-time settlement and peer-to-peer trading (assuming the credit intermediation conundrum that has historically held this back can be solved). Platforms and execution venues will consolidate further, reducing oversupply and concentrating liquidity. In recent years, exchanges have bought into the OTC market; those remaining will face pressure to consolidate. Further disruption will create new opportunities and should be welcomed by market participants.

Service remains paramount

Clients’ appetite for transparency and efficiency will continue to increase, accelerating migration to electronic trading and driving an ever-greater need for advanced technology. Cutting-edge execution algorithms that offer greater control and efficiency will undoubtedly play an important role for many clients. Clients want to be able to transact with as little fuss as possible; their goal is simple, quick and clean execution.

In practical terms, that means making a bank’s capabilities and inventory available in a variety of ways so that clients have the flexibility to connect to the bank however they want. It also requires banks to invest in automation to continually drive down costs and ensure that clients have access to rich data and functionality that enables them to make better-informed decisions.

Nevertheless, despite the importance of technology, the personal touch will continue to be important. More complex trades are still executed by phone given their size and the greater need for risk management. And, for example, when trades are executed via algorithms, many clients like the reassurance of having someone available should they wish to talk during the execution lifecycle.

More generally, while clients now look to electronic channels first for both spot and more complex products, the benefits of having a close relationship with a bank cannot be underestimated. A strong relationship ensures that clients receive hands-on support throughout the execution lifecycle and new products or algorithms are introduced. Moreover, it means that the bank can tailor data and market information to the client’s needs, delivering greater value and convenience.

Contributor

Ian Daniels

Head of eFX Distribution, EMEA

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.