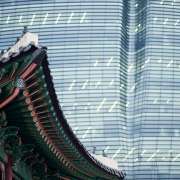

China outlook 2019: after winter comes spring

- China’s economic condition is expected to face a difficult H1 2019 before the rebound in H2

- Strong, synchronized headwinds in 2019, including credit down cycle and end of front-loading of exports to the US, will likely hit growth

- As room for Beijing to step up its conventional stimulus measures is limited, we expect more reliance on unconventional policy tools, such as further VAT tax cuts and RMB depreciation

A difficult H1 may lead to real policy moves and a rebound in H2

As the Chinese saying goes, “After endless mountains and rivers that leave doubt whether there is a path out, suddenly one encounters the shade of a willow, bright flowers and a lovely village. (山重水复疑无路,柳暗花明又一村)”, China’s economic condition is expected to face a difficult H1 2019 before the rebound in H2.

Despite China’s growth slowdown seems to moderate in Q4 2018 and Q1 2019 due to the front-loading of exports and an easing of the anti-pollution campaign, we expect it to worsen in Q2 2019 due to synchronized negative demand shocks, including slowing credit growth, the end of front-loaded exports, the downturn of the property market and the end of durable goods replacement cycles. The cut in individual income taxes and increased infrastructure spending should help, but will fall far short of offsetting those negative shocks.

Compared to several years ago, room for easing/stimulus is much smaller now due to surging debt, the smaller current account surplus and falling FX reserves, while the decision-making process is longer due to a more complexed environment and murkier views on strategic directions. In addition, the conventional easing measures have reached diminishing marginal utility and thus may not be able to solve many of the problems that arose from the non-market-based policies. While the markets are putting hope on the speed, scale, scope and efficiency of Beijing’s stimulus measures, and could thus be unprepared for a worse slowdown, we believe that unshackling the economy via market-oriented reforms is the key to releasing growth potential.

Strong headwinds in 2019, especially in Q2

In 2019, especially in Q2, some synchronized headwinds will likely hit growth due to the below factors:

- Ongoing credit down cycle is expected to continue into H1

- The front-loading of exports to the US will tail off at the end of February, when the US-China truce period ends

- The stimulus-driven boom of small city property markets is coming to an end

- The replacement cycle of durable goods such as construction machinery is over, while the sharp slowdown of auto sales could also extend into H1.

Policy constraints and policymaking in 2019

We expect growth to slow to such a worrying pace in Q2 2019 (we forecast 5.7% y-o-y) that Beijing may have to aggressively ramp up its stimulus measures at that time.

The key policy move in 2019, in our view, is to revamp the urbanization strategy and to ease those non-market-based policies. This includes home price controls and increase land supply in big cities, and to let the market play the dominant role in determining urbanization and property development. Without a market-based urbanization strategy, we believe even infrastructure investment could be inhibited because many infrastructure projects, such as subways, do not always make economic sense in low-tier cities which have been overly boosted by the pledged supplementary lending (PSL) program over the last three years.

The rising constraints for policy easing and stimulus include high debt-to-GDP ratio, “long-term-mechanism” nature of the non-market-based measures, limited impact further tax cut could bring, and negative current account balance.

Three game-changing policies

As room for Beijing to step up its conventional stimulus measures – mainly characterized by pumping credit and ramping-up infrastructure spending – is limited, we expect more of a reliance on unconventional policy tools.

1. More expansive tax cuts to boost growth and market sentiment

We believe VAT cuts are at the top of Beijing’s tax reform to-do list. In addition to VAT cuts, corporate income tax and social security tax cuts would also be helpful. Although the likelihood of a large-scale corporate income tax cut is limited, Beijing could choose to cut the corporate tax rate for some specific sectors to benefit small and medium-sized enterprises and high-tech enterprises. Furthermore, the reduction of social security tax rates is required to mitigate the negative impact from the strengthening of tax collection.

2. More RMB depreciation to mitigate downside pressures on export and growth

Further RMB depreciation may provide some support to export growth and then headline GDP growth. We believe authorities will continue to allow RMB to be more market-determined which, against the current backdrop, implies depreciation.

3. Deregulating property markets in large cities

The non-market-based tightening measures in the property sector in big cities – especially price controls – have led to a crash in home sales, falling land sales, worsening build quality and even reduced spending on infrastructure, which relies extensively on local government revenue from land sales. Given the key role the property sector plays in driving growth, we believe Beijing will be pragmatic and eventually ease these distortionary interventions during or after the spring of 2019.

For more insights into 2019 China outlook and how the game-changing policies could stimulate growth in H2, please read Asia in 2019: Always darkest before the dawn.

Contributor

Ting Lu

Chief China Economist

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.