Japan Retail Investors Embrace ESG Amid Pandemic, Nomura Survey Shows

The results of Nomura Securities’ December 2021 Individual Investor Survey reveal that Japan retail investors are increasingly interested in ESG-aligned financial products.

- Respondents placing importance on ESG investments climbed to about 40% in 2021 from 30% a year earlier

- In the youngest age group, under 39, the percentage of respondents saying they began to place importance on ESG investment grew to 32.7% from 19.2%

- The pandemic has spurred interest in ESG themes and climate change

Retail investors in Japan are increasingly interested in ESG investments after the coronavirus pandemic drew attention to environmental issues and human rights matters, according to findings in Nomura Securities’ December 2021 Individual Investor Survey.

The quarterly poll seeks to understand Japanese retail investment trends. The survey was conducted online and questionnaires were sent out to 3,000 randomly selected investors from a pool of about 24,000 people with experience in stock investments. It was complete when the number of valid responses reached 1,000.

Overall, the survey revealed that individuals are prioritizing ESG to a greater extent than in previous years, matching the intensifying global attention on the topic.

At least 189 countries have submitted plans for climate solutions, opening up several trillion dollars in climate-related investment opportunities. These plans will make the consideration ESG factors even more critical for investors in the years ahead.

How Covid-19 Changed Perceptions around ESG

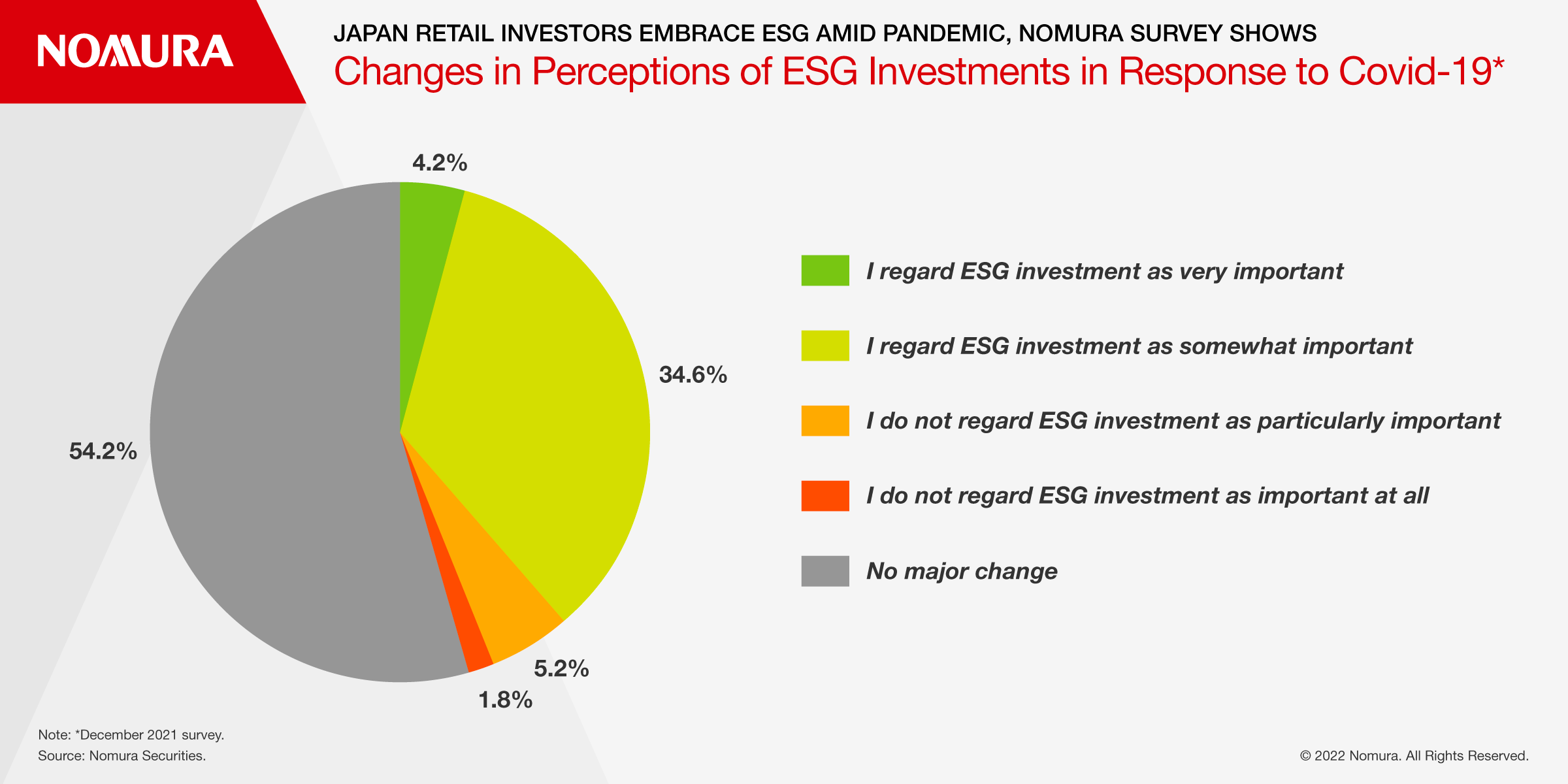

In Japan, the number of people placing importance on ESG investment rose to nearly 40% from 30% between December 2020 and December 2021 due to the impact of Covid-19, the survey showed.

The pandemic’s impact on the global economy in a short span of time -- which pushed several countries into recession -- prompted policymakers and investors alike to look more closely at risks such as climate change that threaten the planet.

Interestingly, the youngest demographic in the survey appeared to see more value in ESG investments. Last year, in the age group of 39 or younger, the percentage of respondents saying they began to place importance on ESG investment grew to 32.7% from 19.2% a year earlier, demonstrating that the pandemic had sparked interest in sustainable investing among those who had previously paid less attention to the topic.

Assets under management among ESG funds in Asia grew to $94.2 billion as of June 2021 from $30.8 billion in 2019, according to a report by consulting firm Cerulli. In the first nine months of 2021, 76 new ESG funds were launched in Japan and China, and retail appetite for ESG products in Asia-Pacific also increased, according to the report.

Return on Investment: the Crux of the Matter

While some investors worry that putting money into companies that invest in improving their ESG performance will mean sacrificing returns, they are relatively few and far between.

In Nomura’s December 2021 survey, the majority of respondents, or 51.2%, said that while return on investment is important, ESG factors need to be considered. About 21% said ESG factors are important for sustainable growth and are more important than return on investment.

The proportion of respondents saying ESG factors need to be considered above return on investment has increased incrementally in recent years, rising from 18.8% in 2018 to 20.9% in 2021.

Only about 7% of those surveyed said that ESG factors need not be considered at all and return on investment remains paramount.

In line with this, the survey also revealed that interest in financial products that actively invest in environmentally conscious companies increased steadily over the past four years from 24.5% in 2017 to 33.2% in 2021. The trend indicates that investors are especially sensitive to investments with exposure to climate themes.

On a similar note, retail interest in financial instruments that contribute to Sustainable Development Goals or specific objectives increased from 15% of respondents in 2020 to 17.5% in December 2021.

Encouragingly, the percentage of respondents not interested in ESG-related financial products dropped from 45.8% to 38.5% between 2017 and 2021. While these results are positive, more work needs to be done.

Corporate ESG Initiatives and Investment Decisions

Retail investor interest in corporate ESG efforts was more or less stable between 2018 and 2021, according to the study. In December 2021, about 53.3% of survey participants said they were interested in corporate ESG initiatives: this was down 1.5% from the December 2020 study and 0.1% lower than December 2018.

Notably, participants aged 60 and over ranked higher in their interest in corporate ESG efforts.

In conclusion, Japan retail interest in ESG investments is growing at a steady pace but there is scope to increase awareness of securities investments as a means of responsible long-term asset formation.

Download a PDF of the full whitepaper

Contributor

Kengo Nishiyama

Senior Analyst, Nomura Institute of Capital Markets Research

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.