Japan Pioneered Transition Bonds but Needs Demand to Grow the Market

Japan's adoption of transition bonds to support heavy industry means that it now accounts for nearly 70% of global issuance

- Japan’s use of transition bonds may help the government reach net zero by 2050

- Challenges include ensuring investor demand without creating a market imbalance

- Japan’s transition roadmaps provide support to eight GHG-intensive industries: iron & steel, chemicals, electric power, gas, oil refining, cement, pulp & paper, and automobiles

Japan has pioneered the transition bond market and now needs to promote broader global adoption while cementing demand for the instruments as a key tool to decarbonize hard-to-abate sectors and reach net zero.

A global movement towards realization of a decarbonized society has been accelerating since the 2015 international agreements on Sustainable Development Goals and the Paris Agreement. In Japan, then Prime Minister Yoshihide Suga declared in October 2020 that Japan would aim to be a decarbonized, carbon neutral society by 2050 by reducing greenhouse gas emissions (GHG) to virtually zero.

Fulfilling this goal will require the expansion of industries and businesses that do not emit GHGs to offset the impact from some incumbents that have large emissions footprints and are technically difficult to decarbonize in a short period of time. In order to achieve a decarbonized society, it is necessary to support a broader transition, including energy conservation and fuel conversion.

Reaching net zero is expected to require significant financial resources. For Japan, the government estimates that in order to achieve carbon neutrality by 2050 while strengthening industrial competitiveness and growing the economy, public and private investment in green transformation (GX) will exceed JPY150 trn ($1trn) over the next ten years. Against this backdrop, the government has taken various measures to promote transition finance as a decarbonization tool over the past four years.

We examine the development of transition finance, the situation in Japan, and the future challenges.

EVOLUTION OF TRANSITION FINANCE

The world’s first transition bond was issued in July 2017 by Castle Peak Power Finance Company Limited, a subsidiary of a Hong Kong electric power company. In December 2020, the International Capital Market Association (ICMA) published its first Climate Transition Finance Handbook (CTFH), contributing to greater global awareness of transition finance.

In Japan, the Financial Services Agency (FSA), Ministry of Economy, Trade and Industry (METI), and the Ministry of the Environment (MoE) published Japan’s Basic Guidelines for Climate Transition Finance (the Basic Guidelines) in May 2021. Based on the four elements outlined in ICMA’s CTFH (transition strategy and governance, business model environmental materiality, science-based strategy, and implementation transparency), the Basic Guidelines cover disclosure, and issues related to independent reviews.

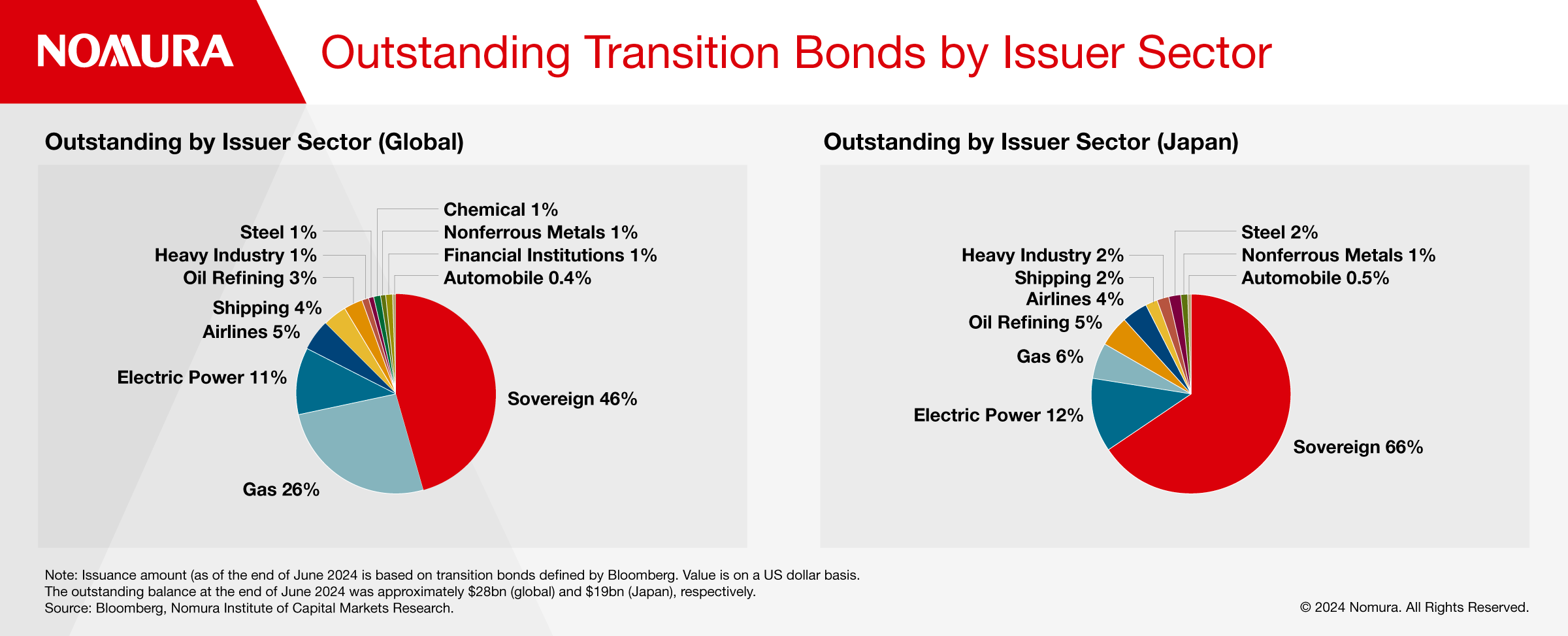

In addition, METI has developed technology roadmaps that provide concrete directions for eight GHG-intensive industries (iron & steel, chemicals, electric power, gas, oil refining, cement, pulp & paper, and automobiles) to transition to carbon neutrality in 2050. The roadmap is intended to be referenced by companies as they consider climate change measures funded by transition finance. It is also intended as a reference for financial institutions to determine whether companies’ strategies and initiatives toward decarbonization qualify them for using transition finance when procuring funds. In addition to METI’s roadmap, the Ministry of Land, Infrastructure, Transport and Tourism has developed a roadmap for the shipping and aviation industries. Combined, these two roadmaps cover approximately 80% of Japan’s carbon dioxide (CO2) emissions.

METI has also implemented its Transition Finance Model Project and Subsidy for Global Warming Countermeasures Promotion Project since FY2021 to disseminate information about projects considered to be good examples of transition finance. Model projects receive government support to cover the costs of external assessment to determine eligibility for transition finance.

In addition to the government’s measures, the Climate Response Financing Operations launched by the Bank of Japan (BoJ) in December 2021 may have helped stimulate demand for investment in and financing of transition finance projects. The BoJ’s Climate Response Financing Operations provide long-term funds at near 0% interest rates to financial institutions that invest in and lend to climate-change related projects, including projects qualifying for transition finance.

In February 2024, the Japanese government issued the world’s first sovereign climate transition bonds, under its GX Economy Transition Bond program. These interest-bearing government bonds (JGBs)1 totaled approximately JPY 1.6trn. Japan plans to issue a total of JPY20trn worth of GX economy transition bonds over ten years from FY2023 to support upfront investment in green transformation. Proceeds will support the development of innovative technologies and capital investment to decarbonize energy and raw materials, and enhance the profitability of companies.

CURRENT STATE OF TRANSITION BOND ISSUANCE

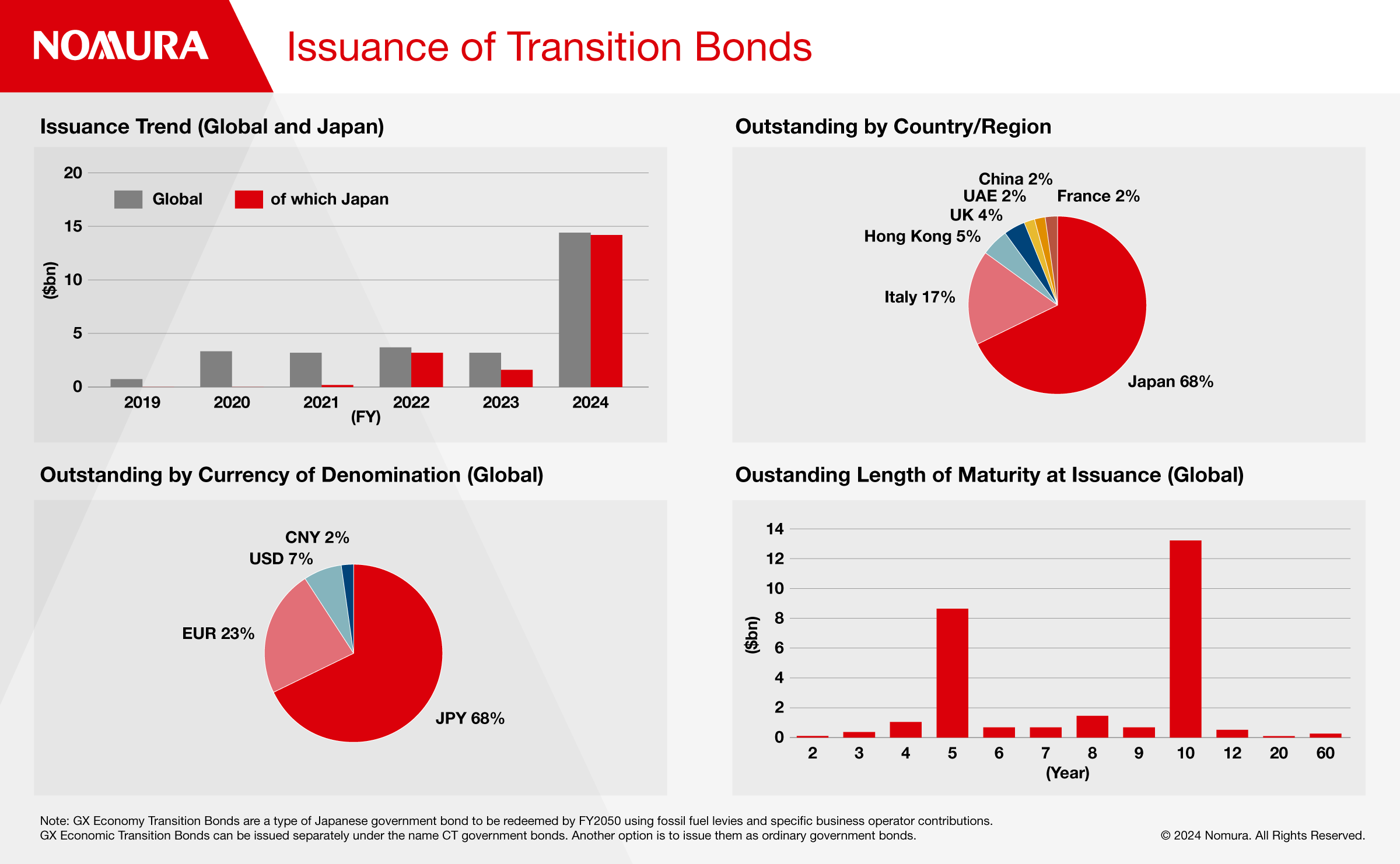

Transition bonds have been issued around the world since 2017 with Japan’s first issuance coming in summer 2021. The Japanese government’s first sovereign climate transition bond issue in February 2024 increased the outstanding issuance of transition bonds by Japanese issuers as of the end of June 2024 to US$19bn, accounting for about 68% of total global issuance (US$28bn) (see figure below). The Japanese government is now the largest issuer of transition bonds in Japan while other major issuers include companies with relatively large GHG emission levels, including the electric power, gas, and oil refining industries.

Transition bond issuance in countries and regions other than Japan, however, has not expanded very steadily. The main reason seems to be that ICMA’s CTFH is a guideline for disclosures when implementing transition finance, unlike the Green Bond Principles, which provide information on eligibility of projects. For this reason, financing that expresses the transition strategy of issuers outside Japan tends to be conducted through sustainability-linked bonds, which are already widespread in financial markets and designed as general corporate purpose instruments. The number of countries, regions, and industries represented by transition bond issuers is also limited.

CHALLENGES IN JAPAN

In Japan, transition finance has increased steadily, thanks in part to the government’s multi-layered measures promoting its role in the green transition. In order to build upon its good progress and ensure its use of transition finance contributes to the realization of a decarbonized society, Japan needs to address three issues.

First, it needs to create a positive image of transition finance in international markets. In many countries, there are negative associations about transition finance, due to concerns that it may extend the life of industries with high GHG emissions. In order to dispel this negative image and gain more credibility, it is important to show the validity of the transition strategy.

This can be done by taking measures such as enhancing information disclosure by issuers and continuing to explain, through dialogue with investors and other stakeholders, that transition finance truly contributes to realizing a decarbonized society.

Second is the need for greater international cooperation. Many countries are implementing measures to increase the credibility and transparency of transition finance. In particular, the Association of Southeast Asian Nations, which needs transition finance to decarbonize, has followed the European Union and created a classification for transition activities in its Sustainable Finance taxonomy. Although Japan has not formulated a taxonomy, it may be meaningful for Japan to cooperate with other countries’ systems in order to spread the use of transition finance globally.

Third, Japan needs to promote measures to ensure smooth demand for its climate transition government bonds by financial markets given they account for the largest share of Japan’s transition bond market and could therefore influence supply and demand in the overall market. Consequently, the Japanese government needs to make constant efforts to ensure its bonds are appealing to investors via steps to improve the reliability of impact reporting through external audit and verification. Furthermore, and over time, it may be necessary to expand the investor base to include individuals as well as institutional investors to create a diverse market.

To gain further insights on this topic, please contact Akane Enatsu

Contributor

Akane Enatsu

Head of Nomura Research Center of Sustainability, NICMR

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.