Korea Outlook 2019: Expect a Counter-Cyclical BOK Policy

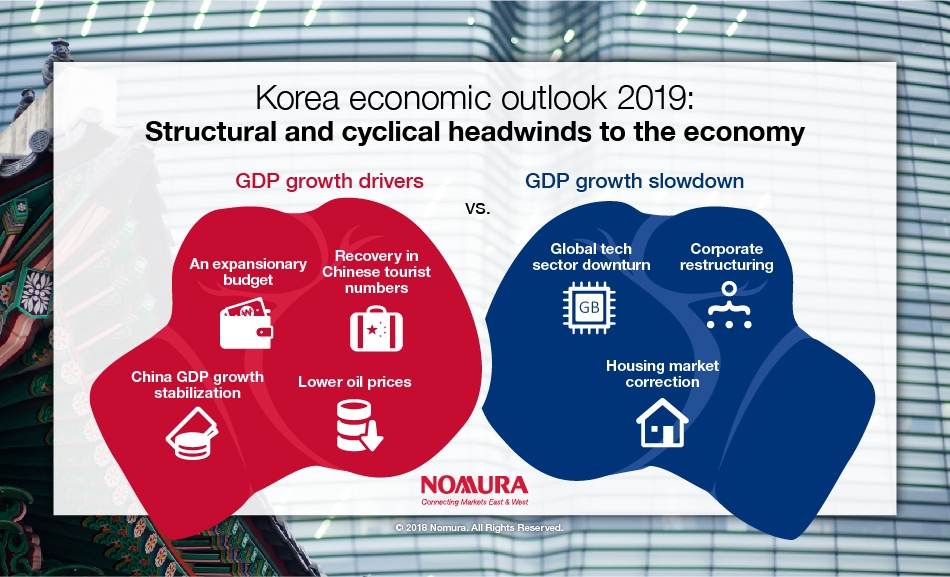

- Global tech sector downturn, corporate restructuring and housing market correction to contribute to real GDP growth slowing down

- An expansionary budget, recovery in Chinese tourist numbers, China GDP growth stabilization and lower oil prices should support growth in 2019

- A denuclearization deal between the US and North Korea could mean faster economic cooperation between the two Koreas; failure could increase tensions on the Korean peninsula

Structural and cyclical headwinds to the economy

We believe Korea’s economic cycle will enter and remain in a contraction phase in 2019-20, as we expect real GDP growth to slow from 2.7% in 2018 to 2.5% in 2019 and further to 2.3% in 2020 – below our estimate of the economy’s potential growth of 2.8%. This is mainly because of the global tech sector downturn, corporate restructuring (especially in the labor-intensive auto and shipbuilding industries) and a housing market correction alongside household debt deleveraging.

Struggling with an inventory overhang, the auto and shipbuilding sectors reduced their capacity, marking the very first decline in Korea’s overall manufacturing production capacity. We believe business investment will continue to decline in 2019, given still-elevated uncertainty over trade protectionism amid weaker global demand.

Despite weak job data, the Bank of Korea (BOK) hiked the policy rate by 25bp to 1.75% at its 30 November meeting as hawkish MPC members proved more concerned with financial imbalances associated with higher household debt and house prices. We believe this will inevitably hurt domestic demand – the trade-off between the short-term costs of weaker growth for the longer-term benefit of financial stability.

An expansionary FY19 budget, a recovery in Chinese tourist numbers, China GDP growth stabilizing in H2 2019 and lower oil prices should all support growth in 2019 – but not to the extent that they offset the structural and cyclical headwinds to the economy.

Below-target inflation ahead

We expect CPI inflation to rise from 1.6% in 2018 to 117% in 2019 before slowing down sharply to 1.4% in 2020 – all far below the BOK’s 2% inflation target. We forecast the unemployment rate to rise to 4.0% in 2019 from 3.9% this year. That said, the unemployment rate gap will widen, meaning more labor market slack and diminishing demand-side inflation pressure. Lower oil prices and a temporary fuel tax cut should more than offset higher public service prices.

Larger current account surplus largely due to weaker investments

The current account surplus is expected to widen to USD85bn in 2019 (4.8% of GDP) from USD75bn (4.4%) in 2018. Structurally, domestic investment should weaken on lower expected investment returns, but domestic savings should rise for precautionary needs as the population ages. Weaker business investment should lower capital goods imports, while a recovery of Chinese tourist arrivals will likely improve the service account. Korea’s net external assets amid lower local rates than global interest rates, and the National Pension Service’s increasing asset allocation to overseas equities suggest a better income account balance in 2019.

Denuclearization deal could be a big swing factor

A denuclearization deal between the US and North Korea could be a big swing factor; success would mean faster economic cooperation between the two Koreas, but failure could reignite geopolitical tensions on the Korean peninsula.

Read more about our 2019 outlook of different Asian economies here.

Contributor

Young Sun Kwon

Senior Economist Korea, Taiwan and Hong Kong

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.