Europe – Heading Over the Recession Precipice

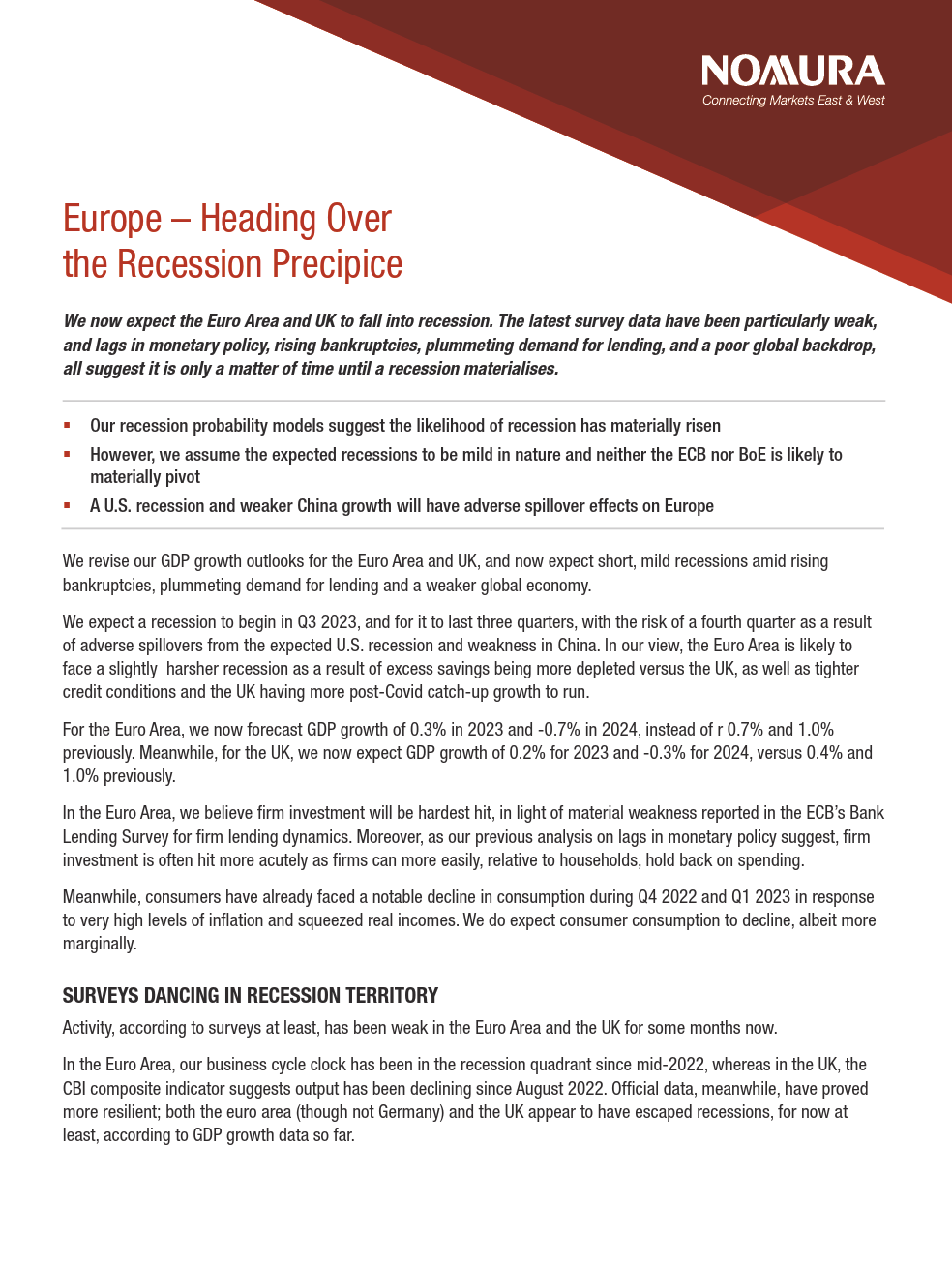

We now expect the Euro Area and UK to fall into recession. The latest survey data have been particularly weak, and lags in monetary policy, rising bankruptcies, plummeting demand for lending, and a poor global backdrop, all suggest it is only a matter of time until a recession materialises.

- Our recession probability models suggest the likelihood of recession has materially risen

- However, we assume the expected recessions to be mild in nature and neither the ECB nor BoE is likely to materially pivot

- A U.S. recession and weaker China growth will have adverse spillover effects on Europe

We revise our GDP growth outlooks for the Euro Area and UK, and now expect short, mild recessions amid rising bankruptcies, plummeting demand for lending and a weaker global economy.

We expect a recession to begin in Q3 2023, and for it to last three quarters, with the risk of a fourth quarter as a result of adverse spillovers from the expected U.S. recession and weakness in China. In our view, the Euro Area is likely to face a slightly harsher recession as a result of excess savings being more depleted versus the UK, as well as tighter credit conditions and the UK having more post-Covid catch-up growth to run.

For the Euro Area, we now forecast GDP growth of 0.3% in 2023 and -0.7% in 2024, instead of r 0.7% and 1.0% previously. Meanwhile, for the UK, we now expect GDP growth of 0.2% for 2023 and -0.3% for 2024, versus 0.4% and 1.0% previously.

In the Euro Area, we believe firm investment will be hardest hit, in light of material weakness reported in the ECB’s Bank Lending Survey for firm lending dynamics. Moreover, as our previous analysis on lags in monetary policy suggest, firm investment is often hit more acutely as firms can more easily, relative to households, hold back on spending.

Meanwhile, consumers have already faced a notable decline in consumption during Q4 2022 and Q1 2023 in response to very high levels of inflation and squeezed real incomes. We do expect consumer consumption to decline, albeit more marginally.

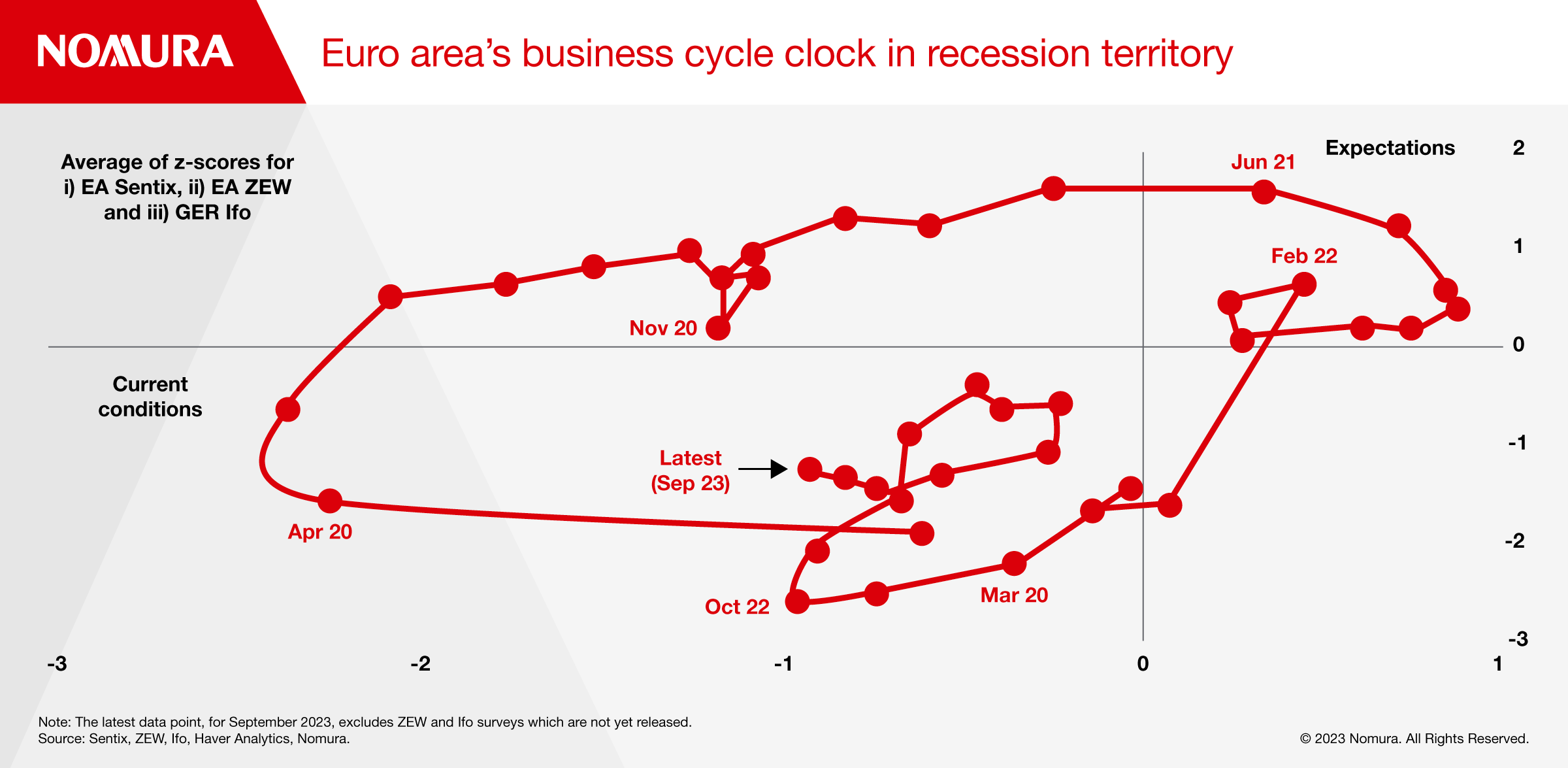

SURVEYS DANCING IN RECESSION TERRITORY

Activity, according to surveys at least, has been weak in the Euro Area and the UK for some months now.

In the Euro Area, our business cycle clock has been in the recession quadrant since mid-2022, whereas in the UK, the CBI composite indicator suggests output has been declining since August 2022. Official data, meanwhile, have prove more resilient; both the euro area (though not Germany) and the UK appear to have escaped recessions, for now at least, according to GDP growth data so far.

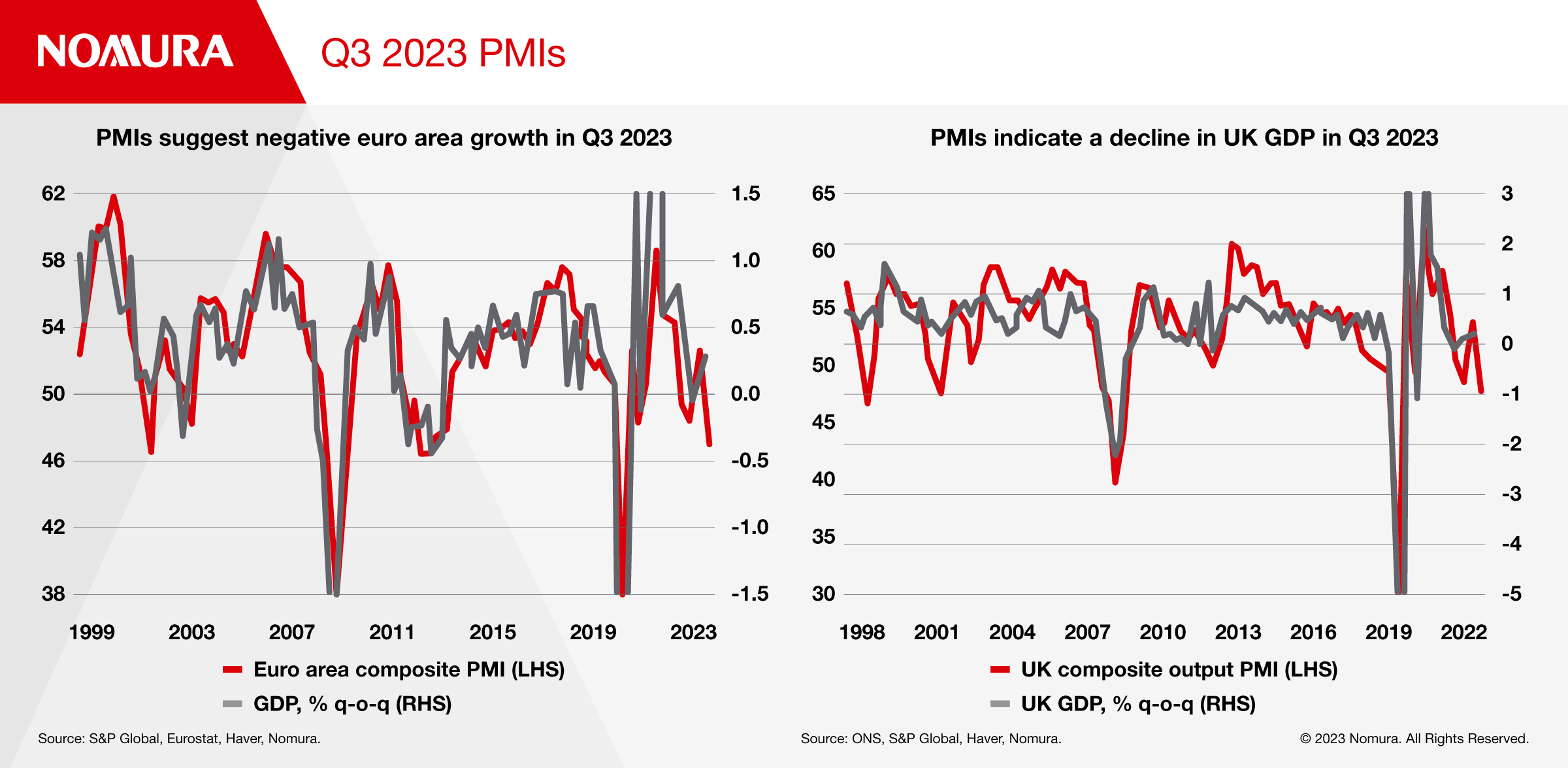

In terms of surveys, the Purchasing Managers’ Index (PMIs) are widely watched by investors, as they tend to have the strongest correlation with official GDP growth versus other data. Many investors are focused on the timing of a possible recession, and whether central banks will pivot towards supporting growth earlier by easing policy.

While PMIs have been trending down for some time, the most recent prints came in much weaker than expected. The PMI composite output indices for both the Euro Area and the UK are now firmly in contraction territory, suggesting GDP growth is likely to be negative in both jurisdictions in Q3 2023.

WHAT ELSE SUPPORTS A RECESSION VIEW?

Lags in monetary policy

There are strong reasons to believe that lags are longer now versus previously. While the BoE began to hike in December 2021, the ECB was late to the game, beginning to hike only in July 2022.

Credit conditions and lending

Demand for loans by households and firms has plummeted in the Euro Area, in direct response to the ECB’s aggressive pace of monetary policy tightening, according to the ECB’s Bank Lending Survey.

Euro Area bank credit conditions have also tightened, and the number of rejected loan applications has increased. A similar picture is painted in the UK by the BoE’s Credit Conditions Survey and its monthly mortgage lending data.

Bankruptcies

In the Euro Area, the number of bankruptcies rose by 9.0% q-o-q in Q2 2023, accelerating from 3.5% q-o-q in Q1 2023. In the UK, the total number of company liquidations is at levels not seen since the global financial crisis.

Real wage growth

Euro Area negotiated wage growth for Q2 2023 printed unchanged at 4.3% y-o-y, weaker than we had expected. In the UK, while wage growth remains robust, there are signs that the UK labour market is cooling, which is likely to further weigh on wage growth in coming months.

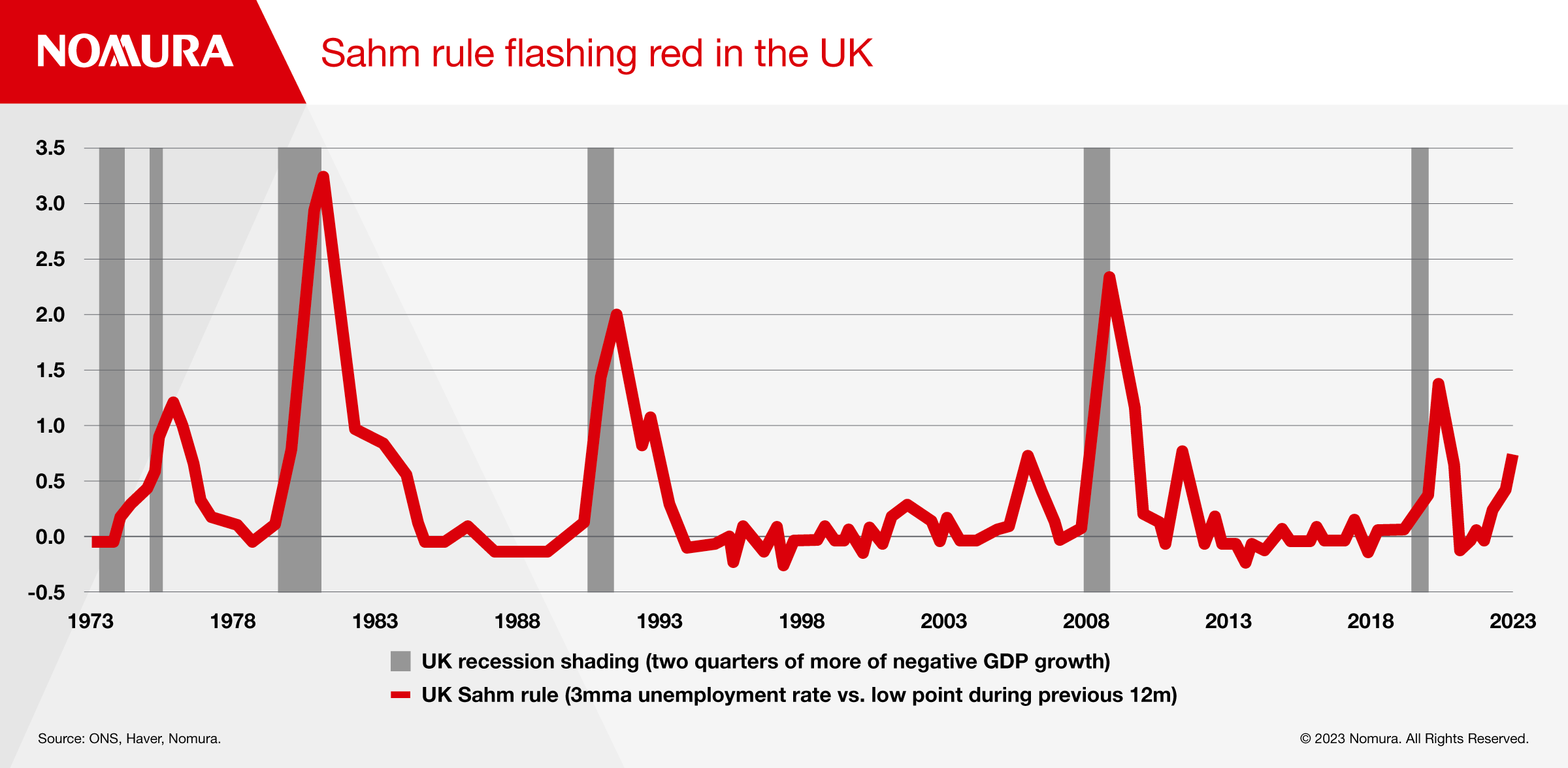

Labour market weakness

In the UK, the unemployment rate has risen to 4.2%, up from 3.5% in mid-2022.

Employment, meanwhile, contracted by 66k in Q2 2023, with further weakness suggested by the latest REC (recruitment) survey.

Moreover, the Sahm rule - which is often used in the U.S. to signal an impending recession - is flashing red for the UK. Specifically, the Sahm rule signals the start of a recession when the three-month moving average of the national unemployment rate rises by 0.5 percentage points or more relative to its low during the previous 12 months.

In the Big 4 Euro Area member states, this is not yet the case; however, euro area labour markets are more inflexible than their UK and U.S. counterparts, partly as a result of furlough schemes often being de facto in place.

Global backdrop

Our U.S. economics team forecasts a U.S. recession from Q4 2023 to Q1 2024, worth a cumulative 0.9pp decline in GDP, which is likely to have material adverse spillovers for Europe.

Otherwise, Chinese macro data have been weaker than expected, resulting in our China economics team cutting its year-on-year Q3 2023 and Q4 2023 GDP growth forecasts to 3.7% and 4.0%, respectively, from 4.9% and 4.9%. Central bank (ECB, BoE) analysis suggests that a 1% adjustment to China’s growth rate should affect European growth by just 0.1-0.15%.

RISKS TO OUR RECESSION CALL

While we now believe European recessions are likely, there are risks to this including:

- Excess savings;

- Divergence between surveys and official data;

- Different levels of tightening and asymmetric country-level effects; and

- Fiscal largesse.

THROUGH THE LOOKING GLASS

Central banks face a trade-off between fighting inflation and supporting economic activity.

Against that backdrop, for the ECB, we had expected the cutting cycle to begin in October 2024, whereas we now expect it to come a month earlier.

At the margin, a recession in the Euro Area supports our below-consensus view that the ECB is done with its hiking cycle. As for the BoE, a recession risks ending the cycle slightly earlier than forecast. Still, with core inflation and services inflation proving more persistent in the UK, we believe this justifies the BoE hiking two more times despite us now forecasting a minor recession.

Click here to read the full report.

Download a PDF of the full whitepaper

Contributor

Andrzej Szczepaniak

Senior European Economist

George Buckley

Chief UK & Euro Area Economist

George Moran

Week Ahead Podcast Host and European Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.