Germany: Here Comes the Recession

We believe Germany is in recession and structural factors such as manufacturing competition from China and an ageing and shrinking workforce will lead to a period of stagnation.

- Germany has entered a three-quarters-long recession, triggering a decline in GDP, followed by stagnation, owing to structural, not cyclical, factors

- Germany’s economic contraction, in addition to France's slowdown, will weigh on euro area GDP growth but the periphery will likely outperform due to tourism

- Inflation below 2% from September, earlier than the ECB expects, and Germany’s recession, will raise market expectations for back-to-back ECB cuts

Germany has entered a three-quarters-long recession, which will cause a 0.4pp decline in GDP, followed by stagnation amid tepid consumer demand, rising unemployment and manufacturing headwinds on top of structural factors like an ageing and shrinking workforce.

Germany’s second quarter 2024 GDP growth contracted against expectations, with the expenditure breakdown indicating that the decline in domestic demand was more pronounced than expected. Official data suggest that Q3 is off to a poor start; July factory sales and industrial output fell materially, with August manufacturing surveys indicating further deterioration. Services surveys, too, have materially weakened in Q3 thus far relative to Q2.

We had expected a consumer-led recovery. However, this now appears unlikely to materialise. Subcomponents in consumer surveys related to consumption have barely improved since the height of the European gas crisis. In part, this could be because households have less available cash than before the pandemic. Additionally, the unemployment rate in Germany has risen more than peers, and some 200k more people than usual are on short-time work schemes (government subsidised wages), with this number only set to increase, an additional sign of a weak labour market. Finally, a fiscal contraction in 2025 relative to 2024 is likely due to Germany’s fragile government.

Germany’s recession will weigh on euro area GDP growth. However, we think the periphery will outperform, and tourism in particular will be key to preventing a euro area contraction. Recession concerns should become increasingly important in ECB speak, and we expect markets will begin to raise expectations for back-to-back ECB cuts. Our view remains that the ECB is likely to cut gradually, bringing the deposit rate down to 2.50% by September 2025, albeit we acknowledge the risk of a faster pace of cuts and the possibility of a lower terminal rate than we forecast; after all, central banks typically cut rates to accommodative levels in response to recessions, rather than to neutral.

Germany: A recession, followed by economic stagnation

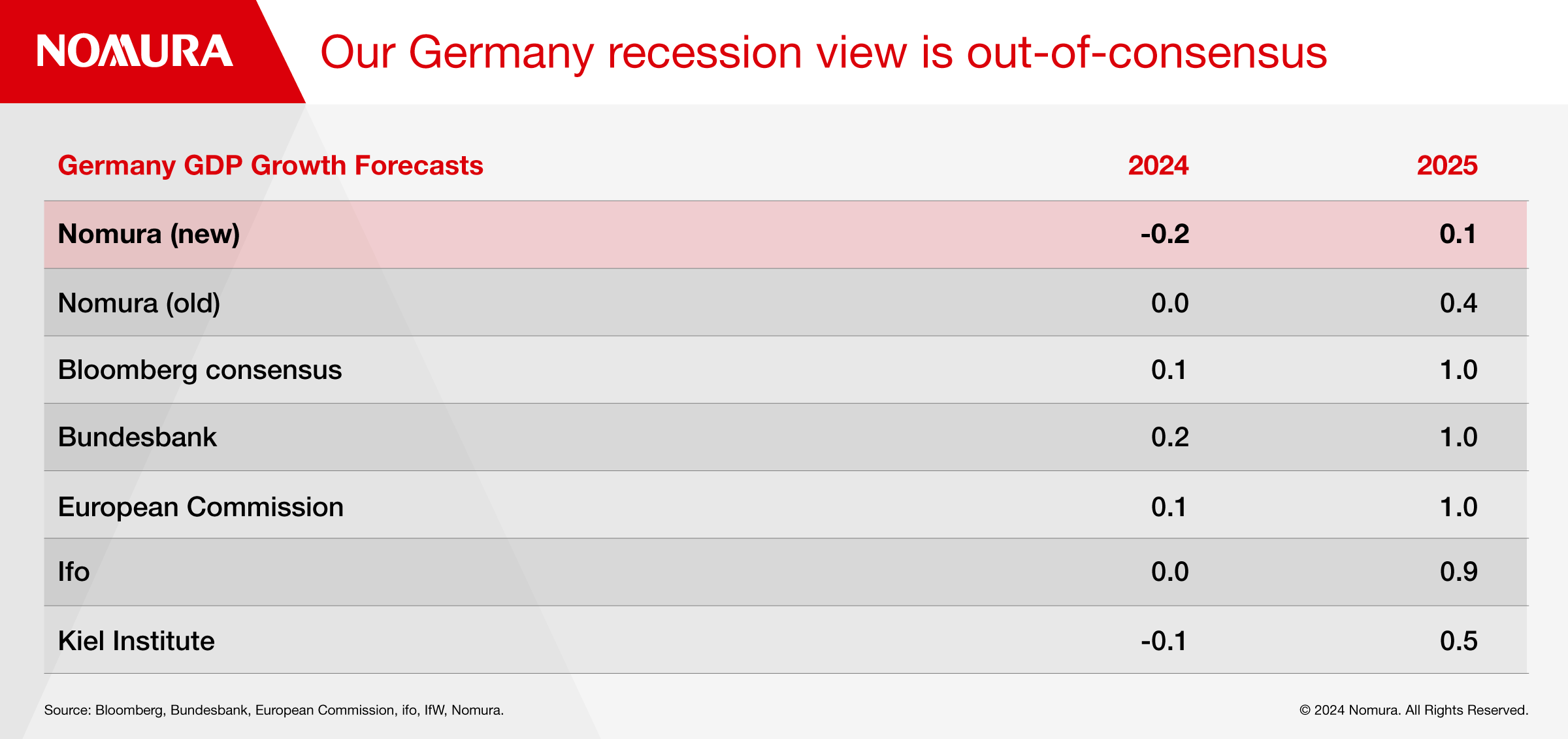

We now forecast German GDP growth of -0.2% for 2024 and 0.1% in 2025, relative to our previous forecasts of 0% and 0.4%, respectively. This contrasts with the Bloomberg consensus and European Commission, which both expect 0.1% and 1.0%, respectively (Figure 1).

Activity surveys have been weaker in Q3 relative to Q2

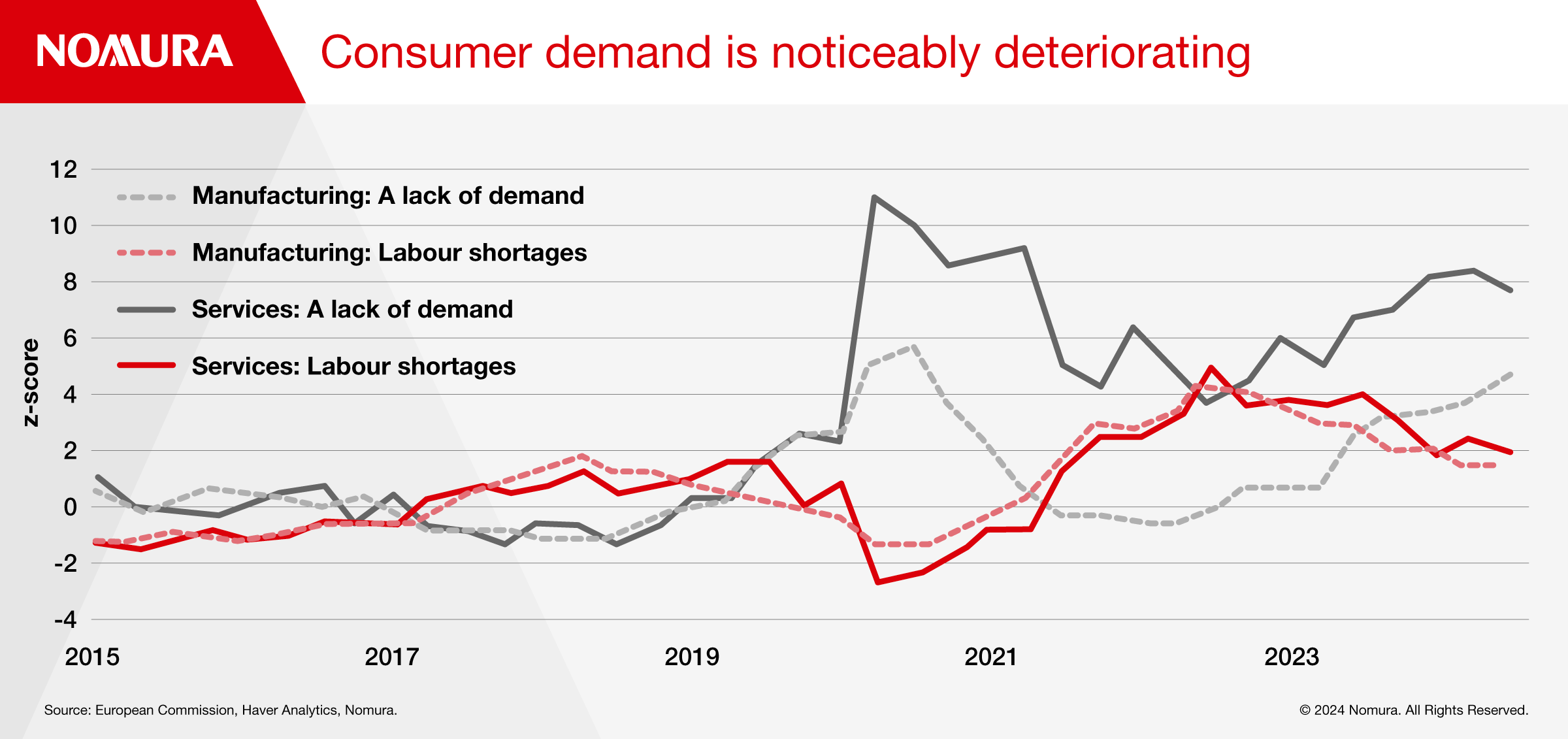

The current conditions component of the German Sentix survey (which represents market expectations of investors) declined in July, August, and September, and averages -41 in Q3, relative to an average of -31.9 in Q2. The current conditions component of the German Ifo survey, too, has deteriorated in Q3, averaging 86.8 for July and August after 88.5 in Q2. The German composite PMI output index, meanwhile, averages 48.8 for July and August, down from 51.1 in Q2; importantly, both manufacturing and services have deteriorated. Additionally, the European Commission quarterly survey suggests consumer demand in both the manufacturing and services sectors has rapidly waned, with a lack of demand now being more important in inhibiting firms from increasing output than labour shortages (Figure 2), which is not the case in Germany’s peers.

Official data in Q3 are off to a poor start

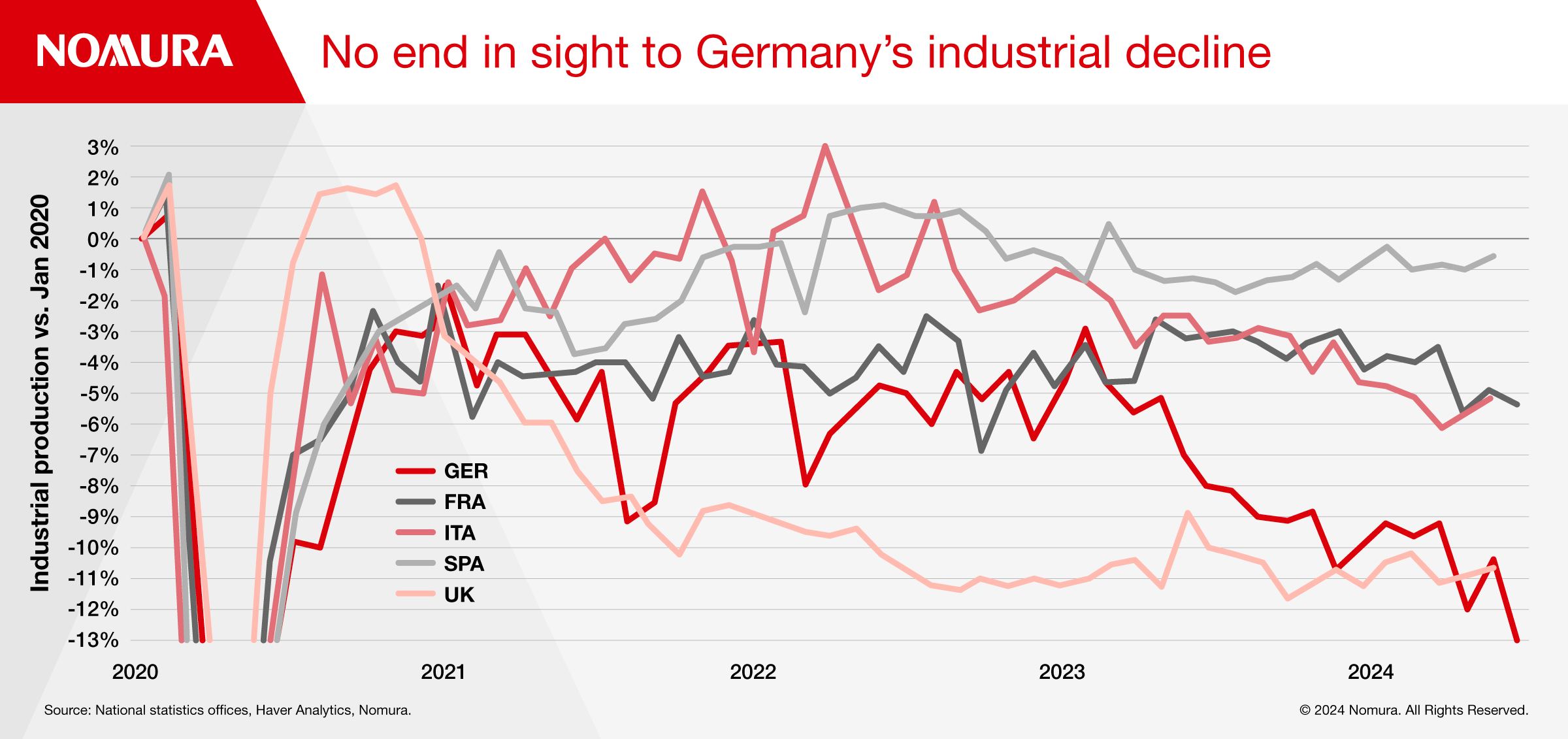

July industrial output and factory sales declined notably. Assuming no growth in August and September, German industrial output for Q3 would contract by 2.2% q-o-q, which implies subtracting 0.6pp from German GDP growth for Q3 (almost 0.2pp off euro area GDP). However, manufacturing surveys suggest Germany’s industrial decline continued, meaning even an assumption of no growth in August and September may be too optimistic.

A consumer-led recovery now seems unlikely to materialise despite being the consensus

- GfK consumer confidence increased to -22 in September, 0.4sd below its long-term average, from a trough of -42.8 in October 2022. The consumption subcomponent, however, has seen less improvement; it stands at -10.9 in September, following a trough of -19.5 in October 2022, remaining 0.6sd below its long-term average.

- Real wage growth has eased more sharply than expected. Forward-leading indicators suggest wage growth will continue to moderate, while we expect German HICP inflation to be stable between now and end-2025, hovering around 2% y-o-y.

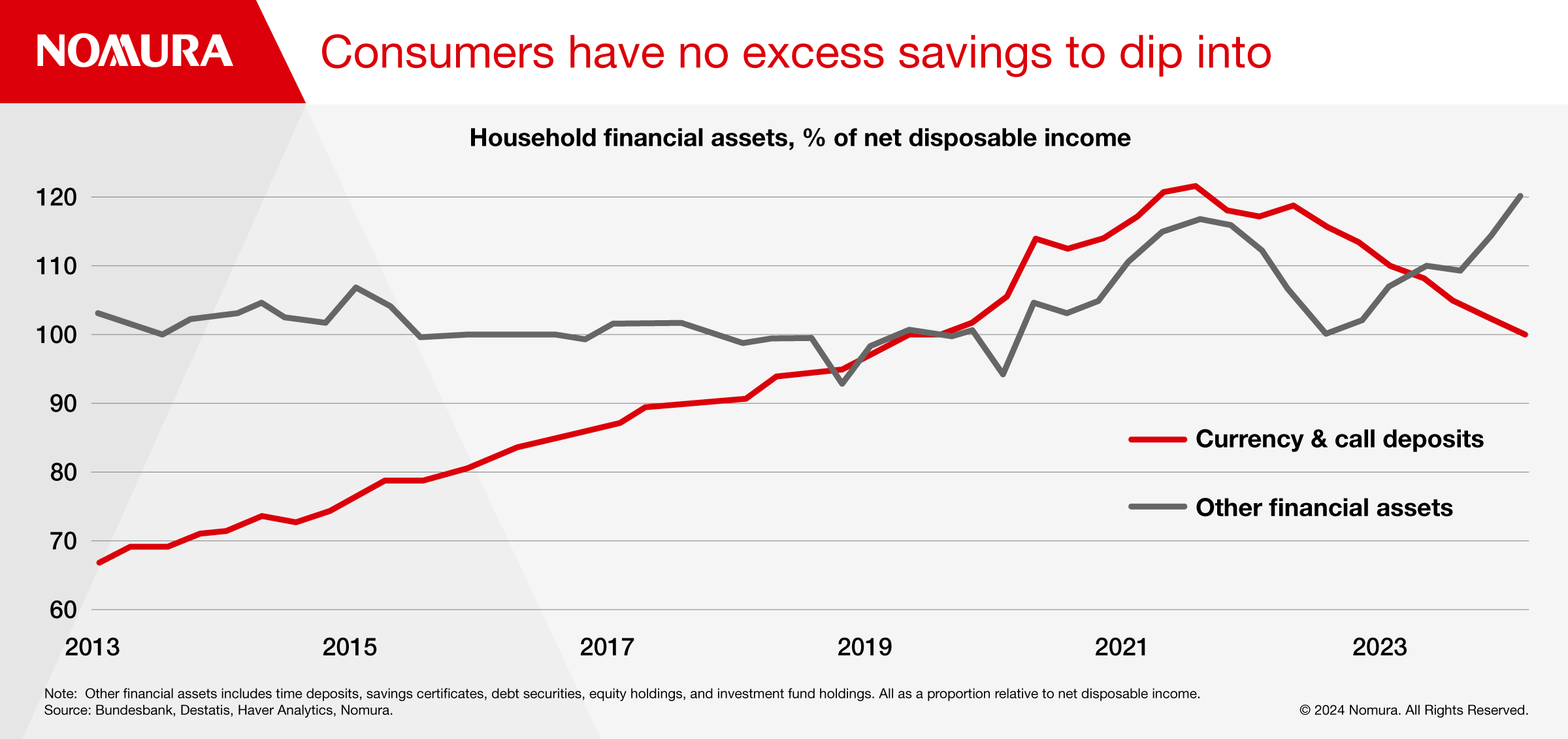

- Household financial balance sheet data suggest that while the savings ratio has risen since the pandemic, available cash has not (Figure 4). Consumers have instead increased their holdings of assets (equities, debt securities), while pension valuations have also increased. Households would need to divest in order to free up cash to increase consumption, which we think is unlikely.

- Real wage growth is slowing more sharply than expected and households have less available cash relative to before the pandemic in other euro area countries and at the euro area aggregate level, too, suggesting risks that a consumer-led recovery elsewhere in the euro area may also not materialise.

The labour market is weakening

The unemployment rate is ticking up. The harmonised International Labour Organization measure has risen to 3.4% in July 2024 from 2.9% in May 2023. Meanwhile, the national claims measure stands at 6% in August 2024, having risen from a trough of 5% in May 2022.

Germany has a short-time work measure (Kurzarbeit), which allows companies to retain employees on fewer hours with the government topping up salaries. Currently, there are approximately 232k on this scheme, substantially more than the 2015-19 average of 9k, though the number of people on short-time work schemes remains low relative to the total workforce.

Fiscal policy is unlikely to provide support

While Germany has fiscal space, its self-imposed fiscal rules are more restrictive than those of the European Commission, which prevent it from using the extra headroom. We expect fiscal policy to be a drag near-term; the European Commission forecasts Germany's cyclically adjusted primary budget balance in 2025 to be lower than in 2024. Moreover, German politics is fragile, suggesting it will be a challenge for the German coalition government to implement necessary structural reforms ahead of the general election in September 2025.

Beyond the three-quarters-long recession, we expect the German economy to stagnate because we believe Germany’s problems are largely structural, not cyclical, which means that German GDP growth is unlikely to return to its pre-pandemic trend by the end of our forecast horizon.

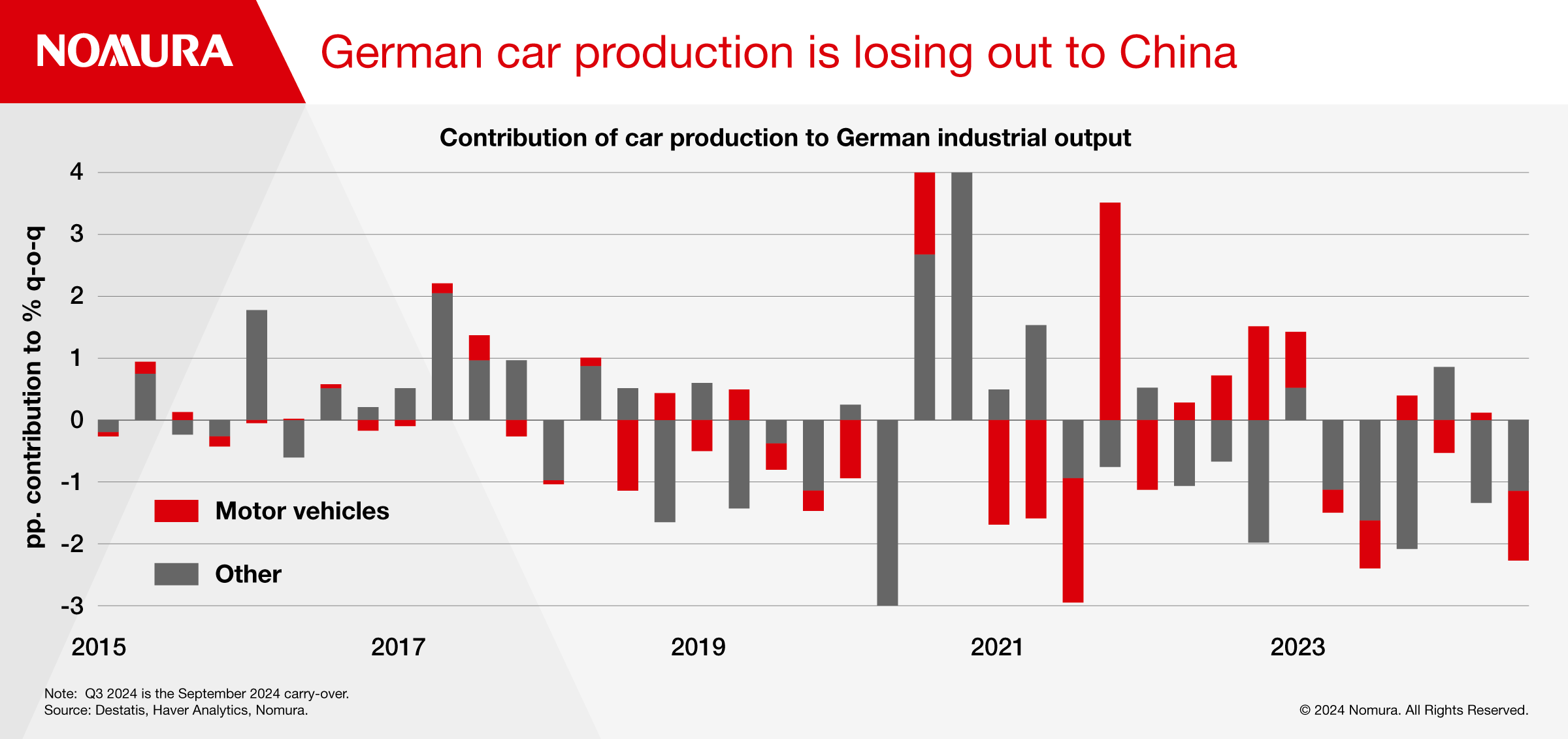

Important adverse structural factors include: (i) greater exposure to a weakening China which has its own structural headwinds; (ii) more pronounced exposure to a global manufacturing downswing, as well as increased competition from China and a shift to electric vehicles (Figure 5); (iii) deteriorating demographics, with the biggest expected rise in dependency ratios among the G7 in the next decade and a shrinking population. All of these factors suggest little is required in the way of cyclical weakening in Germany to produce a recession – and perhaps less of a slowing than is necessary for other countries without similar structural problems.

Implications for the euro area and the ECB

We expect the German recession to be a drag on euro area GDP growth. As a result, we have lowered our euro area quarterly GDP growth profile by a cumulative 30bp between Q3 2024 and Q4 2025.

While we forecast a German recession and think France is likely to stagnate (following an Olympics-related boost in Q3 2024), we expect the periphery to outperform and prevent the euro area itself from entering recession.

Keep up to date with what's on the horizon for the global economy.

Contributor

Andrzej Szczepaniak

Senior European Economist

George Buckley

Chief UK & Euro Area Economist

George Moran

Week Ahead Podcast Host and European Economist

David Seif

Chief Economist for Developed Markets

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.