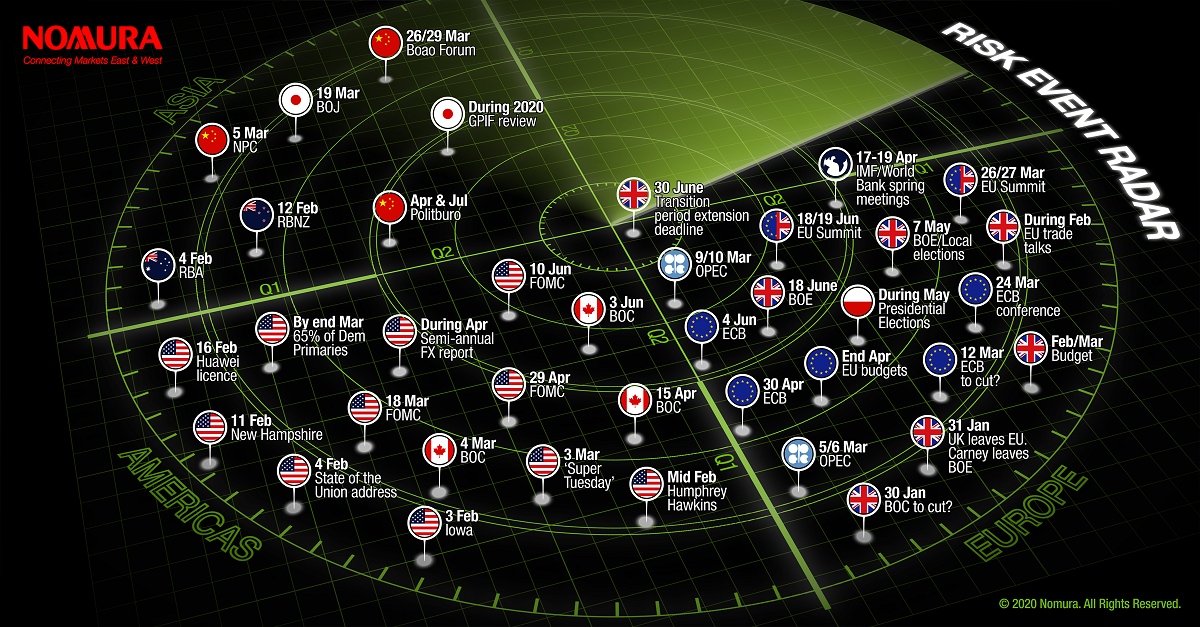

Event Risk Radar

The top market moving events that should be on your radar. Including the US Presidential election, trade talks, rate cuts & QE, Brexit and budgets, and green shoots in market survey data.

- Asia - US-China tensions, Tokyo Olympics, semi-conductor cycle picking up

- America - US-China trade talks, Democratic primaries, mixed data, expanding Fed balance sheet

- Europe - Brexit talks, green shoots in the data, reforms in question, Italian politics a risk

2020 Q1 and Q2 events to watch

The main events of 2020 for the US

- 3 March: Super Tuesday US Democratic Primaries

- Around end Q2: Fed Review of policy framework

- April: US Report on International Economic and Exchange Rate Policies

- 29 Sep/15 Oct: Presidential TV debates

- 3 November: US Presidential election

The main events of 2020 for the euro area and the UK

- 5/6 Mar: OPEC+ to extend their output cut in March or make plans to end it?

- 12 March: The ECB to cut interest rates by another 10bp?

- 24 March: “The ECB and Its Watchers” conference in Frankfurt

- 26 March & 18 June: UK FTA talks start with EU summits to be key moments.

- 30 April: deadline for euro area countries’ budget submission to the EC

- Likely in H2: Announcement of the results of ECB strategy review

- Ongoing: Banking Union Reform

The main events of 2020 in Asia and Australasia

- 4 Feb: RBA rate cut in Feb? Then later in 2020 – to start QE?

- 12 Feb: RBNZ to cut rates in February?

- 16 Feb: Deadline - Temporary General License for Huawei

- 28 Feb: JPM includes CGB in its Government Bond Index over 10-months

- 3/5 Mar: China National People’s Congress session.

- 23 Mar: FSTE Russell interim review (WBGI).

- 26/29 Mar: Boao Forum

- In 2020: GPIF review could announce a new target portfolio.

For more information and insights read our full Event Risk Radar.

Contributor

Jordan Rochester

FX Strategist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.