Japan begins discussions on carbon pricing framework

Carbon pricing in Japan could focus on policy mix involving carbon tax, emissions trading, subsidies

- As part of global moves toward reducing carbon emissions, attention will likely focus on the debate surrounding carbon pricing in 2021.

- While the overall shape of Japan's carbon pricing scheme is unclear at this point, we expect it to focus on a policy mix that combines a carbon tax, emissions trading scheme, and subsidy programs.

- What is the potential economic impact of carbon pricing? We analyzed how it might affect the earnings of Japanese businesses.

Discussions begin on full-scale launch of carbon pricing

We expect carbon pricing to be a global theme in 2021 given its key role in moves to decarbonize. Progress with the debate on carbon pricing in Japan is a response to the global trend toward reducing carbon emissions. Carbon pricing can be broadly divided into explicit and implicit carbon pricing. Globally, the debate on explicit carbon pricing (particularly carbon taxation and emissions trading schemes) has advanced the furthest. While carbon taxes can be easily applied even to SMEs, it is doubtful how effective they are in lowering emissions. We think emissions trading schemes will inevitably be used mainly by large companies that are able to monitor their emissions, but we expect them to be cost effective and reliably translate into lower emissions. The two schemes can also be combined.

MOE, METI launching debate on carbon pricing

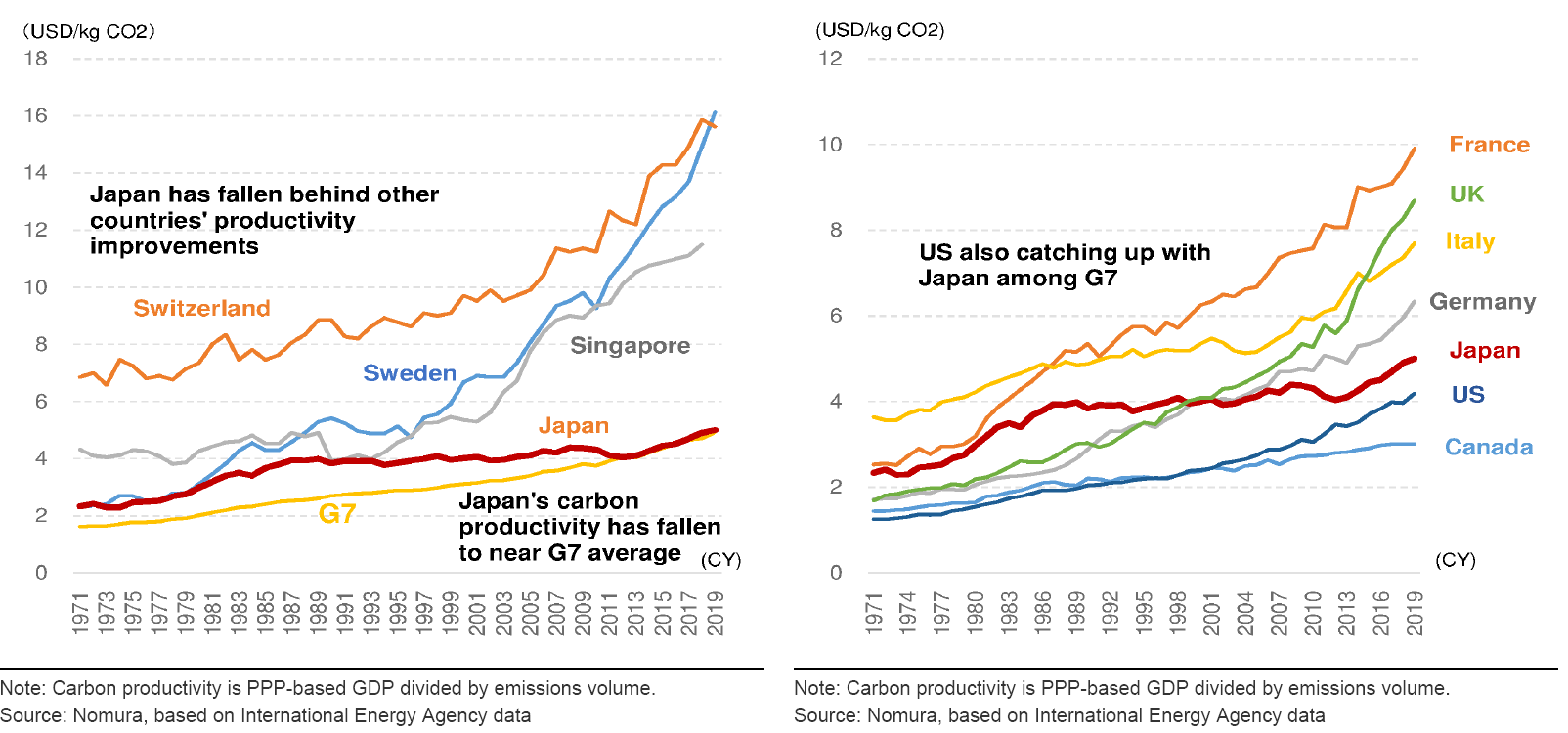

In the past, Japan had a strong presence as an energy-efficient, low-carbon economy. However, Japan's carbon productivity (GDP/carbon emissions) has barely improved since the 1990s. During this period, the US and Europe steadily increased their carbon productivity, with a particularly marked improvement since the 2010s.

In Japan, the Ministry of the Environment (MOE) and Ministry of Economy, Trade and Industry (METI) have begun discussions on carbon pricing. METI, which has the authority to introduce subsidies to overcome industry reluctance about carbon pricing, appears to have followed on from previous MOE discussions. While the overall shape of Japan's prospective carbon pricing scheme is unclear at this point, we expect it to focus strongly on a policy mix that combines a carbon tax, emissions trading scheme, and subsidy programs.

Potential earnings impact from carbon pricing

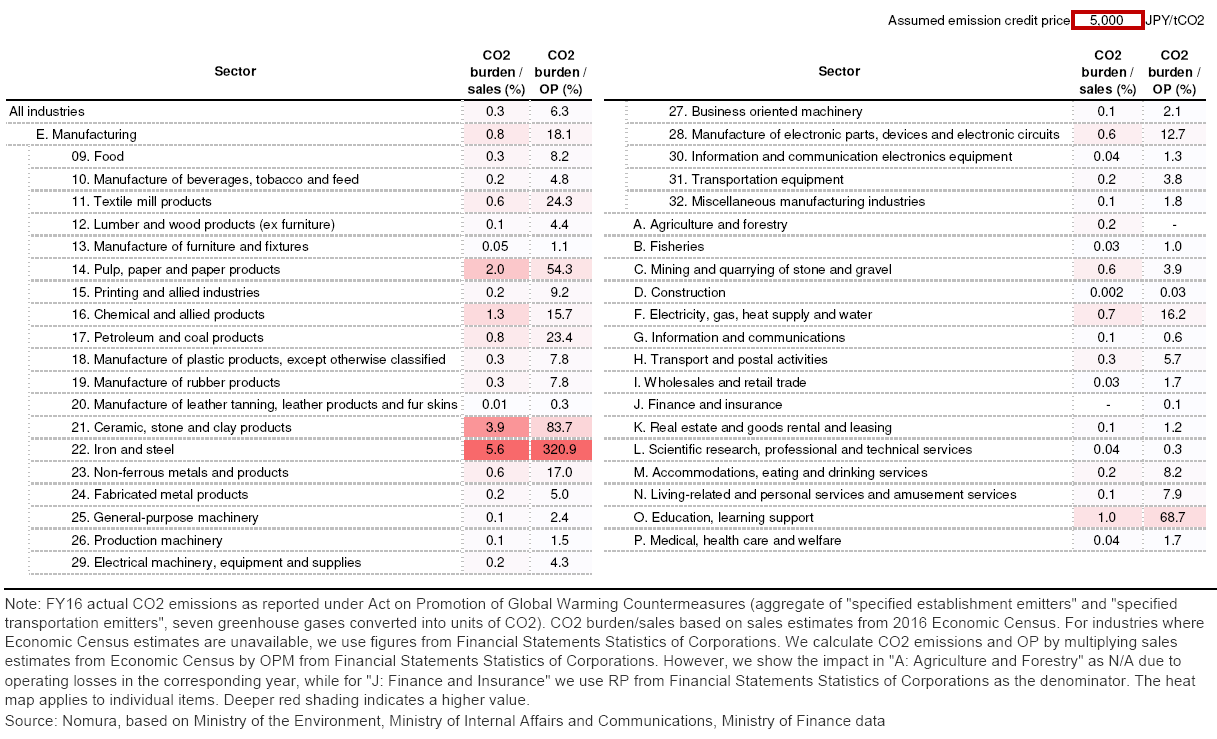

The impact of carbon pricing on corporate earnings will depend on the details of the scheme. The government may also study the quantitative impact on corporate earnings in future. A simple estimate based on carbon emissions versus profit levels suggests that iron & steel, ceramic, stone and clay products, education and learning support (including universities), and pulp, paper & paper products could see the largest impact on profits.

We think Japanese industries in general will feel a smaller impact than other countries from a carbon border adjustment mechanism, though this will depend on the scheme's structure. We think measures to reduce the financial burden on individual industries will be key to full-scale carbon pricing implementation. Interest in technology for monitoring and preventing data falsification could also increase if Japan's emissions trading system takes off in earnest

Read our full report here.

Contributor

Kohei Okazaki

Senior Japan Economist

Masaki Kuwahara

Senior Economist, Japan

Takashi Miwa

Chief Japan Economist

Masaki Motomura

Senior Equity Strategist

Juichi Wako

Head of ESG Team, Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.