Is the ECB calling the end of the pandemic?

The ECB looks set to conclude its pandemic response program (PEPP) and step up its asset purchasing program (APP) in its stead.

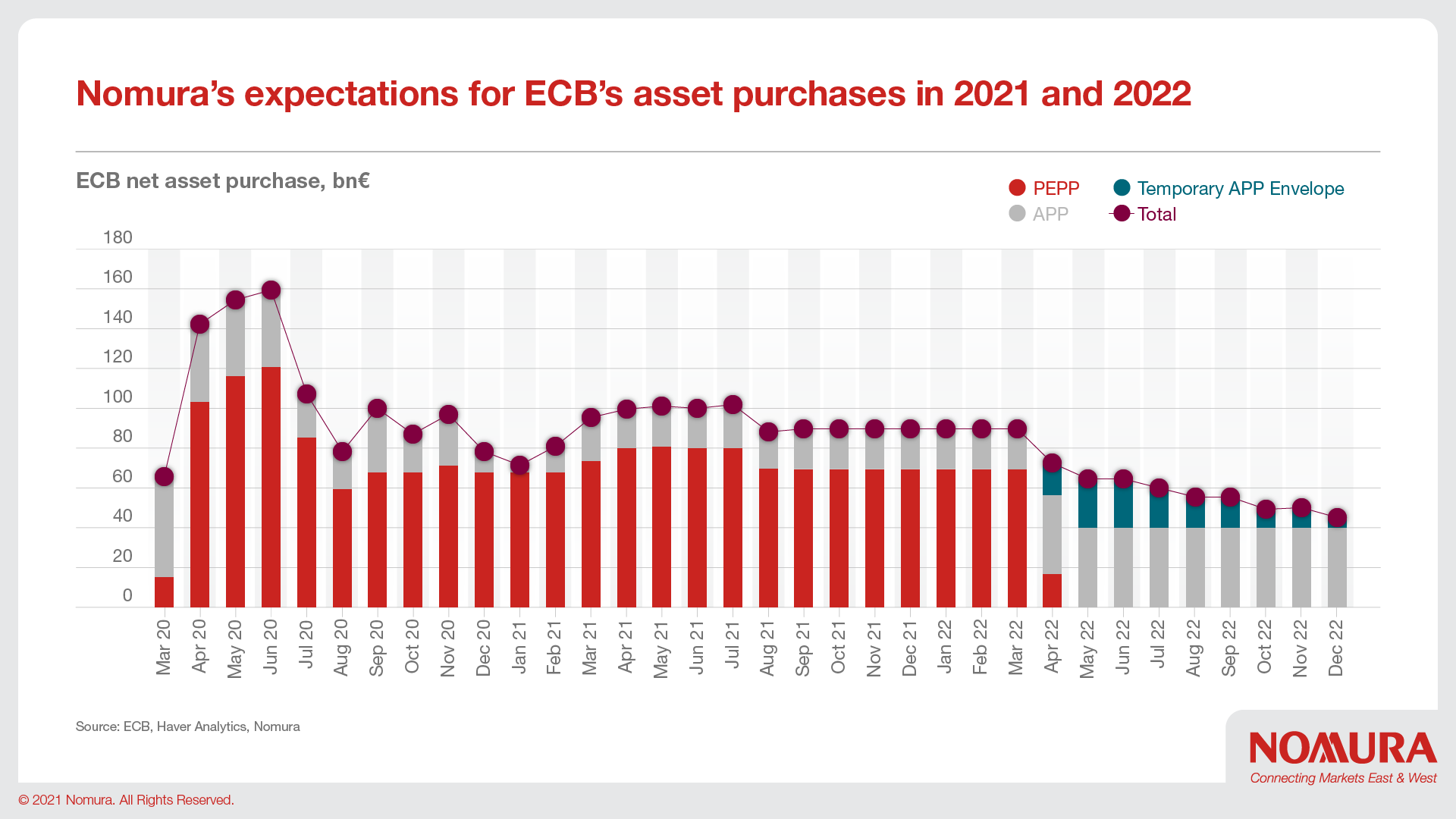

- After the ECB decided at its September meeting to slow the pace of PEPP purchases for Q4 2021, we think this will translate into a reduction in PEPP purchases from around €80bn per month to around €70bn per month.

- We think the ECB will focus on increasing its APP purchases from €20bn per month to €40bn per month in December 2021 and we expect a higher level of purchases from the start of Q2 2022, when PEPP ends.

- To stabilize markets when PEPP ends, we think the ECB will announce an additional €140bn temporary APP envelope in December, used flexibly over time and depending on market conditions, from the start of April until end-2022.

In short, following a joint assessment of the inflation outlook and financing conditions, we think the ECB will end its pandemic emergency programme (PEPP) in March or April 2022.

Covid-19 is still here, so can the ECB really end PEPP?

ECB President Madame Lagarde reminded us at September’s meeting that the PEPP will only end once the pandemic emergency is over. This follows ECB Chief Economist Philip Lane’s comments in a recent interview with Reuters, where he described the PEPP phase as lasting “while the downside risks (of the pandemic) is substantial”. In the past, the ECB has also made it clear that the objective of the PEPP is to bring inflation back to pre-pandemic levels. Once that is achieved, the ECB could propose an end to PEPP.

What do we know following September’s meeting?

The ECB did not answer any questions on the future of the PEPP at September’s meeting, but prepared markets for a decision in December. By then the ECB expects growth to have returned to its pre-pandemic level.

Assuming the pandemic remains under control this winter, we think the ECB will be in the perfect position to end the PEPP, which is an emergency programme as Madame Lagarde emphasised. We maintain our ECB view as follows:

- We expect the ECB to use its PEPP envelope in full — based on our expectations, it should be exhausted by the first week of April 2022 — and end the programme thereafter. We don’t think the ECB will expand its PEPP.

- In our view, the ECB will increase the pace of its APP purchases from €20bn per month to €40bn per month in December 2021. We expect it to implement a higher level of purchases from the start of Q2 2022, when the PEPP will come to an end.

- In order to stabilise markets as the PEPP ends, we think the ECB will announce an additional €140bn temporary APP envelope in December, to be used flexibly over time depending on market conditions, from the start of April until end-2022.

What about inflation?

The ECB’s more upbeat language on inflation and the euro area’s economic outlook, together with the upward revisions to the ECB’s inflation projections were important. Taken all together, we believe these developments support our view that the PEPP will end in Q1 2022.

The ECB will publish its 2024 inflation for the first time in December. With the 2023 inflation forecast currently at 1.5%, and the Q4 2023 inflation forecast at 1.6% y-o-y, we think it will likely publish a 2024 inflation forecast at or above 1.6% y-o-y in December. If that materialises, it would imply inflation having returned to its pre-pandemic level by December.

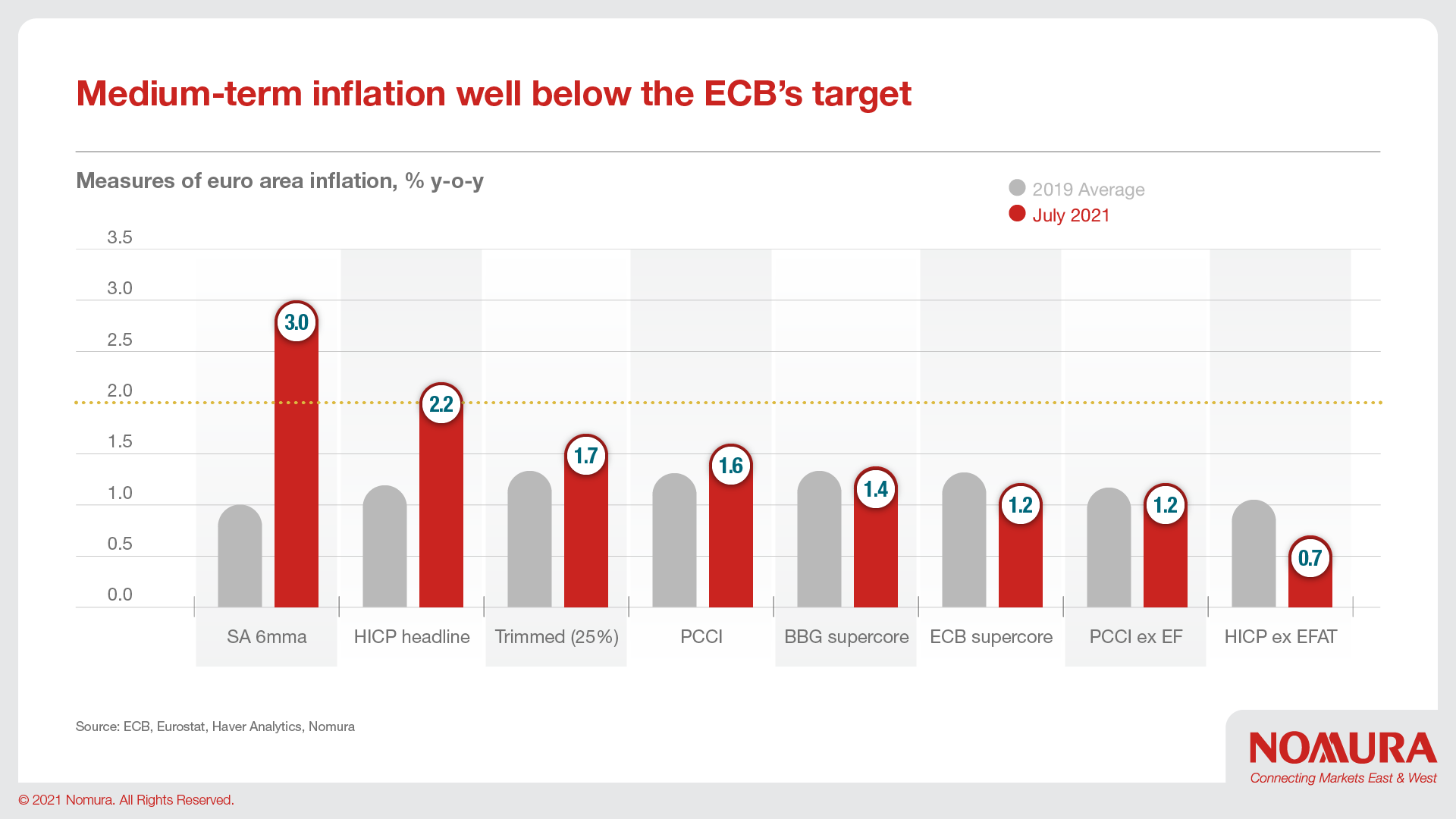

The Governing Council dismissed the recent upward surprises in inflation, and maintained its view that the rise in inflation will be temporary. Madame Lagarde highlighted some progress in underlying inflation during the press conference; however, she also said once more that most measures still point to medium-term inflation being well below the ECB’s target.

What will the increase in APP mean?

The APP envelope seems to be the perfect compromise between the hawkish and dovish views in the Council. A larger expansion of APP monthly purchases, while possibly supported by some of the more dovish ECB members, may face resistance from the hawkish side, most of all at a time when inflation will likely be printing well above 3% y-o-y, in our view. A temporary envelope to be used flexibly, only if market conditions make it necessary, would be much easier to digest for the hawkish members in the Council.

Longer term, we think stronger APP purchases will show the ECB’s renewed commitment to reach its inflation target, especially after the announcement of its new rates forward guidance in July.

Risks to this forecast

There are several key risks to the view presented above, as it represents just one of the many ways the ECB could adjust its purchases at the end of this year.

- If European economies enter another full round of lockdowns later this year, the ECB might decide to expand its PEPP in December. In this scenario, an expansion of €500bn could be possible.

- The ECB could slow its PEPP purchases more than we expect over the next six months. At that point, even without an expansion of the PEPP envelope, the ECB would be able to extend the duration of the PEPP until for example, September 2022.

- If the ECB goes down the route of expanding APP rather than the PEPP, as we expect, then there are different ways in which it could do this. We think a €20bn increase in monthly APP purchases and an additional temporary APP envelope are the most likely. However, the ECB may also simply increase APP monthly purchases by €40bn to €60bn per month. In our view, such a decision is unlikely to be supported by the less dovish ECB members. Also, by opting for a larger increase in the monthly APP, the ECB would lock itself into a level of monthly purchases that might be unnecessary next year.

- The ECB may even decide on a smaller increase in APP purchases than we envisage. That would be a hawkish development, in our view, but with much lower net issuance coming into the market next year, the ECB might find lower monthly purchases sufficiently supportive of the euro area economy.

The way in which the ECB adjusts its purchases next year will be relevant to markets to the extent that any increase in the APP may be perceived as a longer-lasting form of monetary policy stimulus than an expansion of the PEPP. While the ECB’s monthly asset purchases will likely decline next year once the PEPP ends, the good news for markets is that higher APP purchases are here to stay, we believe. We expect APP purchases to run at €40bn per month at least until the end of 2023.

Read the full article "Fore! ECB on track to end PEPP in spring 2022" on the here.

Contributor

Chiara Zangarelli

European Economist

George Buckley

Chief UK & Euro Area Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.