China FinTech: from exuberance to execution

Over the past year, precautionary regulations have held back the "disruptive FinTech" and redirected the "innovative FinTech" start-ups away from B2C to B2B. We see likely commercial deployment of blockchain in 2018, and the ultimate quantum leap in big-data-based intelligence on a five-to-ten-year view.

Transforming FinTech Landscape in China

Since mid-2016, the FinTech industry in China has gone through its early stage hype to what is now a process of “survival of the fittest”. This has been driven partly by more restrictive regulations mindful of potential disruptive and chaotic consequences, and due to the overhyped capabilities among some start-ups which have subsequently under-delivered with regard to their promises.

- Technologies and applications truly solving financial institutions’ problems – such as blockchain, mobile payments, financial service cloud, internet insurance and online brokerage – have expanded rapidly.

- Areas with less-than-compelling value proposition – such as robo-advisors, insurance box and robot analyst – have seen stagnant growth and business exits.

- After strong growth in 2015, P2P lending has entered industry consolidation on increasing credit events and tightening policy stance.

- Investors’ exuberance has also come down to reality, as evidenced by the drop in funds raised by FinTech ventures since 2Q16. Compared to a year ago, we see less hype and more substance in this space.

- Solution-specific start-ups are very likely to become acquisition targets of established financial institutions, internet firms and technology firms. In the report, 14 FinTech pure players in the private space are listed, with their specialization mapped out in detail.

FinTech: A New Force of Productivity in the Making

FinTech, short for financial technology, stands for technology used to support or enable financial services. While the term has become a big hit in recent years, the inter-linkage of finance and technology has a long history, and dates back to the 19th century when the infrastructure for modern financial services, e.g. trans-Atlantic cables, was built.

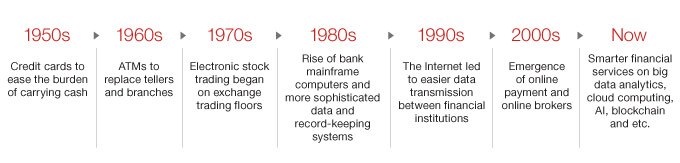

The figure below highlights the milestones in the advancement of financial technology over the past six decades. Each of the new technologies brought transformational impact to financial services at the time. At the moment, we are again on the verge of a breakthrough in the FinTech field, with blockchain and AI taking the lead.

After the Global Financial Crisis, financial institutions have been helped by central bank monetary easing as well as continued cost discipline and business rationalization, amid an extended period of slow recovery in economic growth. Technologies such as blockchain and AI have the potential to streamline and automate front office, middle office and back office functions, and reduce the level of labor intensity in the business, while freeing up bandwidth for growing business intelligence for optimal decision-making. In China, blockchain and AI are gaining investment dollars at a time when the general population, and particularly millennials, is increasingly living their lives online. The internet giants are keenly aware of such a massive commercial opportunity and have been leading the revamp of critical strategic high grounds for this next bonanza: the rapid rise of non-cash payments and IT systems’ migration to the cloud.

- Core technologies to see application-specific deployment in 2018

We believe that blockchain and AI have the potential to trigger organizational changes, which we could be the biggest shift yet since the creation of the modern banking model in the Florentine Renaissance period. - Big data analytics to transform business intelligence

While solution-specific applications built on blockchain and AI are helping financials to improve their operational efficiency, use of big data analytics has the potential to revamp business intelligence completely. Internet giants and technology leaders have rushed into this field, competing for useful data sources. - Sectors facing transitional challenges

In the commercial application field, we note three sectors that are facing transitional challenges, namely: 1) robo-advisor, where a big gap lies between what it claims and what it delivers; 2) big data credit reference, where quality issues are yet to be solved; and 3) P2P lending, which is a mixed bag with industry consolidation ongoing.

Public equity exposure proxies: prefer early and capable movers

In our view, the mega home-runs will come from successful start-ups. That said, in our full report we identify six early movers in the public market with scalable platforms and strong execution capabilities.

Read the full report here, for further insights into the world of block chain growth, AI, big data and cloud computing, as well as analysis on sectors that are facing transitional challenges.

Contributor

Bing Duan

China Technology and Telecom analyst

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.