Classification of Risks Is Key to Tackling Climate Change

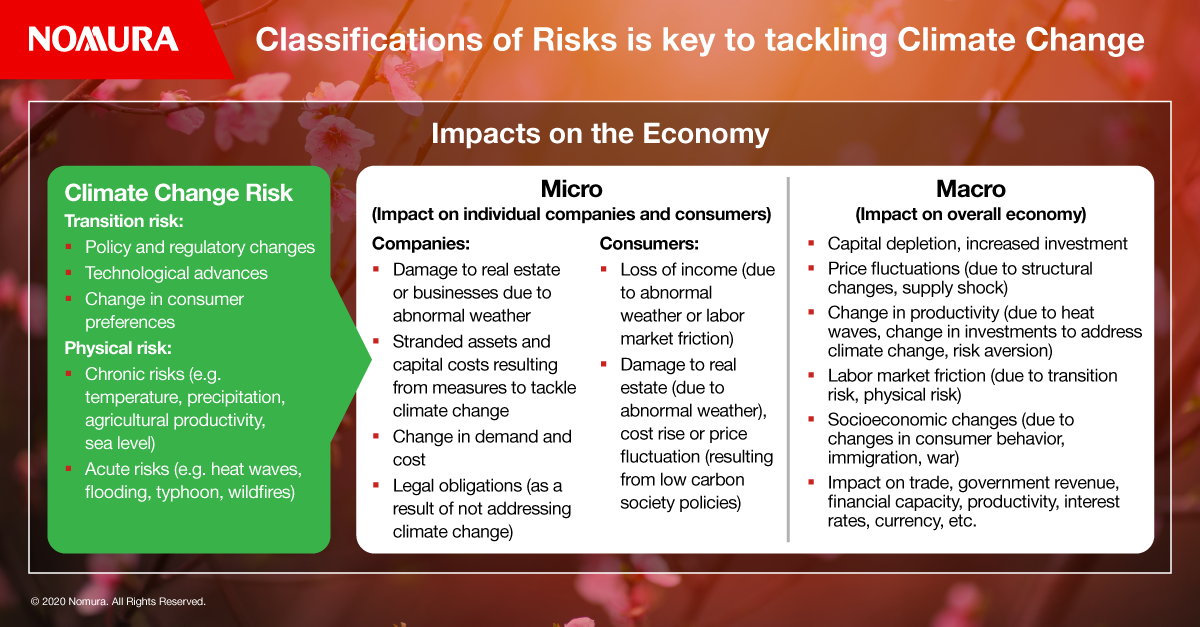

Absence of clear standards makes analyzing the financial risk differential between green and brown assets challenging for financial institutions.

- How will the EU Taxonomy may prove helpful in the classification of risks?

- Both backward- and forward-looking methods for understanding the impact of client change are problematic, due to a lack of data, or the difficulty of selecting high probability scenarios.

- Bank capital requirements – specifically Pillars 1 and 2 – are a potential option to manage the risk of climate change for financial institutions.

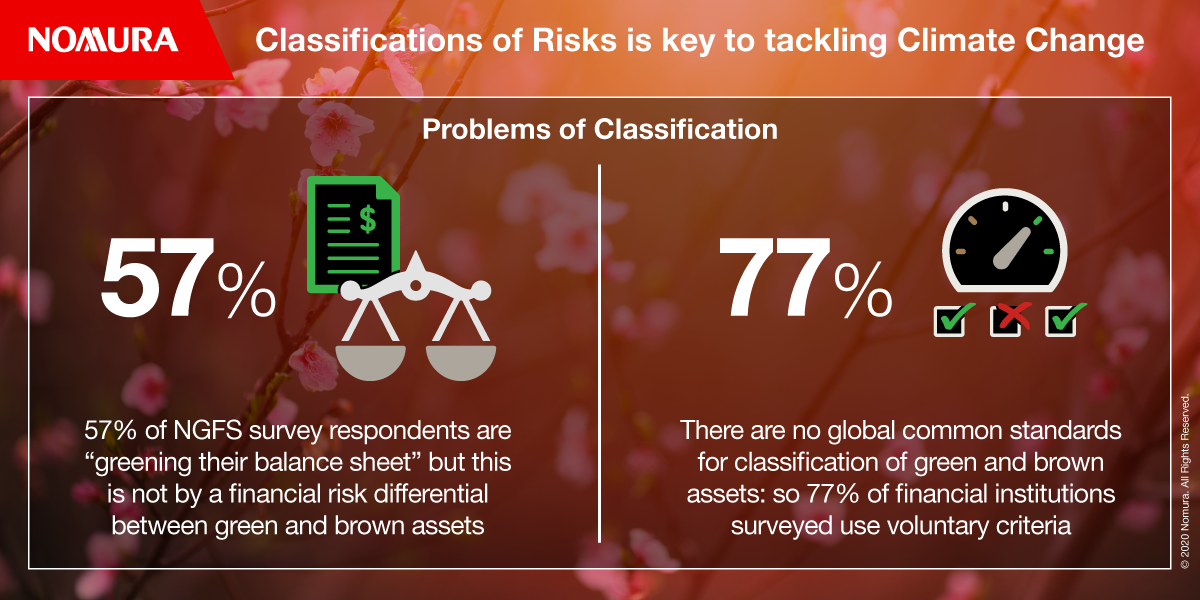

A recent survey of 54 banks and insurance companies in mainly Europe and Asia reveals that many are insufficiently aware of the differences in credit risk between green (low carbon, climate-resilient) and brown (high carbon, climate-risk inducing) assets and face significant difficulties in developing approaches to distinguish between these assets. The survey also highlights the challenges associated with the use of voluntary or internally developed classification criteria.

The survey was conducted by the Network of Central Banks and Supervisors for Greening the Financial System (NGFS), a grouping of 72 regulators and central banks and 13 observers from countries in Europe, Asia, Africa, and the Americas. NGFS participants account for around 60% of global greenhouse gas emissions, and are responsible for the supervision of over three-quarters of global systemically important banks and two-thirds of global systemically important insurers.

NGFS conducted the survey because it believes it is important for financial institutions to consider all relevant risks in order to avoid suffering unexpected losses, which could negative impact the stability of the financial system. Against the backdrop of the increasing impact from climate- and environment-related risks, financial supervisors need to understand how these risks are taken into account by supervised institutions.

While 57% of survey respondents have committed to “greening their balance sheet” by limiting exposure to brown assets or by setting green or positive impact targets, this has been driven not by a financial risk differential between green and brown assets but rather by a more diffuse perception of risks. Most banks consider their actions to be part of corporate social responsibility or mitigation measures for reputational, business model or legal risks.

Problems of classification

There are currently no global common standards for classification of green and brown assets, and in many countries, there are no official government standards. For this reason, 77% of financial institutions surveyed use voluntary criteria for classification, such as the UN Principles for Responsible Banking and the International Capital Markets Association's Green Bond Principles. Alternatively, they use internally developed criteria.

Respondents note that it is difficult to classify assets such as loans based on available criteria. Other than single-purpose loans such as project finance, many loans are allocated to a wide range of business activities; linking them to individual green assets or projects is challenging.

Many respondents also cite a lack of unified customer data. The number of companies that voluntarily disclose information based on the recommendations of the Climate-Related Financial Information Disclosure Task Force is increasing. However, many countries do not have legal disclosure requirements, and the survey highlights problems relating to data acquisition, particularly from SMEs.

How to measure climate change

Under the current bank capital adequacy regulations, banks are required to estimate the risk of unexpected losses in the short term from historical data using a backward-looking approach, and to hold capital that can absorb such losses. In doing so, they ensure the sufficiency of their capital through a forward-looking approach that checks whether their capital is sufficient in the light of a probable stress scenario. Respondents to the NGFS survey therefore measure climate change risks in one of two ways:

- Backward-looking methods enable robust analysis based on past data, but they cannot respond to events that have not occurred in the past, and the robustness of analysis decreases when sufficient past data cannot be obtained. Backward-looking studies on a potential risk differential have only been performed by five respondents to the survey. Another three respondents indicated that they conducted backward-looking analysis with ESG or energy ratings, but not strictly using green or brown criteria. In both cases, they failed to reach strong conclusions on a risk differential between green and brown assets.

- Forward-looking methods make a broad analysis possible by flexibly setting scenarios that may occur in the future. However, selecting scenarios with high probability can be a challenge. Forward-looking studies to assess how different climate scenarios can affect different kinds of activities and assets were performed at the portfolio level by twelve respondents (22%). Of these forward-looking studies, scenario analyses and stress tests are the most common.

What will drive change?

Financial institutions have yet to find a suitable method to satisfactorily identify the difference in credit risk between green and brown assets. Progress is being made with some survey respondents working on integrating counterparty ESG factors into their credit processes and, subsequently, their risk management frameworks. Respondents mentioned a variety of environmental risk monitoring measures including ESG scoring, risk appetite statement limit setting, internal capital allocation models, and environmental veto systems.

Greater clarity over standards is essential. This may be helped by use of the EU taxonomy (passed in June 2020). Most respondents are considering using a classification framework in the future and the EU’s is most often cited (regardless of whether the institution operates within the EU or not). Under the EU Taxonomy Regulation, sustainable activities are defined as contributing to at least one of six environmental targets, contributing to at least one of six environmental targets, and not harming any of the others

Despite these advances, the greatest challenge for financial institutions remains quantitative measurement of climate-related risks. One solution could be the use of bank capital requirements – specifically Pillars 1 and 2 – as an option to manage the risk of climate change. In its Guide for Regulatory Authorities published in May 2020, NGFS suggests that either Pilar 1, which currently considers credit defaults only in the coming year, could be revised to incorporate forward-looking analysis into internal and external ratings to reflect climate change risks. Alternatively, Pillar 2, which is more flexible, could be used to reflect climate risk.

Read more insights from Nomura Institute of Capital Markets Research (NICMR) here.

Download a PDF of the full whitepaper

Contributor

Shogo Isobe

Financial Industry Analyst, NICMR

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.