Demystifying blockchain technology: what you need to know

- With continued investment and research in blockchain technology, many businesses are beginning to see the benefits that blockchain offers and are considering the adoption of the technology

- One major challenge that blockchain faces today is scalability. Nonetheless, blockchain can be a revolutionary solution to combat data breaches and protect data privacy

From its inception a decade ago, blockchain is now one of the most disruptive technologies in the modern digital economy and is on the verge of impacting many industries. Don Tapscott, coauthor of The Blockchain Revolution, described blockchain this way: “Think of a giant, global spreadsheet that runs on millions and millions of computers. It’s distributed. It’s open source, so anyone can change the underlying code, and they can see what’s going on. It’s truly peer to peer; it doesn’t require powerful intermediaries to authenticate or to settle transactions.”

Despite its promise of simplifying transactions, blockchain can be confusing to understand. Here are four questions and answers based on the latest research and development to help you demystify blockchain technology.

Will blockchain’s rapid growth continue?

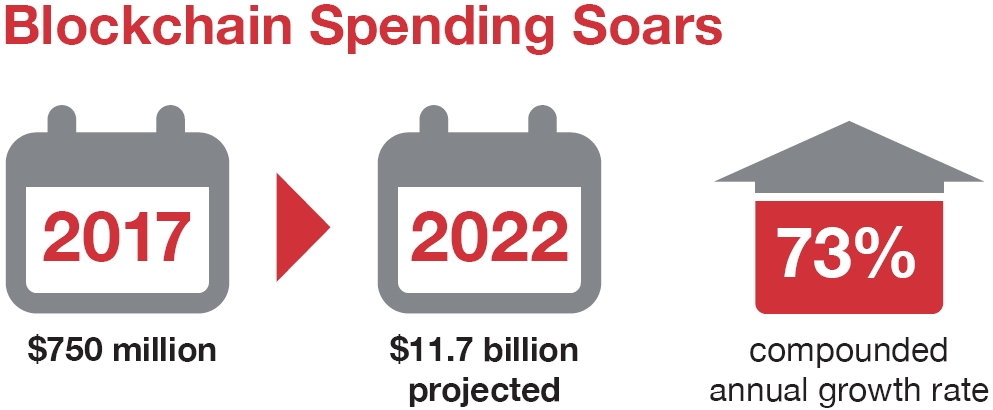

Investment in blockchain has grown exponentially and continues to expand across industries. According to the IDC, a global provider of IT market intelligence, worldwide spending on blockchain solutions was estimated to be around $1.5 billion in 2018, double the amount spent in 2017. By 2022, spending is expected to soar to $11.7 billion, amounting to a five-year compounded annual growth rate of 73 percent from 2017 to 2022.

Even these statistics may understate blockchain’s eventual impact. According to Christian Catalini (MIT) and Joshua Gans (University of Toronto), blockchain has key features of a General Purpose Technology (GPT), defined as “technologies that can spur economic growth over the long run and have substantial and pervasive impact on the society across multiple industries, such as steam engine, electricity and internet.” To quote Amara’s Law, “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.” This is likely the case with blockchain as the continued investment will help to ensure a long-term impact for this technology.

How is blockchain transforming and benefitting businesses?

One of the key benefits of blockchain is its ability to reduce the time and cost of verification. Enabling verification across the increasingly global and interconnected networks of buyers, sellers and other parties can be costly. Fortunately, as long as data is entered correctly, verification with blockchain can often be accomplished without additional resources such as costly third parties. Securely recording and time-stamping each transaction builds a reliable foundation and validates subsequent actions. From real estate transactions to complex supply-chain management, blockchain not only reduces costs, it also adds accuracy and accountability by preserving immutable, time-stamped records of all transactions.

Another interesting area to consider is blockchain’s ability to further grow the crowdfunding industry. In 2018, this was an $8B industry and it is expected to double over the next 5 years. Crowdfunding has been an exceptional medium for entrepreneurs to attract capital needed to nurture and grow their businesses. Unfortunately, due to its centralized nature, crowdfunding platforms have been able to charge costly “middleman fees” in order for businesses to list on their platforms. This is an area where blockchain can bring about a reduction in costs along with providing a fair and efficient system for entrepreneurs to raise capital. Typically, through an Initial Coin Offering (“ICO”) businesses can issue utility tokens to investors in return for much needed operating and growth capital. These utility tokens often hold the rights for the investors to benefit from the goods and services being offered by the underlying businesses.

Overall, this feature of blockchain technology constitutes an architectural change to traditional value creation and can help new businesses and entrepreneurs raise much needed capital more efficiently.

Can blockchain tackle a core challenge of scalability?

The defining characteristic of blockchain—decentralization—poses challenges to scalability. The technology today suffers the Scalability Trilemma which states that “a blockchain can only at most have two of the three properties: fast, secure and decentralized.” As blockchain engineer Preethi Kasireddy explains, decentralization means that “every single node on the network processes every transaction and maintains a copy of the entire state. While a decentralization consensus mechanism offers some critical benefits . . . it comes at the cost of scalability. The number of transactions the blockchain can process can never exceed that of a single node that is participating in the network…”

Several solutions to this problem are under development but are difficult to achieve. As Kasireddy notes, “In order to scale, the blockchain protocol must figure out a mechanism to limit the number of participating nodes needed to validate each transaction, without losing the network’s trust that each transaction is valid.”

This will be an interesting area to keep an eye on as it will have a direct impact on whether or not blockchain technology will be implemented across several industries.

Can blockchain reduce data breaches and protect data privacy?

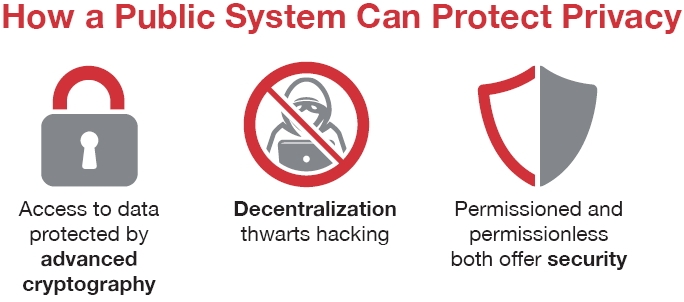

While it may be counterintuitive to think that a technology built to make everything public and transparent can help preserve privacy, a properly implemented blockchain can do exactly that. Blockchain’s use of cryptographic keys offers a better level of security for personal data than today’s methods. The decentralized nature of a blockchain ledger protects personal data against hacking attempts as all records are codified and replicated on all nodes within the network instead of on a centralized database. Access to this data is protected by advanced cryptography. Based on its design, blockchain can give an individual exclusive control over his or her own personal data.

Blockchain platforms fall into one of two categories: permissionless and permissioned. A permissionless blockchain is an open-ended system that anyone can participate in and contribute to. By contrast, a permissioned blockchain is a closed-end system that is run by members of an agreed-upon group and encompasses only known and trusted nodes, controlling access to private and sensitive data. Both of these methods protect data using cryptography and ensure data is immutable through the distributed nature of blockchain.

With the right design, blockchain can provide a revolutionary solution for individuals, businesses and organizations to achieve a greater level of privacy, security and control over their personal data.

As blockchain use and acceptance grows, it has increasing potential to transform the world in a similar manner to the internet—completely and irrevocably. While financial services are among the leaders in exploring blockchain today, other industries are also forging ahead. Part of the process for users and potential users is demystifying blockchain, ultimately propelling it to become a critical, reliable and global system of record.

Contributor

Sohail Khalid

Digital Asset Strategy

Serena Dang

Securitized Products Trading

Conor O'Callaghan

FinTech Investment Banking

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.