Asia Pacific Technology: The Bull Phase to Continue in 2020F

- Upstream (semi and equipment/materials) to be more attractive in the tech sector in 2020. The memory sector, in particular, should show strong recovery in 2020.

- 5G-related themes are likely to remain as a major growth catalyst for major components in 2020F.

- Mega trends (OLED, EV) to benefit related supply chain companies.

We expect upstream companies to be more attractive in the tech sector in 2020. Though the shipment growth of major set products is unlikely to be exciting, major component companies are likely to benefit from the product upgrade cycle stimulated by the fierce competition among set companies, coupled with set customers’ inventory replenishment demand in 2020F. Notably, we expect memory sector stocks to record the highest growth in our tech coverage space owing to the favorable supply and demand dynamics after significant downturn after capex cuts in 2019.

5G-related themes are likely to remain as a major growth catalyst this year. Among foundry and fabless players, we are selectively positive on companies that are likely to benefit from booming 5G demand with decent valuation.

Meanwhile, the LCD market, helped by ongoing restructuring, is expected to recover. Chinese panel companies are likely to benefit. In addition, we expect a surge in OLED TV production and strong demand for foldable display, thus, OLED companies and related supply chain are also attractive.

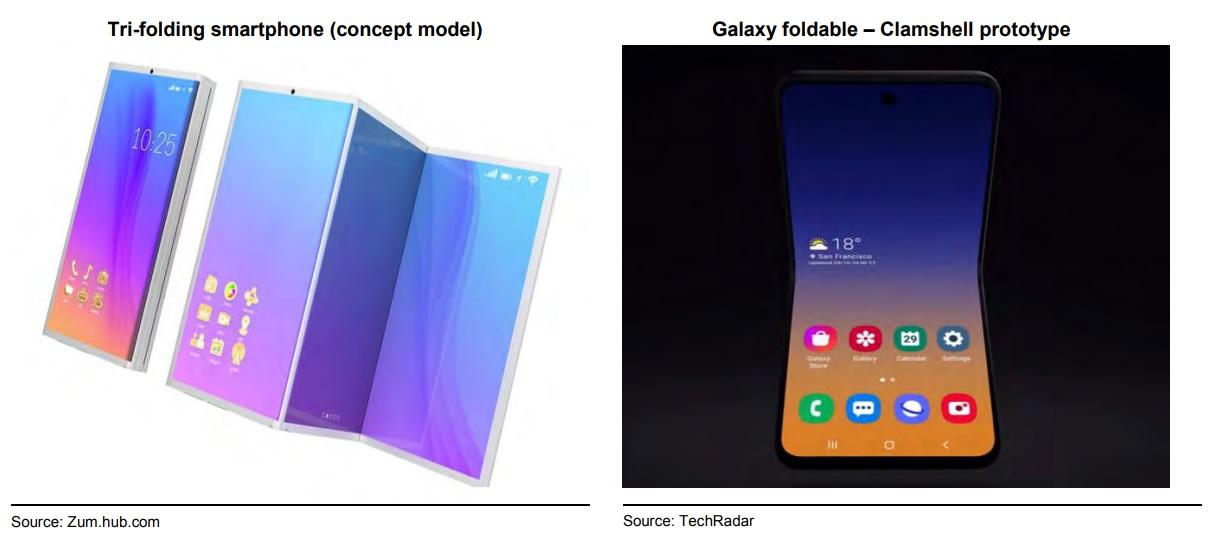

Emerging new tech or components including, notably, foldable phones should see increased interest with various form factors in 2020, and more multi cameras and under-display fingerprint sensors should continue to remain mainstream.

We also believe that EV demand and related supply-chain should benefit from the tightening of CO2 regulations in EU.

For more details on new memory super cycle, display and handsets looks like in 2020F, read the full report here.

Contributor

CW Chung

Head of Research, Korea and Pan-Asia Tech / Semiconductors Research

Masaya Yamasaki

Industrial Electronics, Japan

Tetsuya Wadaki

Semiconductor Production Equipment & Precision Instruments, Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.