A global warming countermeasure

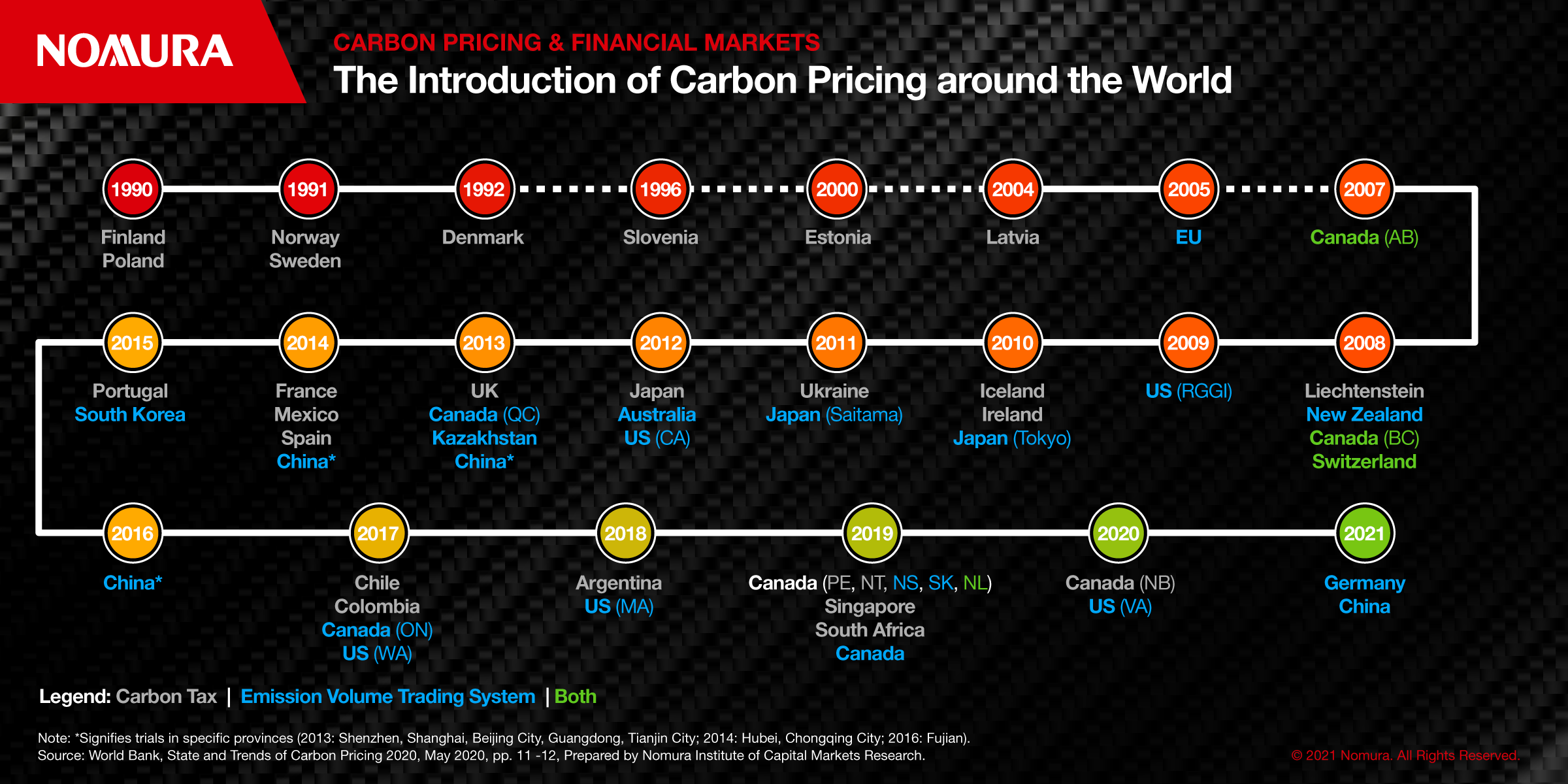

In 1990, Finland introduced the world's first carbon tax. Now, more than 30 years on, "carbon pricing" is once again in the spotlight as a potentially highly effective tool for combating global warming.

In this article, we provide an overview of the mechanism of carbon pricing, the current status of its introduction, and its future interplay with financial and capital markets.

What is a carbon price?

A carbon price adds a defined monetary cost to a specific amount of emitted greenhouse gas. Its ultimate aim is to reduce emissions and promote investment in low-carbon technologies by pricing something which was previously seen as “free”.

In recent years, various approaches to carbon pricing have been trialed, spread across the globe to varying degrees of success so far.

However, there needs to be a significant increase in the development and adoption of carbon pricing schemes for the world to collectively achieve the “below 2°C” target set out in the Paris Agreement.

Outline of carbon pricing and its types

Carbon pricing works by setting a uniform price for greenhouse gas emissions and is a measure to combine both the actual costs with the non-economic costs of their impact. Carbon pricing also has the added advantage of being transparent.

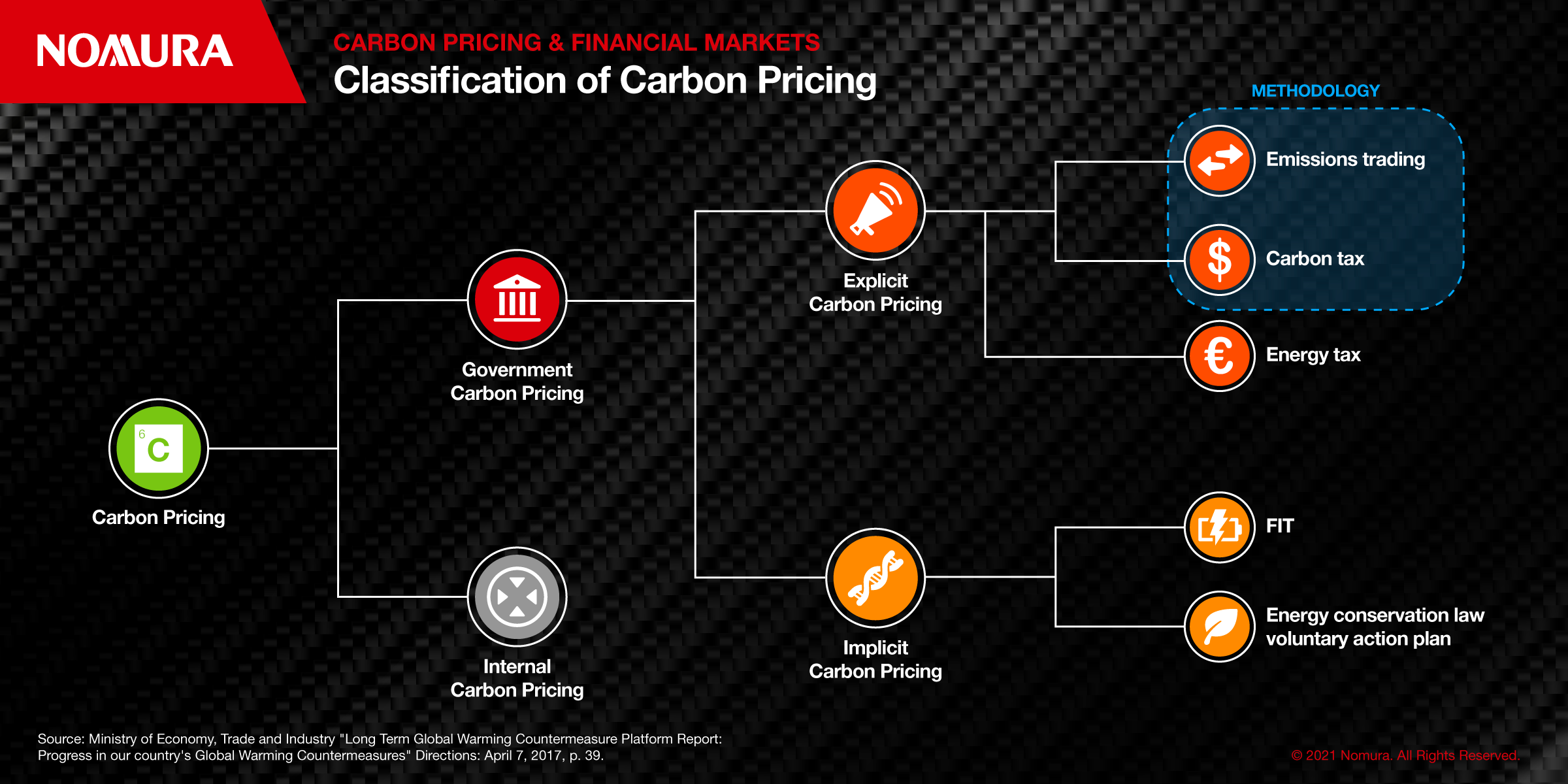

Carbon pricing can be broadly divided into (1) government carbon pricing and (2) private companies’ voluntary carbon pricing (See Figure 1).

Government carbon pricing seeks to induce businesses to reduce their greenhouse gas emissions by providing economic incentives to do so. Carbon pricing as an economic method is classified into:

- Explicit carbon pricing (Government): a measure to price greenhouse gases in proportion to their emissions - applicable to carbon taxes and emission trading schemes. The Organisation for Economic Co-operation and Development (OECD) has said it is the most cost-effective way of creating incentives for the transition to a zero-carbon economy compared to other policy approaches.

- Implicit carbon pricing (Government): imposes indirect emission reduction prices on consumers and producers, including energy taxes, regulations, subsidies, tax incentives, and Feed-in Tariffs. Measures that focus on reductions also provide economic incentives for further emission reductions.

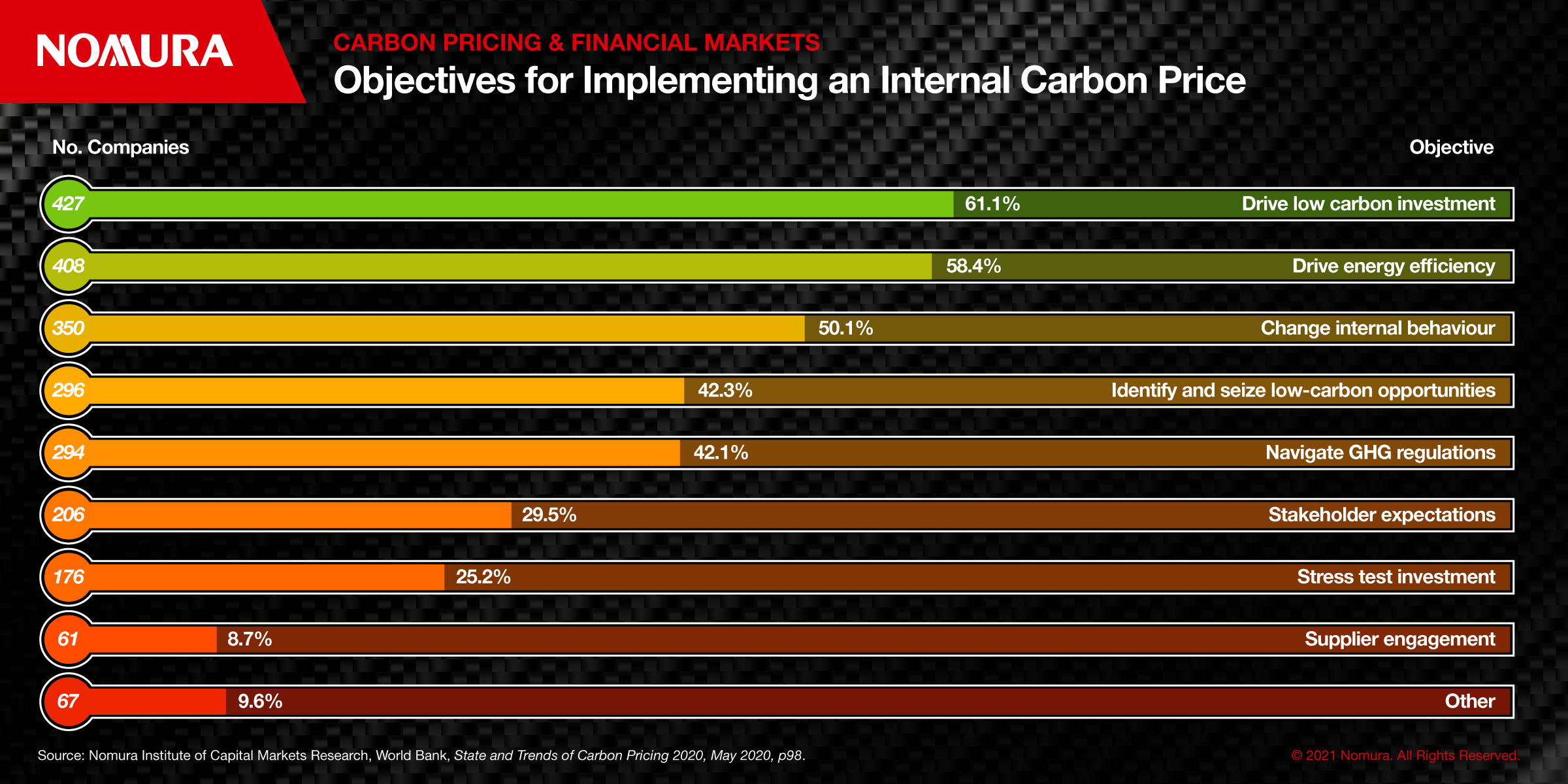

- Voluntary Internal carbon pricing (Private companies): A type of internal carbon pricing where the price of carbon is estimated internally by a company. The mechanism for promoting low carbon investment and strategic action taken by a company to reduce carbon intensity, is also decided within an entity. Below in Figure 2, we have outlined in more detail the objectives of internal carbon pricing and the company uptake.

Global adoption since 1990

According to a World Bank study, as of April 2020, 46 countries had adopted carbon pricing, with their collective emissions accounting for approximately 22% of global greenhouse gas emissions.

The adoption of carbon pricing has accelerated over the past decade following the 2011 launch of the Partnership for Market Readiness program by the World Bank. Now superseded by the Partnership for Market Implementation, launched last year, the objective of the partnership is to assist countries to design, pilot, and implement explicit carbon pricing instruments aligned with domestic development priorities. The 10-year program aims to introduce a strong price signal on carbon emissions through programs and policies globally.

As a result of schemes like this, the number of countries and regions that have introduced pricing policies is rising. See Figure 3 below for a global timeline of carbon pricing adoption so far.

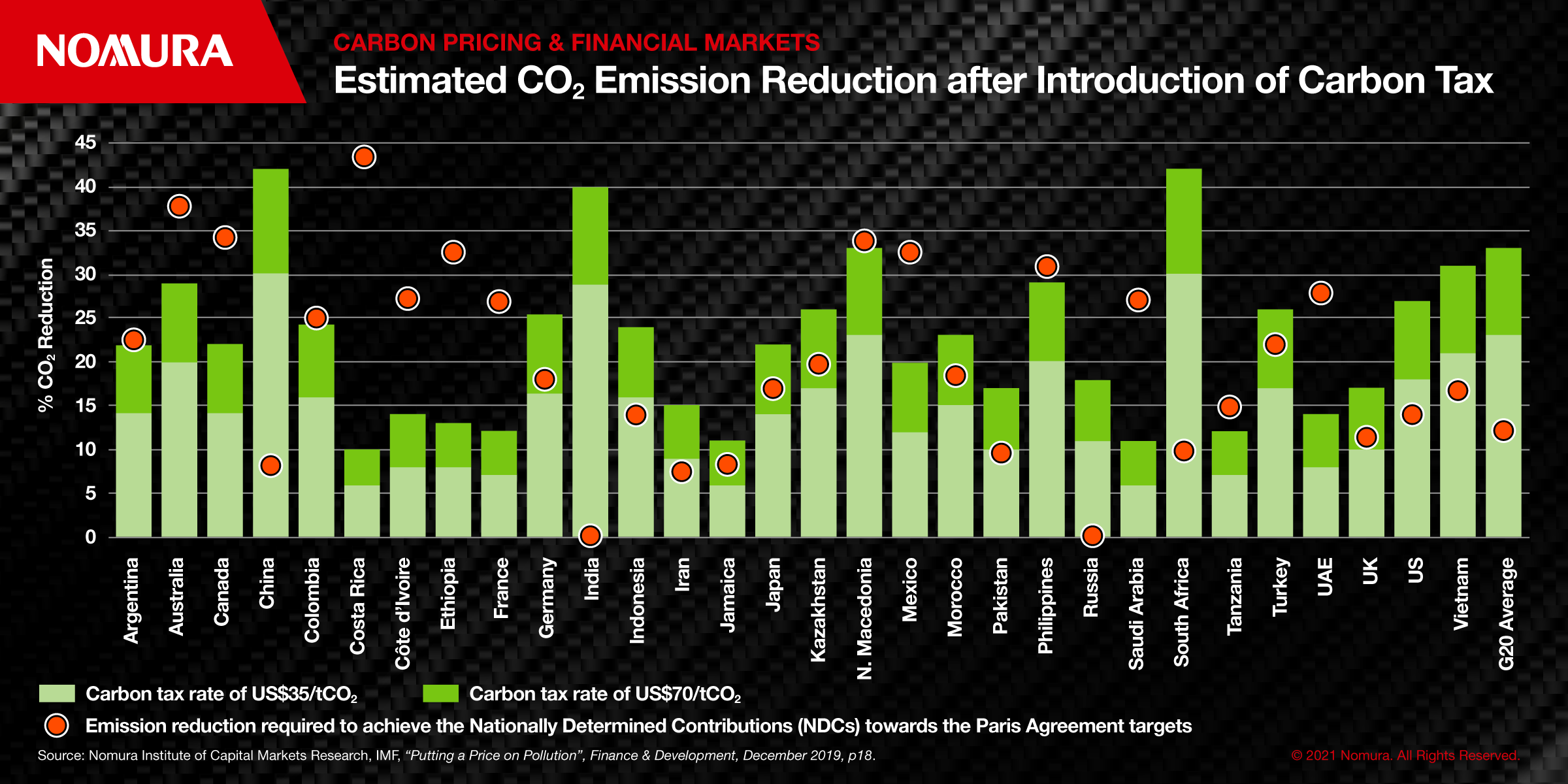

The IMF and International Energy Agency have said that in many cases, the projected rate of reduction in carbon dioxide emissions would not be sufficient to meet the Paris Agreement targets unless a higher tax rate was imposed.

In recent years, governments around the world have committed to achieving “net-zero” in the coming decades, with Japan, China, South Korea, and the EU (under its Green New Deal) all seeking to reach net zero at the latest by 2060. Under a new administration, the United States has also recently re-joined the Paris Treaty. Carbon pricing is likely to play an instrumental role in helping these countries reach their greenhouse gas emissions targets.

Future focus in financial markets

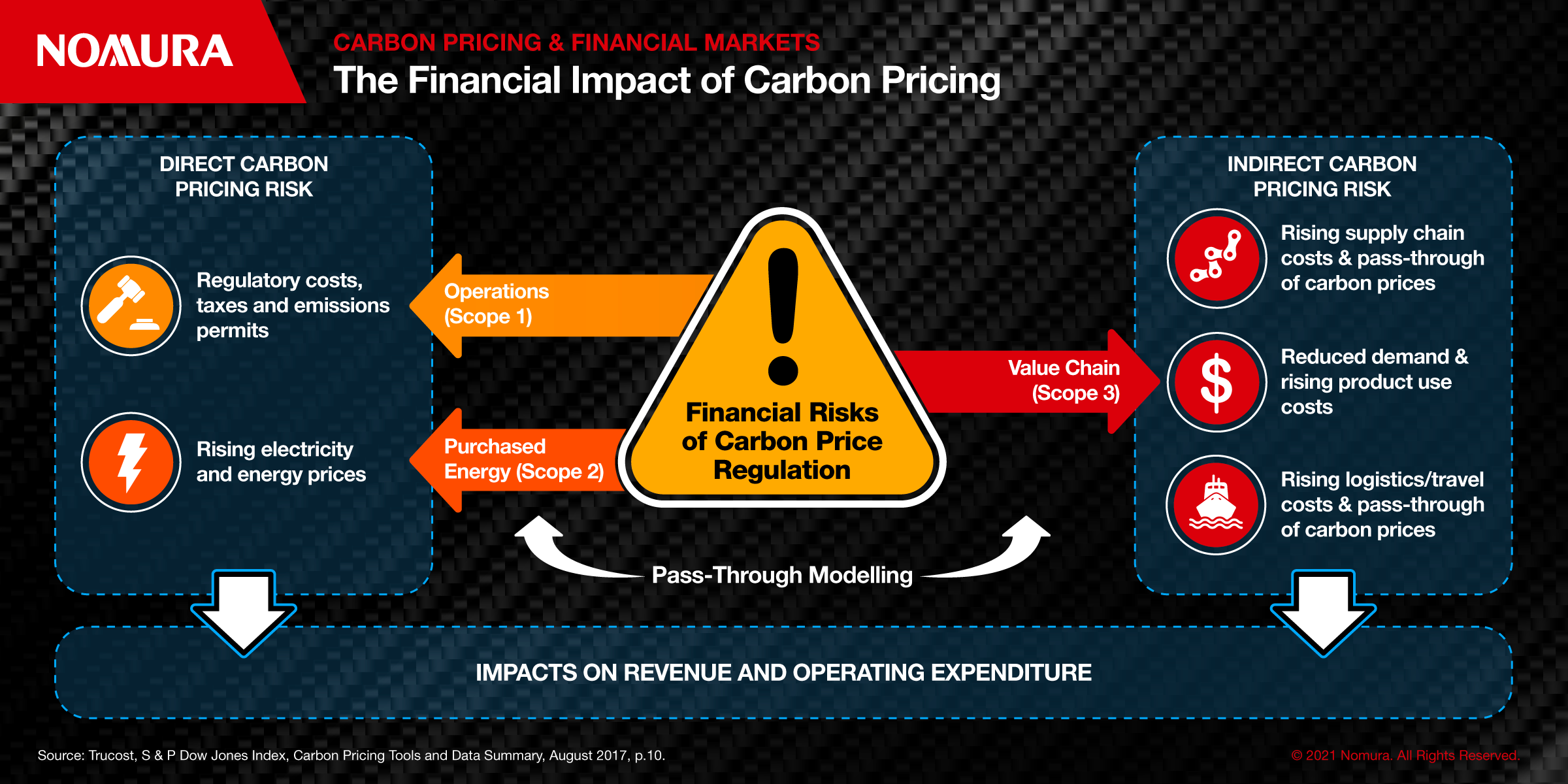

Financial market participants recognize that carbon pricing is set to have a wide range of both direct and indirect impacts on corporate finance. For example, a direct impact could be regulatory costs such as tax, while an indirect impact could be higher supply chain costs (See Figure 4).

We see three key factors for consideration by financial and capital markets participants:

(1) the presence of the ESG (Environment, Society and Governance) as an evaluation axis;

(2) enhancing information disclosure by companies; and

(3) developing new financial products.

- Carbon pricing is likely to play a leading role within the evaluation of companies from an “ESG” perspective. Investors will seek to understand the true carbon cost of a company, with it playing a major role in defining a company’s true “Enterprise Value” – i.e. the measure of a company’s total value.

- Both the Task Force on Climate-related Financial Disclosures’ recommendations and the CDP Climate Change guidelines include items related to internal carbon pricing, with an increasing number of companies expanding their disclosure of carbon pricing. As investors continue to focus on the impact of carbon pricing on Enterprise Value, it is expected that companies will continue to enhance disclosure to diversify their investor base and ensure the stability of financing.

- Financial market participants continue to develop a wider scope of products aimed at increasing investment in sustainable finance. In recent years, for example, sustainability-linked loans/bonds and transition bonds and the like have been introduced. It is likely therefore that financial instruments linked to carbon pricing, such as bonds, stocks, derivatives, and funds, will also be introduced.

Carbon pricing is set to play a leading role in how the global economy responds to tackling climate change. The fundamental shift in the emphasis that companies, investors, and society place on what was once seen as a “free” commodity will have far-reaching consequences for capital and financial markets. This is a changing landscape and one set to grow incrementally in importance in the near future. Understanding the potential ramifications will be increasingly important. Figure 5 above shows the changes countries need to make to meet the Paris agreement.

Read more on our Sustainability insights, or further information on Carbon Pricing and ETS schemes.