Biden gears up the US auto-industry to get back on a more sustainable track.

Given Biden's pledges to reform environmental policy what are the likely repercussions for the auto industry?

- What kind of regulations can we expect from Biden given his pledge to reform environmental policy?

- What are the specific standards US automakers should watch out for?

- How are these potential changes going to be different from Obama/Trump era regulations?

A pillar of president-elect Joe Biden’s bid for the keys to the White House was the radical reform of US environmental policy, something which will force change in the US automaker industry.

We think the Biden era Presidency is likely to impact the auto industry in two main ways:

- Tighter environmental regulations.

- Promotion of zero-emission vehicles through tax breaks and expansion of charging infrastructure.

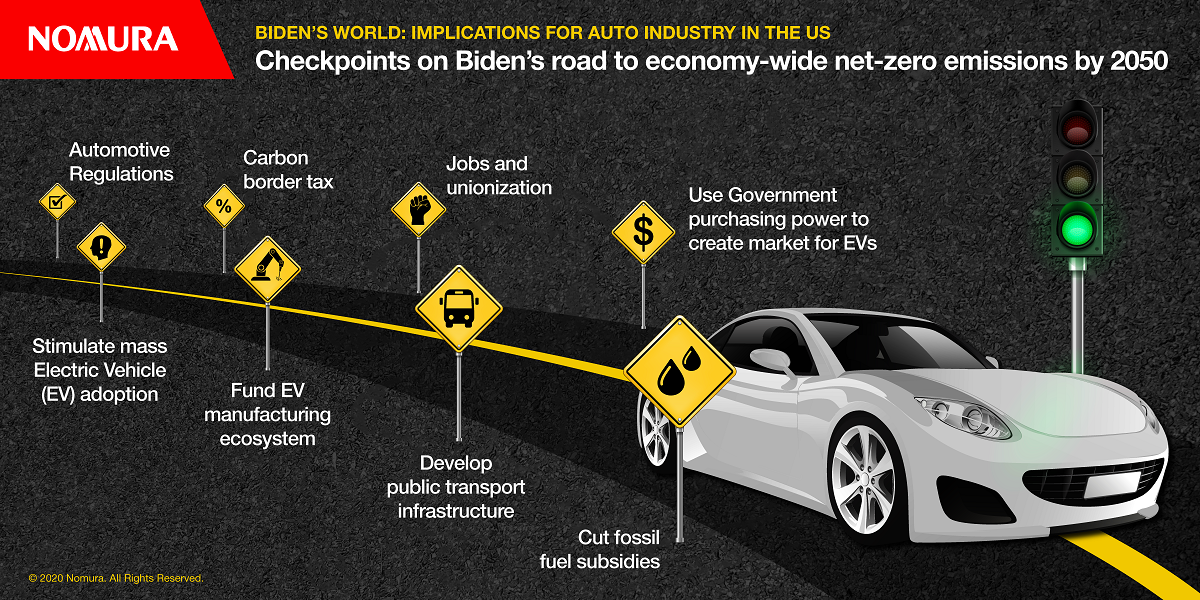

In his election manifesto, Biden devoted considerable space to his priorities for the auto industry and how it dovetails with his broader intention to set the US on a path to achieve economy -wide net-zero emissions by 2050. Furthermore, Biden has declared that he will re-commit the US to the Paris Agreement on his first day in office.

From his election manifesto (detailed here, here, and here) we have outlined and summarised his priorities:

- Automotive regulations: Develop fuel economy standards that go beyond what the Obama administration put in place, such that these standards accelerate the adoption of zero-emission light- and medium-duty vehicles.

- Stimulate mass Electric Vehicle (EV) adoption: Restore full EV tax credit and ensure it is targeted toward middle-class consumers and prioritizes US-made vehicles; Support the Clean Cars For America proposal through a “green” cash-for-clunkers program to swap old cars for US-built EVs, PHEVs and FCVs; Set up 500,000 new public chargers by the end of 2030, funded as part of a $2 trillion infrastructure spending program.

- Use government purchasing power to create market for EVs: Government will purchase “tens of billions of dollars of (US-made) clean vehicles and products”. This is part of Biden’s commitment to increase federal procurement of products made by American workers by $400bn in his first term.

- Fund EV manufacturing ecosystem: Dedicated funds and grants to help auto and parts manufacturers retool and build new factories for EV production, including EV components and batteries; promote more EV research and development in the US.

- Jobs and unionization: Pledge to create 1mn new jobs in auto manufacturing and supply chains in the US; working to pass the PRO (Protecting the Right to Organize) Act so that auto workers can choose to join a union more easily.

- Carbon border tax: Impose carbon adjustment fees or quotas on carbon-intensive goods from countries with loose environmental standards.

- Develop public transport infrastructure: Increase federal transportation funding for infrastructure that lowers emissions, and promote public transportation to speed up decarbonisation of society.

- Cut fossil fuel subsidies: Pledge to cut fossil fuel subsidies in the US and redirect funding to build clean energy infrastructure; support demands for a worldwide ban on fossil fuel subsidies

How are these likely to trickle down to US automakers?

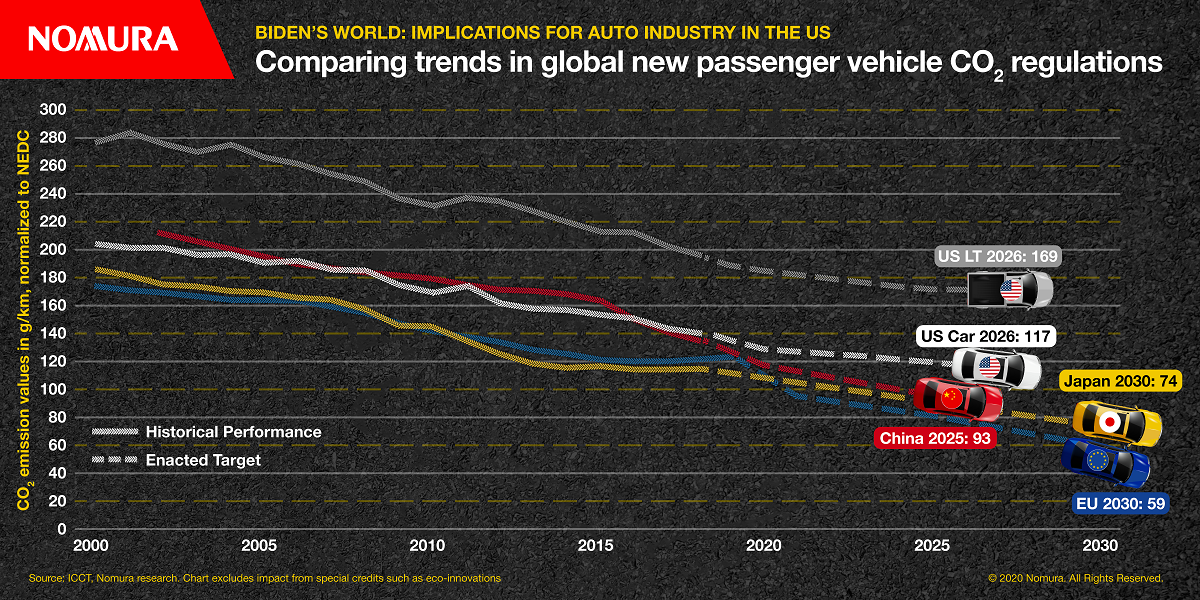

These policies and projected changes would reverse the direction taken by the Trump administration thus far, and would take the US auto industry far closer to the fuel economy standards envisaged during the Obama era.

We think these stricter regulations are unlikely to come into force before 2025 due to legal requirements for allowing automakers enough time to prepare for such changes.

However, automakers already see the writing on the wall, and have to speed up their fuel economy improvement and CO2 reduction efforts from next year (2021) itself to be in shape to face these tougher standards in 2025. Exceeding requirements now, while the regulations are still relaxed, would allow automakers to accumulate excess “credits” which they can use to cover up their shortfalls when the regulations become stricter in later years. Otherwise they run the risk of paying large fines.

Biden also might increase fines for failing to comply with fuel economy regulations. Fines are still relatively low at $5.50 per 0.1 mpg, after Trump overturned a proposed increase to $14 from 2019 onwards. Last heard, American courts had reversed Trump’s rollback and if Biden does not pursue the matter then the $14 rate will become a reality. This would suit Biden as the higher penalty rate would act as a stick for automakers to improve fuel economy faster.

Overall Biden’s increased focus on environmental policy and economy-wide net-zero emissions by 2050, are going to provide a tricky landscape for automakers to navigate. But this is not purely a challenge for the US, as other countries are already going down that path. The US will just have to catch up.

For more information read our full report on ‘Biden’s world: Implications for Auto Industry in the US’

Contributor

Anindya Das

US Auto sector analyst

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.