Decarbonizing Heavy Industry is Key to Climate Progress

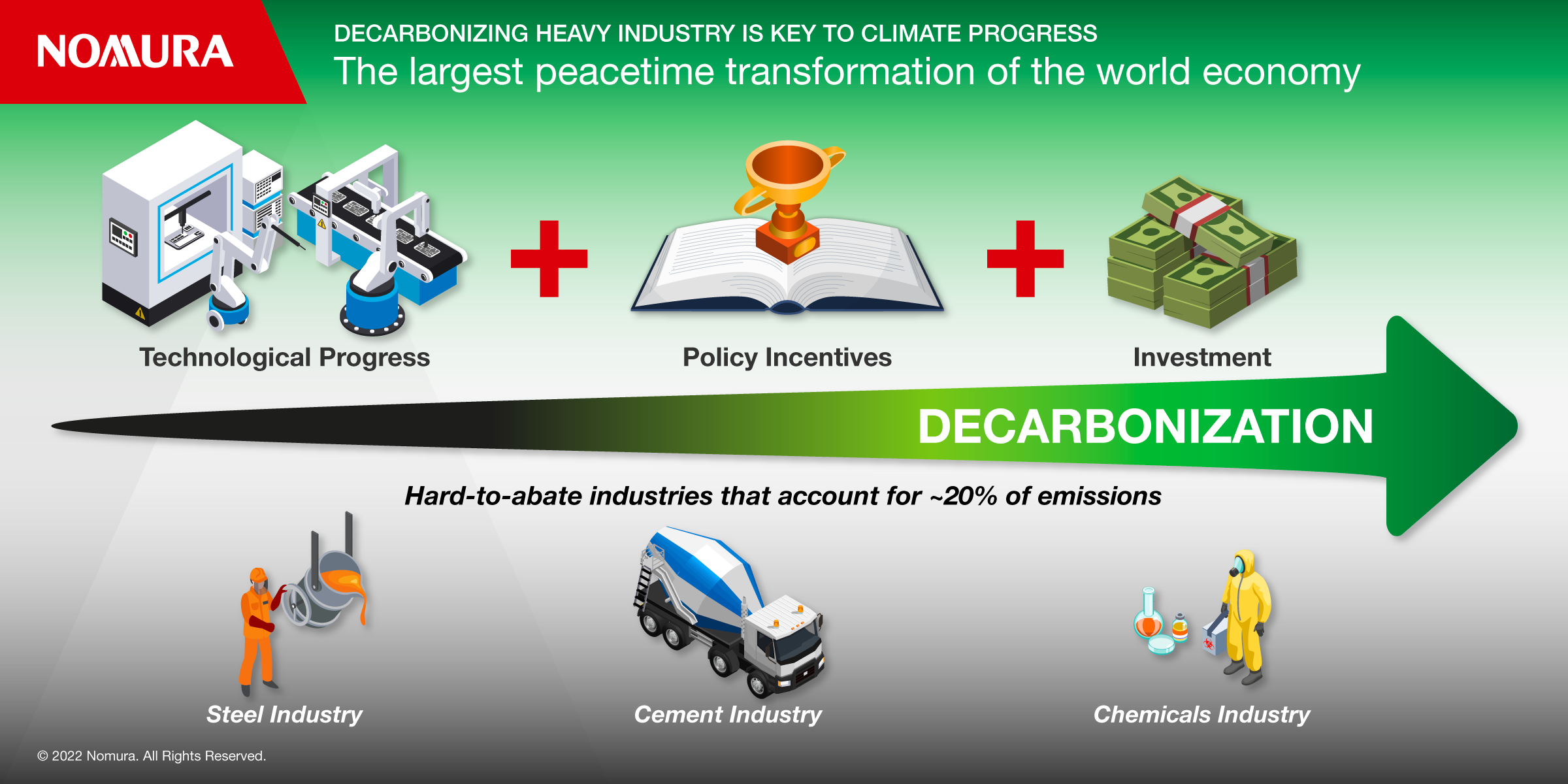

Technological progress, policy incentives and investment will speed the decarbonization of heavy industry sectors to help the world reach net zero

- Hard-to-abate sectors like steel are about 20% of global emissions

- A ‘sustainability scarcity’ will make more green investments appealing

- Once the technology is proven, regulation becomes a great enabler

Technological progress, policy incentives and investment will speed the decarbonization of sectors like steel and cement to help the world reach net zero, according to speakers at Nomura Greentech’s Sustainable Leaders Summit 2022.

Hard-to-abate sectors like iron and steel, cement and chemicals represent about 20% of global emissions yet they are difficult and costly to decarbonize.

For example, green steel[1] is 50% more expensive than regular steel while green cement[2] is double the price of its heavier emitting counterpart, posing challenges for the business case and the investment required, according to an industrials expert, speaking at the conference held under the Chatham House Rule.

The scale of the challenge is also formidable as global demand will require about 100 green steel plants by 2030 to reach net zero compared to only a handful currently in operation, he said.

“This is the largest peacetime transformation of the world economy,” he said. “By comparison we had the industrial revolution and a shift to oil from coal but that happened across 50-70 years and with this set of ambitions it’s in 10-20 years.”

But he explained that a number of levers are addressing these problems. For example, the cost of hydrogen - as a reducing agent in the re-design process instead of CO2 - is falling in price.

This was backed by the head of a climate think tank who said that green hydrogen is on a ‘learning rate’ – the way unit costs decrease by a constant percentage for each doubling of production - of 22%. That means every time installations double, the price falls by about 22%. By comparison, solar is on a learning rate of 25%.

The industrial expert said that the overall energy transition is affordable for the global economy but it’s mostly a question of distributing where costs occur and finding the right mechanism to spread costs evenly to those further down the value chain. He gave the example of a car made with low carbon steel increasing the cost to the end consumer by $500 on a $30K car. A similar premise is true when buying a house with low carbon cement.The share of cost increase relative to the project cost is relatively small.

He added that investors in large-scale infrastructure are becoming increasingly concerned about stranded asset risk, which makes greener technologies more viable even if demand takes longer.

But a climate infrastructure investor said that without demand it would be hard to justify a $100mn investment in such assets.

A second investor cited challenges in the green plastics industry where a big push for new investment caused firms to start building facilities, which ended up being poorly constructed and behind schedule, eventually leading to loan holders calling in their debt. He said that the first movers in any market risk creating a black eye for entire sectors and making future lenders more reluctant to offer financing.

Sustainability Scarcity

The industrials expert said that a ‘sustainability scarcity’ will eventually emerge, mitigating some of the risk. In other words, a tipping point will be reached, giving these investments broader appeal.

He also gave the example of Hybrit – a green steel producer helped by the Swedish government to get off the ground, which is now seeing a tangible increase in demand.

A maker of green concrete said that in the early stages, regulation is a barrier but once the technology is proven, it becomes a great enabler and the industry is on the cusp of seeing the rewards of those efforts.

Other tailwinds include the ‘Mission Possible’ coalition of financiers, regulators, and industrial players collaborating across hard-to-abate sectors to accelerate change.

The industrials expert said that “to be early is challenging and to be late is devastating as the risks of sitting this out are mounting by the hour.”

- [[1] Using hydrogen from renewable energy to replace high-emitting coal or natural gas in traditional steelmaking]

- [[2] Using discarded industrial waste like blast furnace slag and fly ash to reduce emissions]

Download a PDF of the full whitepaper

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.