Economics | 3 min video December 2018

Emerging Markets | 0 min video | December 2018

Emerging Markets | 0 min video | December 2018

Reflect and refract: Our best- and worst-performing FX trades

Our best-performing FX trades over the first 11 months of 2018 were long USD/CNH and IDR recommendations. Long USD/CNH was added on seven occasions from July to November 2018, which yielded total spot returns of +584bp (total return of +322bp). Our view was premised upon capturing the step up in trade protectionism and the deteriorating China macro backdrop. Due to concerns over policymaker FX actions and volatility related to trade protectionism, the tenor of these trades was relatively short. We traded USD/IDR on ten separate occasions from the start of the year until end-November for a total return of 715bp. With oil price falling, environment for EM high yielders improving, and stable foreign equity inflows, we switched our positions from long USD/IDR to short in November 21 and managed to capture a total return of 284bp.

On the other hand, although THB was one of the better performing currencies in the region, our 14 short USD/THB trades suffered (TR -93bp) and thus it became one of the worst-performing trades. We held this position through most of the year as a relative value trade and to lower the volatility of our portfolio.

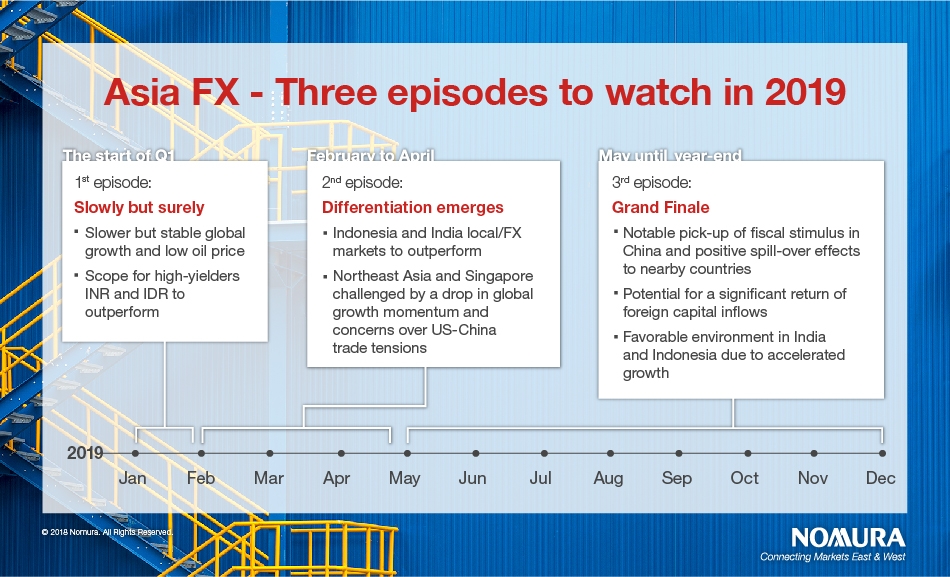

Asia FX strategy into 2019: Three episodes to watch

We believe the performance of Asia FX/local markets over the coming year can be categorized into three episodes. In the first episode, which runs into the start of Q1 2019, we expect a continuance of our base case of slower but stable global growth and low oil prices. Asia FX should hold stable (versus USD) and local markets should remain broadly conducive. We see scope for high-yielders INR and IDR to outperform following recent selling pressure.

Episode two occurs from around February to April and should lead to some differentiation, where Indonesia and India local/FX markets outperform while Northeast Asia and Singapore are challenged by a drop in global growth momentum and concerns over US-China trade tensions in February. Asia FX could experience notable moves during this period, as USD/CNY could break 7.0 and exert depreciation pressure on Northeast Asia FX and SGD.

During episode three from May until year-end we expect some positive developments – such as a notable pick-up of fiscal stimulus in China – to support China and markets closely linked to China. Following the expected period of capital outflows and reduced positioning in February to April, we see potential for a significant return of foreign capital inflows. We also see a favorable environment in India and Indonesia from an anticipated acceleration of growth, a greater divergence with developed market growth and solid capital inflows.

Key factors that affect our Asia rates outlook

We believe a maturing Fed tightening cycle and lower oil prices will put flattening pressure on regional rates curves. We also see real yield compression among highyielders and a constructive EM backdrop increasing demand for Indonesia and India bonds. In China and India, we believe liquidity and local factors will play a major role in 2019. Finally, we see value in front-end receivers and steepeners in countries where we believe money markets rates will remain stable.

Asia rates strategy: back to Goldilocks

We believe a maturing Fed tightening cycle and lower oil prices will exert flattening pressure on the curves and therefore recommend SGD and THB curve flatteners. We also see real yield compression among the high yielding markets and positive EM macro conditions should increase demand for Indonesia and India bonds. On China, we expect long-end swap rates to decline as macro headwinds remain a strong theme in H1 2019. In Hong Kong, we like receiving the front end to position for a potentially slower pace of Fed rate hikes in 2019. Finally, we like AUD steepeners on valuation grounds and our view of a stable front end.

For more detailed Asia FX and rates strategy into 2019, please read Asia in 2019: Always darkest before the dawn

Global Head of FX Strategy

Asia Rates Strategist

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.

Economics | 3 min video December 2018

Economics | 2 min video December 2018

Economics | 4 min video December 2018