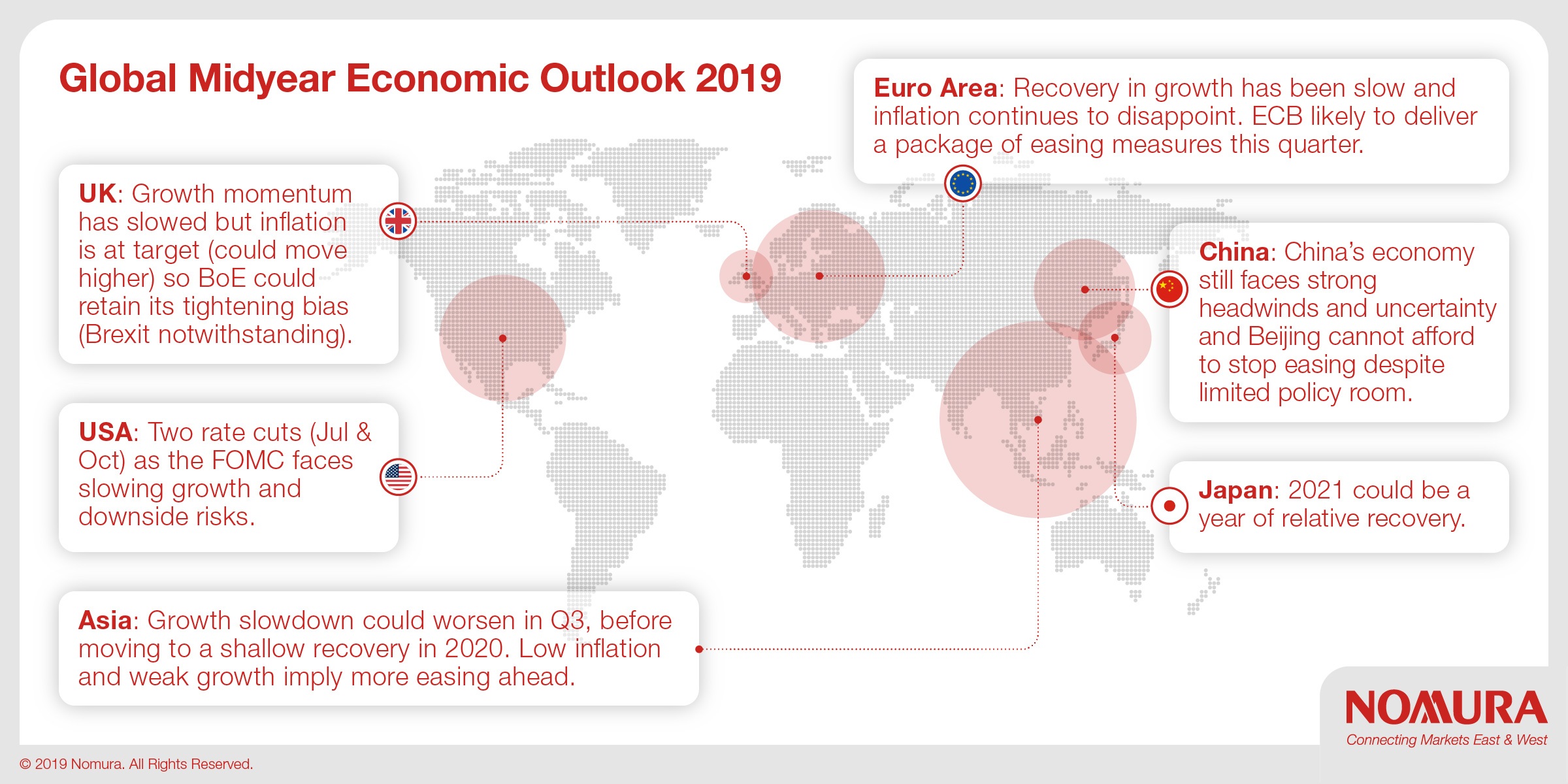

Global midyear economic outlook 2019

Our midyear review looks at different regions around the globe and the key factors affecting them through the remainder of 2019.

- We expect the trade war between US and China to reignite before the end of the year.

- In this environment, we expect the Fed to deliver two insurance rate cuts in July and October.

- ECB President Draghi’s Sintra speech was a game changer and we now expect easing from the ECB as well.

- In Japan, we expect very muted growth in 2020 to give way to a moderate recovery in 2021.

- In the rest of Asia, a worsening growth slowdown should lead most countries to ease monetary and fiscal policies in H2.

Japan

What we had been expecting for Japan’s economy was that growth would remain very muted through 2020, as real exports drag down overall growth while domestic demand – especially from fiscal expenditure – should contribute positively. From a cyclical perspective, 2021 could be a year of recovery. As we assume Japan’s major trading partners will return to near-trend growth in the year, we can expect the export environment to stabilize for Japan. However, it is often the case that a contemporaneous cyclical economic recovery weakens policy efforts to support growth. We should expect the overall growth recovery in 2021 to remain very moderate.

China

China’s recovery in March was short-lived, and the GDP growth slowdown continued in Q2. In H2, we believe China will face even more uncertainties related to US-China trade tensions, Beijing’s stance on property markets and the size of stimulus, with trade protectionism remaining the key risk. We maintain our view that China’s growth has yet to fully bottom out and growth headwinds remain strong (especially from exports, property markets in lower-tier cities, passenger car sales and construction machinery sales). Although Presidents Trump and Xi at the G20 summit agreed to resume trade negotiations, long-standing issues between the two countries remain. All things considered, we fine-tune our annual GDP growth forecasts to 6.1% and 5.8% in 2019 and 2020, respectively, from our previous forecasts, made at end-2018, of 6.0% and 6.0%. We expect Beijing to ramp up stimulus measures in H2 despite a more limited policy room.

The rest of Asia

Emerging Asia’s export-led growth downturn is likely to deepen and spread more to domestic demand; we expect a shallow recovery to take hold only in 2020. The effect of potential US-China trade frictions and the ongoing global tech downcycle, are heavy headwinds for the region overall, given Asia’s long value chains that rely on China. Trade and FDI diversion can benefit some countries – notably Vietnam – but in aggregate, the overriding impact of worsening US-China trade and tech frictions is negative for Asia, and the region has become more vulnerable due to its high accumulation of private debt. With benign inflation and generally low public debt, we forecast substantial policy responses in H2: policy interest rate cuts in China, South Korea, Malaysia, Indonesia, India and the Philippines, and almost across-the-board fiscal stimulus save India, Malaysia and Thailand. We see starker differentiation in economic performances: from the most vulnerable – Hong Kong, South Korea, Singapore and Thailand – to the rising stars – India, Indonesia and the Philippines.

United States

We expect the US economy to slow over 2019 and into 2020, as the industrial sector moves through a soft patch. However, our modal forecast anticipates a gradual pick-up of economic activity in H2 2020 and into 2021. The services sector should remain resilient despite industrial weakness, and we believe consumer spending, bolstered by firm fundamentals, will remain an anchor for the economy. We expect the unemployment rate to move slightly lower before holding steady at 3.5%, as employment growth slows. Finally, we think core PCE inflation will accelerate above 2% due to higher tariffs on imports from China before moving back down towards the Fed’s target, as the tariff impact wanes. In this environment, we expect two insurance cuts from the FOMC to guard against a steeper-than-expected slowdown by the end of this year.

UK

The UK has not been immune to the global growth slowdown, but it is in much a stronger position with respect to inflation. As a result, and based on our view of a transition to a Brexit deal being agreed upon this year, we see the Bank of England retaining a tightening stance. However, we expect next move in May next year (six months later than originally envisaged).

Euro area

We have, until now, resisted the temptation to change our ECB view from unchanged to looser monetary policy. However, since our last forecast update a month ago, Mr Draghi’s speech at the ECB’s Forum on Central Banking in Sintra has proved to be a game-changer. While we still think growth and inflation will improve as the year progresses (there have already been some signs), we now see the ECB delivering a package of easing measures in September that extends policy guidance, lowers interest rates, restarts the QE programme and offers banks a tiered interest rate scheme.

EEMEA

The sequential recovery in Turkish GDP Q1 seems to have given way to a renewed slowdown in Q2, as evidenced by the weakness in growth rates of credit, industrial production, and retail sales. Consequently, we stick to our 2019 GDP growth forecast of -2.8% and continue to expect sluggish recovery over the forecast horizon. On monetary policy front, the base effect-driven disinflation, the dovish turn in the global monetary policy outlook and the recent appreciation of TRY should pave the way for an easing cycle that lowers the policy rate by a total of 400bp this year. In South Africa, we expect economic activity to return to a growth path following the Q1 contraction; however, we see full-year growth remaining weak at 0.8% and we do not expect growth to exceed 1.5% over the forecast horizon. In our view, weak growth and accommodative global monetary conditions should allow the SARB to cut rates as early as the July meeting.

For more information and insights read our full report Global economic outlook midyear update

Contributor

Lewis Alexander

Chief US Economist

George Buckley

Chief UK & Euro Area Economist

Inan Demir

Senior EEMEA Economist

Ting Lu

Chief China Economist

Takashi Miwa

Chief Japan Economist

Euben Paracuelles

Week Ahead Podcast Host and Chief ASEAN Economist

Rob Subbaraman

Head of Global Macro Research

Andrew Ticehurst

Week Ahead Podcast Host & Australia Economist

Sonal Varma

Chief Economist, India and Asia ex-Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.