Upturn in global IT cycle and the Japanese economy

- Attention is focusing on the global IT cycle following the launch of commercial 5G services.

- Global semiconductor sales bottomed out in 2019 H1 and recovered in the summer.

- We take a simple look at the global IT cycle and the implications for the Japanese economy.

Japanese economic growth likely to be on the strong side in 2020 H1

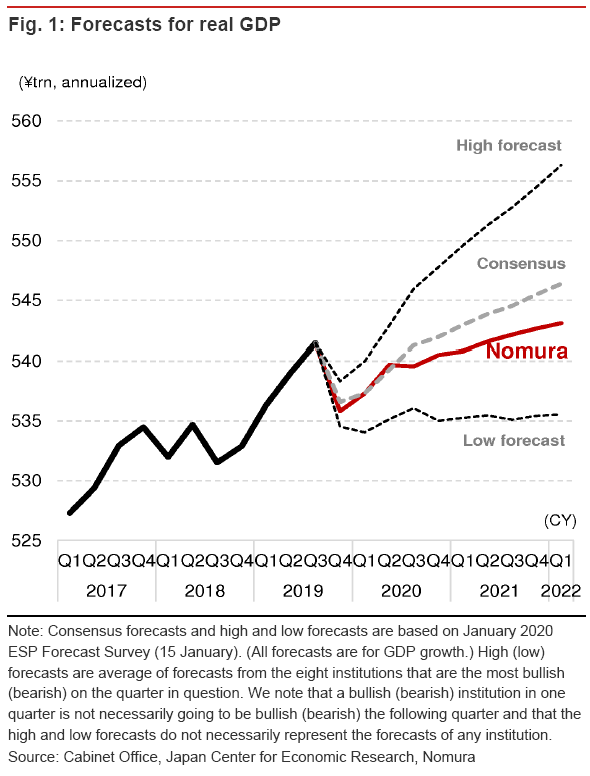

Growth in the Japanese economy is highly likely to dip into negative territory temporarily as a result of the consumption tax hike implemented in October 2019. We expect negative growth for all of the main items making up GDP, and particularly for consumer spending, which has been directly affected by the consumption tax hike.

However, the consumption tax hike is the main reason for this negative growth, and in our view any major contraction in the economy is likely to be only temporary. Partly because we think the government's measures to mitigate the impact of the consumption tax hike, along with its economic stimulus measures, will start to have an effect, we think economic growth will turn positive in 2020 Q1 and expect growth to be relatively strong in 2020 H1.

Evaluation of upturn in IT cycle is key

In order to consider the underlying trend in the economy, as well as considering the pattern of economic fluctuations around the time of consumption tax hikes, as shown in the exhibits above, it is also important to look at external demand. In our view the upturn in the global IT cycle is of particular importance for external demand. Demand for IT related goods is increasing around the world following the launch of commercial 5G services. World Semiconductor Trade Statistics (WSTS) indicate that global semiconductor sales bottomed around February or March 2019 and started to rise from around July or August. Meanwhile, on the financial markets, the Philadelphia Semiconductor Index (SOX) has recently been at record high levels, and evaluation of the upturn in the IT cycle is now essential to any discussion of the outlook for the real economy in 2020 H1.

The short-term cycle appears to have already peaked in Japan, and to be close to its peak in the other regions too. Meanwhile, the medium-term cycle appears to have bottomed first in the US, around Jul-Sep 2019. This might be the reason why global semiconductor sales clearly started to pick up speed around the summer of 2019. It is reassuring to see that the medium-term cycle also appears to have been bottoming out through November in the other regions too. It looks highly likely that semiconductor demand will start to rise again through 2020 H1 on the back of an upturn in the medium-term cycle around the world.

We now take a fresh look at the usefulness of the electronic parts and devices industry as a leading economic indicator

Semiconductors, the industry’s “bread-and-butter”, are used as parts and materials for various types of goods, and business confidence in the semiconductor industry is sensitive to economic trends. It certainly appears to us that the IT cycle is something that we need to focus on when attempting to assess the outlook for the economy as a whole. Indeed, during the economic expansion phase from February 2002 to February 2008, the shipment-inventory balance for the electronic parts and devices industry, which includes semiconductors, tended to lead the economy.

However, this situation changed from 2010. The time-lagged coefficient of correlation between the shipment-inventory balance in the electronic parts and devices industry and industrial production as a whole reveals that the ability of the electronic parts and devices industry to act as a leading indicator has weakened considerably. Put starkly, what this means is that the shipment-inventory balance in the electronic parts and devices industry is now a coincident economic indicator.

Semiconductor demand in Asia is important for the Japanese economy

If we compare semiconductor sales in various regions around the world with Japanese semiconductor exports to the same regions, we find that there is no correlation between the two in the case of North America. In other words, it is highly likely that an upturn in the semiconductor cycle in North America is not linked to Japanese exports of semiconductors to North America. However, there is a strong correlation between semiconductor sales in Asia and Japanese semiconductor exports to the region. On the back of semiconductor demand from Asia, where the medium-term cycle is likely to be on an upward trend through 2020 H1, Japanese semiconductor exports to Asia might support the economy in 2020 H1.

For a breakdown of each researches, read our full report here.

Contributor

Takashi Miwa

Chief Japan Economist

Masaki Kuwahara

Senior Economist, Japan

Kohei Okazaki

Senior Japan Economist

Kengo Tanahashi

Economist, Japan

Yuki Takashima

Japan Economist

Makoto Arai

Economist, Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.