A digital-native and young population with increasing income levels is providing significant tailwinds for a sustained period of growth for technology-enabled businesses in Asia. There are over 500 tech-enabled unicorns in Asia, with a majority of them being in China, followed by India and Southeast Asia, according to CB Insights. We believe the number of unicorns from Asia, despite current market volatility, will continue to expand in the coming years.

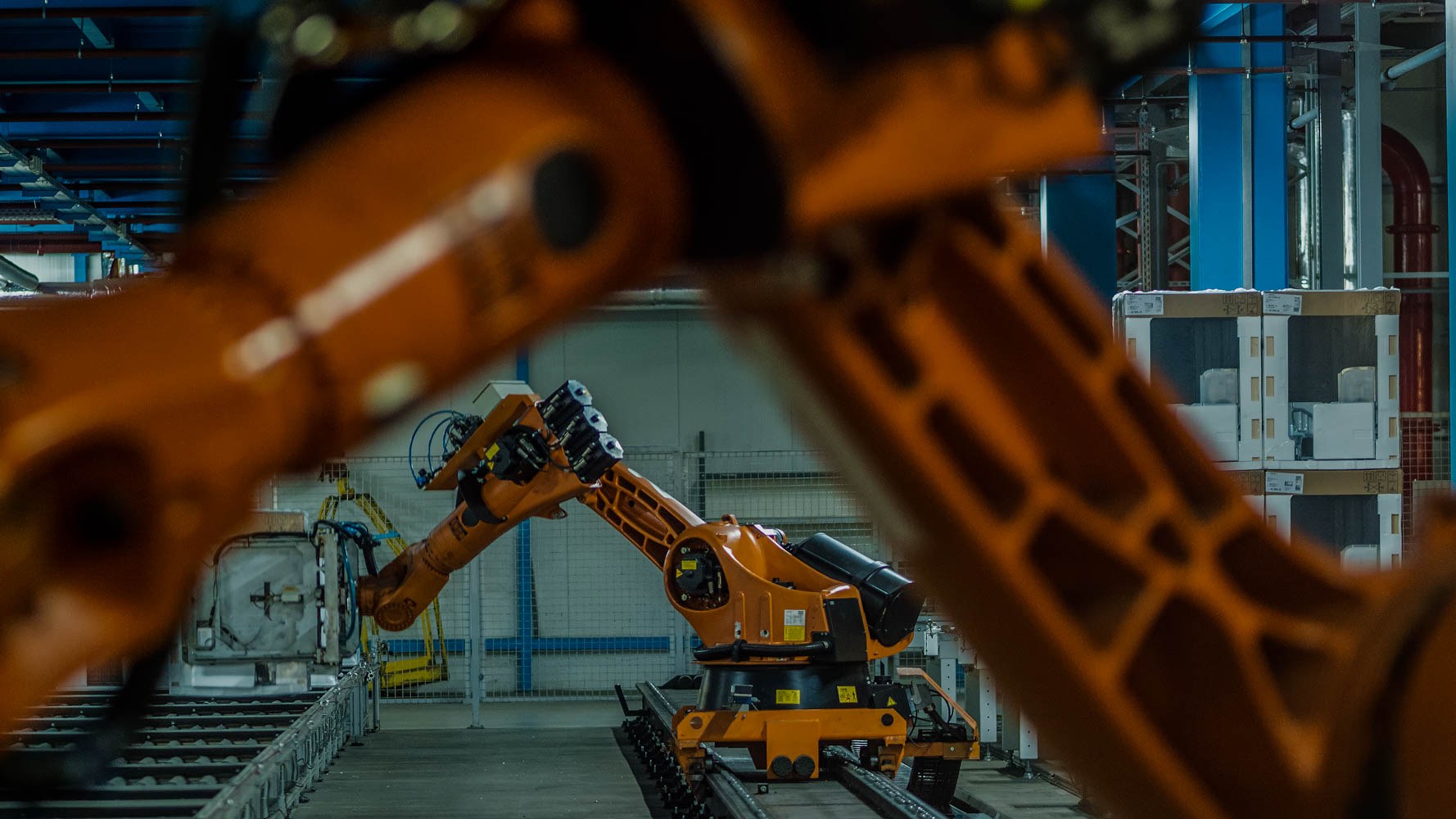

While consumer, enterprise and financial technology have been the more established sectors in the region, the next generation of large technology businesses are expected to emerge in segments such as blockchain and digital assets, artificial intelligence, robotics, gaming, the metaverse, and food & agri-tech.

Across the broader tech ecosystem in Asia, three major themes are playing out:

- The growth-at-all-cost mindset is replaced by a sustainable growth model. Rather than breakneck revenue growth at 3-4 times annually, companies are opting to grow at a more moderate pace as they increasingly focus on becoming profitable. Both private and public market investors are also increasingly guiding mature start-ups towards that.

- Companies are also preparing for growth with increased regulatory awareness. With more regulatory review of the technology sector across the region, sub-segments such as fintech, mobility, digital health and education technology that touch everyday lives, are expecting and preparing for greater oversight.

- As global macro uncertainties have resulted in a lull in the IPO markets, most young companies are preparing to remain private for longer. As such, they will continue to rely a lot more on private capital in the near term to fund their expansion and growth till public markets reopen.

Whether it’s consumer technology companies improving people’s quality of lives by providing them access to a variety of services through the internet, enterprise technology companies providing software and IT services to other businesses, or fintech companies enabling digital payments and credit to the unbanked and underbanked population in Asia, they have all seen valuations correct significantly in the current market environment.

Against this backdrop, it’s natural to compare this period with the dotcom meltdown in 2001. But it is equally important to note that some of the global household names in the technology sector today emerged from the dotcom meltdown. Companies that are able to overcome the current short-term challenges in the market are well positioned to emerge stronger on the other side.

The tailwinds for growth of tech-enabled companies in Asia remain extremely strong. The demographics are right, the population is mobile-first and digitally enabled, with around 3 billion mobile subscribers across China, India, and Southeast Asia. Overlay that with the right GDP per capita growth and income levels, and the potential is immense.

The continued investor appetite and confidence to fund the youngest of companies in the technology space in Asia is borne out by the high levels of early stage, or Series A and B funding. There were 605 early stage deals closed in Asia in the second quarter of this year, a 16 percent increase from the same period last year, according to Crunchbase. There are new venture and growth funds being raised for China, India, and Southeast Asia to invest in the newer areas.

While investors in the sector are used to the process of creative disruption that upends business models, they are increasingly looking at companies that exhibit sustainable growth, are already profitable or are on the path to profitability, are large enough, and have a healthy addressable market. Those are the businesses that will survive any winter.