Liberation Day Tariff Policy Triggers Economic Forecast Revisions

President Trump’s reciprocal tariff announcement was more severe than expected. We have revised our inflation forecasts higher, our growth estimates lower, and continue to expect the Fed to remain on hold in the near term

- President Trump’s reciprocal tariff announcements were more severe than we had expected. If these rates go into effect, we forecast the average tariff rate would rise to 20-25%.

- We have revised our inflation forecasts higher and our growth estimates lower. We still expect the Fed to remain focused on inflation in the near term. However, increased downside risks to growth and a more front-loaded inflation shock should allow cuts to resume sooner than we had expected

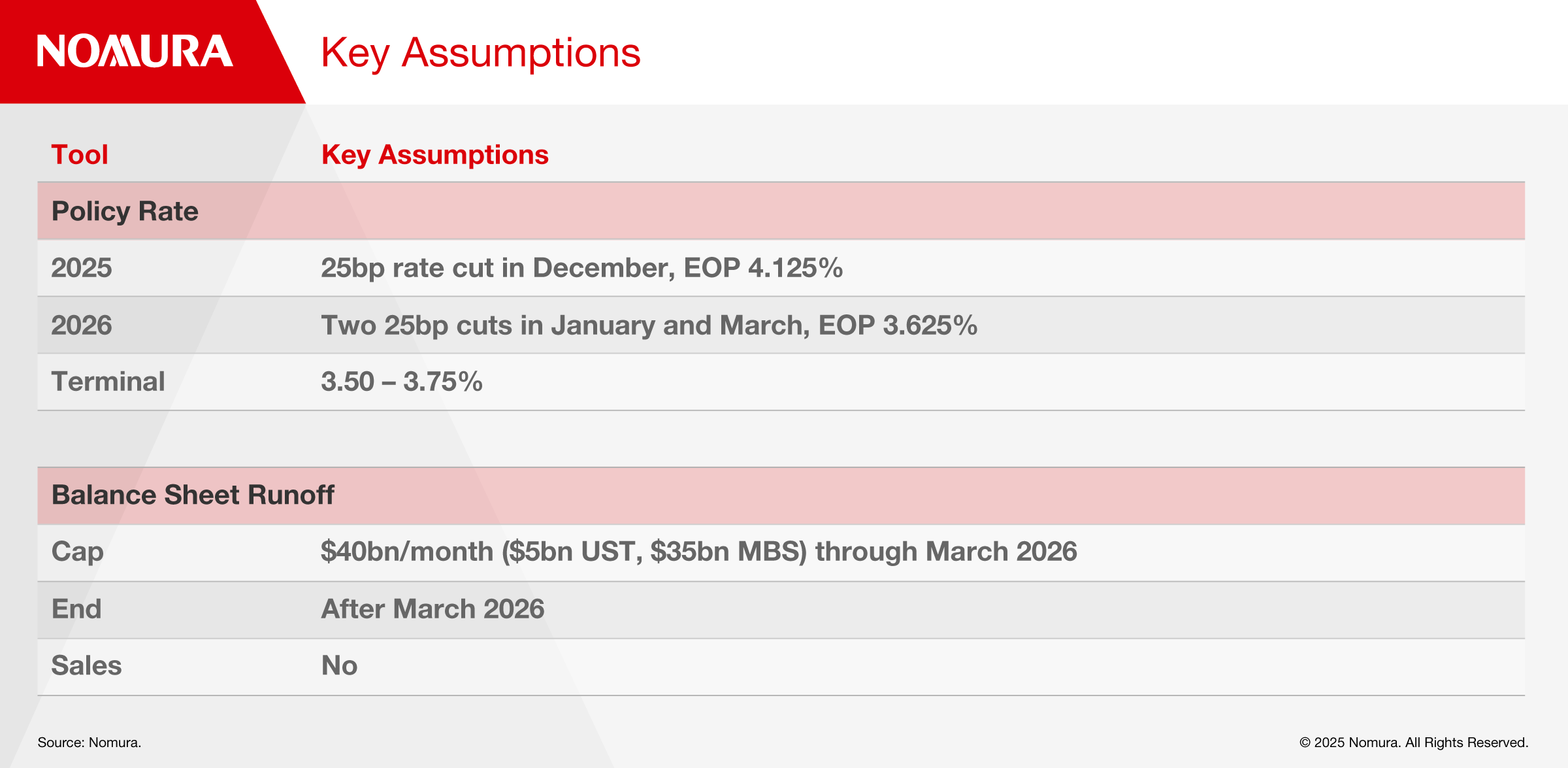

- We now see the Fed cutting rates once this year in December, followed by back-to-back cuts in Q1 2026 (previously, we had expected no rate cuts until Q2 2026)

- Headline tariff rates for targeted countries were significantly higher than we had estimated. This was mitigated by the exclusion of Canada and Mexico from reciprocal tariffs and exemptions for certain products that are already or will likely be targeted by sector-specific tariffs through Section 232

Tariffs worse than feared

The latest announcement on reciprocal tariffs was more severe than we had anticipated. Headline rates for targeted countries rose 10-49%, far beyond our baseline expectation of a 10-15% increase. Details of the announcement included several mitigating factors, but the upside surprise to tariff rates outweighs any positives.

The scope of tariff announcements was mixed. On the one hand, Canada and Mexico were exempted from any escalation as part of today’s announcement. However, beyond North America, the Trump administration implemented a 10% across-the-board tariff, which was a hawkish surprise relative to earlier reporting that reciprocal tariffs would target a narrower set of trade partners. Separately, he announced an end to de minimis exemptions for imports from China, effective on 2 May.

Higher headline rates were partly mitigated by exemptions for specific sectors. Reciprocal tariffs announced will not apply to products that are currently subject to Section 232 tariffs (including autos, steel and aluminum) or to products currently under investigation or likely to be targeted (copper, lumber, semiconductors and pharmaceuticals). There is also an exemption for energy and “certain minerals that are not available in the United States.” These exempted items account for approximately 25% of total imports

In our view, there is likely some scope for de-escalation in the near term. The announcement built in a small delay between the implementation of 10% across-the-board tariffs (in effect on 5 April) and the more punitive country-specific rates (9 April). Recent tariff announcements against Canada, Mexico and China (de-minimis exemptions) have frequently been rolled back within several days of announcement, which suggests Trump may have a preference to propose aggressive tariffs in order to extract quick concessions in a negotiation. The White House fact sheet released along with the announcement noted that Trump would have discretion to lower rates in exchange for concessions on trade restrictions as well as broader alignment with the US “on economic and national security matters.”

Overall, if reciprocal tariffs go into effect as announced, we would expect the average effective tariff rate to rise by 18.4pp to 20.8% from 2.4% in 2024. Our forecast for the peak tariff rate is now 23%, well-above our previous forecast of 14.4%.

Impact on growth and inflation

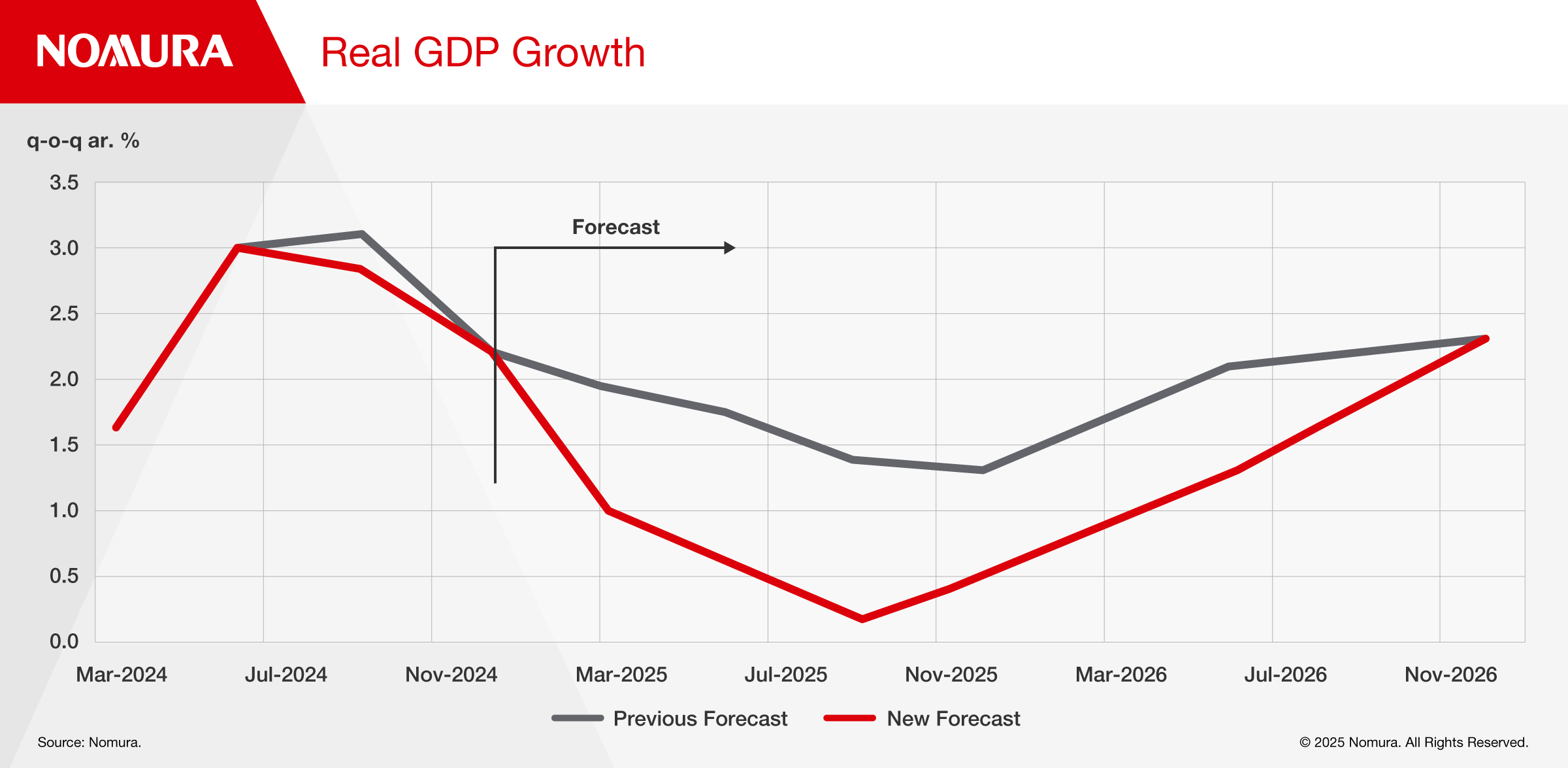

We expect higher tariffs to exert inflationary pressure while weighing on growth and employment (Fig. 2).

We have reduced our Q4/Q4 real GDP growth estimate to 0.6% from 1.5% and lowered our average NFP growth forecast to 90k per month for rest of the year. We have also made a more modest upward adjustment to our unemployment forecast. Recession risks have risen, but our base case remains for a continued expansion.

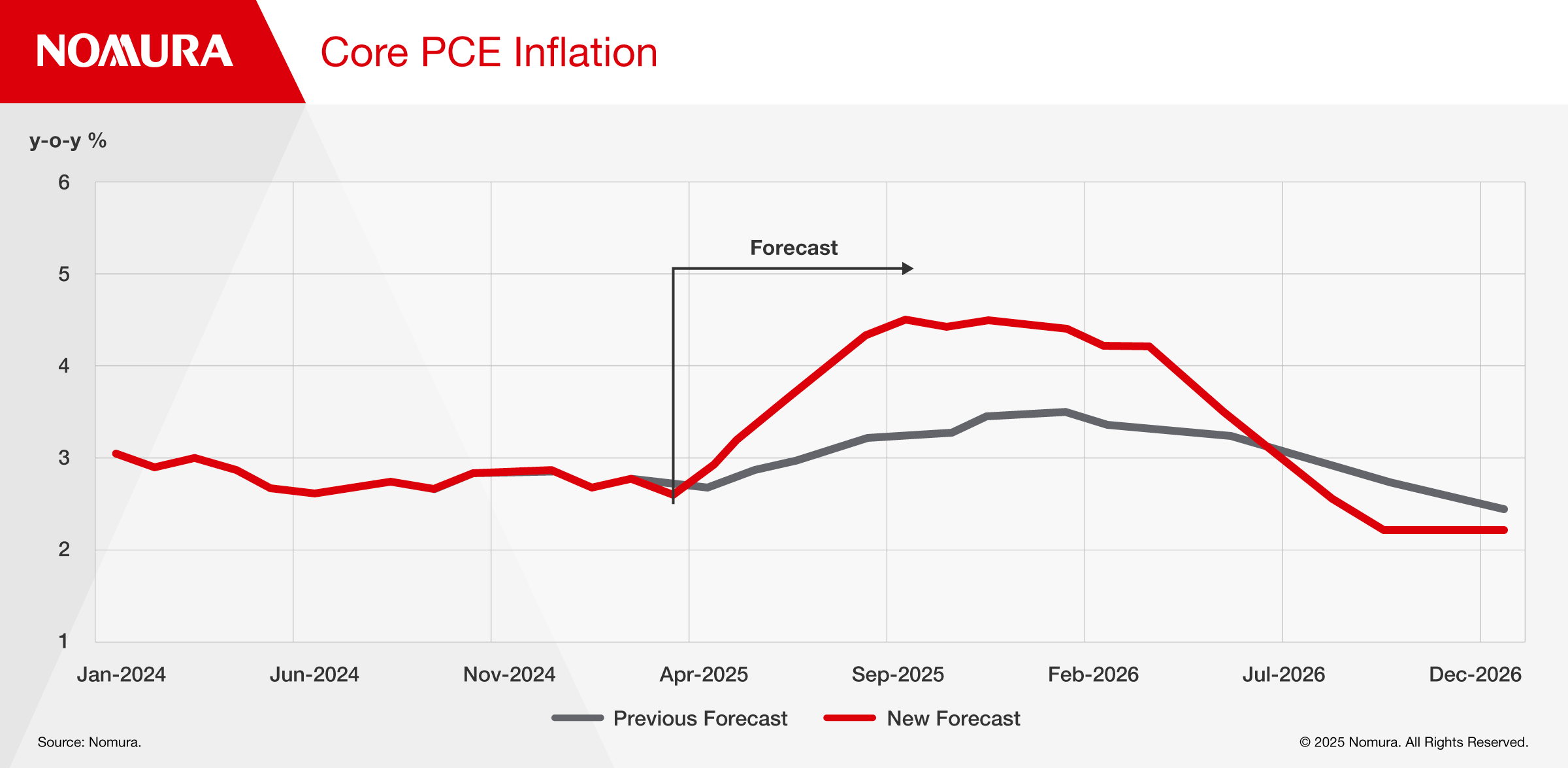

We have revised up our year-end core PCE inflation forecast to 4.5% y-o-y from 3.5% (Fig. 3). Earlier and more-aggressive tariffs and a worsening growth outlook should cause the inflationary impulse from tariffs to fade sooner than we had expected though. We expect monthly inflation prints should begin to cool by Q4 this year, with the 3m-annualized pace returning to below 2.5% by the end of this year.

We expect the Fed to remain focused on its inflation mandate, leaving rates unchanged until tariff-driven inflation has faded. Increased downside risks to growth and a more front-loaded inflation shock should allow cuts to resume sooner than we had expected though. Note that our previous monetary policy outlook assumed no rate cuts until Q2 2026. We now see the Fed cutting rates once this year in December, followed by back-to-back cuts in Q1 2026.

Contributor

David Seif

Chief Economist for Developed Markets

Aichi Amemiya

Senior US Economist

Jeremy Schwartz

Senior US Economist

Ruchir Sharma

US Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.