How Trump’s Tariffs May Impact European Growth

US tariffs are likely to hamper European growth rather than cause an inflationary problem, making it more likely that European central banks further lower rates.

- President Trump’s tariff policy aims to narrow the US trade deficit, reshore production, and raise revenue to fund lower domestic taxes

- Europe already faces tariffs on steel and aluminium, and may yet be singled out for specific tariffs

- Our current base case is for 10% blanket tariffs to shave 0.2-0.3pp from euro area GDP and 0.1-0.2pp off UK GDP

What has Trump Threatened for European Tariffs?

Trump announced 25% tariffs on all steel and aluminium imports, set to come into force on 12 March, though there may yet be some country-specific exemptions. The EU was the third largest provider of steel imports into the US in 2024 (well behind Canada and just behind Brazil), while for aluminium the EU was outside the top 10.

Trump is also threatening blanket tariffs of 10-20% across all products. The focus of market participants is turning to what Trump may announce on European tariffs specifically after he described trade surpluses with the European Union as “an atrocity.”

Reciprocal Tariffs

Tariffs could be customized on a country-by-country basis, with the aim of offsetting not only tariffs on US goods but also non-tariff barriers including subsidies, value-added taxes (VATs) and exchange rate manipulations. EU VAT rates are in the 15-25% range.

In the case of Mexico and Canada, their 30-day reprieve was brokered by offering to tighten up border security and clamp down on fentanyl trafficking.

Trump’s grouse is largely related to the EU’s trade surplus with the US: “They don’t take our cars, they don’t take our farm products, they take almost nothing, and we take everything from them.” Following Trump’s inauguration last month he said, “The one thing they [the EU] can do quickly is buy our oil and gas.”

Tariffs as a Bargaining Chip

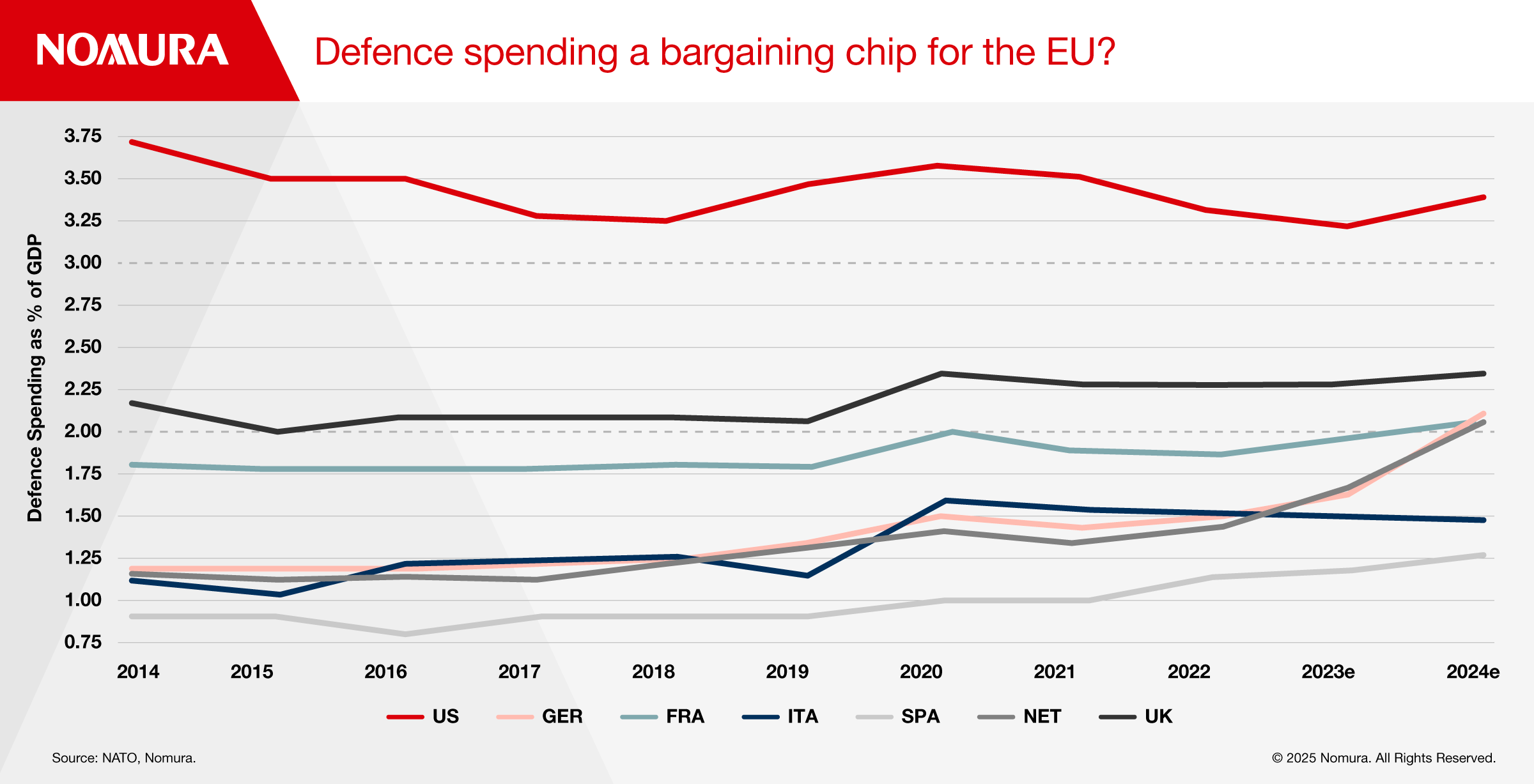

Tariffs could prove an effective bargaining chip to compel Europe to step up defence spending. Trump would prefer European countries to meet their 2014 NATO commitments of at least 2% of GDP on defence. That could also lower the trade surplus if procured from the US.

In January, Trump suggested the NATO spending commitment should be 5% of GDP, which is far higher than any country (including the US) is spending on defence, but the sentiment is not falling on deaf ears. The war in Ukraine has already led to increased spending (Figure 1).

While jointly issued defence bonds might prove a stretch, there is a strong push among some European countries to encourage the European Investment Bank to be more active in funding the continent’s defence.

Trump may also use tariffs as a bargaining chip in the reconstruction of Ukraine; he may argue that US companies should reap the benefits at the expense of Europe, given how much financial and military support the US has provided Ukraine and because Trump would have brokered the peace deal, something Europe has failed to do since the war started in February 2022.

How Exposed is Europe to Trade with the US?

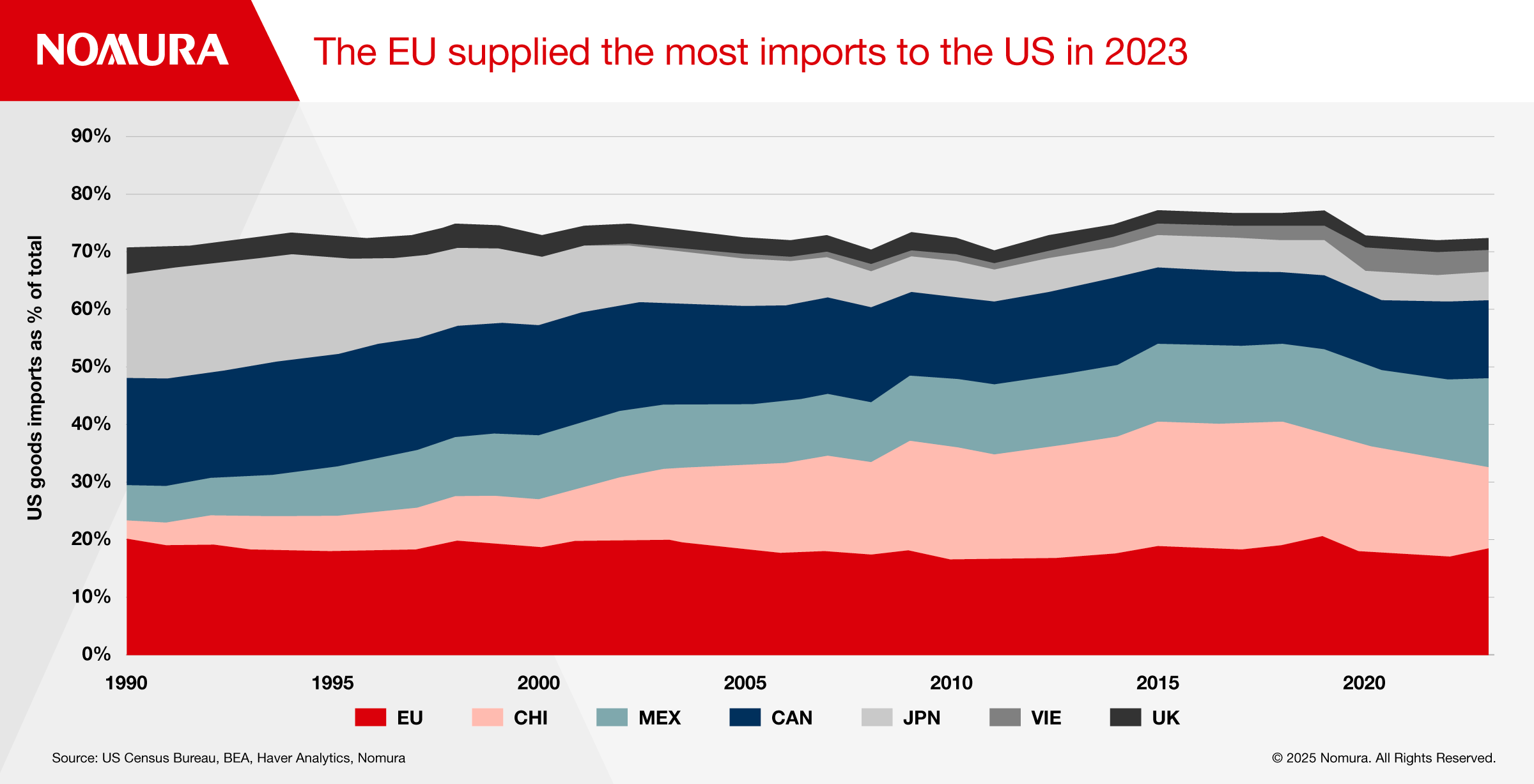

In our view, Trump appears most focussed on the absolute magnitude of goods imports into the US. as shown in Figure 2 and 3. Figure 2 shows that, on average during the three years to 2023, the EU, China, Mexico and Canada (in that order) supplied the most goods imports to the US. The EU ranking first illustrates Trump’s frustration with the bloc.

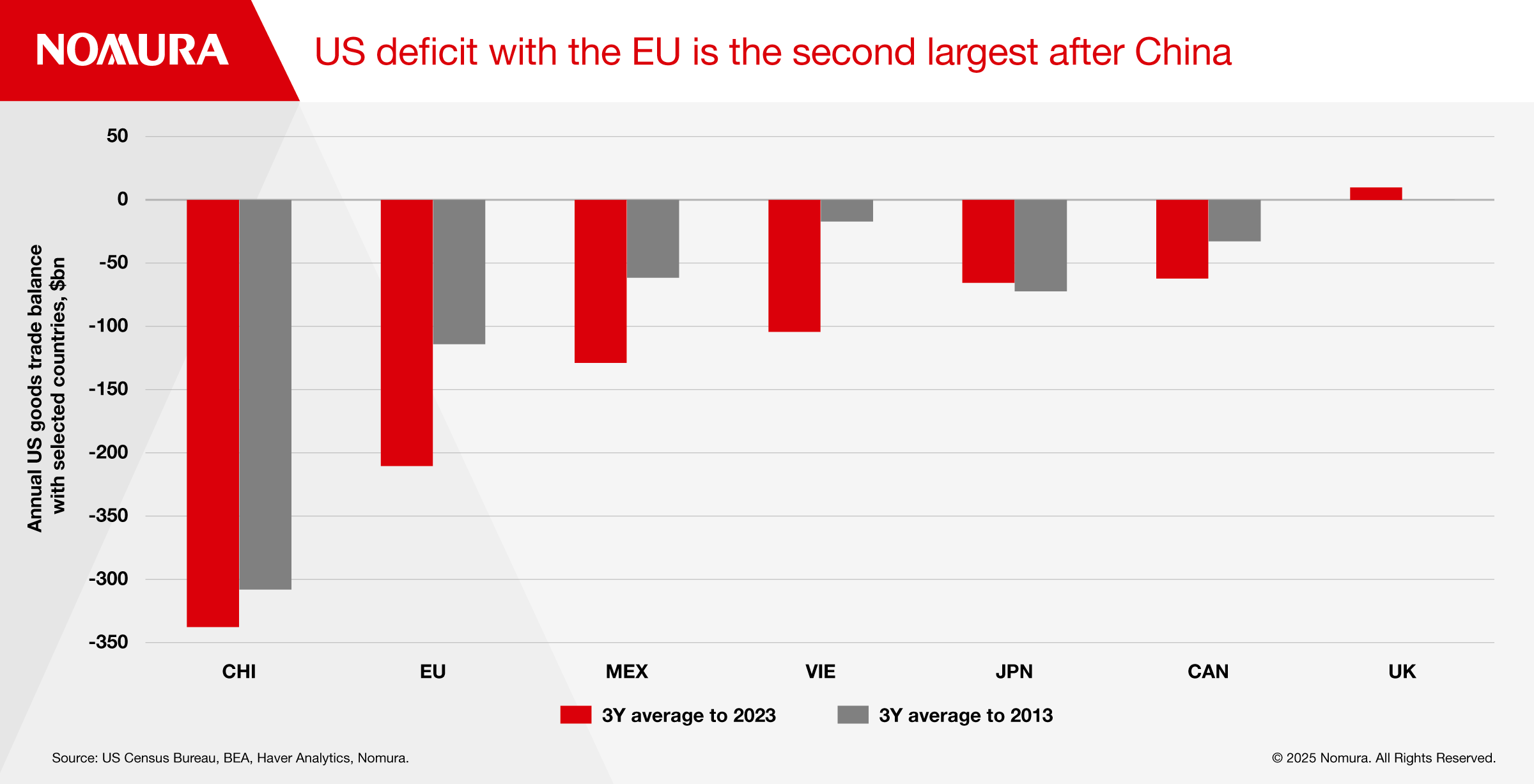

Figure 3 shows that China, the EU and Mexico are also the top three in terms of US goods trade deficit, albeit in a different order than the import ranking.

How Would Europe React to US Tariffs?

Europe’s response to Trump will be important in determining the ultimate impact that tariffs have on the euro area and UK economies – on both inflation and economic growth. The EU’s Commissioner with responsibility for economics, Vladis Dombrovkis, said at the end of January that Europe would respond in “a proportionate way.”

The head of the European Parliament’s trade committee, Bernd Lange suggested that Europe could pre-emptively reduce tariffs on US cars coming into the bloc. But Trump’s tariffs on steel and aluminium may impede that, with European Commission President von der Leyen saying these “unjustified” tariffs “will not go unanswered.” The UK is in a slightly better position, and the risk to our assumption of 10% tariffs on imports of goods coming into the US is that the UK could yet escape.

How Could Tariffs Affect European Growth?

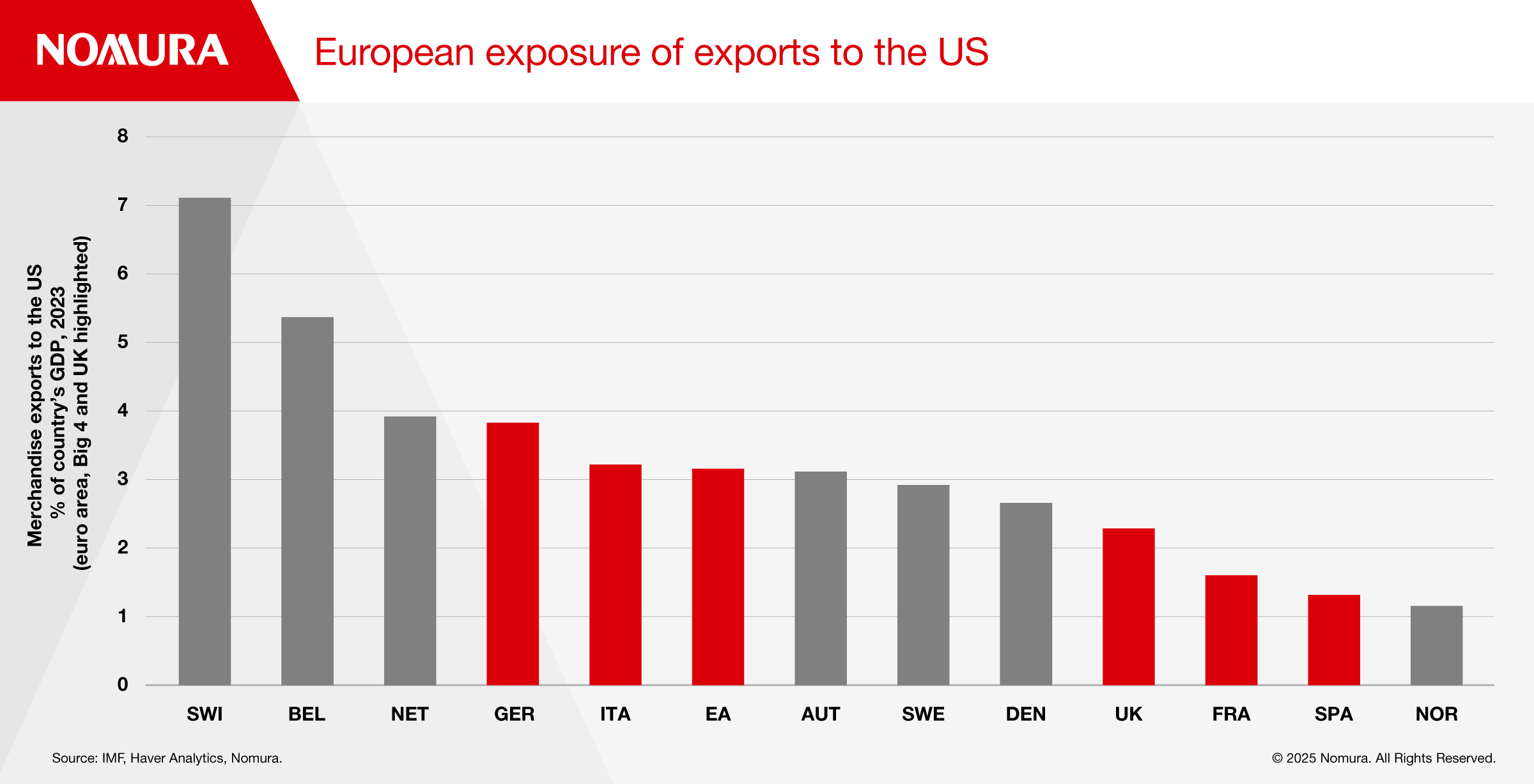

We illustrate Europe’s exposure, in terms of merchandise exports as a proportion of each country’s GDP, in Figure 4, highlighting that among the Big Four, Germany and Italy are more exposed than France and Spain.

Tariffs could affect European growth via several channels, with the net effect likely being downwards:

- Reduced US demand for European exports on account of higher final prices to US consumers/firms.

- Should European firms attempt to offset US tariffs by lowering prices and compressing profit margins, that could mean weaker European consumption and investment.

- Should USD strengthen and EUR and GBP weaken due to tariffs, that could have a positive effect on European growth. Since Trump was elected three months ago, both EUR and GBP have fallen by just over 5% vs. USD.

- Over the longer term, productivity growth is likely to be weaker, due to less trade openness.

Should the US impose 10% tariffs on global imports, as Trump initially suggested, we assume this would shave 0.2-0.3pp from euro area GDP and 0.1-0.2pp from UK GDP. However, there are significant uncertainties surrounding any estimates given the multiple channels through which tariffs can influence the economies, and also the uncertainty of Trump’s actions and Europe’s response.

How Could Tariffs Affect European Inflation?

To the extent that US tariffs lower European growth via weaker exports, this could mean more spare capacity and thereby lower inflation. The most impactful routes by which inflation could rise would be via European retaliatory tariffs and lower currencies lifting import prices more generally.

European manufacturing firms’ pricing power is so diminished, they will likely have to absorb some higher costs, with the rest passed onto consumers. Hence, the inflationary impact is likely to be limited. We have assumed a modest upward impact on European inflation from 10% blanket US tariffs, adding 0.1-0.2pp to both euro area and UK inflation.

Monetary Policy Implications

Inflationary pressures will dominate for the Fed, whereas the hit to growth will dominate for European central banks. Higher inflation in the US as a result of tariffs is highly likely to be the Fed’s focus, particularly with the US economy having rebounded significantly since before the pandemic (GDP up 12% since Q4 2019, consumption over 15% higher), the January CPI print coming in above expectations, and reshoring of production meaning even stronger growth versus potential.

In Europe, inflation is likely to be only modestly stronger due to tariffs. Survey data suggest that the growth outlook is already precarious in Europe, and punitive US tariffs are likely to only compound this weakness.

As a result, we think Europe’s central banks can and will diverge from the Fed. We expect both the ECB and the BoE will cut rates four more times until their respective terminal rates are reached (1.75% for the ECB by September 2025, 3.50% for the BoE by February 2026.

Contributor

George Buckley

Chief UK & Euro Area Economist

Andrzej Szczepaniak

Senior European Economist

David Seif

Chief Economist for Developed Markets

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate. The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com.