Fixing the Problem with US Quality Investing – an ESG Approach

Adding ESG features to a portfolio of U.S. ‘quality’ stocks dramatically improves performance.

- ‘Quality’ investment in the U.S. has a history of poor benchmark-relative performance

- Removing companies with low ESG ratings from the long leg of a ‘quality’ portfolio and removing companies with high ESG ratings from the short leg of ‘quality’, significantly improves performance

- The technique highlights the benefits of expanding the definition of ‘quality’ to include ESG

Taking an ESG filter to a portfolio of U.S. ‘quality’ stocks transforms it from subpar to an outperformer, underscoring the lopsided nature of using financial ‘quality’ metrics that may not account for increasingly important factors like corporate governance.

Buying stocks of high ‘quality’ companies may sound like a dependable investment especially in turbulent markets like we have seen so far this year. While that’s somewhat true, it’s not the complete picture. ‘Quality’ stocks in developed markets have been a good long term investment with one notable exception. The U.S. market has a history of poor benchmark-relative performance when it comes to this type of investing strategy.

What does Quality Investing Involve?

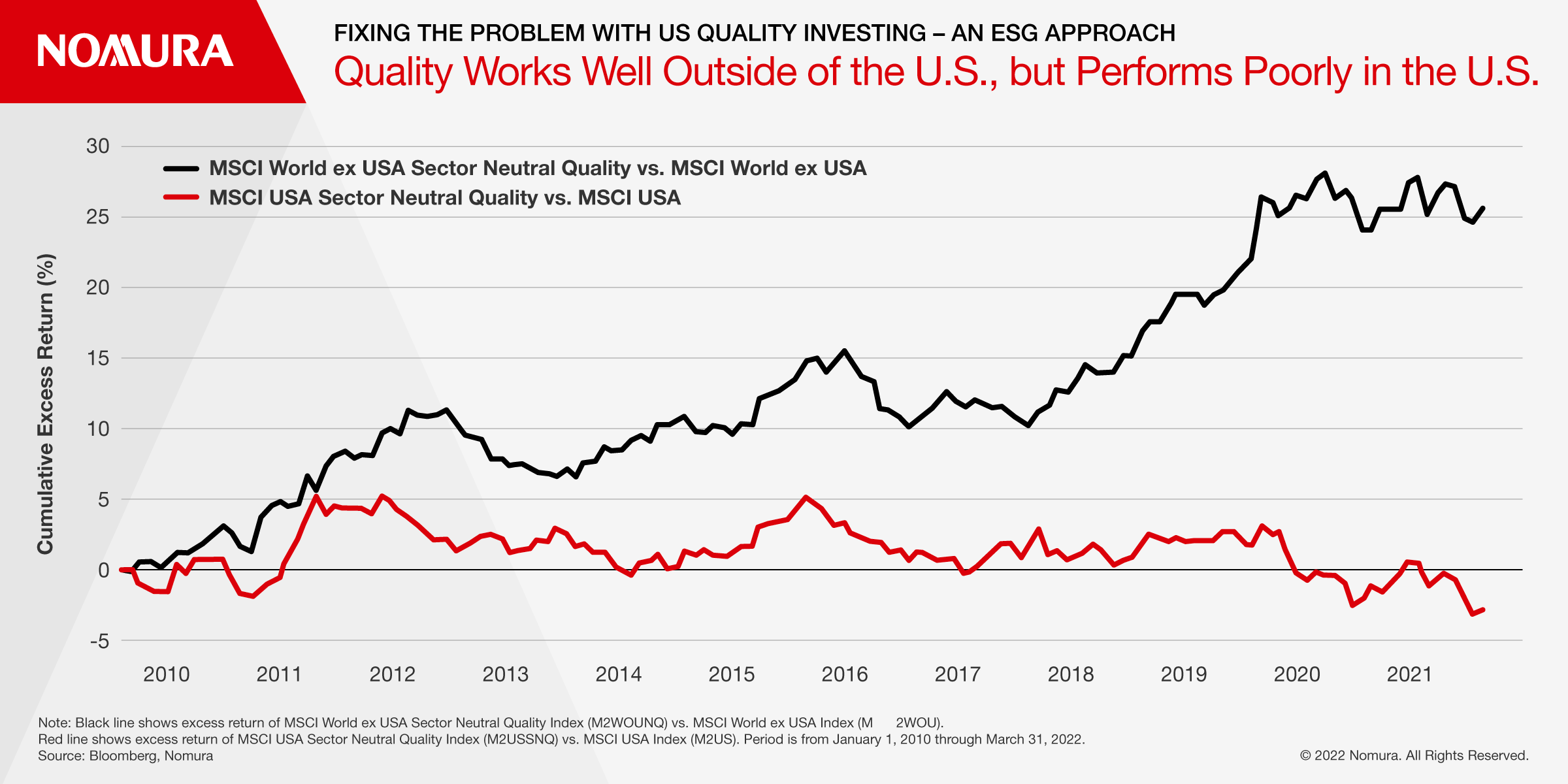

There are several ways to define a ‘quality company’. MSCI's approach is based on a company's return on equity (ROE), debt to equity ratio, and earnings stability. The black line in Figure 1 shows the cumulative excess return since January 2010 of the MSCI World ex USA Sector Neutral Quality Index relative to the MSCI World ex USA Index (from which the quality index is derived). The red line represents the cumulative excess return for the MSCI USA Sector Neutral Quality Index relative to the MSCI USA Index.

Developed market ‘quality’ stocks excluding the U.S. outperformed by 26% since January 2010. For the U.S., the excess return has been minus 3% for that period. Over the past two years, since the recovery from the March 2020 market meltdown, excess return for U.S. quality was minus 4.5%, while for Developed markets ex USA Quality was in line with the benchmark[1].

Despite the poor U.S. performance, one of the biggest exchange-traded funds based on this U.S. ‘quality’ index has over $20 billion in assets. Given the strong demand for US ‘quality’ investments, we show how combining ESG with traditional financial measures of company quality can remedy the U.S. quality investing problem and produce attractive outperformance. The idea is that ESG identifies company attributes that financial measures of quality may miss, but are relevant to stock performance.

[1] All numbers through Q1 of 2022

Remedying U.S. Quality Investment – Using ROE as an Example

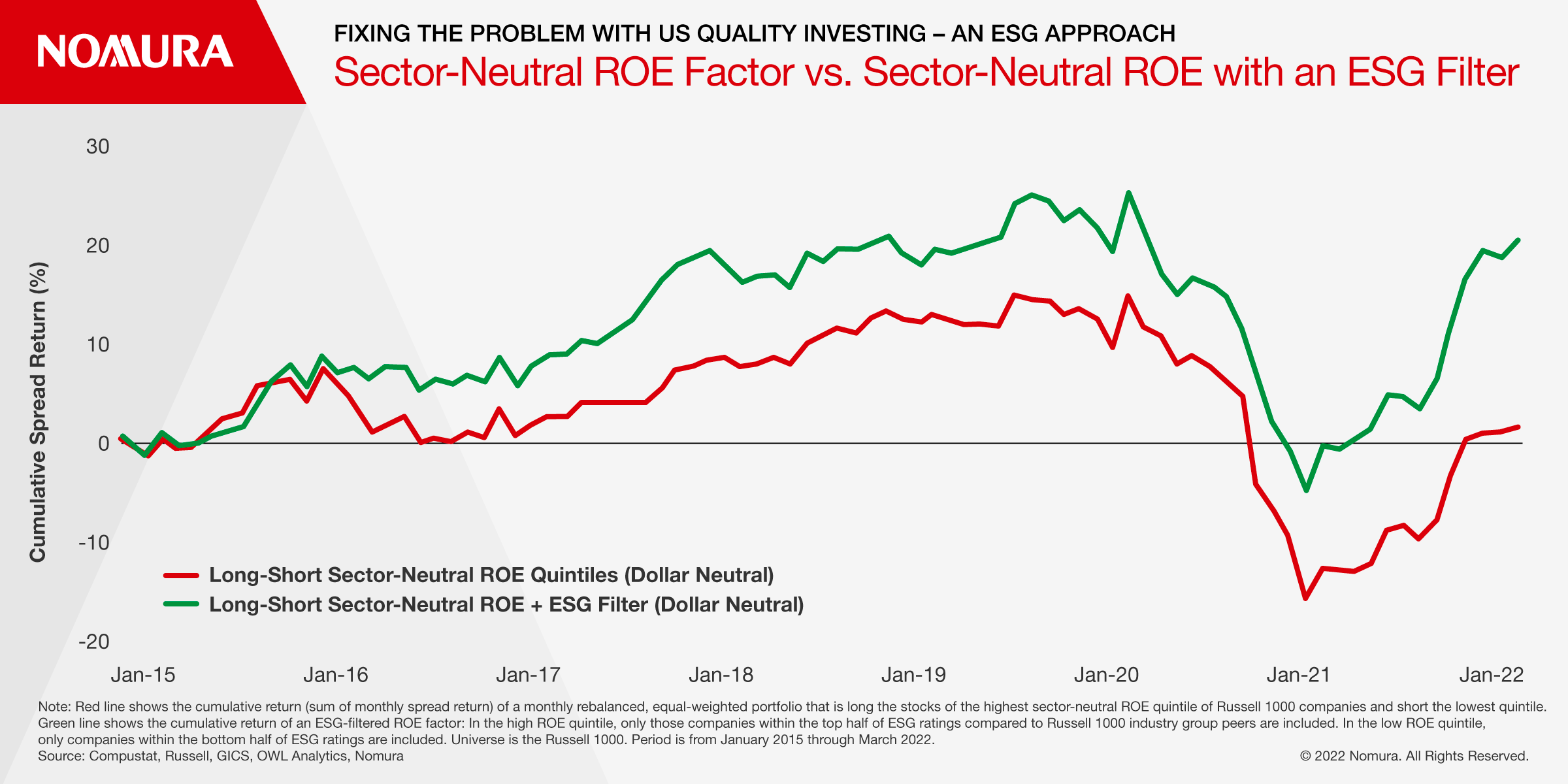

ROE is a key component of most versions of a quality strategy, including the MSCI USA Sector Neutral Quality Index. We show that involving ESG helps a U.S. sector-neutral ROE portfolio: ‘Quality’ investing based on ROE is improved if the high ‘quality’ stocks selected are also rated well for ESG, and the poor ‘quality’ stocks shorted in a long-short strategy are also poorly rated for ESG.

The red line in Figure 2 shows the cumulative return of a monthly rebalanced, equal-weighted portfolio that is long the top 200 stocks of the Russell 1000 companies ranked on sector-neutral ROE and short the bottom 200 stocks ranked on The black line of Fig. 2 charts the cumulative return of an ESG-filtered ROE portfolio: In the high ROE basket (long leg of sector-neutral ROE), only those companies within the top half of ESG ratings compared to Russell 1000 industry group peers are included. In other words, we filter out companies with bad ESG features from the long leg. In the low ROE basket (the short leg of the sector-neutral ROE), only companies within the bottom half of ESG ratings are included. In other words, for the short leg, we exclude companies with good ESG features compared to industry group peers. The chart makes clear the benefit of the ESG filter for the long-short ROE strategy. It’s also important to point out that the ESG performance boost to ‘quality’ comes mostly from the improvement on the long leg, making it useful for long-only investors.

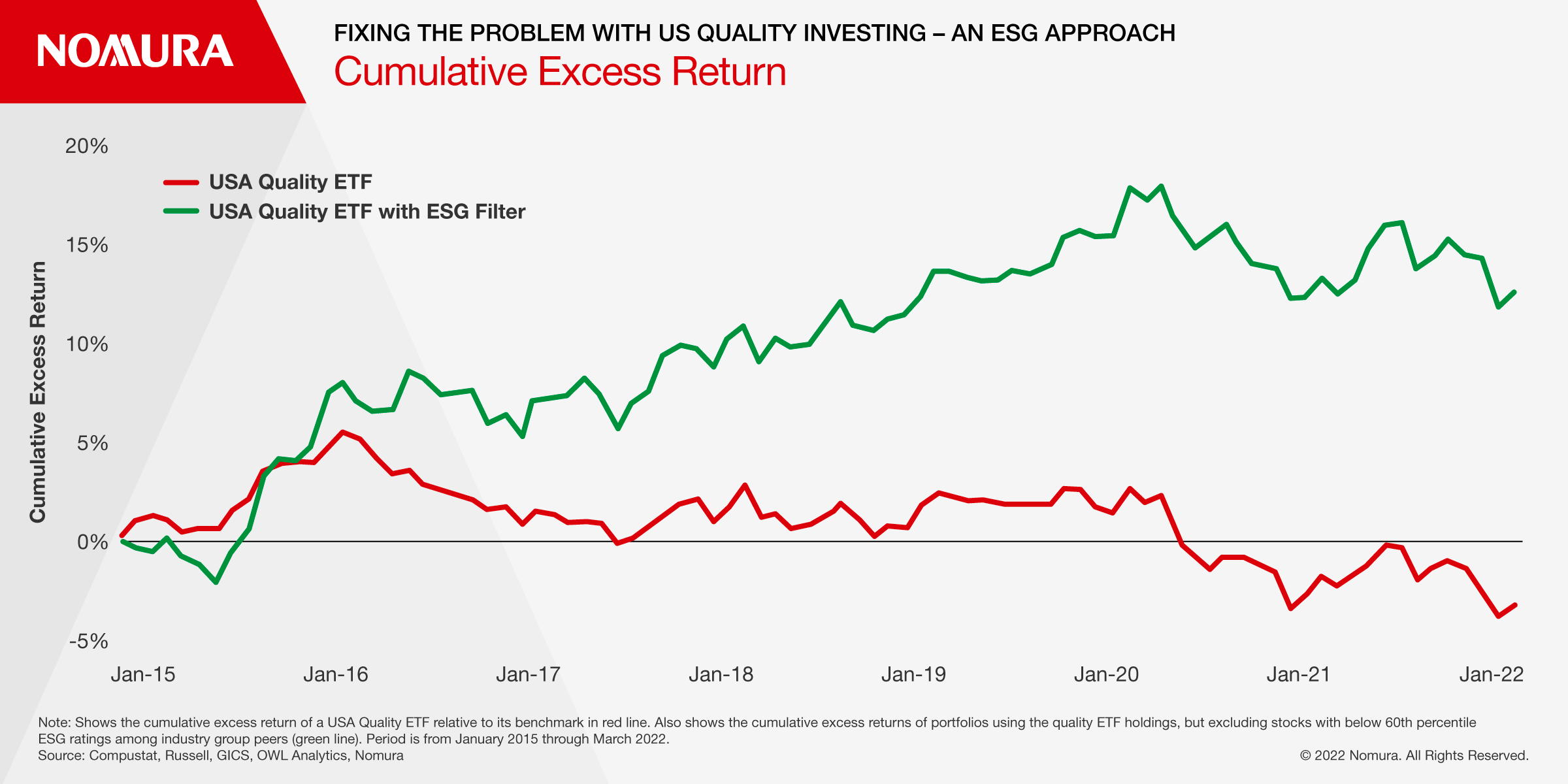

Fixing Long-Only Quality

We pointed out that one of the biggest ETFs (with more than $20 billion in AUM) tracking the MSCI USA Sector Neutral Quality Index has underperformed its benchmark for years. The lesson is that performance can be improved by adding ESG to a ‘quality’ strategy. In figure 3, we explored adding an ESG filter to the long-only members of this quality ETF to exclude companies that are poorly rated on ESG. The red line shows the excess return of the ‘quality’ ETF with no ESG filtering, which underperformed the MSCI USA Index by more than 3% from January 2015 through March 2022. The green line removes companies in the ETF holdings with low ESG ratings among industry group peers. The remaining ETF holdings are weighted proportionally according to their weights in the original ETF. A poorly performing quality ETF is transformed into a winning strategy by incorporating ESG.

Why does ESG improve ROE’s performance as a quality investment?

Generally, ‘quality’ is identified by financial metrics, such as ROE. But company ‘quality’ certainly involves attributes that are not easily measured by conventional financial yardsticks, yet affect stock performance. Governance is an obvious example. In other words, ESG scores quantify company attributes that the usual financial measures fail to identify, but which nevertheless affect overall company ‘quality’ and are relevant to stock performance. Thus, using ESG in conjunction with financial ‘quality’ measures makes sense.

Conclusion

Company ‘quality’ scores typically use historical financial ‘quality’ measures. But these measures miss some important company features, like governance issues, which should be part of a complete ‘quality’ picture.

Applying an ESG filter to U.S. ‘quality’ investing strategies improves performance dramatically. We found most of the performance boost to a long-short ‘quality’ strategy comes from the long side (from owning high ‘quality’ companies with superior ESG features). Incorporating ESG is therefore beneficial to both long-short ‘quality’ investors and long-only investors.

Download a PDF of the full whitepaper

Contributor

Joseph Mezrich

Head of Equities Quantitative Strategy

Lai Wei

Quantitative Investment Strategist

Thelonious Jensen

Quantitative Investment Strategist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.