What's the impact of Brexit on the UK Auto Industry?

We update and expand the scope of our analysis for the impact for global automakers, and the intensity of the fallout from a hard Brexit.

- US $63bn in cross-border auto trade at risk of exposure to import tariffs as a result of Brexit.

- For the 19 global Original Equipment Manufacturers (OEM), we estimate that a no-deal Brexit would lead to their profit pool shrinking by US $5.5bn for the full year.

- We conclude that Tata, Nissan and Ford are most exposed to the fallout of a hard Brexit.

The UK has faced continued political uncertainty since the EU referendum in 2016. And, with new Prime Minister Boris Johnson in the driving seat, it looks set to be stepping up a gear, with a no-deal Brexit looking like an increasingly likely prospect.

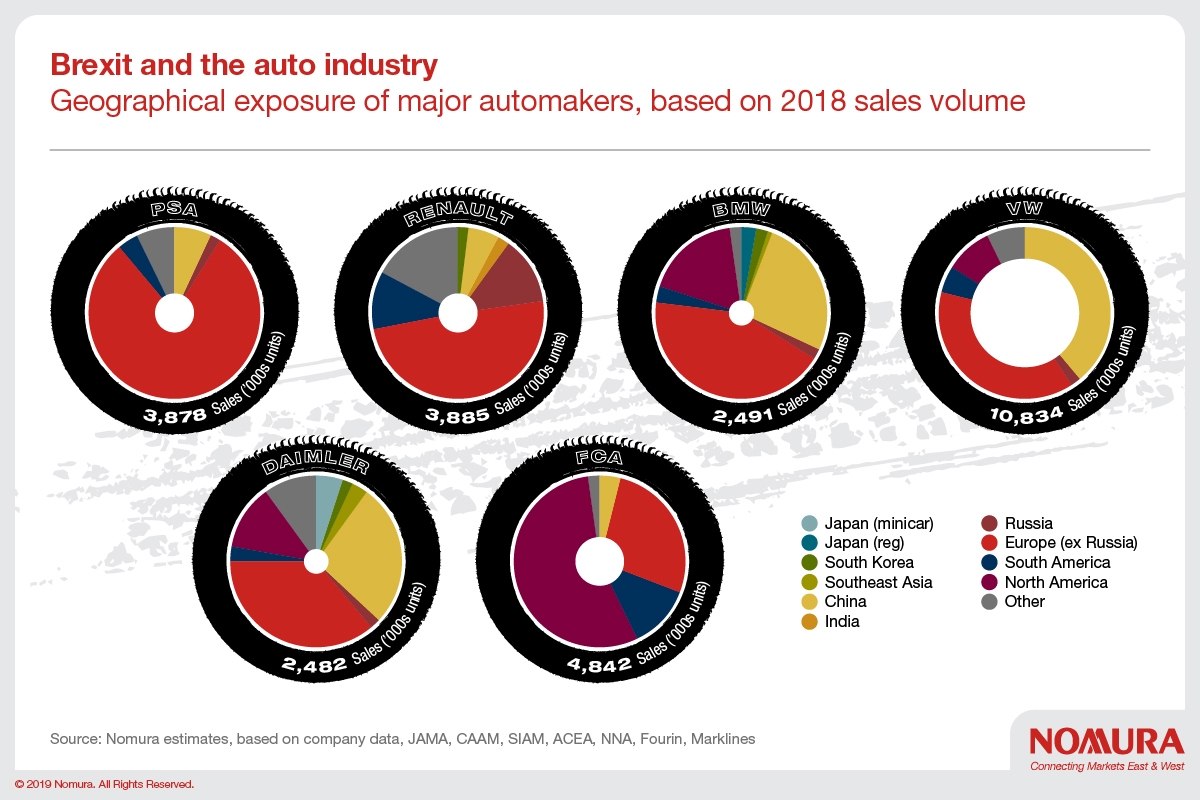

This uncertainty has already been felt in the auto industry and here we take a look at how a no-deal or “hard” Brexit could create further shocks. It’s likely that a hard Brexit would lead to severe negative consequences for auto makers operating in Europe. However, the intensity of the impact on major global automakers would vary significantly, depending on the nature of their exposure to Europe (including the UK).

Before we attempt to quantify the impact of a hard Brexit, we consider the “pathways” through how this event would manifest itself in the auto industry in Europe. We think there are three main areas of concern that would most likely materialize:

- Customs tariffs imposed on the cross-border trade of new vehicles between the UK, and the EU and Turkey.

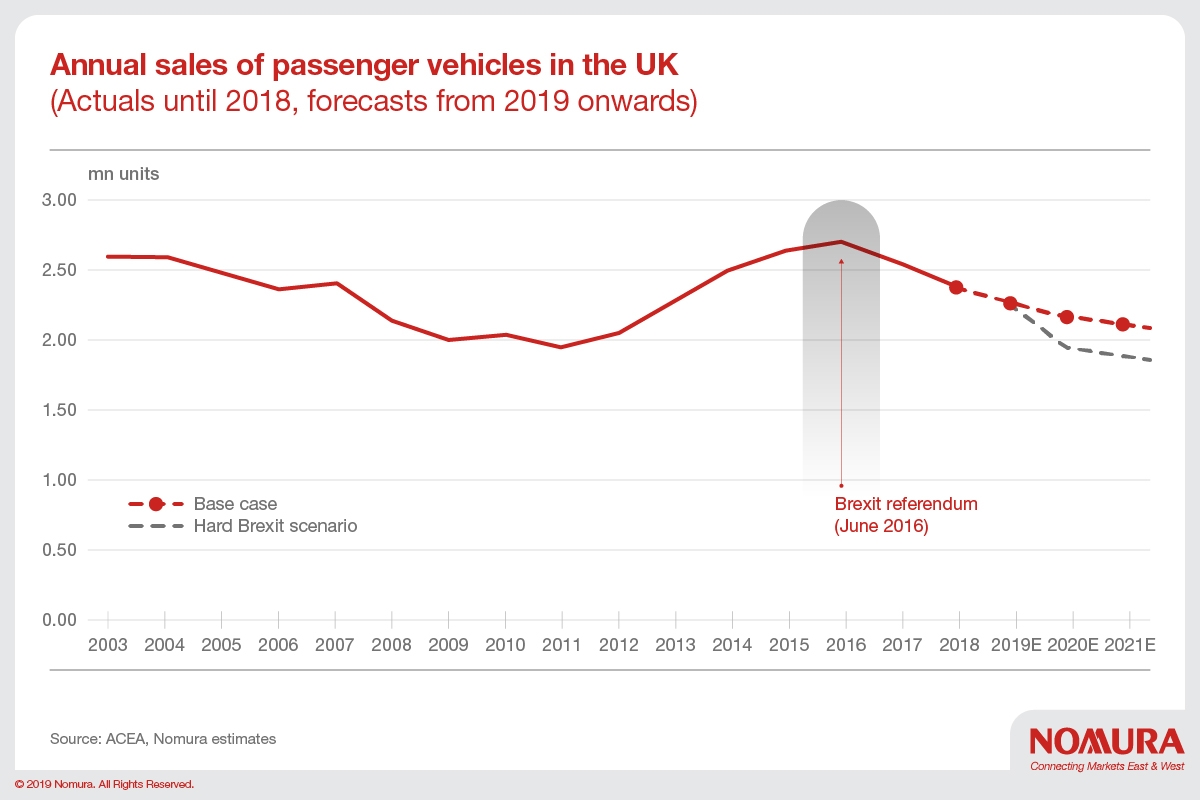

- Lower demand for new vehicles, especially in the UK, as a result of slower economic growth.

- Impact on automotive supply chains in the region, through a) customs tariffs imposed on auto-parts and b) delays at the borders due to removal of the customs union. Specifically impacting the just in time (JIT) production method used throughout the UK auto industry where the movement of goods in and out freely is essential.

Automakers are likely to put the brakes on their manufacturing operations in the UK and significantly downsize, and some may completely shut down, following the precedent of similar decisions made by Honda and Ford earlier this year. After a hard Brexit, the UK government is likely to offer lucrative subsidies and tax breaks in an effort to sweeten the deal for global automakers to maintain their manufacturing operations in the UK.

However, most automakers are likely to go ahead and downsize their UK operations as the uncertainties are too high and it is difficult to justify new investments in UK factories. The UK is a small (annually less than 2.5mn-unit) auto market that is likely to shrink. As a developed market, labour costs are high. Without the benefit of open borders, it would be difficult to sustain auto manufacturing in the country.

Additionally, as automakers start to close manufacturing operations, it impacts other players in the automotive ecosystem (notably auto parts makers), who start to find the lower volumes unsustainable, and eventually close shop as well. Ultimately, we see a hollowing out of the auto industry in the country – similar to what we witnessed most recently in Australia, where the doors closed on the car manufacturing industry in October 2017.

For more information read our report on A Hard Brexit and global OEM’s

Contributor

George Buckley

Chief UK & Euro Area Economist

Masataka Kunugimoto

Head of Global Autos & Auto Parts Research

Anindya Das

US Auto sector analyst

Kapil Singh

Analyst, India Auto & Auto Parts Research

Angela Hong

Analyst, Korea Autos Research

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.