The Global Economic Impact of Covid-19

Our weekly update on the global economic impact Covid-19 has had on GDP, and provide their base, good and bad scenarios.

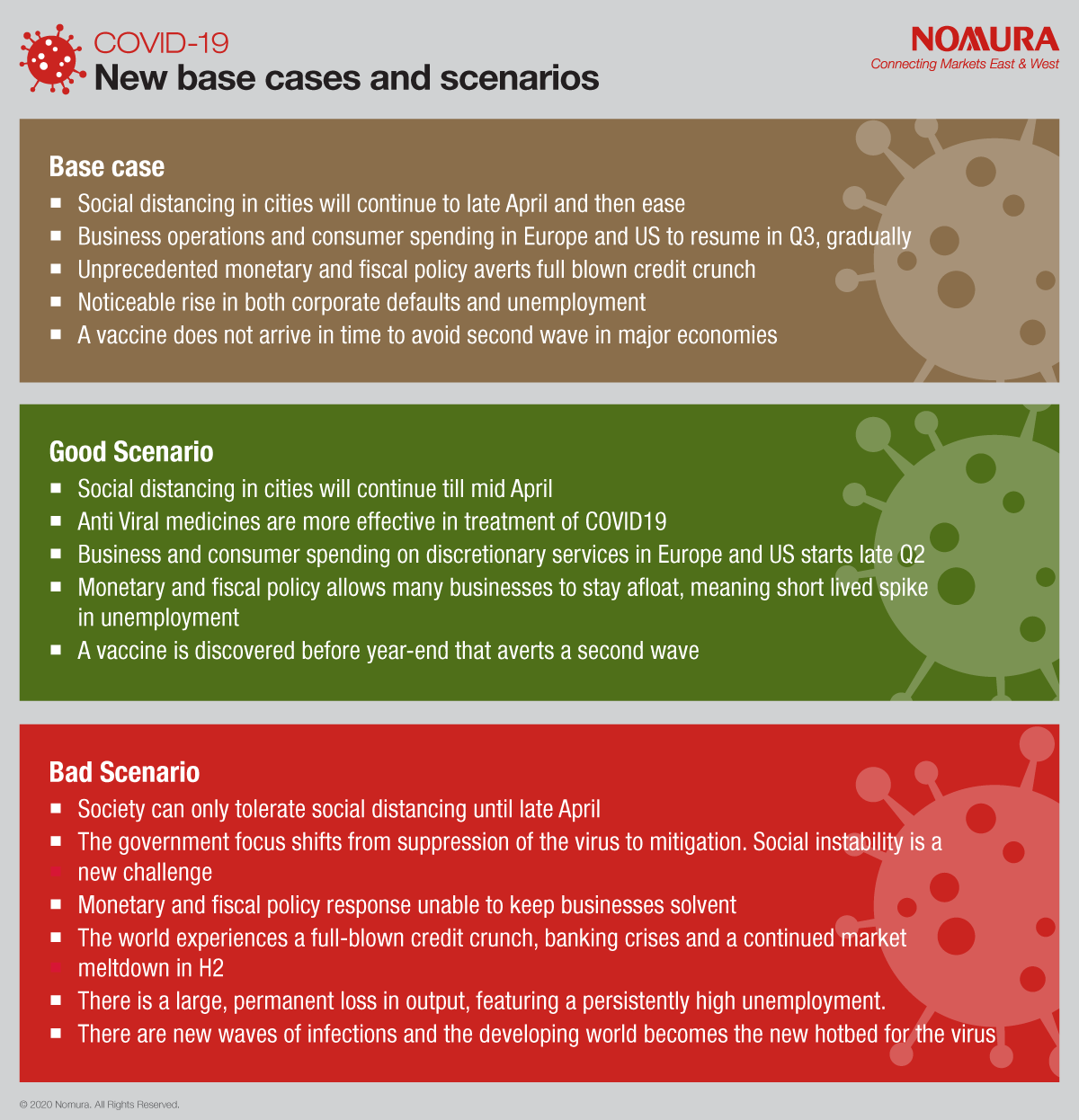

- Our base case assumes social distancing eases gradually after April and the unprecedented forces of central bank and fiscal responses are broadly successful in avoiding a full-blown credit crunch, although there is another, smaller, wave of infections in Q4.

- Under a good scenario, actions such as social distancing and medical and technological innovations will beat the virus, but economies will still face a short, deep recession.

- Under a bad scenario, the virus continues to grow exponentially and the cash flow support from monetary and fiscal policies do not last long enough to save companies and jobs.

Weekly Updated Global Economic Outlook

Japan

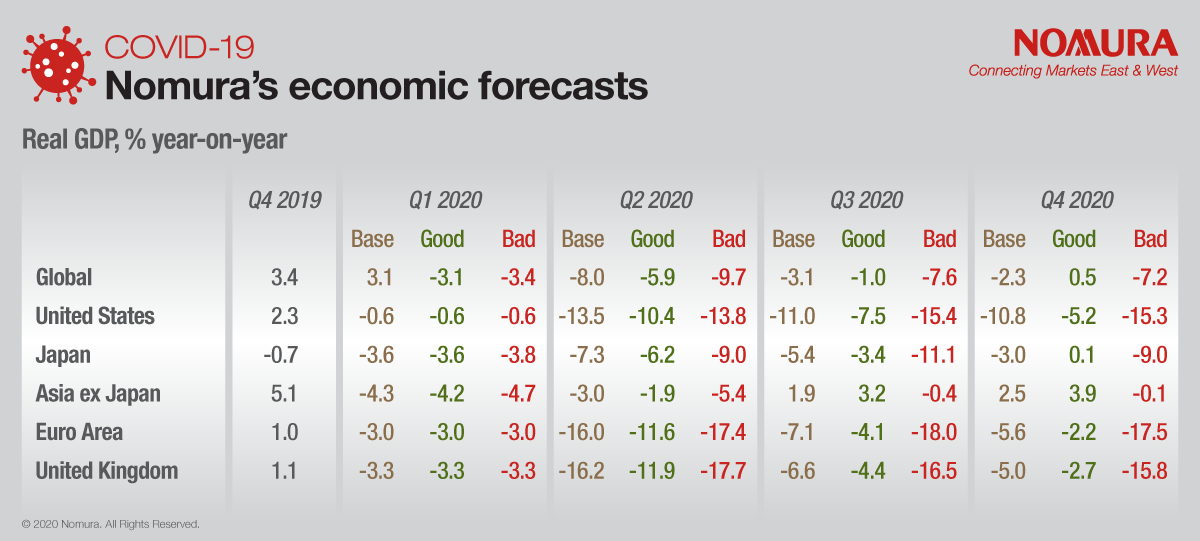

- With COVID-19 spreading, we expect real GDP to keep declining for three quarters through Q2, followed by a gradual recovery.

- We expect core CPI inflation to continue to decelerate and to plunge below -1.0% y-o-y in Q1 2021 led by lower oil prices.

- The ¥117trn stimulus package will help keep the economy from falling into a vicious cycle but have a limited impact on demand.

- The risk is renewed yen appreciation, caused by a full-blown global recession and further risk averse moves in markets.

Asia ex-Japan

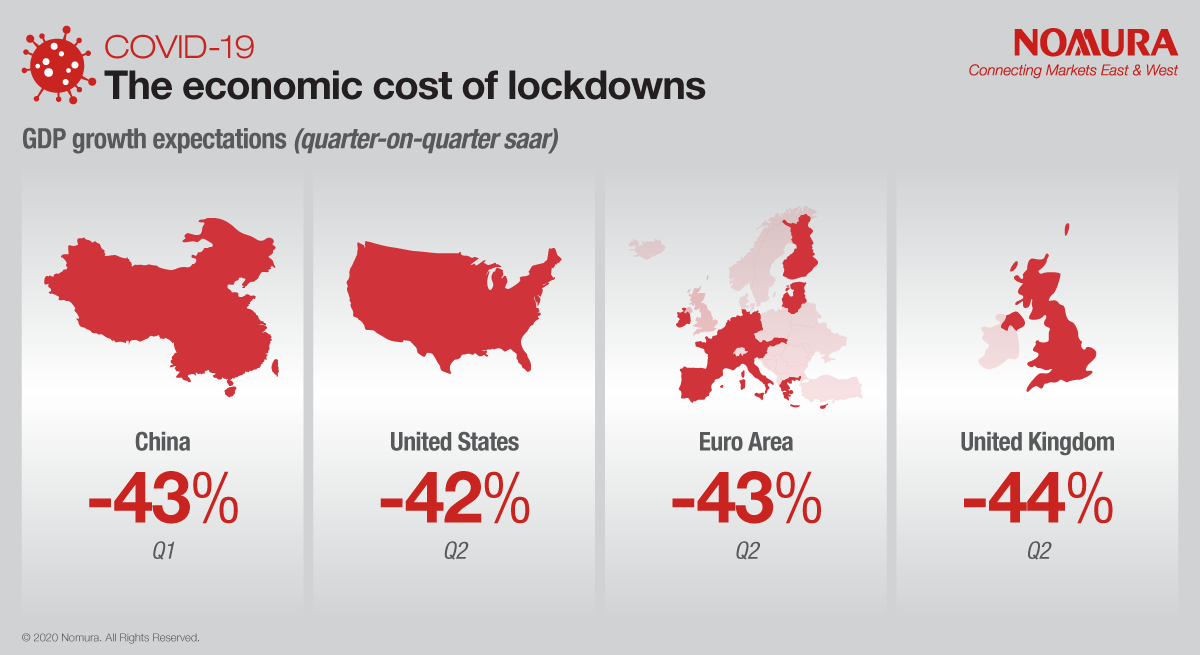

- COVID-19 to derail Asia’s GDP growth to -1.3% y-o-y in 2020, from 5.3% in 2019. 9 out of 10 economies will contract in 2020.• After China spillovers in Q1, we expect a sharper growth slump in Q2 due to domestic lockdowns and weaker external demand.

- A sequential recovery is likely in H2, but at a gradual pace due to spillovers from unemployment and weak corporate profits.

- Despite the supply-side disruptions, we expect disinflationary pressures due to lower oil prices and weak aggregate demand.

- Monetary and fiscal policy easing have already been stepped up, but be prepared for even more easing ahead.

- China: We raised our Q2 GDP growth forecast to 1.2% y-o-y but cut our H2 growth forecast on increasing downward pressure.

- Korea: Growth may contract more sharply in Q2 on slumping external demand, with policy focus turning to fiscal and UMP .

- India: COVID-19 amid a weak financial sector to trigger a contraction in 2020 and easy policies – monetary, fiscal and liquidity.

- Indonesia: Slow COVID-19 containment implies a larger growth shock, higher fiscal risks and more balance-of-payment pressure.

- Australia: We see a sharp recession in H1, with unemployment rising from 5.2% to around 9% and inflation falling sharply.

United States

- We expect a short, but steep, recession in H1 2020 before a gradual recovery aided by fiscal and monetary accommodation.

- Responding to a significantly weaker outlook, we expect the Fed to remain at the ELB through 2021.

- The Fed will implement credit facilities already announced and ensure that long-term rates do not constrain the recovery.

- We expect additional fiscal stimulus from Washington, but it may be less effective due to social distancing.

- The unemployment rate will rise sharply, peaking around 15-20% in Q2, as labor market conditions deteriorate due to COVID-19.

- Core inflation will likely be weighed down by COVID-19’s impact on service prices and excess labor market slack.

- Notable risks include the failure of social distancing policies as well as corporate credit and financial sector stress.

Europe

- As COVID-19 spreads across Europe, we expect the euro area economy to fall into an even deeper recession in 2020.

- Lower oil prices and a demand shock caused by COVID-19, should push euro area inflation lower.

- We expect the ECB to keep rates on hold but to announce an increase to its €750bn PEPP envelope at the June meeting.

- We have axed again our UK GDP forecasts and see a recession in H1 – with output falling by more than 15% vs Q4 2019.

- GDP recovers from H2 though takes time to get back to its pre-virus peak. Loose monetary and fiscal policy remain supportive.

- The BoE has cut rates to 0.10% and announced €200bn of QE; we expect the BoE to announce additional €100bn of QE in June.

- The tail risk of a Brexit cliff edge at end-2020 has risen, but the outcome is uncertain with COVID-19 disruption.

Contributor

Rob Subbaraman

Head of Global Macro Research

Craig Chan

Global Head of FX Strategy

Ting Lu

Chief China Economist

Lewis Alexander

Chief US Economist

George Buckley

Chief UK & Euro Area Economist

Sonal Varma

Chief Economist, India and Asia ex-Japan

Chetan Seth

APAC Equity Strategist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.