Blue Bonds – A Blueprint for Ocean Conservation

Blue bonds, like their better known green cousins, are growing in popularity as awareness of ocean conservation becomes more important and countries commit to protecting the seas.

- UN signatories have committed to protecting the ocean, a potential tailwind for blue bonds

- Covering 70% of the planet, the ocean helps mitigate climate change by storing large amounts of carbon dioxide

- Efforts are underway to create global guidelines for blue bonds

Blue bonds have emerged as an innovative new financing mechanism to support projects including the sustainable use of the ocean and its resources, and coastal and marine tourism.

Their popularity is increasing as awareness grows about the need to protect the world’s oceans and address the impacts of climate change. In March, UN signatories ratified an historic treaty to protect a third of the seas by 2030, which could be a catalyst for accelerated development of the market. Currently, only about 1% of international waters are protected, which puts limits on overfishing and mining activities.

Covering 70% of the planet, a healthy ocean helps mitigate climate change by storing large amounts of carbon dioxide. It is threatened by plastic pollution, overfishing and temperature rises, which can cause some of that stored carbon to be released.

“We see huge demand for blue bonds from institutional investors yet there isn’t enough supply,” says Aya Kawamoto, Head of Structured Syndicate, EMEA at Nomura. “The 30x30 agreement could be exactly what the market needs to really take off.”

In 2018, the Seychelles issued the world’s first sovereign blue bond, raising $15mn to finance marine conservation and related projects. Since then, several other countries have followed suit including Fiji, Palau and Portugal.

Blue bonds are especially relevant to regions like the Caribbean, home to 23 small and island countries surrounded by coastlines, making its population especially vulnerable to the effects of climate change.

While sovereign blue bonds have been the most common issuance, corporates and municipal organisations have also tested the market. In 2021 AXA investment managers issued a blue bond to finance projects including renewable energy and sustainable water use.

IDB Invest, an arm of Inter-American Development Bank priced a series of blue bonds at the end of last year including a 20-year AUD 50 million issuance. Japan-based T&D Financial Life Insurance Company invested in the bond, that was arranged by Nomura.

The proceeds will finance private sector projects that contribute to UN Sustainable Development Goal 6, Clean Water and Sanitation, and will promote the sustainable use of water resources for economic growth, improved livelihoods, and jobs, as well as ocean conservancy.

A number of Japanese life insurance companies have invested in IDB Invest’s green and blue bonds highlighting their support for concerted climate action.

“Japan is an island nation so its investors understand the challenges of coastal communities,’’ says Kawamoto. “The efficient use of water is linked to increased economic growth making it a win for nature and sustainable development.”

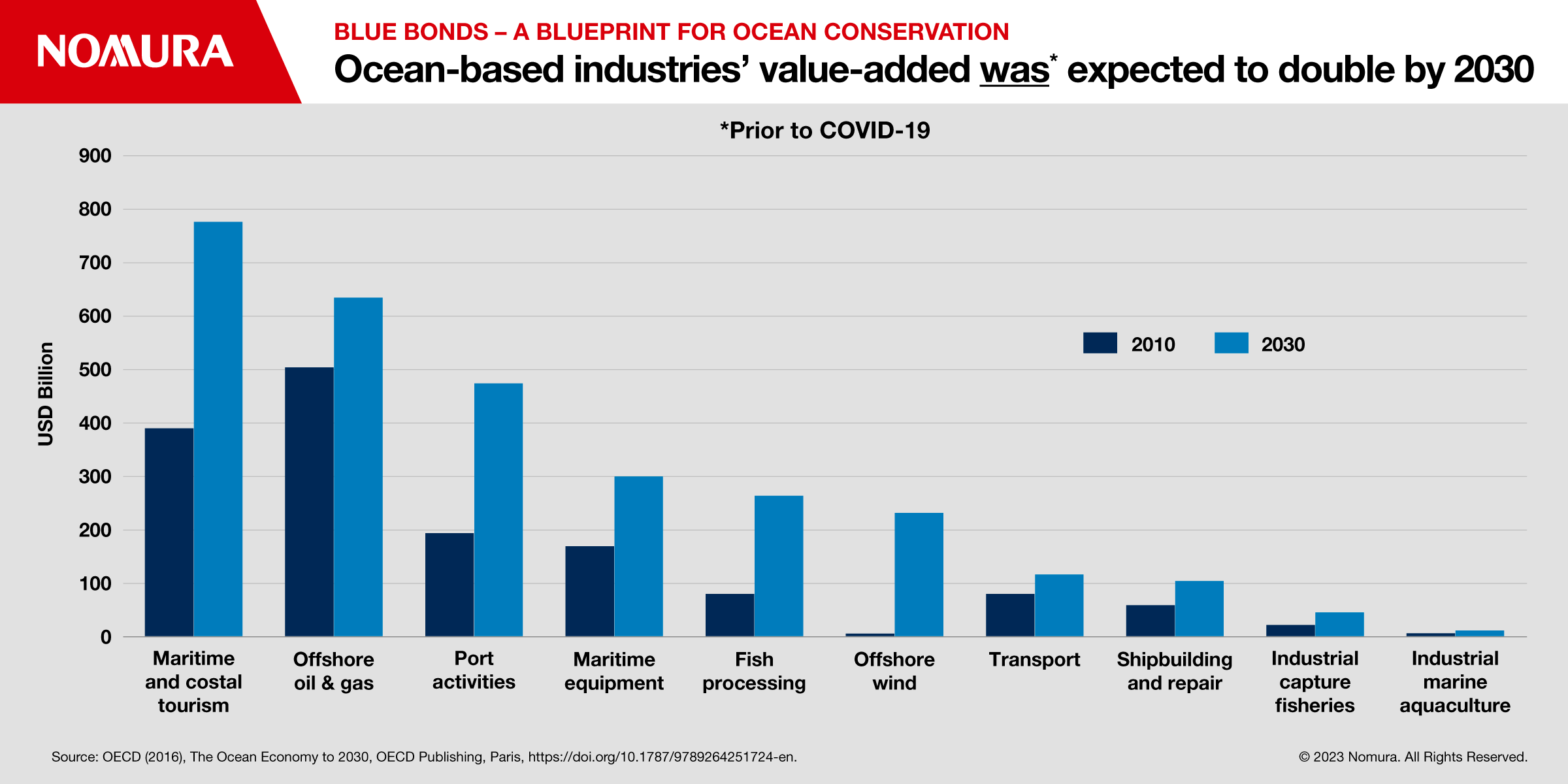

Prior to the COVID-19 pandemic, the OECD projected a doubling of the ocean economy from 2010 to 2030, to reach $3 trillion and employ 40 million people.

Blue bonds are also being used to finance a wider range of projects to address the impacts of climate change.

In 2020, the Seychelles, issued its 2nd blue bond raising $15mn to finance marine conservation and climate adaptation projects such as coastal protection.

UN climate science body, the IPCC, recently underscored the importance of climate mitigation measures to reach net zero emissions. Last year’s floods in Pakistan left a third of the country underwater highlighting the seriousness of the issue.

As with any thematic bond, transparency and accountability are critical to building market credibility. Investors want to know that their funds are being used for the intended purposes and that the projects are achieving their objectives. This requires a strong regulatory framework, clear and measurable targets, regular reporting and independent verification.

For example, the Seychelles’ first blue bond includes a commitment to report annually on the use of funds and the impact of the projects. It was structured in accordance with the International Capital Markets Association’s (ICMA) green bond principles and certified by the climate bonds initiative.

The World Bank’s International Finance Corporation (IFC) and ICMA are among a consortium of organisations working on guidelines for global consistency of the blue bond market, which could further incentivize issuance.

This includes the need for clear eligibility criteria for projects, independent assessments of the projects’ environmental and social impacts, and effective monitoring and reporting mechanisms.

A robust market for blue bonds would help attract a more diverse range of investors. While there has been an increase in the number of issuances, the market for blue bonds is still a tiny fraction of the overall ESG bond market.

This can make it challenging for issuers to raise sufficient funds and for investors to find suitable investment opportunities.

To address this, there is a need for standardization of blue bond structures, as well as greater awareness and education about the benefits and risks of investing in blue bonds.

Finally, it is important to recognise that blue bonds are just one of many tools that can be used to support ocean conservation and sustainable use albeit one that has tremendous potential.

Other tools include grants, subsidies, and technical assistance. Blue bonds can complement these tools by providing long term financing for larger scale projects that require significant investment.

Download a PDF of the full whitepaper

Contributor

Aya Kawamoto

Head of Structured Syndicate, EMEA

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.