FX Options: Embracing the Potential of Platforms

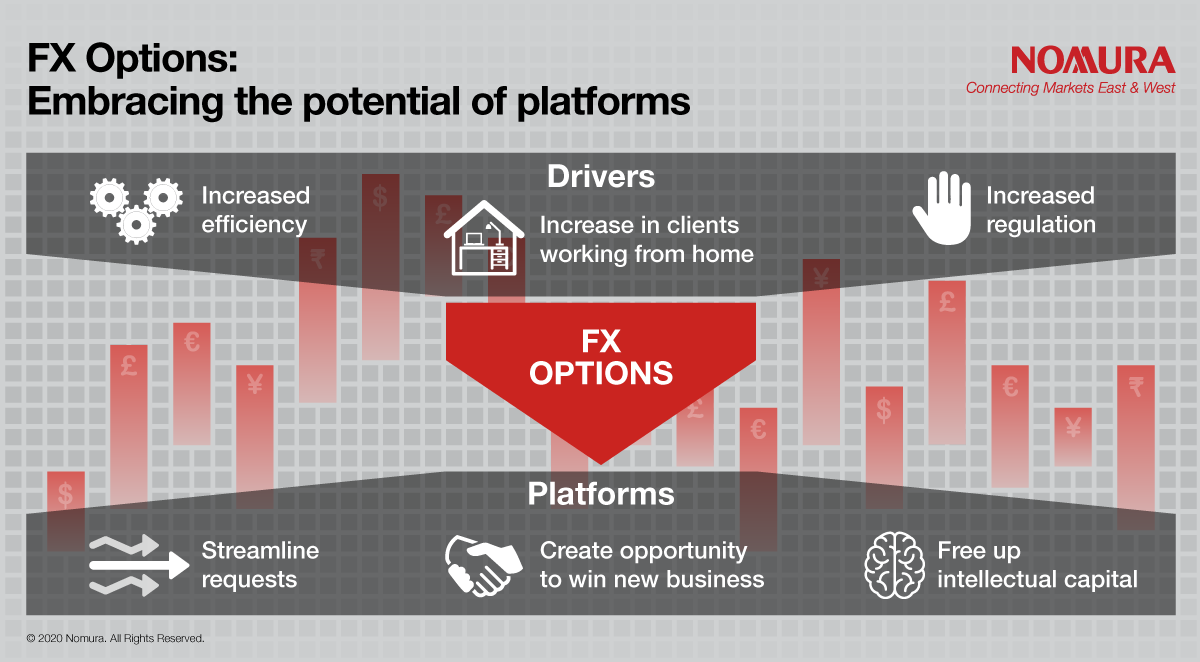

Regulatory requirements, clients’ drive for efficiency, and the experience of working from home during the COVID-19 pandemic are spurring a shift of FX option activity to platforms.

- Recently launched platforms for FX options and structured products can benefit clients by streamlining price requests, and create new business opportunities for banks.

- Vanilla products are becoming increasingly commoditised; electronification frees up banks’ intellectual capital for more complex value-added activity.

Hedge funds, private banks and other clients are increasingly seeking to trade FX options on platforms, driven by regulators’ requirements for investors to prove best execution and the growing depth and range of offerings available. From a client perspective, aggregator and multi-dealer platforms are an attractive proposition, offering convenience, transparency and the potential for lower costs; they make the processing of price requests significantly more straightforward.

In the past, many buy side clients relied on a handful of liquidity providers. The need to prove best execution has transformed how these users access FX option products. In order to comply with regulations, some users initially requested quotes electronically and simply captured a screenshot of the quotes in order to prove best execution. However, this process is cumbersome and fails to realise the full benefits of moving to electronic trading.

Now, hedge funds and private banks in particular are seeking to integrate their requests for quotes into a workflow that leaves a clear audit trail – ensuring compliance with best execution requirements– and also facilitates execution. Aggregator and multi-dealer platforms streamline regulatory and execution workflows into one system, driving automation, improving efficiency and reducing operational risk. The benefits of such platforms have been brought into sharper relief during the COVID-19 pandemic, which demonstrated the value of a streamlined system when working from home.

Meeting the changing needs of hedge funds and private banks

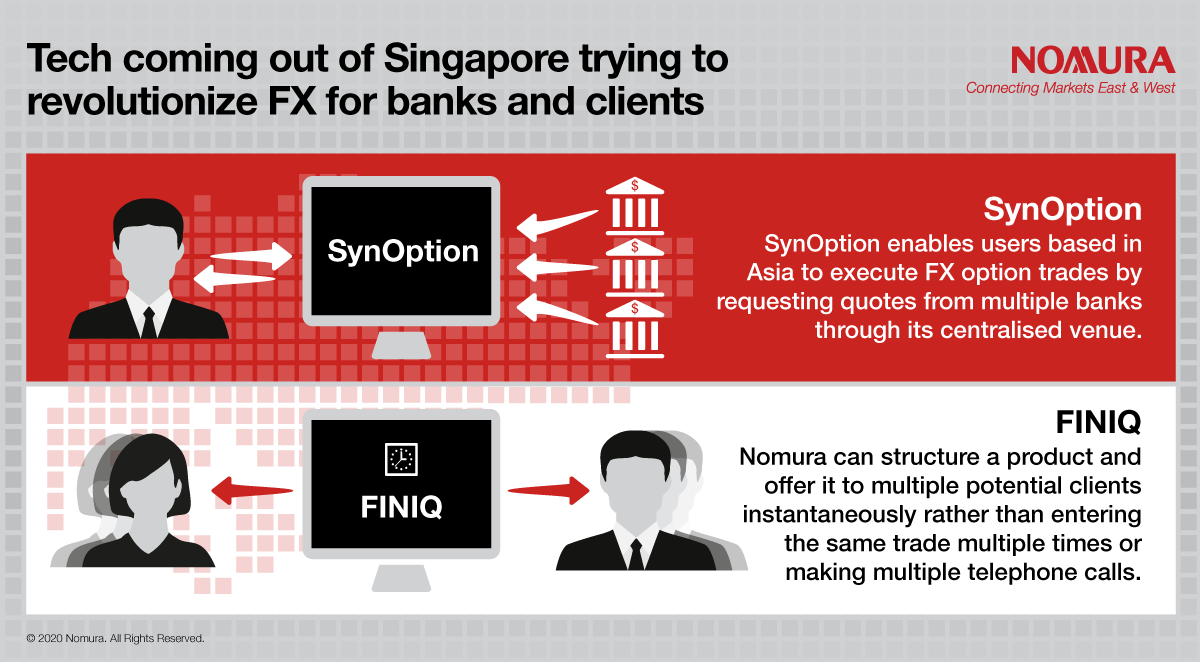

The changes underway in the hedge fund and private bank markets are highlighted by the recent launch of two platforms in Asia.

In January, Singapore based start-up SynOption launched an electronic trading platform for FX options, aimed at hedge funds. It enables users based in Asia to execute FX option trades by requesting quotes from multiple banks through its centralised venue. SynOption is the first firm approved by the Monetary Authority of Singapore (MAS) to establish and operate an organised market under the MAS’s Sandbox Express framework, which enables firms to test innovative financial products and services in the market. SynOption was awarded a grant by MAS Financial Sector Development fund as a designated special project.

The Asian structured FX product market for private banks is also being transformed by a new platform. FinIQ’s Market Connect solution is Asia’s only cross-asset structured product multi-dealer trading platform. It responds to moves by many private banks to automate and streamline execution processes for structured products in response to regulatory initiatives. They are seeking new ways of interacting with product providers rather than calling up a number of different dealers to get product prices to prove best execution. Another key goal in using innovative technology is to facilitate an efficient workflow and robust documentation that makes it easier to process and distribute products – a critical issue given their relatively large end-investor base and high product volumes.

Benefits for both clients and banks

At first glance, aggregator platforms might appear to undermine banks’ own efforts to win client deals. But in reality, they offer new opportunities to win business and lower costs – banks can structure a product and offer it to multiple potential clients instantaneously rather than entering the same trade details multiple times. Ultimately, it enables banks to shift focus to added-value business.

Regulatory changes are prompting an evolution of the market and client demands. This process is likely to be accelerated by the experience of working from home during the COVID-19 pandemic: few on the buy side are likely to return to piecemeal solutions having experienced an integrated electronic workflow. Banks would be wise to embrace change and build out their eFX options capabilities to give clients what they want.

Banks with strong existing capabilities that move rapidly have an opportunity to win new clients and business and facilitate cheaper distribution via platforms. Moreover, by leveraging the benefits of automation to service clients’ day-to-day FX option activity, which is likely to become increasingly commoditised, banks can save time, improve efficiency and reduce risk. As importantly, electronification frees up banks’ intellectual capital for more complex value-added activity.

Contributor

Ian Daniels

Head of eFX Distribution, EMEA

Simon Keen

Head of FX Options Technology

Tim Albers

Head of FX Structuring, Asia ex Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.