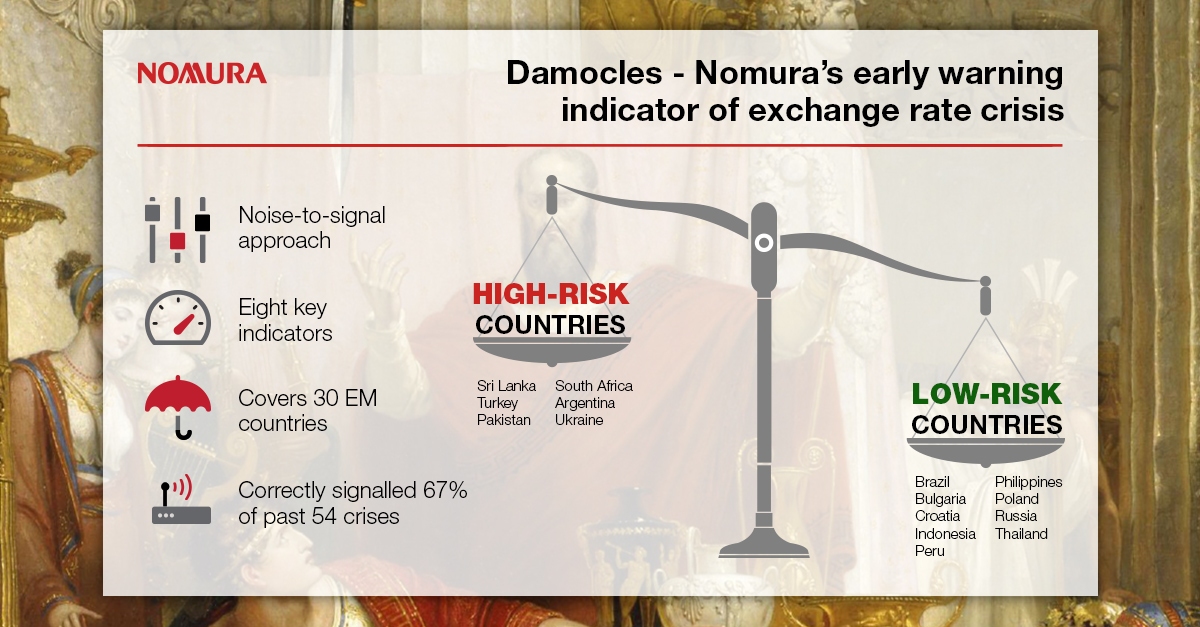

Damocles Update: Who is at Risk?

- Sri Lanka, South Africa, Argentina, Pakistan, Turkey and Ukraine remain above the 100 threshold

- There are nine countries with scores of 0, signaling a low probability of currency crises

- There have been notable increases and drops in Damocles scores in this update, driven by several factors

Damocles is based on a noise-to-signals approach in which we use eight key indicators to predict currency crises in 30 emerging market (EM) countries; this approach has correctly predicted 67% of the 54 crises since 1996. These eight indicators, using the timeliest data, send a warning signal that a currency crisis could occur when they breach prescribed threshold levels. The signal information is then weighed into a single summary measure: the Damocles score. A score above 100 suggests a country is vulnerable to a currency crisis within the next 12 months.

When launching Damocles in September 2018, there were seven countries with scores above our crisis threshold of 100: Sri Lanka, South Africa, Argentina, Pakistan, Egypt, Turkey and Ukraine. Out of these, Argentina and Turkey were experiencing currency crises. While Argentina, Egypt, Sri Lanka and Ukraine turned to the IMF for financial assistance, Pakistan and South African were left as the standouts. In our first update in February 2019, the results had not changed much; of the seven countries, six still had Damocles scores over 100, and Pakistan had a currency crisis in October 2018. The only country moving off the vulnerable list was Egypt.

Now, results from fresh data to May 2019 show the same six countries above the 100 threshold, which suggests that, even though most of these countries have already had large currency devaluations and/or are under IMF programs, they are not yet out of the woods. The remaining standout is South Africa. Its economy is struggling and it remains the only one of the six that has neither sought IMF assistance nor had a currency crisis since we launched Damocles. At the other end of the spectrum, there are nine countries with scores of 0, signaling very low risks of a currency crisis and highlighting the high differentiation in EM.

It is uncommon for economic fundamentals of a country to change quickly, and so Damocles scores tend to move slowly. That said, there have been some notable changes from when we first launched and this latest update.

Despite experiencing a currency crisis, Turkey’s score has risen by a further 39 points since July 2018 due to a sharp rise in the real interest rates, low FX reserve adequacy, high external debt and a larger fiscal deficit. For India, though its latest score is still below 100, it has risen by 32 points because the joint indicator of the current account and fiscal balances breached its threshold levels. Finally, due to the indicator of short-term external debt/exports breaching the threshold level, Czech Republic’s score increased by 19 points to 43.

While there have been notable increases in scores, there have also been significant drops. Argentina’s score has decreased by 32 points due to a narrowing of the twin (current account and fiscal) deficits to below threshold levels. Due to a decrease in gross non-FDI capital inflows relative to the change in FX reserves, Egypt’s score has fallen by 26 points to a score of 85, and Mexico’s has fallen to a score of 17. South Africa remains well above the crisis threshold of 100 with a score of 118, despite its drop by 25 points. This is primarily due to the real effective exchange rate no longer appreciating by 3% above its five-year average. Finally, Colombia had a slight drop of 6 points, reaching a score of 19, as the joint indicator of the current account and real effective exchange rate stopped breaching its threshold.

For a breakdown of each country’s Damocles score, read here.

Contributor

Rob Subbaraman

Head of Global Macro Research

Sonal Varma

Chief Economist, India and Asia ex-Japan

Michael Loo

Macroeconomic Research Analyst, Asia ex-Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.