Impact of the US Tariff Shock

Liberation Day tariffs to have different effects on different parts of the world

- The US faces a front-loaded inflation shock

- In Europe and especially Asia, the negative growth shock should outweigh the inflation shock

- Bank of Japan will likely buck the global trend and hike rates in July

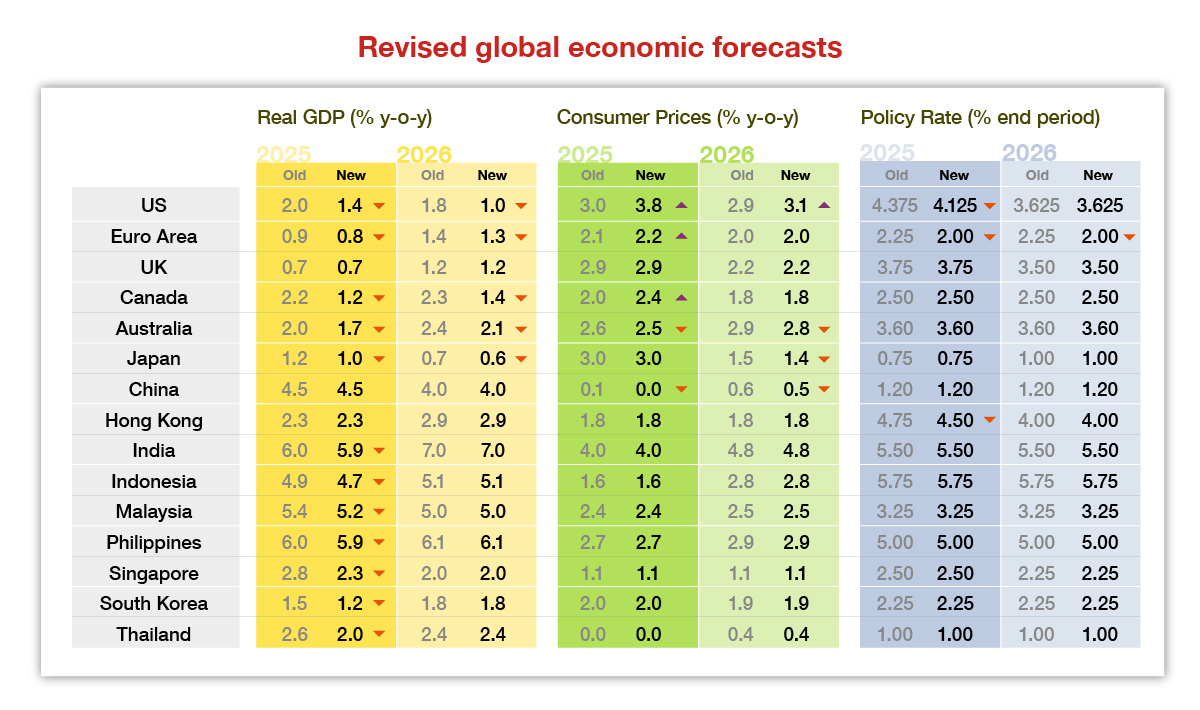

The US tariff announcements on the so-called Liberation Day amounts to 10 times what President Donald Trump did during his first term and is similar to the peak of the Smoot-Hawley tariffs almost 100 years ago. In reaction to effective US tariff rates being lifted to about 23% if fully implemented, Nomura’s economics team has made several forecast changes.

US

In the US, we see a more front-loaded inflation shock and a growth slowdown to a near-recession baseline, with the Fed holding off cutting rates until December.

Recession risks have risen to 30-35%, but our base case is for continued expansion well below trend. Factors such as healthy balance sheets in the private sector supporting the resilience of the US economy still exist, and credit supply remains ample. The US is also a tariff-light economy dominated by services, not manufacturing, which accounts for just 10% of GDP, or goods, which account for 32% of private consumption.

We expect monthly inflation prints to begin cooling by Q4 this year, with the 3-month annualized pace returning from over 6% in Q3 to below 2.5% by the end of the year. Based on our economic and inflation outlook, without sharp deteriorations in credit conditions, we expect the Fed to remain focused on its inflation mandate, leaving rates unchanged until tariff-driven inflation has faded.

Europe & Asia

By contrast, in Europe & especially Asia, the negative growth shock should outweigh the inflation shock, making room for larger monetary and fiscal stimulus.

We have lowered our 2025 euro area GDP growth forecast by 20 basis points and raised our inflation forecast by 10 basis points, based on a half proportionate retaliation by the European Union. We now expect the European Central Bank to cut in April.

We have kept our UK growth, inflation and Bank of England forecasts unchanged, as the 10% tariffs announced on the UK were as we had incorporated in our baseline view.

Asia will be hit particularly hard, resulting in disinflation or even deflation in some countries.

China

The 54 percentage point additional US tariffs will impact China’s exports sector and weigh on growth. Including rerouting via Mexico, Vietnam and other countries, the US share of China’s total exports was a hefty 20.6% in 2024. China is still heavily dependent on exports, which account for around 14% of its GDP in terms of value added. Rerouting will be much more difficult, as the US government uses reciprocal tariffs to plug the loopholes. The ending of the de minimis exception is set to hit many Chinese exporters, which contribute around 11% of China’s exports to the US. China’s 34% retaliatory tariffs on all US products will also curb its imports from the US. As such, we lower our export and import growth forecast for 2025.

The drop in export growth would dent GDP growth, but we expect larger fiscal stimulus to fill the gap. We thus maintain our GDP growth forecast of 4.5% for this year, which is below Beijing’s target of around 5.0%.

On the inflation outlook, the redirection of export goods to the domestic markets, a softening of global economy and falling global commodity prices will all be disinflationary, while China’s retaliatory tariffs will be inflationary. Balancing these factors, we estimate disinflationary forces will prevail.

Japan

We have lowered our overall growth outlook for Japan. We estimate the reciprocal tariffs will dent growth of Japanese real exports goods and services by 1.0 percentage point and real GDP growth by 0.3 percentage points, compared to when there were no tariff hikes.

We expect Japan’s government to prioritize negotiation over retaliation against the US, Japan’s economy to avoid a recession and the Bank of Japan to continue gradually adjusting the degree of monetary easing in response to rises in wages and prices. Bucking the global trend, we expect the Bank of Japan to hike rates in July and then in January 2026.

Rest of Asia

The US reciprocal tariffs will likely hit Asia the hardest, due to the export-oriented economies in the region and the higher-than-expected tariff rates. Tariff rates are highest for Southeast Asia (32-49%), notably Cambodia, Vietnam and Thailand, which suggests closing the third country circumvention loophole played a role. The impact on Asia will be felt directly, as exports to the US account for around 15% of Asia’s total exports, and indirectly, as Asian economies are an intricate part of global supply chains.

Based on our estimates, Vietnam stands out as the most vulnerable, with its ultimate exposure to the US at 8.9% of its GDP, followed by Thailand (5.5%), Malaysia (4.6%), Singapore (4.5%) and South Korea (4.5%).

We continue to believe India is the least exposed to the US tariff shock, as it is more domestic demand oriented and benefits from lower oil prices and the ongoing global supply chain shifts. India’s reciprocal tariff rate is lower than competitors such as China and Southeast Asia countries, and it is a strategic ally to the US, which means it can benefit via trade diversion in the short term, and from the next round of supply-chain shifts in low- and mid-tech manufacturing sectors in the medium term. We also see Malaysia as a potential beneficiary.

Faced with higher US tariffs, we expect Asian growth to slow sharply in coming months. Tariff fears have also led to the frontloading of exports to the US, which is now likely to fade.

We have lowered our 2025 GDP growth forecasts for most economies in Asia, with the greatest downward revisions to Thailand, followed by the highly open economies of Singapore and Korea. Weaker growth, lower oil prices and the risk of China dumping suggest a sustained period of low inflation in Asia. This soft growth-inflation backdrop also supports further policy easing.

Read our full report published on April 8, 2025, here.Our economists David Seif, Aichi Amemiya, Jeremy Schwartz, Ruchir Sharma, George Buckley, Andrzej Szczepaniak, Ting Lu, Sonal Varma, Euben Paracuelles, Kyohei Morita and Andrew Ticehurst contributed to this piece.

Contributor

Rob Subbaraman

Head of Global Macro Research

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.