Why global bonds are still attractive to Japanese issuers

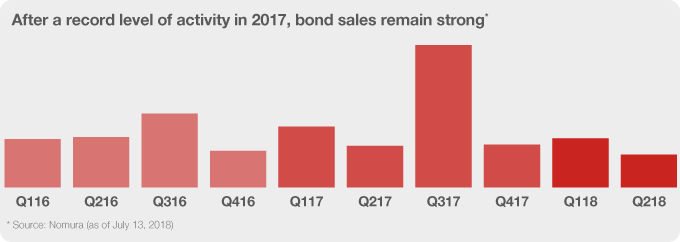

- Issuance hit a record high in 2017 and conditions remain supportive for new issues.

- Regulatory capital requirements and investor diversification are helping to drive bank issuance.

- Higher M&A activity is prompting corporates to sell bonds overseas.

After a record 2017 for Japanese activity in the international bond markets when issuance totaled $81.7 billion – surpassing the 2016 record of $58.8 billion – volumes have slowed somewhat in 2018. Despite this, many of the factors that created a sweet spot for new bond sales remain in place; Nomura expects total issuance of $65 billion in 2018.

While quantitative easing is winding down, with the European Central Bank set to cease buying bonds in December, there are plenty of other supportive factors.

Market conditions remain benign; many investors have cash on their hands and are desperate for yield. The weight of money has helped tighten new issue spreads, enabling borrowers to lower their funding costs.

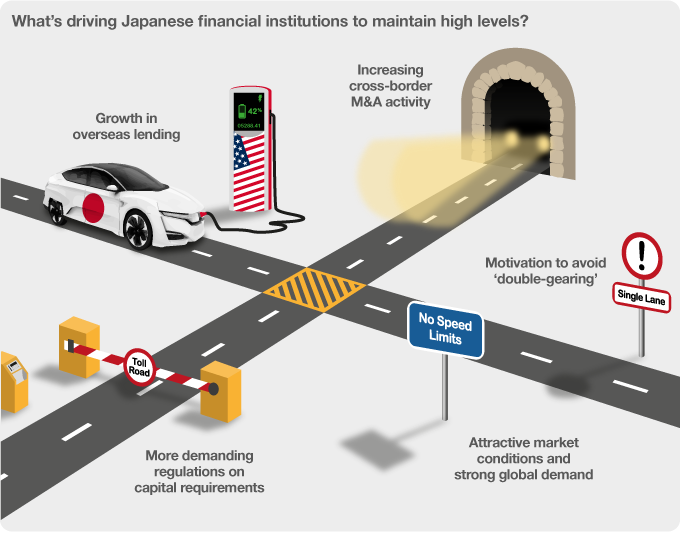

Moreover, Japanese names are in especial demand, given their stability, strong credits, and the relatively robust domestic economy. Meanwhile, attractive dollar-yen swap rates make it cost effective for Japanese issuers to tap international markets even when they have no need for foreign currency, adding at least $6 billion to issuance in 2017.

What’s driving bank issuance?

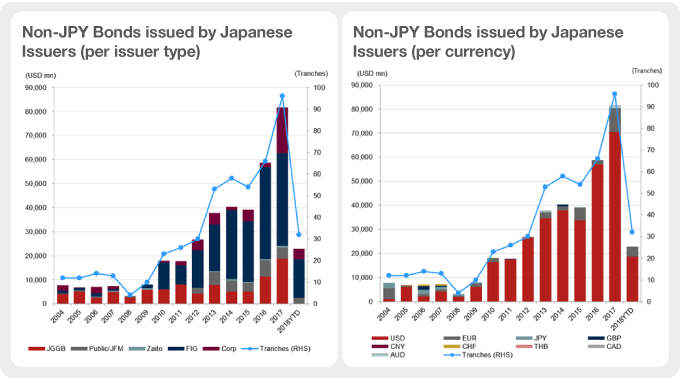

The largest contributor to issuance volumes in recent years is financial institutions (FIs – shown in dark blue in the bar chart) such as the three mega banks – Mitsubishi UFJ, Sumitomo Mitsui and Mizuho – and life insurers.

As well as responding to attractive market conditions, more demanding regulations relating to capital requirements (introduced in the wake of the financial crisis) have prompted FI deals. Banks have issued Total Loss Absorbing Capacity (TLAC) eligible bonds (such as those classed as additional tier 1 (AT1) or subordinated) as a result.

Japanese banks have issued AT1 or subordinated bonds in Japan. But they have been eager to take advantage of buoyant conditions in overseas markets for several reasons, in addition to cost efficiency and investor diversification.

One motivation is to avoid ‘double gearing’ and ensure a wide variety of domestic and foreign institutions hold their TLAC bonds rather that a geographically concentrated set of investors. A second explanation is that Japanese banks have grown their overseas lending and expanded their international business. It therefore makes sense for them to raise funds in the same currency as they originate loans.

Corporates go global

While FIs are the mainstay of Japanese international issuance, corporates are becoming a more significant component (purple in the chart); 13 non-FI issuers (including ORIX and NTT Finance) sold benchmark international bonds in 2017; five were market debutants. Of the five corporate issuers in 2018 to date, two are new names.

Just like FIs, corporates are taking advantage of strong global demand to exploit arbitrage opportunities compared to JPY funding. Similarly, they want to diversify their investor base, which maximizes demand, lowers prices and ensures a stronger secondary market (which has pricing benefits for subsequent issues). In order to access investors unable to buy longer-dated bonds, issuers, such as NTT-Finance and Central Nippon Expressway, are becoming increasingly flexible and adding shorter tenors, such as three- and four-year bonds, to their curve.

One important additional factor driving issuance is overseas business expansion, which encourages issuers to issue regularly in USD or EUR. Similarly, increasing cross border M&A activity is being funded either through bond issuance or, more usually, via bridge loans that are then refinanced in the bond market.

Increasing M&A activity by the Japanese corporates has also led to higher issuance by Japanese Government Guaranteed Bond issuers (red in the chart), such as JBIC or DBJ, which provide finance alongside commercial banks.

Cautious optimism

Many of the conditions have prompted the uptick in FI and corporate international bond issuance are still in place. Indeed, Standard & Poor’s recently changed its outlook of Japan to ‘positive’. However, a variety of factors, including increased volatility in the bond market (possibly driven by faster than expected US rate rises), less attractive dollar-yen swap rates, geopolitical tensions or escalating trade wars could impact volumes.

There have been false dawns for Japanese international bonds; issuance has faded away as arbitrage opportunities disappeared. But things may be different this time. While some issuance is undoubtedly driven by arbitrage, strategic imperatives – including higher international lending by banks and stronger corporate M&A activity – could provide a structural rationale for issuance that was largely absent in the past.

For further insights about Japanese international issuance, read the Global Capital Markets roundtable and whitepaper.

For more Nomura thought leadership and insights click here and to see some Nomura case studies click here.

Contributor

Masanori Kazama

Executive Director, International DCM, Nomura

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.