Quantamental Analysis Combines the Best of Both Worlds

- Quantamental analysis is gaining popularity among the investing community

- Integrating fundamental and quantitative approaches provide optimal outcomes

- Our International Wealth Management offers quantamental investing frameworks

Traders are increasingly mixing quantitative and fundamental analyses in what is called quantamental assessments to arrive at optimal investment decisions.

While quantitative analysis involves statistical methods and big data to assess the probability of price movements, fundamental analysis studies factors such as emerging trends or financial statements to assess growth potential. In isolation, both approaches have their limitations. Quantitative analysis takes data at face value and can assume that markets are rational, while fundamental analysis can take too narrow a view and is often subject to behavioural biases.

If investing is considered a combination of art and science, then quantitative analysis using the power of computing to understand market trends is the science, and assessments based on fundamentals is the art. Putting them together as quantamental analysis harnesses the power of machines and combines it with the application of human skills and reading of the markets to generate alpha for portfolios.

Over the past few decades, many of the benefits of quantitative investing have come to the fore. Using machines, this approach is able to analyze the exponentially growing volume of data being generated via advanced technologies including artificial intelligence and machine learning. It can also handle a diverse array of data from price-volume action and financial statements data on a stock to the number of clicks on a company’s web page to social media trends. In particular, quantitative analysis is capable of breaking down behavioural elements such as trading sentiment of retail investors or the CEO’s tone of voice on an earnings call.

In a matter of seconds, this method enables real-time updates of the various metrics, allowing for quick critical decision-making. With traditional methods, assessments may not be as swift, while analysing large and diverse data sets may not be economical or even possible.

That said, never expect quantitative models to convey the full picture. The human element and fundamental analysis are critical components of investing, as evident from recent failures of some funds and investors who relied only on their quant models. Human judgment is needed when the investing landscape changes significantly due to unusual circumstances not captured by a model. It is also important to know the limits as well as the assumptions that go into building a quantitative model.

International Wealth Management Quantamental Investing Framework

As such, we have focused on building a robust, rules-based quantamental framework around various data sets for our high-net-worth clients. The objective is to systematically select stocks, exchange-traded funds and indices that offer attractive opportunities, and which could potentially be missed by an individual looking at the large universe of investment options available.

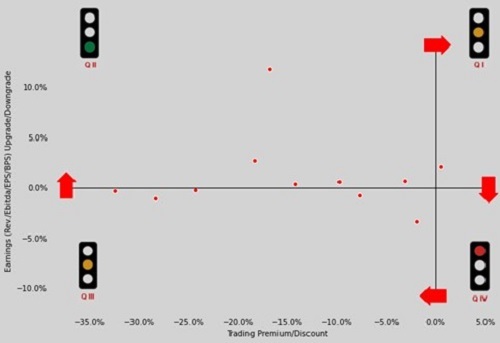

Fortuna is one of our most-used models, allowing investors to exploit market mispricing and make informed entry and exit decisions. Its quadrant framework depicts stock cycle phases as stocks move circular from one quadrant to another. Each quadrant is a combination of trading multiples, i.e. premium or discount to historic valuation multiples, and earnings upgrades or downgrades for the underlying security.

Quadrants as Traffic Lights – For investors, an underlying in quadrant 2 (Q2) should be a favored buy, in green, as its combines earnings upgrades with trading multiple expansion. As the underlying moves into Q1, investors should enjoy the expansion in the trading multiple, but look out for signs of earnings downgrades, as expressed by the amber color. They should become sellers as the underlying moves into Q4, which is depicted in red. And as it gradually moves from Q4 to Q3, investors should again be in amber mode, on the lookout for earnings upgrades to become a buyer.

After selection of the underlying using the quadrant framework, a fundamental analysis is recommended. This is to avoid buying deeply discounted stocks which are in Q2 due to fundamental issues with the underlying or early selling of the underlying in Q1 and missing any additional upside.

Plutus is our other model that uses quadrants as traffic lights. Looking at price and volumes data, it recommends whether to buy or avoid buying a stock, exchange-traded fund or index over the next 30 days.

To the Future

Fundamental investors integrating aspects of what quantitative investors do well – and vice versa – is not something to be debated, but actively explored.

The logic of quantamental investing is simple. Well-trained human analysts can understand how the future may look different than the past – think of changing industry structures, emerging technologies, shifting company positions or new industry regulations. In these situations, machines focused on historical data are at a disadvantage.

On the other hand, well-developed computer models are unmatched in automating tasks and analyzing past data to identify future trends. No human can match an algorithm’s ability to vet millions of data points.

Investors uniquely integrating both these approaches will find optimal outcomes.

Contributor

Gareth Nicholson

CIO & Head of Discretionary Portfolio Management, International Wealth Management

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.