China Home Appliances: Structural Positives, Near-Term Challenges

- Home appliances such as kitchenware, air conditioners and small appliances have been multi-year growth drivers within the sector

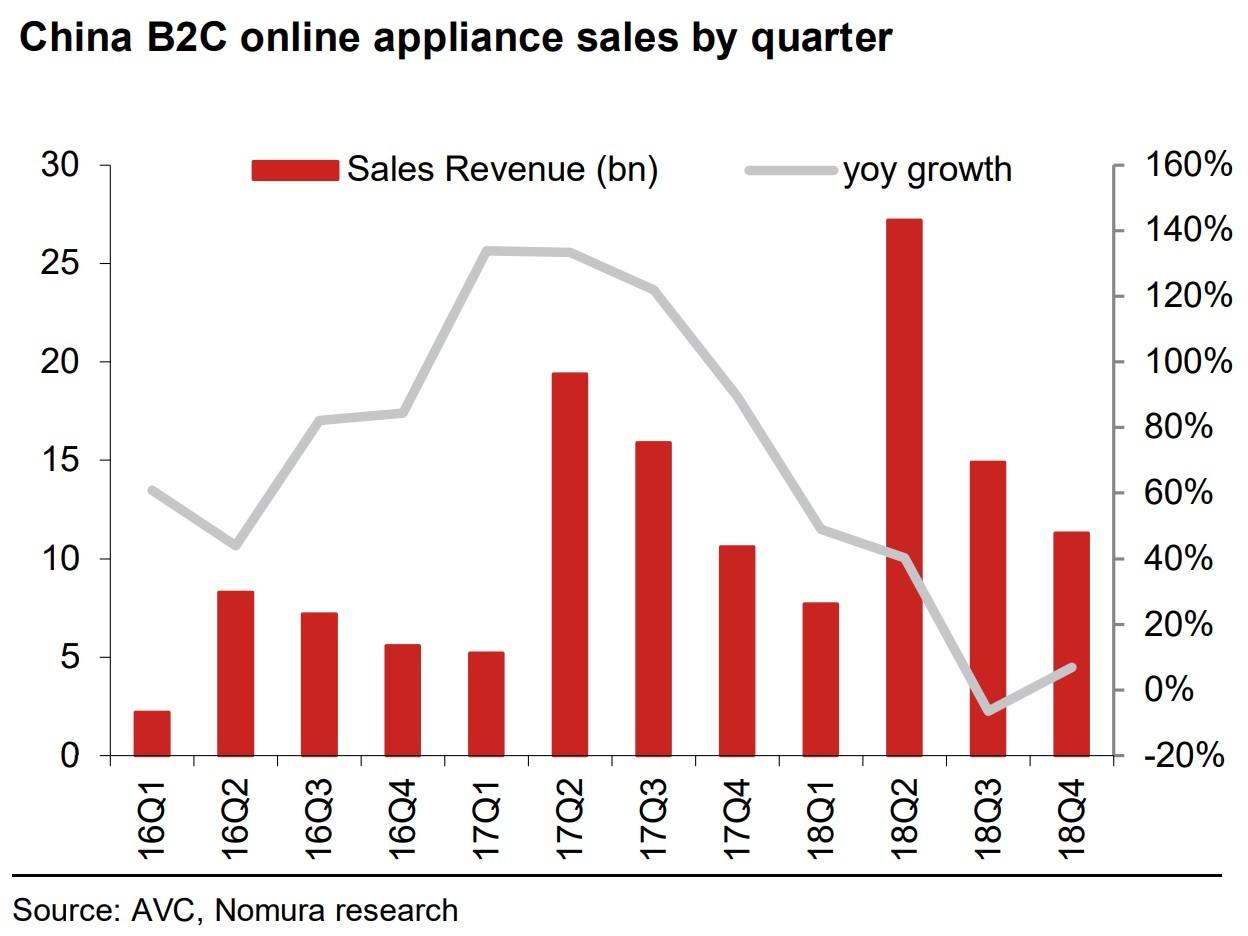

- Online sales in home appliances saw a steady expansion in FY2018

- Higher disposable income and pursuit of a better lifestyle are key factors in growing sales

In view of a slower economy, overseas exposure has naturally become the key differentiator that will help home appliance makers arrest the growth slowdown, despite our cautious take, on the effectiveness of the forthcoming nationwide incentive package on home appliance sales. During FY09-15, there was a wide range of fiscal subsidies applied to the home appliance segment in response to industry hiccups. Assuming that some of these hiccups will be replicated, the effects of the next subsidy program could be underwhelming, as deceleration in rural disposable income and a cooling property sector have become new drags to recovery.

Structural positives remain

Despite a relatively high penetration rate for major white-appliances, some structural trends have continued to be multi-year growth drivers within the sector. These include:

1) Kitchenware

With growing disposable income and urbanization well in place, kitchenware fares as a multi-year upgrade built on social wealth accumulation and pursuit of better lifestyle. The shift in consumer sentiment should also drive kitchenware sales due to the markets for items such as televisions and air conditioners (AC) saturating.

2) ACs in rural areas

AC penetration in China has surged to approximately 127% over the past five years. While this is still below other developed countries, this is due to a low rural penetration rate, owing to higher price tags and poor power infrastructure in these areas. Despite these factors, rural sales will continue to grow, driving up China’s overall AC penetration, and offsetting the weakness in urban areas.

3) Small appliances emerging as new growth drivers

Dishwashers, one of the most popular small appliances, exhibited strong sales volume growth over FY18. With rising demand driven by ongoing product upgrade and supply of dishwashers launched by traditional kitchenware companies and Internet of Things companies, we expect dishwasher sales volume to continue to increase.

4) The continuation of consumer premiumization

We believe the next stimulus package will continue to drive consumers to trade up their appliances, benefitting market leaders with high-end brands exposure. The trend should continue to be fueled by a higher average social income as a result of the increasing number of educated households.

Online sales still a good growth drivers

Subsequent to negative growth in 3Q18 and a turnaround in 4Q18, China's online B2C home appliance sales continued steady expansion in FY18. Despite its sensitivity to change in disposable income, we believe the online appliance market would still benefit from lower transaction costs (relative to shopping in offline stores), rising smartphone/ecommerce penetration in lower-tier cities, a more comprehensive service package offered by online vendors and most importantly, rapid improvement in product delivery.

To know more about why home appliances are a key sector to own in China, read the full report here.

Contributor

Joseph Wong

China Home Appliance, Autos and Auto Parts Research

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.