2021 Global Economic Outlook - A topsy-turvy recovery

The still-raging pandemic produced a unique recession in 2020, but what does the future hold?

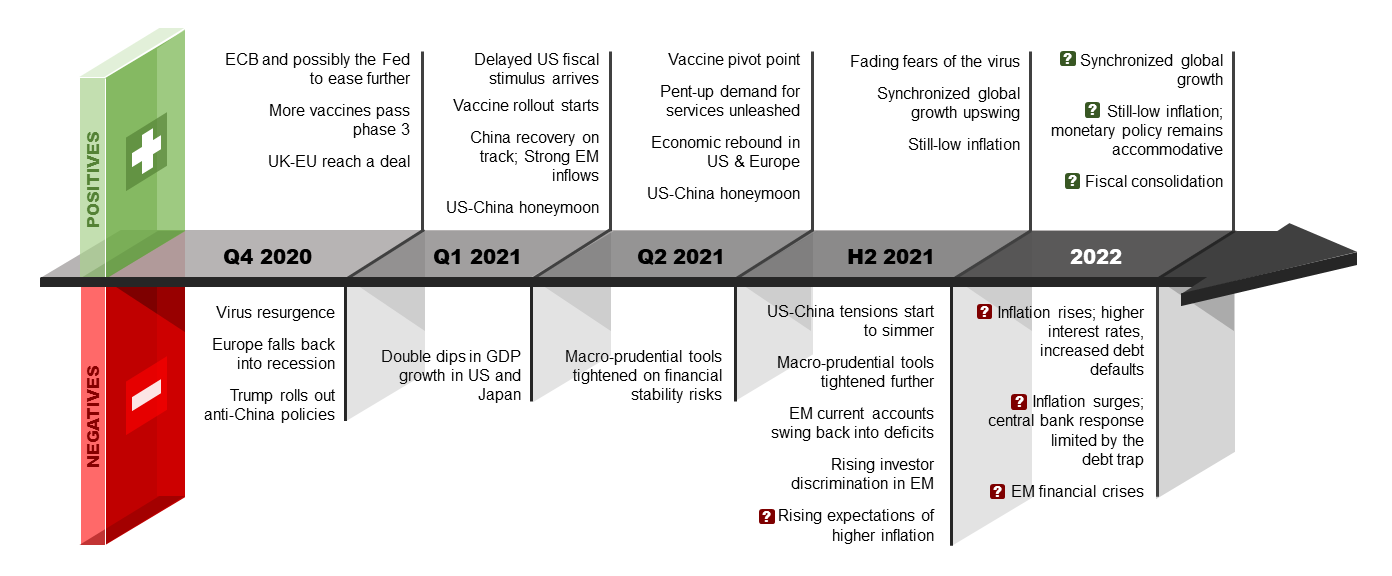

- A low-inflation, synchronized global recovery should start taking hold from Q2 2021

- We expect inflation to remain depressed in 2021. This, coupled with the extreme unevenness of recovery will keep central banks from normalizing super accommodative monetary policies.

- We highlight several major unresolved challenges facing the world, including potentially new ones such as forward-looking markets starting to price the risk of an inflation surge in 2022.

Listen to us on

The still-raging pandemic produced a unique recession in 2020. The contact-intensive services sectors were hit disproportionately hard, causing a very uneven distribution of losses.

Of all the alphabetical letters used to describe the path of recovery, our favourite is the K-shape. It signifies the defining feature of this crisis: the overwhelming burden borne by less-skilled workers, youth, women, small businesses and lower-income countries. It also signifies how high-income earners and large companies have benefitted the most from the massive rally in equity markets, fuelled by the unprecedented monetary policy accommodation.

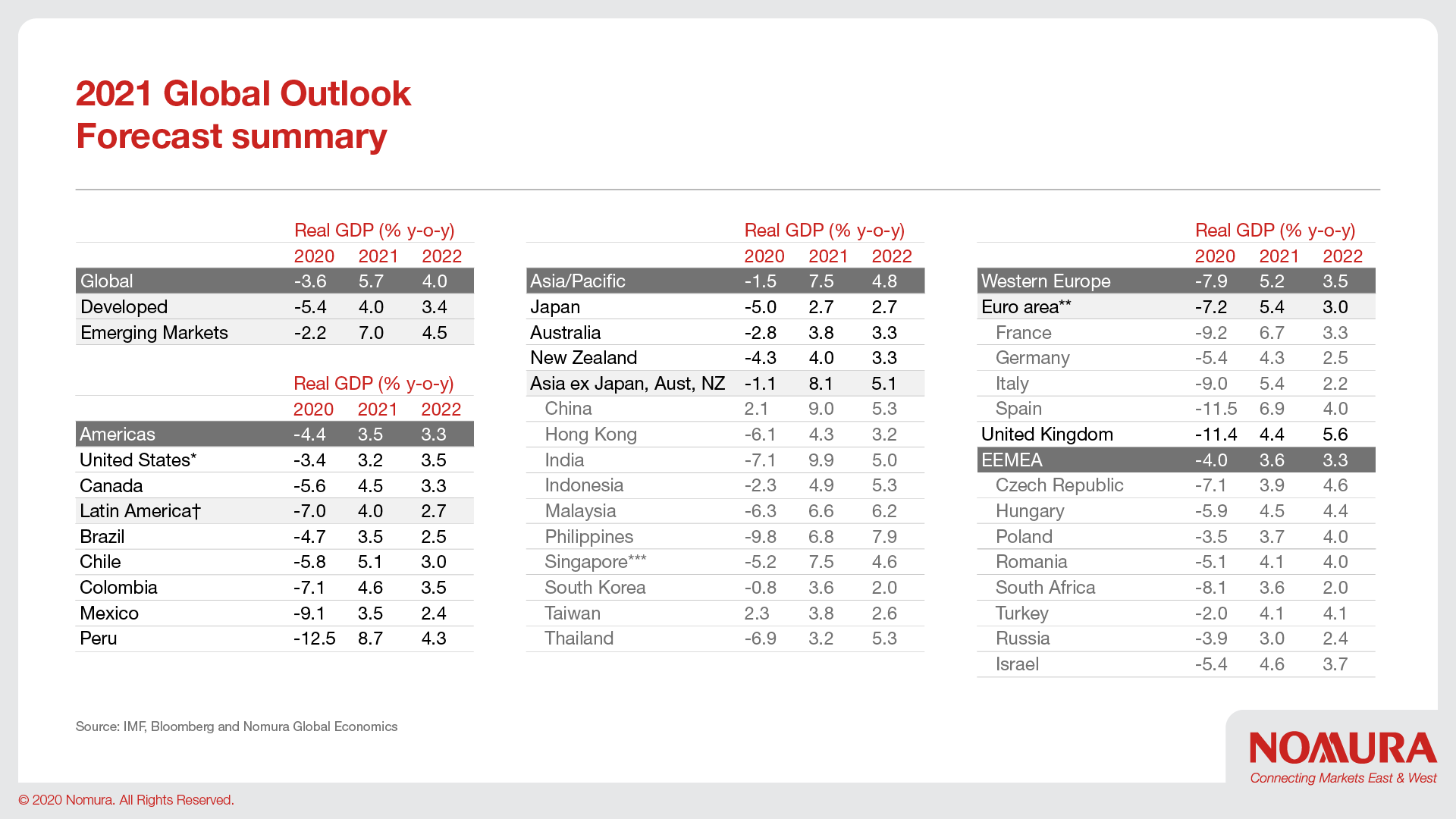

All this has polarised the world’s economies, and has left a lot of scope for growth in the future. Below we showcase countries performance in GDP for 2020 and our forecast.

2021 Outlook by region.

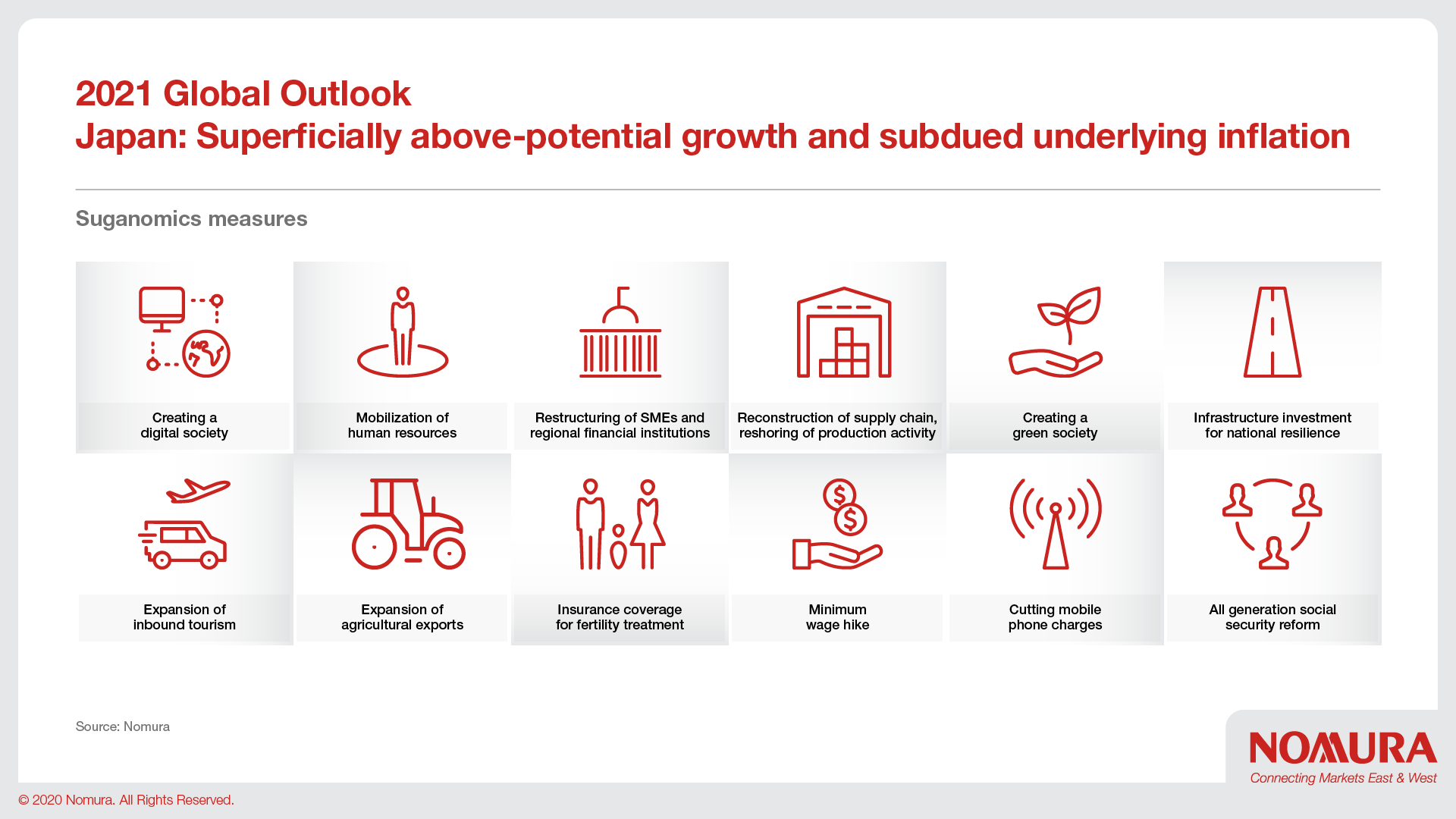

Japan: Superficially above-potential growth and subdued underlying inflation

In 2021, we expect Japan’s economic performance to feature a combination of superficially above-potential growth and subdued underlying inflation. We say ‘superficially’ because this above-potential growth will mostly reflect pent-up demand and therefore should not be mistaken for an underlying improvement in growth potential, which is an important precondition for regaining inflation momentum. In this regard, what Japan really needs in 2021 is a strong policy push from Suganomics to improve the supply-side potential of the economy, which is unlikely until after the next election.

US: A growth re-acceleration in Q2 and a very patient Fed; prepare for QOG

The resurgence of Covid-19 and waning fiscal support are near-term threats to the economy. However, in H1, the widespread availability of effective vaccines should support faster growth as social consumption recovers. President-elect Biden should normalize policymaking in Washington, but persistent partisanship will likely constrain his legislative agenda. Labor markets should continue to improve, but more gradually. We expect inflation to remain depressed, and the Fed to keep the policy rate unchanged through 2023 and begin tapering asset purchases only in 2022. This should limit the rise in longterm bond yields. The Fed is likely to soon introduce qualitative outcome-based guidance (QOG), which would link future asset purchases to the evolution of the economy.

China: A year of high growth and low inflation 2021 should be a year of respite.

We expect GDP growth to surge to 9.0% in 2021 from an estimated 2.1% in 2020, as Covid-19 is checked by vaccines, while CPI inflation may stay below 2.0%. US-China tensions might ease under a Biden administration. The moderate stimulus in 2020 to combat the pandemic reduces the need for deleveraging in 2021. The elevated current account surplus, a strong RMB and low inflation provide a more room to deal with financial risks.

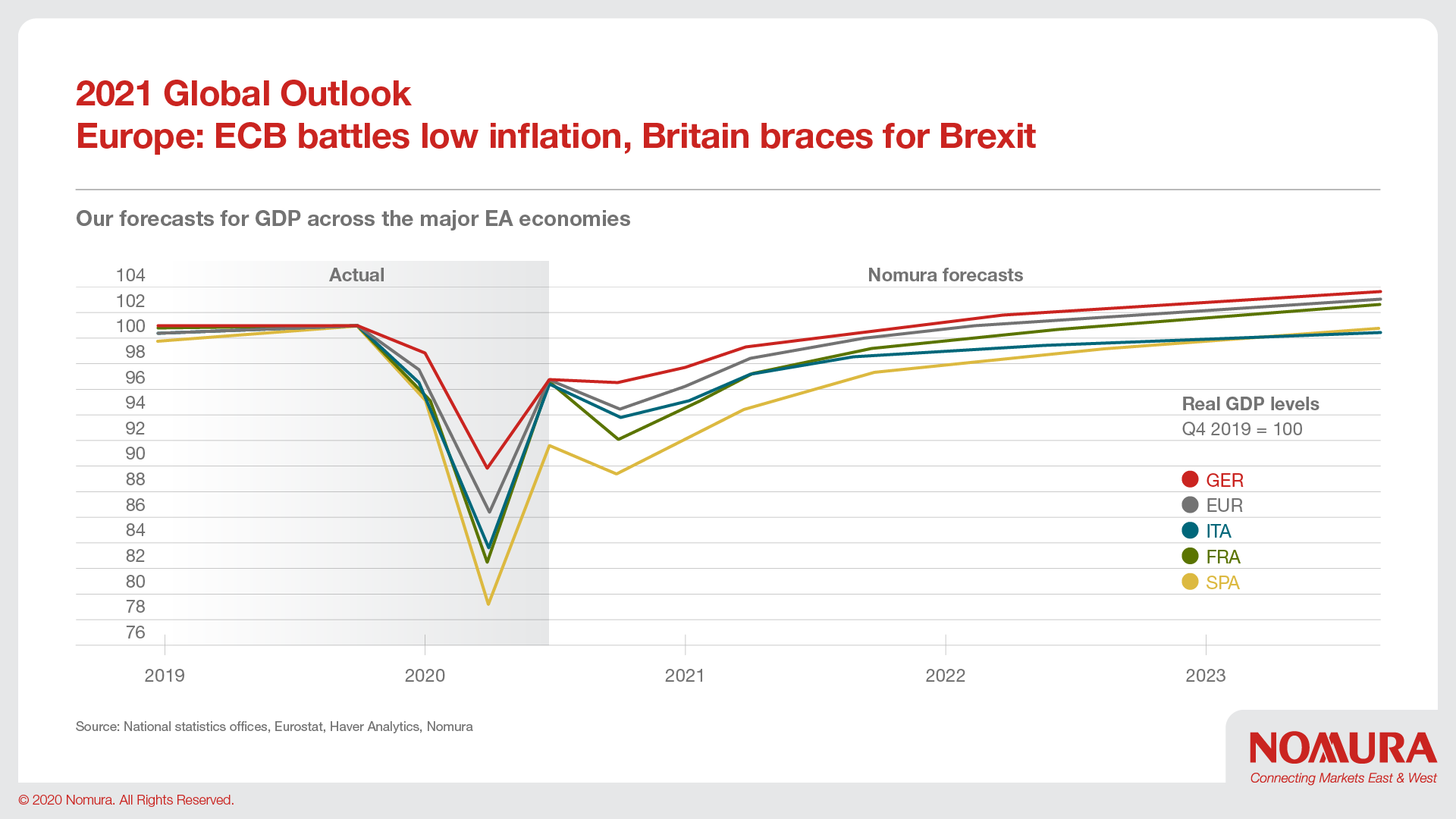

Europe: ECB battles low inflation, Britain braces for Brexit

Recent expansions of ECB and BoE policy have bought some time. But with euro area inflation on the floor (our forecasts are weaker than the ECB’s) we think the ECB may find itself loosening policy again in 2021. As the generosity of furlough schemes is reduced rising unemployment carries with it sizeable risks to the economy during the recovery phase. We see fiscal policy being neither expansionary nor contractionary in 2021 versus 2020, with talk of consolidation more likely to be a theme of 2022 and beyond.

India: A new (growth and policy) cycle begins

We have turned positive on the cyclical outlook after two years of being negative. Despite structural balance sheet issues and growth hiccups in the first half, we expect easy financial conditions, a synchronised global recovery and vaccinations to support an above-consensus GDP growth outturn of 9.9% in 2021. Inflation should moderate but remain above the RBI’s 4% target, prompting a gradual policy normalisation, starting with liquidity in H1 2021 and rate hikes in early 2022.

Rest of Asia: South Korea and Singapore to outperform; more rate cuts in ASEAN

A multi-speed recovery is likely. We are above consensus on GDP growth in South Korea and Singapore, but expect growth to disappoint in Thailand (student protests and tourism drag) and the Philippines (weak fiscal support and late vaccine pivot point). The interest rate cutting cycle is not over in ASEAN; we expect 50bp of rate cuts each across Thailand, Indonesia, the Philippines and 25bp in Malaysia, all by Q1. Monetary policy credibility issues may return in Indonesia. In Australia, we see rising growth momentum, but still-low inflation and a patient central bank.

Read our full Global 2021 Economic Outlook - A topsy-turvy recovery here

Contributor

Rob Subbaraman

Head of Global Macro Research

Lewis Alexander

Chief US Economist

George Buckley

Chief UK & Euro Area Economist

Takashi Miwa

Chief Japan Economist

Ting Lu

Chief China Economist

Sonal Varma

Chief Economist, India and Asia ex-Japan

Craig Chan

Global Head of FX Strategy

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.