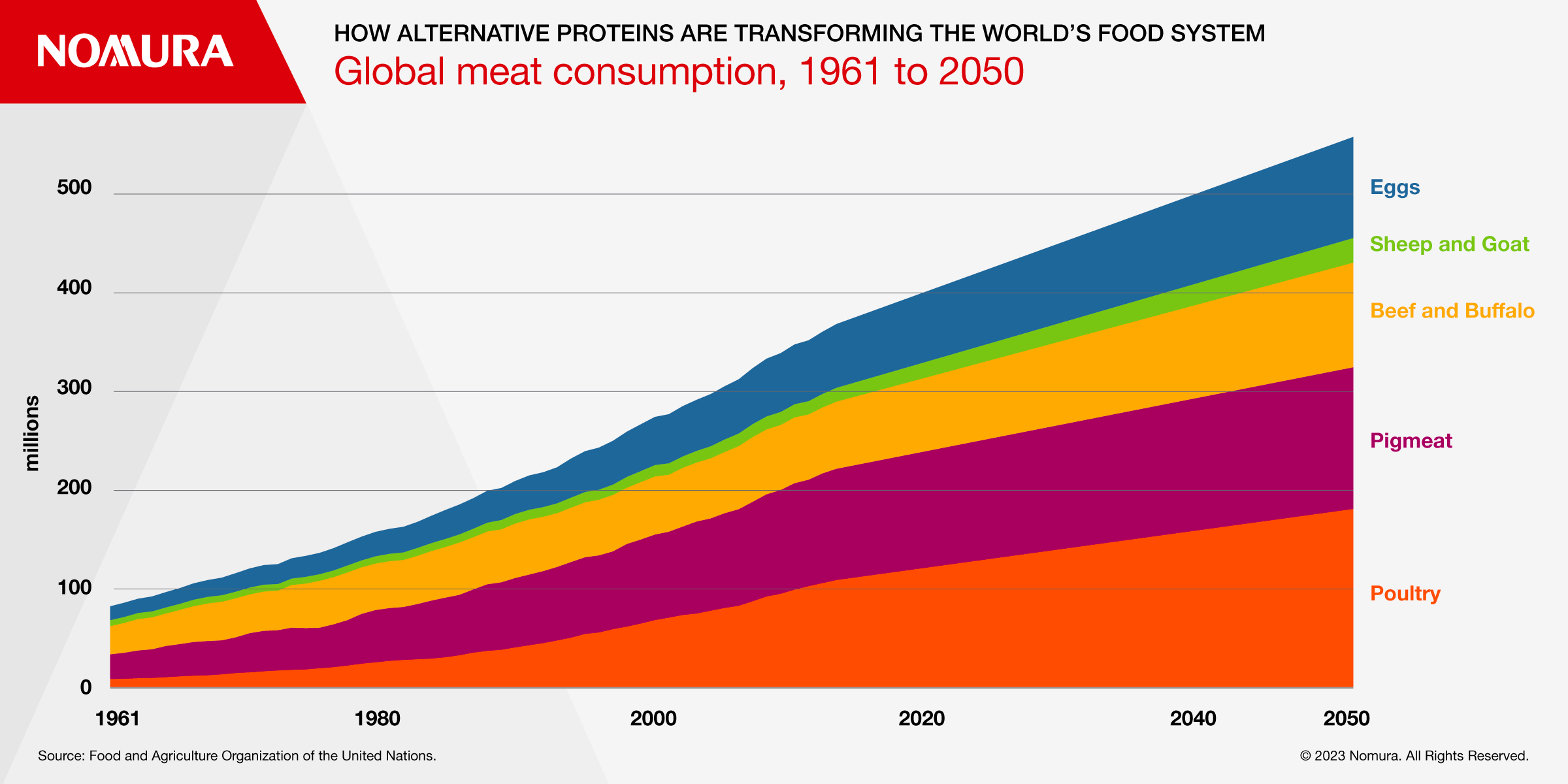

The global population is expected to reach 10 billion by 2050, and protein demand is expected to increase in-line or faster than population growth so we need more sustainable and efficient ways to feed the world that don’t contribute as much to climate change and deforestation, according to an expert speaking at Nomura Greentech’s Sustainable Leaders Summit, held under the Chatham House Rule.

Agriculture is among the top three biggest contributors to climate change, representing about 20% of global greenhouse gas emissions, which is more than the entire transportation sector.

Industrial animal agriculture also poses public health risks through the rise of antibiotic-resistant and other zoonotic diseases that are projected to cause up to 10 million human deaths per year by 2050, according to the United Nations Environment Programme.

We use most of our agricultural land to produce animal protein, which uses 23 to 44 times more land than plant-based protein and 23 to 57 times more water, while at the same time emitting 7 to 41 times more greenhouse gas emissions. Chicken, the most efficient land animal, needs about 2kg of feed to produce 1kg of meat. Pigs need approximately 4kg of feed to produce 1kg of meat while cows are the most inefficient, often requiring more than 8kg of feed to produce 1kg of meat.

“It’s a very nascent industry trying to transform a huge incumbent food system that’s been around for millennia.”

What are alternative proteins?

Three main categories: plant-based, fermentation and cultivated.

Plant-based

- Like the Impossible Burger or Beyond Meat, they use plant-based proteins typically derived from soy or pea. Plant-based ingredients are combined to mimic the taste and texture of meat.

Fermentation

- Fermentation comprises three broad categories. Traditional fermentation that’s used to make kimchi or beer uses microorganisms to modulate plant-based products to improve their taste, nutrition characteristics and digestibility.

- Biomass fermentation harnesses microorganisms like fungi to ferment sugars and other plant-based feedstocks into plant-based protein that is very high in protein and fiber. Precision fermentation produces specific ingredients from plant-based inputs, such as non-egg-based egg proteins for bakery applications, or animal-free dairy proteins for products like ice cream.

Cultivated Meat

- Biologically identical meat and seafood. It uses a cell from an animal and feeds it nutrients in a bioreactor to grow meat.

But more investment is required to create a sustainable, low-emission food system in the coming decades.

From an investment perspective it is important to look at the decarbonization potential of dollars invested into various climate industries, according to the expert.

An analysis by the Boston Consulting Group and Blue Horizon comparing the CO2 equivalent savings from $1 trillion invested across 10 industries, found that the highest incremental savings come from plant-based proteins.

That is partly due to how little has been invested in the industry and also because 20% of greenhouse gas emissions comes from the agriculture sector. Plant-based meat today has a 1% market share.

Between 2011-2020, $2.4trn of public and private money was channelled towards climate investments compared to just $14.2bn in alternative proteins over a similar period.

Several growth drivers are crucial to the future of the industry including government support. Public investment can fund R&D, and scale-up novel technologies to help de-risk the entire industry, she said citing the example of Singapore which has been a leader in this field amid concerns around food security.

Singapore has a goal to produce 30% of its food domestically by 2030 and was the first country in the world to approve cultivated meat. Qatar is also focused on food security, and has invested into a number of alternative protein companies including Eat Just (plant-based meat and cultivated meat) and Innovafeed (insect protein as a sustainable feed source for aqua feed, animal feed, and pet food).

Incumbent animal protein companies are investing in alternative proteins, recognizing the significant opportunities. Collar FAIRR initiative produced an Index of the largest protein producers in the world, which showed that half are involved in alternatives including through acquisitions. At the same time, their current business model poses meaningful risks from developments like zoonotic diseases. China culled half of its pork population due to swine flu in 2019.

The last driver is consumer demand with surveys showing 66% of consumers aged 16 -40 across 10 countries plan to spend more on plant based meat and dairy alternatives in the future.

Despite the stakes being so high to make alternative proteins work, a series of challenges remain including the large up-front financing required for CapEx to scale the industry and build manufacturing facilities, which can cost up to $500 million, the expert said. Cost is a further barrier as alternative meat products command a 67% average price premium.

Consumer acceptance is perhaps the largest obstacle. In the US, plant-based retail sales are decelerating after rapid growth during the pandemic. Consumers often cite taste and a lack of understanding as to why they are not buying alternative protein products.

Addressing these obstacles through further R&D and innovation is critical for the sector to reach its potential. If taste improves and costs decrease, forecasts predict alternative proteins could make up 11% of global protein consumption by 2035.