Technology | 2 min read June 2018

Emerging Markets | 3 min read | July 2018

Emerging Markets | 3 min read | July 2018

A year of further consolidation and rationalization

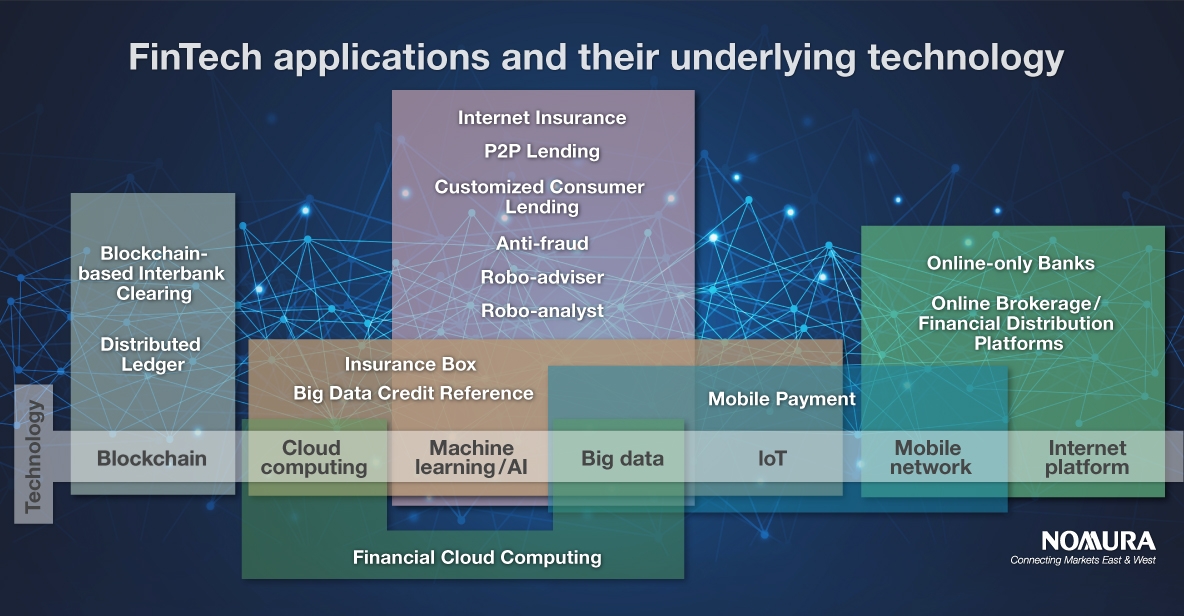

China’s Fintech VC investment dollars peaked in 2Q17. Artificial Intelligence (particularly machine learning) and big data technology have been widely adopted in the bank and insurance sectors, owing to the need of processing and understanding the growing customer base and industry data.

Over the next two years, with regulations tightening and exuberance being curbed further, robo-advisors, big data credit reference and online lending will be the areas seeing most rationalization; while “Insurtech”, technology-led companies that enter the insurance sector, are yet to be commercialized and will need to prove their usefulness to the regulators.

Recap on the technology underpinning FinTech applications

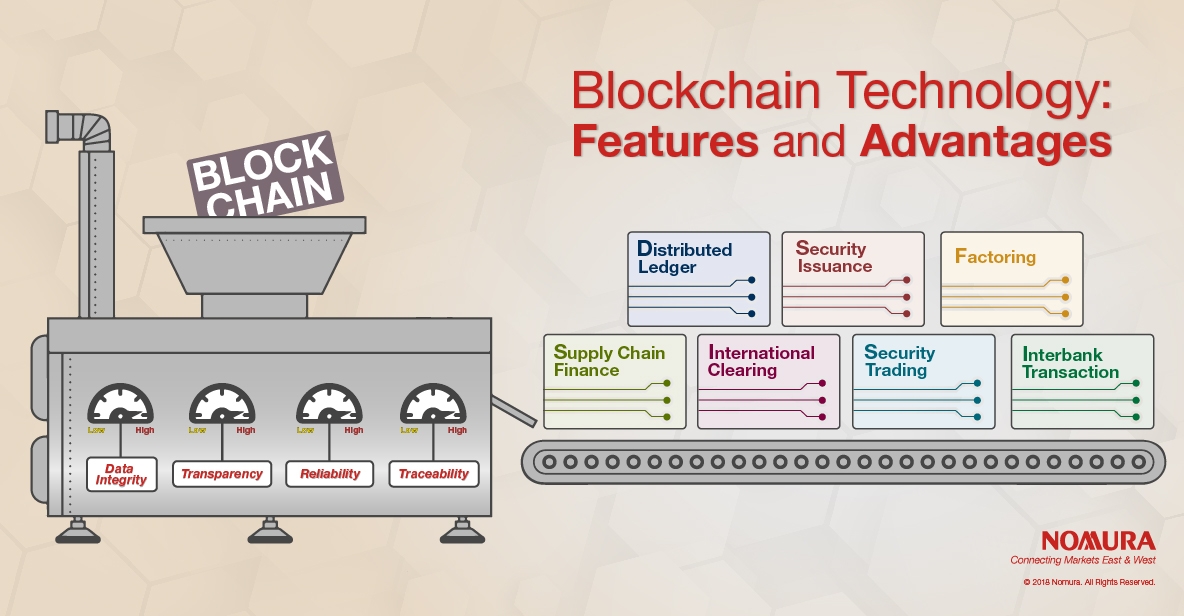

Intrinsic features of blockchain technology, including decentralized data integrity, transparency, reliability, and traceability, have empowered the implementation of various blockchain 1.0 projects, as discussed in our report on China Fintech earlier last year. Cryptocurrencies is one of the most notable, along with other common applications such as interbank transaction, security trading/issuance, and international clearing. As we step into the era of blockchain 2.0, more and more Chinese companies are investing heavily in R&D, and ultimately filing blockchain patents and transforming their existing business. The Chinese government has also shown substantial support to the filing of blockchain patents and protection of intellectual property, as seven of the top ten companies that filed the most blockchain patents in 2017 were Chinese names, with Alibaba ranked the first.

AI continued to stay under spotlight in 2017 and 1H18. Internet giants and financial institutions are incentivized to convert the enormous quantity of bits they have collected into productivity, while AI pure plays with strong R&D capability are focusing on bringing robust algorithms to different industries.

As internet companies are highly digitalized in nature and equipped with the infrastructure for AI to be seamlessly integrated into day-to-day business, they have become the pioneers in the area. More and more internet giants are building their own AI ecosystem, with data generated from their business fed into AI algorithms for spawning solutions that empower their core business, which eventually becomes a service that external clients can purchase on demand.

Consumer Finance: Attractive long-term industry dynamics

With China’s real income per capita doubled over the past decade, and the younger generation in China being far more willing to embrace consumer credit than their parents, China is going through a consumption upgrade that will help turn the country from the world’s factory to the world’s shopping mall.

Players in the consumer finance industry, including banks, consumer finance companies, e-commerce companies and consumption installment platforms, are also capitalizing on the growing credit use in China by catering to different loan sizes and APR range.

There are four implications for China:

Read the report here for more insights into China FinTech.

Greater China Strategy, Asia ex-Japan

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Technology | 2 min read June 2018

Economics | 2 min read March 2018

Technology | 4 min read May 2017