Japan Stocks to Sustain Allure amid Structural and Policy Reforms

A confluence of factors from strong domestic demand and price hikes to increased foreign investor interest, are likely to boost Japan stocks as bigger profits continue through 2024.

- Profits will remain on an upward trajectory due to strong domestic demand and higher prices

- Other tailwinds include a Japanese version of the U.S. Inflation Reduction Act and a new Individual Savings Account system

- It will soon become mandatory for Japanese companies to report on sustainability-related metrics for human capital

STEADY PROFIT GROWTH

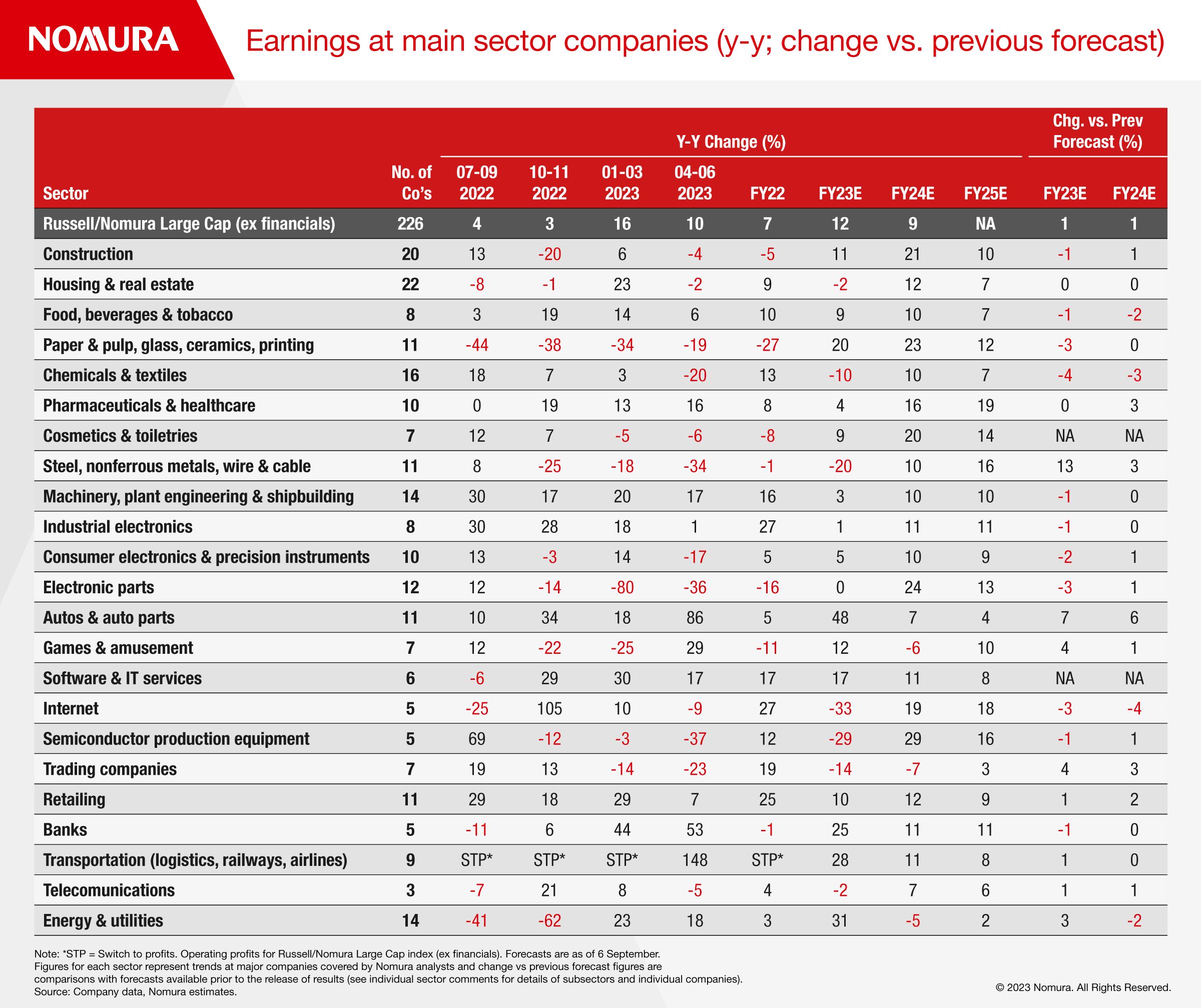

In light of the strong performance from domestic demand sectors thanks to Japan-specific factors such as weak-yen benefits, price hikes, economic reopening, and IT investment, as of 1 September we forecast 2% growth in sales and 12% growth in operating profits at Russell/Nomura Large Cap (ex financials) companies in FY23, a slight upward revision from our previous forecast compilation on 1 June.

Profits will remain on a solid upward trajectory in FY24 too, with a forecasted 9% operating profit growth, as a wide range of industries (especially manufacturers) benefit from economic recovery in Europe and North America.

We have raised our forecast for the TOPIX to 2,400 at end-2023 and 2,450 at end-March 2024. While also monitoring risks to external demand from the US and China, we think expectations will remain high for growth in domestic demand sectors and for corporate governance reforms.

EARNINGS DISPARITIES

While economic activity is normalizing and inbound demand is returning, conditions are now more fluid with respect to fluctuations in forex and interest rates, slower demand as a result of economic slowdowns in the US and Europe, credit concerns in China, input price trends, and progress with reflecting higher costs in product prices. The degree of impact from these factors, shifts in demand, structural reforms, and individual companies’ business strategies are causing gaps to open up between sectors and between companies within the same sector, and we expect continued disparities in earnings and share price movements.

Looking at the breakdown of earnings at major companies in each sector, we see that profits declined year-on-year in roughly half of the sectors in April–June, but for the full year in FY23, many sectors are expected to maintain profit growth.

JAPANESE STOCKS TO WEATHER CHINA CREDIT CONCERNS

Investors should not be overly pessimistic about the overall impact on Japanese equities of macroeconomic conditions in China, for three main reasons. First, non-resident investors increased their purchases of Japanese stocks while Chinese equities declined in May–June. Second, Japanese companies’ direct exposure to China is not so large, with sales in China accounting for roughly 9% of the total. Third, we see little scope for further decline in economic activity in China. On the other hand, we see little prospect of a sharp recovery in the Chinese economy as long as the central government shows no sign of opening the fiscal spigot.

OVERSEAS INVESTORS AND JAPANESE EQUITIES

We expect overseas investors to continue to hike their Japanese equity positions from underweight toward neutral for several reasons: (1) corporate earnings look favorable, as operating profit growth appears likely to accelerate heading into FY23 Q4; (2) Several events on the calendar could draw attention to Japanese equities, including the Japan Weeks events (25 Sep–6 Oct), which the government is inviting many non-resident investors to visit; the drawing up of a Japanese version of the U.S. Inflation Reduction Act; and the launch of the new Nippon Individual Savings Account system in January 2024; (3) While the Tokyo Stock Exchange’s requests have yet to lead to any standout changes, progress is being made, with some low price-to-book sectors starting to disclose prospective corporate value improvement measures.

PERSONNEL STRATEGIES AMID ESG REFORMS

Human capital management, which treats personnel as capital rather than a cost and seeks to maximize their value to boost corporate value, is a growing focus of interest.

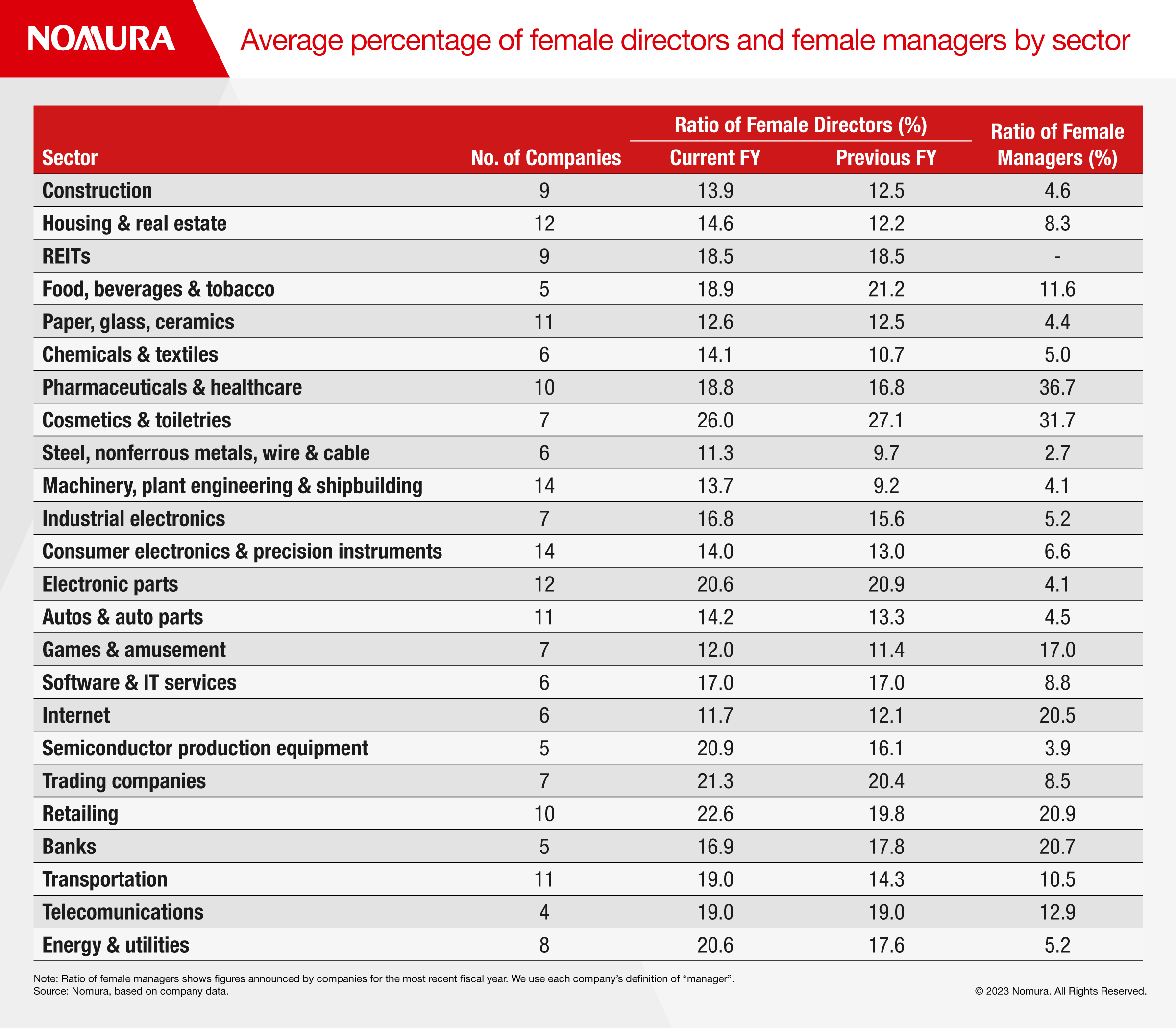

For fiscal years ending after 31 March 2023, it becomes mandatory for companies to report on sustainability-related metrics for human capital (strategies for developing personnel and improving the workplace) and diversity (gender pay gap, percentage of female managers, percentage of male employees taking childcare leave) in their annual disclosure filings.

The Japan Productivity Center (JPC) compiled data on disclosures for 1,225 TSE Prime Market companies with March year-ends. By sector, the percentages were highest in services, followed by finance/insurance/real estate and information & communications, and lowest in mining/construction and electric power & gas.

HUMAN CAPITAL AND MANAGEMENT STRATEGY

Many companies’ corporate philosophies position human capital as integral to their business strategy. We see examples of consumer electronics & precision instruments companies that are putting this into practice to comply with principles laid out by their founders, promoting health and productivity management that aligns with their own businesses, and redefining regional job creation as a strength.

We see company policies aimed at proactively promoting women to director positions, in many sectors (housing & real estate, J-REITs, chemicals & textiles, cosmetics & toiletries, consumer electronics & precision instruments, telecommunications); this reflects the government’s policy of achieving 30% female directors by 2030. Some companies across sectors rely on female directors hired externally and make few internal promotions (construction, housing & real estate, paper, glass, ceramics).

PROMOTING FEMALE MANAGERS

Rather than simply increase the percentage of female directors, a series of companies are increasingly seeking to step up internal promotions, increase the percentage of female managers as candidates for promotion, and create more opportunities for women, with the long-term goal of diversifying their pool of future management personnel.

We see examples where initiatives to develop female leaders have resulted in more than 50% female managers globally (cosmetics & toiletries), sectors where employees are mostly female (mainly pharmacists) and companies aggressively promoting women to management (pharmaceuticals & healthcare).

Other initiatives include using the percentage of female managers as an incentive in executive compensation (steel, nonferrous metals, wire & cable).

STEPPING UP FEMALE EMPOWERMENT INITIATIVES

In sectors with a low percentage of female employees work-style reforms need to be accelerated to increase this percentage in the long term (construction) and to set percentage hiring quotas for female new graduates (autos & auto parts).

We see examples of companies that have set numerical targets for the percentage of female managers (paper, glass, ceramics, energy & utilities).

DIVERSITY DRIVING CORPORATE CULTURE REFORMS

We expect moves to promote more female employees, to ultimately lead to corporate culture reforms. In the food, beverages & tobacco sector, we see an example of a company with a low percentage of female managers where men have thus far led product development and pricing, that have nonetheless incorporated women’s perspectives in setting prices acceptable to consumers, leading to more flexible pricing policies and an increase in added value.

IMPROVING COMPENSATION TO BOOST PERFORMANCE

We highlight moves in a variety of sectors to improve compensation and train personnel, with the aim of attracting and promoting high-quality employees and enabling them to shine. Companies are increasing wages, including initial pay for new graduates (retailing, internet, games & amusement, transportation), but the situation differs considerably by sector.

HUMAN CAPITAL AS A GROWTH DRIVER

Some companies are aiming to translate hiring of more specialized personnel into growth. Examples include the software sector where a shortage of digital transformation personnel is spurring companies to recruit experts to accelerate their growth cycle.

SUCCESSION PLANNING

Given that a company’s personnel strategy is the foundation for sustained growth, it should naturally include succession planning. In telecommunications, companies have introduced in-house schemes to identify and train the next generation of management; while in chemicals & textiles, companies quantify potential candidates in the form of a “succession candidate sufficiency rate” that they track over time.

Download a PDF of the full whitepaper

Contributor

Yunosuke Ikeda

Head of Macro Strategy, Japan

Juichi Wako

Head of ESG Team, Japan

Masaki Motomura

Senior Equity Strategist

Naoya Fuji

Equity Strategist, Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.