Japan Cross-Shareholdings Enter a Dynamic New Era

As corporate governance reforms take hold in Japan, companies are changing how they manage some of their key business relationships.

- The ratio of cross-shareholdings in Japan declined by 0.7% points to 30.8% at the end of March 2024 due to corporate governance reforms

- As cross-shareholdings draw more scrutiny, reductions are likely to accelerate, changing the cross-shareholding relationship from static to dynamic

- This new era requires proper monitoring such as verifying the rationality of holdings and exercising voting rights

A shake-up in Japan’s Corporate Governance Code has triggered an unwinding of cross-shareholdings, which is likely to accelerate and usher in a more dynamic relationship between business partners.

REDUCTION IN CROSS-SHAREHOLDINGS

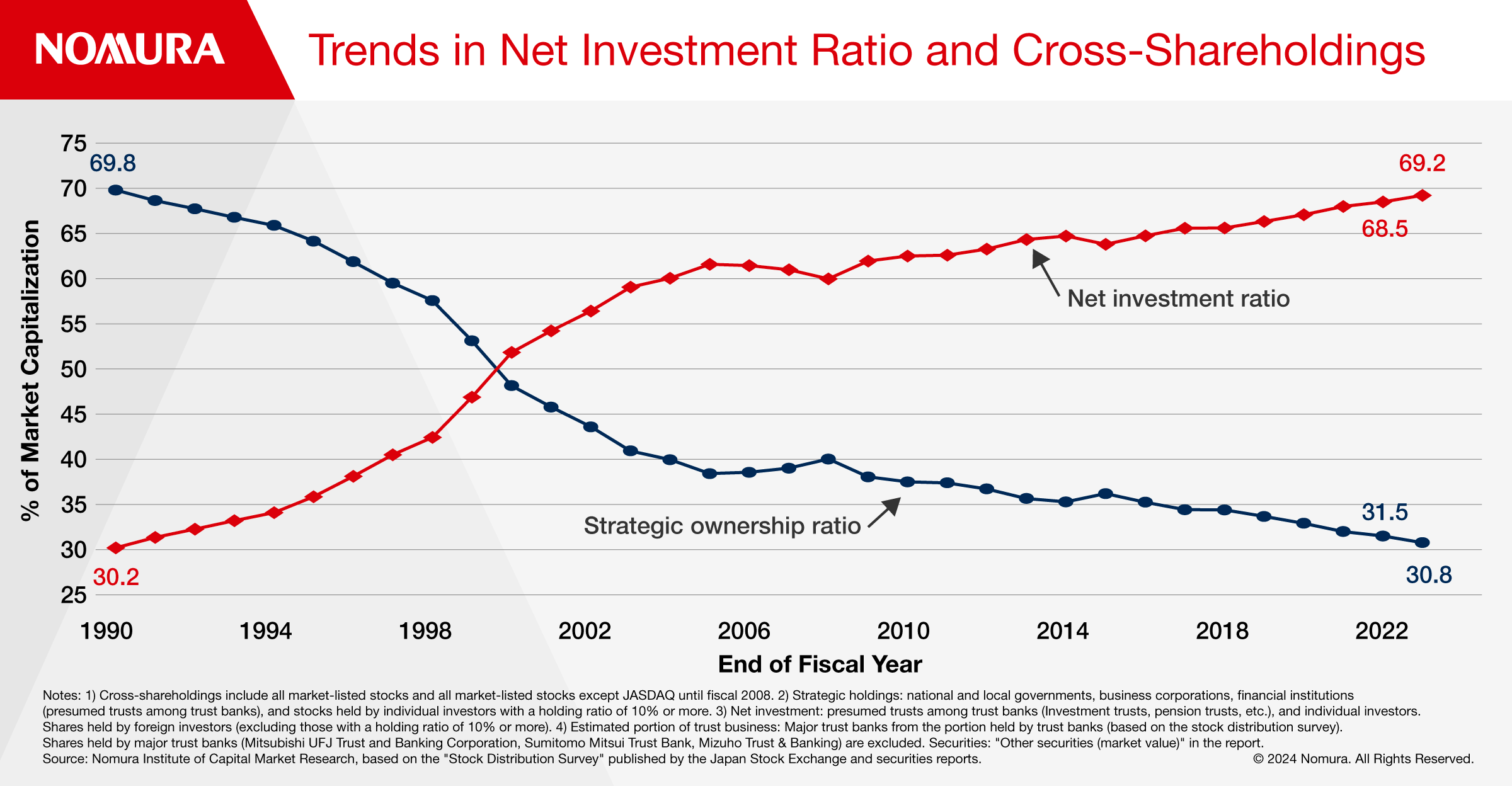

The ratio of strategic cross-shareholdings declined from 31.5% to 30.8% in fiscal 2023 while the net investment ratio rose from 68.5% to 69.2% over the same period (Figure 1).

NET DECREASE IN STRATEGIC HOLDINGS AMONG RUSSELL/NOMURA LARGE CAP WIDENED

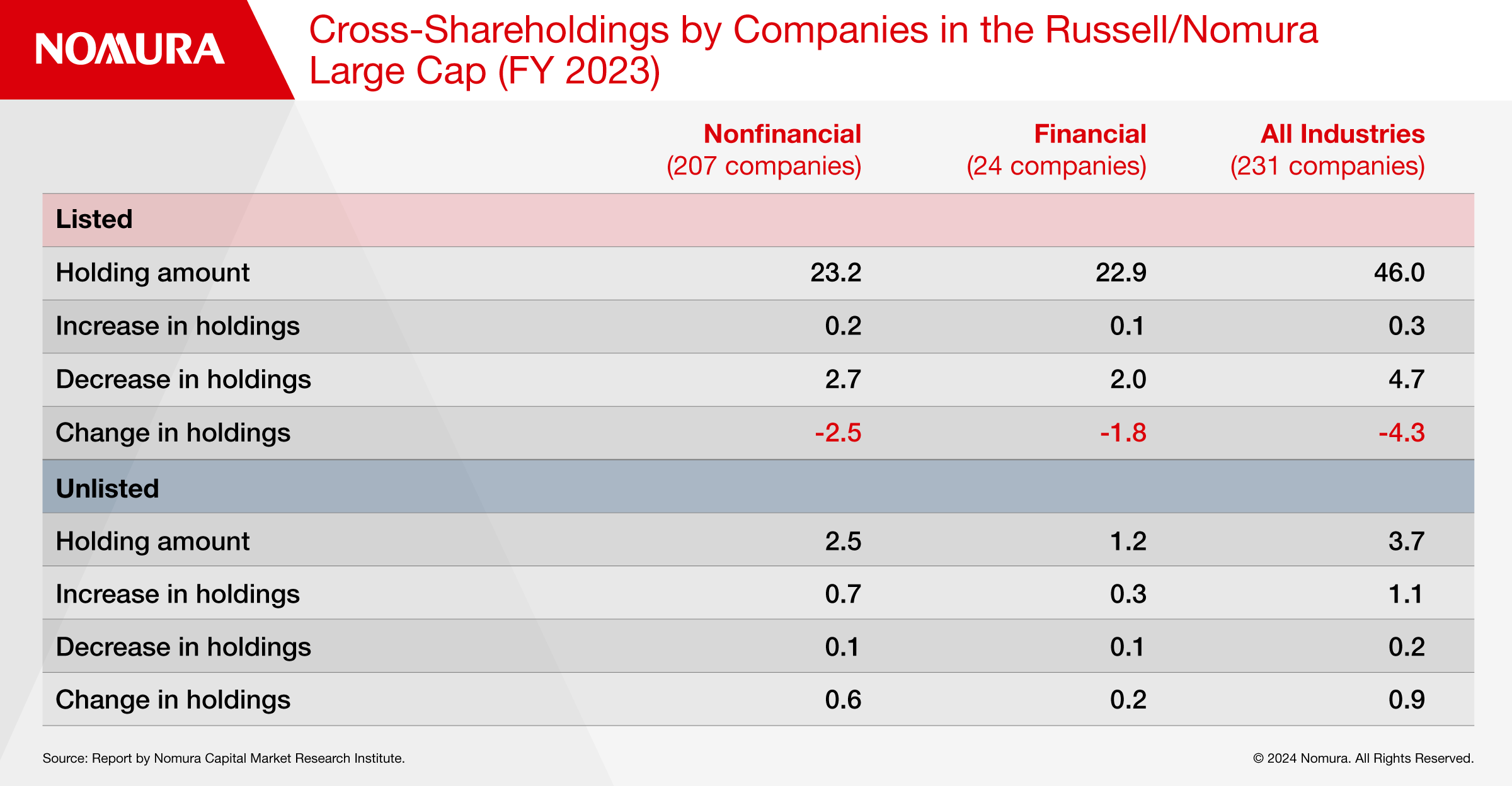

Taking a closer look at changes in the strategic holdings of listed companies, we tabulated the amounts reported on the balance sheets of “investment shares held for purposes other than net investment,” which are listed in the “Status of shareholdings” column of the securities reports for the fiscal year ended March 2024 for the 231 companies in the Russell/Nomura Large Cap whose fiscal year ended March 31 (Figure 2).

The cross-shareholdings of 207 non-financial companies decreased by ¥2.5 trillion ($17.6 billion), while for the 24 financial companies, they decreased by ¥1.8 trillion, resulting in a net decrease of ¥4.3 trillion.

Looking at the breakdown of changes in cross-shareholdings in fiscal 2023, for listed stocks, non-financial holdings increased by ¥200 billion and financial holdings by ¥100 billion. On the other hand, non-financial holdings decreased by ¥2.7 trillion and financial holdings by ¥2 trillion.

CROSS-SHAREHOLDINGS AND FUTURE DIRECTION

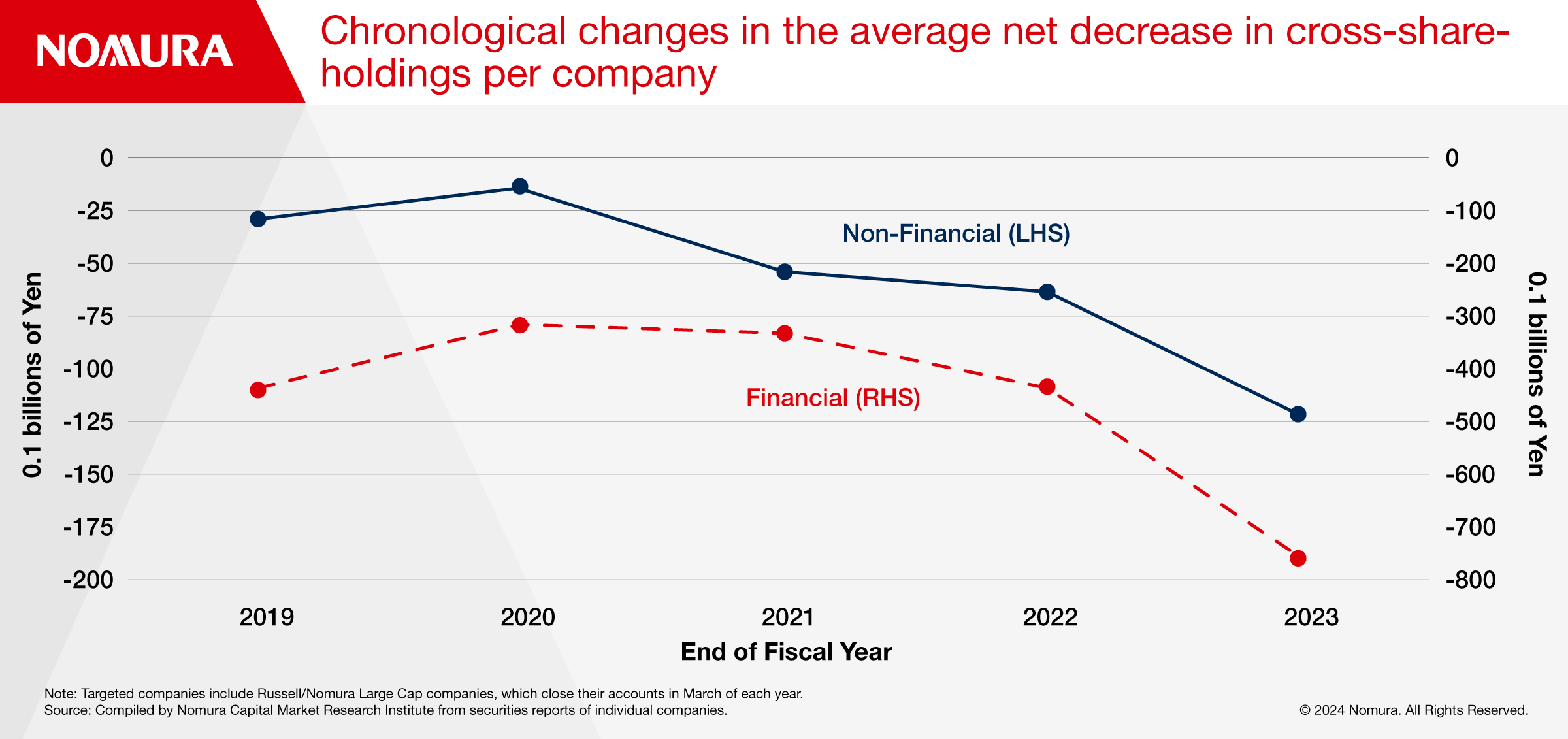

In fiscal 2023, listed companies accelerated their efforts to reduce their cross-shareholdings due to further moves to set a threshold for the number of cross-shareholdings as a criterion for the exercise of voting rights by institutional investors, and the issue of cross-shareholdings was pointed out as a factor in corporate scandals at non-life insurance companies.

STOCKS HELD IN SECURITIES REPORTS

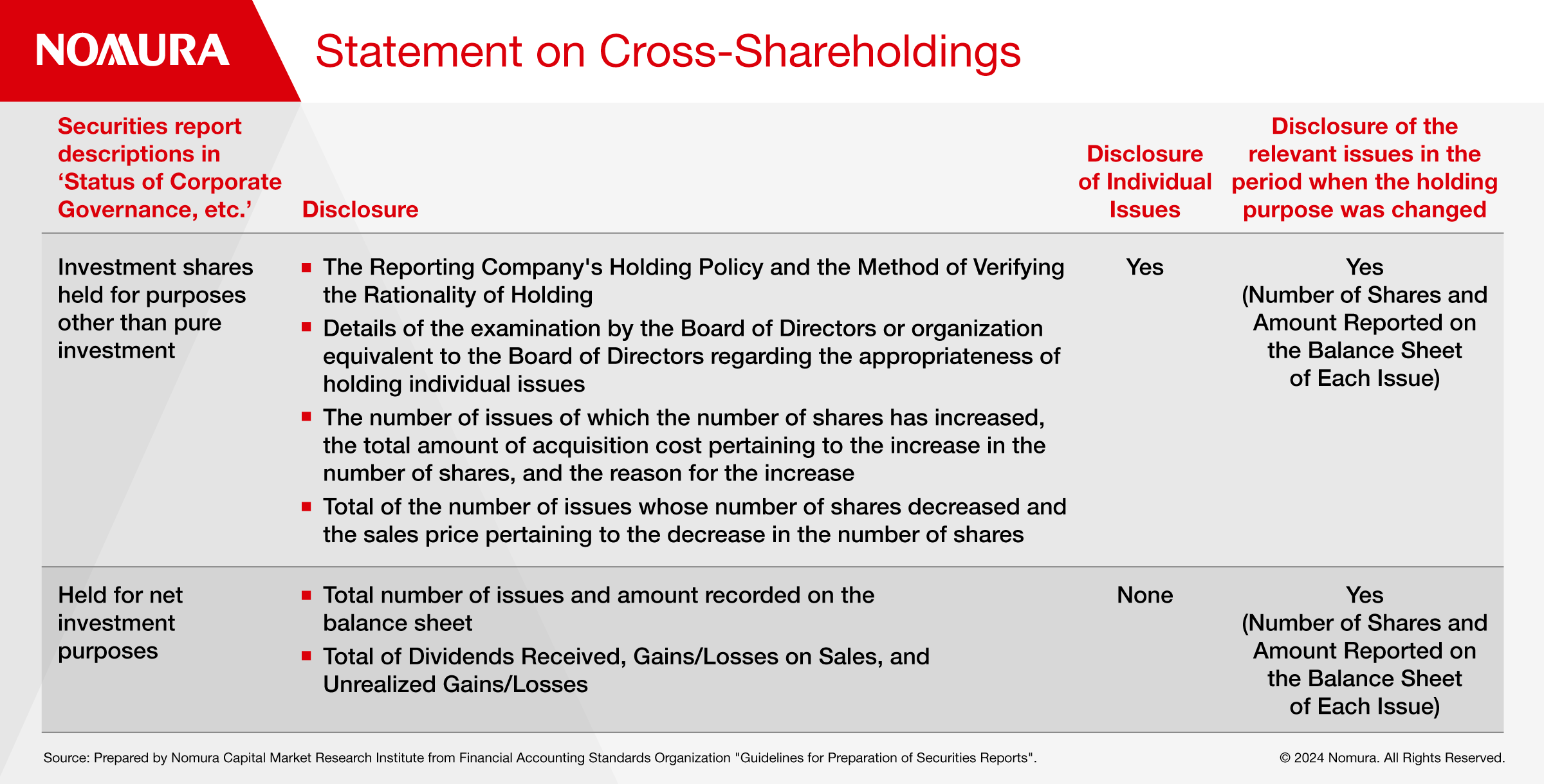

In the “Status of Corporate Governance” of annual securities reports, cross-shareholdings are classified into “investment shares held for purposes other than net investment” and “shares held for the purpose of net investment.”

According to the Financial Accounting Standards Institute’s “Guidelines for Preparation of Annual Securities Reports,” “Net investment purpose is considered to be the case where the purpose is to receive profits solely from changes in the value of shares or dividends related to shares” however, the judgment as to whether the purpose of holding falls under the category of net investment is “likely to be made by individual companies,” and the discretion regarding the classification is left to companies.

Figure 4 shows that investment stocks held for purposes other than pure investment are required to disclose information on up to 60 individual stocks under certain conditions, such as the method of verifying the holding policy and the reasonableness of holding, the number of companies whose shares have increased or decreased, and the reasons for any increase.

However, investment stocks held for pure investment are not required to disclose information on verification of the reasonableness of holding or individual stocks.

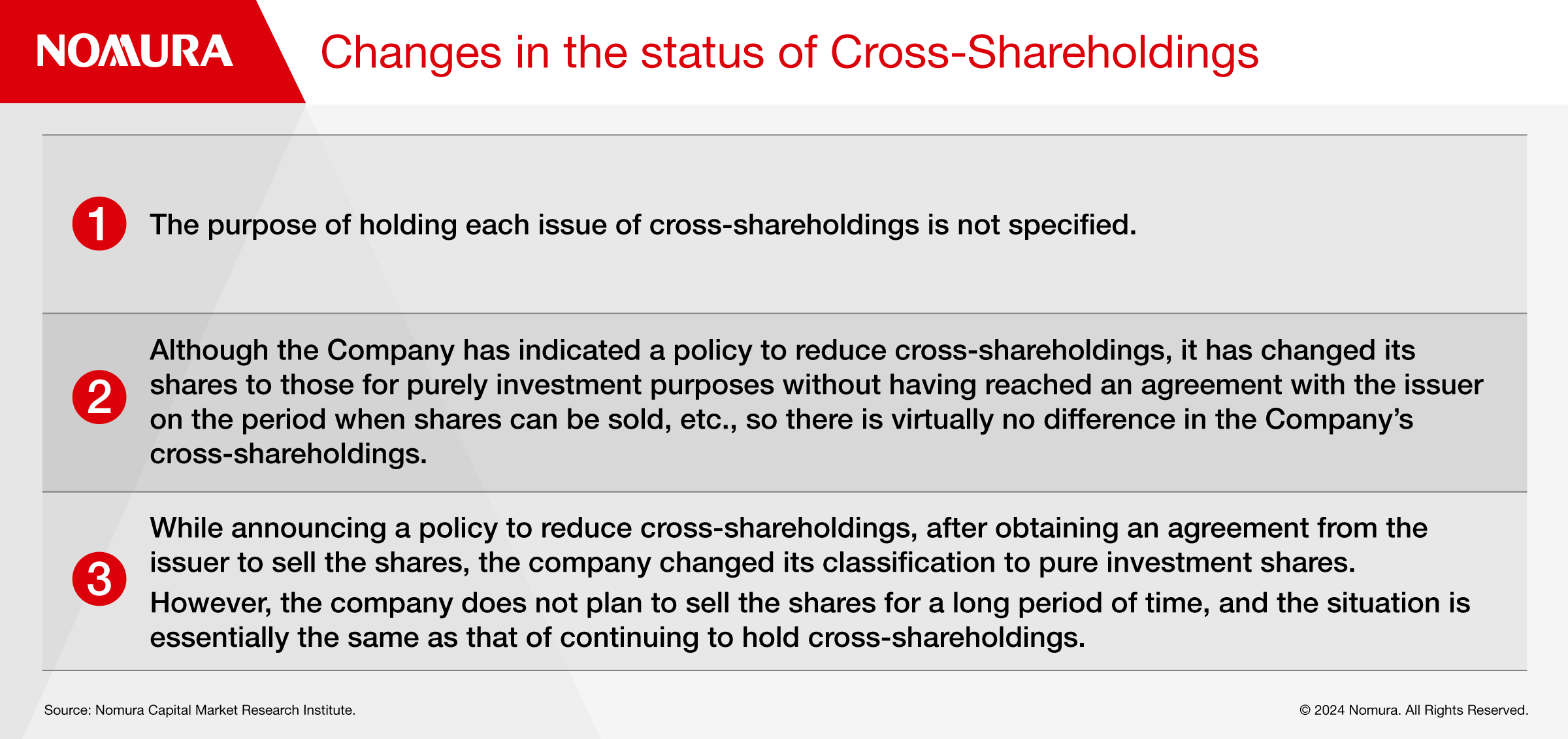

In a March 2024 paper, the Japan Financial Services Agency pointed out as an issue regarding disclosure of cross-shareholdings that, even if the purpose of holding the shares is changed, if they will not be sold thereafter, in reality there is no difference from the previous status (Figure 5).

To address this concern, the FSA Stewardship Code and Corporate Governance Code released “Action Program 2024 for Implementing Corporate Governance Reform” in June. The report recommended: (1) investors and parties concerned with the FSA and TSE should urge companies to thoroughly examine the rationality of their holdings in light of the Corporate Governance Code; (2) it is important for the FSA to make appropriate disclosures in its annual securities reports; and (3) the FSA should conduct a deeper examination of the actual disclosures and take measures, such as expanding disclosure, based on the results of the examination. In response, the FSA plans to begin a survey of all listed companies to see if they are properly disclosing their cross-shareholdings.

Considering the above, investors are concerned about the potential for gaming the system if companies change investor shares that are not for net investment purposes to those for net investment purposes and thus artificially reduce their cross-shareholdings.

Indeed, few of the above-mentioned cases of companies in the Russell/Nomura Large Cap changing from non-investment to net investment explained the reasons for the change and the future direction.

WHAT KIND OF DISCLOSURE IS DESIRABLE?

According to the FSA, when reclassifying a stock for strategic purposes to a pure investment purpose, it is useful to disclose the reason for the reclassification, the criteria for exercising voting rights after the reclassification, and the expected period until the sale of the stock.

Investment stocks with a pure investment purpose require more careful disclosure than investment stocks with a non-pure investment purpose. Since the purpose of a pure investment is to obtain capital gains and income gains, stocks are held as investment assets. If this is the case, it is necessary to establish a management system.

CHANGING VIEWS ON CROSS-SHAREHOLDINGS AS STABLE SHAREHOLDERS

The trend toward a decrease in cross-shareholdings is here to stay, which also means a decrease in the number of so-called stable shareholders. At the same time, the view that even cross-shareholdings are not necessarily stable shareholders is also likely to spread in the future.

As cross-shareholdings are held primarily for the purpose of establishing, maintaining, and developing relationships, including transactions, it was historically considered unnecessary to express particular opinions on the management policies of the company in which the shares were held, and there was little need to vote against a proposal by the company at shareholder meetings.

However, with an increase in net investment and a decrease in cross-shareholdings, alongside the establishment of the Stewardship Code, institutional investors have become more active in exercising voting rights and engaging with shareholders, and the rejection of a proposal by the company has become more routine. Furthermore, with the establishment of the Corporate Governance Code, it has become necessary to justify the reasonableness of cross-shareholdings and to explain how the company views the exercise of voting rights.

As cross-shareholdings continues to change, and the shareholder structure becomes dominated by net investors, a new more dynamic relationship is being built between companies, shareholders and investors.

Contributor

Kengo Nishiyama

Nomura Institute of Capital Markets Research

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.