Asia Economic Monthly: The Currency Dilemma

Despite low inflation and soft growth, currency weakness is constraining some Asian central banks’ ability to cut policy rates

- Amid the broad dollar strength, should Asian central banks let their currencies weaken and cut policy rates to support waning growth, or focus on inflation risks and financial stability?

- Heavy FX intervention may not be sustainable for Asia since depreciation pressures could persist

- Indonesia is most sensitive to FX depreciation risks, while economies like the Philippines, India and Thailand are likely to continue with monetary policy easing, in our view

FX pressures are here to stay

Asian local currencies have been depreciating against the US dollar since October. During this period, central banks in the region have let currencies weaken and drawn down on their FX reserves. Among Asian countries, Indonesia, Malaysia and South Korea have followed a more laissez-faire approach by letting their currencies weaken, while India has intervened the most, according to Nomura analysis.

Pressure on Asia FX is likely to persist. If President Donald Trump imposes tariffs quickly, inflation in the US may pick up, which could prompt the Federal Reserve to cut its policy rate only once (in March). However, it is important to note that Asia’s currency challenge this time will likely not be a repeat of the Asian financial crisis in 1997-1998 or the taper tantrum in 2013 as economies in the region have more flexible exchange rates and higher FX reserves than in the past. The region’s macroeconomic fundamentals have also improved significantly, with greater current account surpluses or lower deficits, lower inflation, positive real rates and less reliance on short-term unhedged FX-denominated debt.

Still, 2025 will be a year in which Asian central banks face a currency dilemma. Cutting rates to support growth can result in capital outflows, which could exacerbate local currency weakness and lead to higher inflation and financial stability concerns. Meanwhile, keeping policy rates unchanged could lead to weaker growth. There are no easy policy options.

As per the impossible trinity in economics, only two of the following three options can be held at any one time: fixed exchange rate, free capital flows and an independent monetary policy. What should they choose this time? Instead of adopting a corner solution, most Asian central banks today have an intermediate policy regime: some exchange rate flexibility and partial capital account openness, which offers them some degree of monetary policy flexibility.

Allowing for currency weakness

There are five reasons why Asian central banks should allow some currency weakness this year rather than let monetary policy be hostage to FX concerns:

- Shock absorber: Export growth remains lackluster outside of semiconductors, and incoming tariffs may slow export growth more sharply this year. A weaker currency can prevent the trade balance from deteriorating too sharply.

- Negate tariffs from President Donald Trump: Resisting currency adjustment may lead to a more adverse hit to export competitiveness at a time when the impact of Trump’s protectionist tariff measures is likely to be compounded by a redirection of Chinese exports into Asia.

- Rising cost of intervention: Excessive FX intervention can work if currency pressures are transitory. Otherwise, there is a risk that currencies become vulnerable to speculative attacks as FX reserves fall. Heavy unsterilized USD selling can also tighten domestic liquidity and worsen growth prospects.

- Inflation is not a problem: Currency weakness leads to higher imported inflation, but the starting point is that of low inflation across much of Asia. 2025 inflation will remain within targets for most economies, according to Nomura analysis.

- FX-denominated debt is low: Currency weakness can inflate the value of FX-denominated external debt, triggering financial vulnerabilities. Since the Asian financial crisis, Asia has proactively reduced its dependence on FX-denominated external debt, favoring more local currency debt.

Asia’s eclectic FX toolkit

Managing the pace of currency depreciation is important. So far, Asian central banks have largely relied on their first line of defense in the form of FX intervention and allowing some currency weakness. Down the line, they could also activate their second line of defense (i.e. macroprudential and capital account tools), such as mandating exporters to sell their foreign currency proceeds and reducing non-productive imports such as gold. In the event of extreme BOP pressures, they can also tap their third line of defense (i.e. bilateral swap lines).

One size does not fit all

Based on Nomura’s assessment, Bank Indonesia is the most sensitive central bank in the region to FX depreciation risks. We expect monetary policy easing to continue in the Philippines, India and Thailand despite currency depreciation. Korea and China lie somewhere in the middle as the timing of their rate cuts may be sensitive to currency risks.

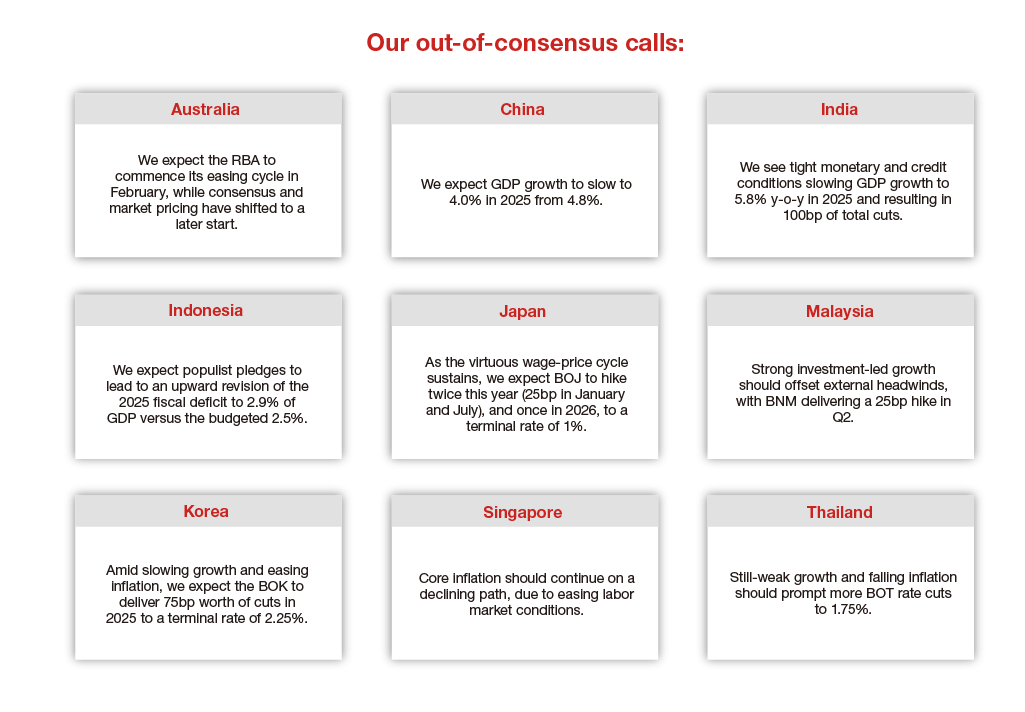

Our more nuanced views on each economy:

- China: Beijing is now less tolerant of significant RMB depreciation versus the dollar because of the mandate to foster a “powerful currency” and stabilize property and stock markets. We expect the People’s Bank of China to cut the RRR soon, while shifting rate cuts to a later timing.

- India: A mix of some FX intervention to smooth the pace of depreciation, while still allowing the currency to weaken is likely. We don’t expect the Reserve Bank of India to use policy rates to defend the currency as domestic demand is already weak due to restrictive monetary policy. It will also need to inject more durable liquidity to enable monetary policy transmission.

- South Korea: Smoothing FX volatility may be the main policy objective and non-rate policy tools will mainly be used to stabilize the FX market. Although the weaker won is limiting the Bank of Korea’s ability to cut the policy rate, we expect non-rate policy tools to help ease depreciation pressures and support rate cuts.

- Indonesia: Bank Indonesia is among the most sensitive central banks in the region to FX depreciation risks and its cutting cycle has been severely constrained by a weakening IDR. In line with a more hawkish Fed, we expect BI to remain on hold for the rest of 2025.

- Philippines: The Philippines adheres most strictly to its inflation-targeting framework. With limited foreign ownership of government bonds, interest rate differentials are unlikely to be the main driver of capital flows, allowing the central bank to decouple from a more hawkish Fed.

- Malaysia: Malaysia is not an inflation targetter. Bank Negara Malaysia decides on a policy rate that is consistent with its assessment of the outlook for growth and inflation. However, BNM is also focused on preventing a build-up of financial imbalance risks.

- Thailand: Thailand should welcome Thai baht depreciation to support external competitiveness and the tourism sector, which continue to struggle. FX weakness has limited implications on policy rate decisions, which are driven more by other considerations, including preserving policy space. Bank of Thailand may cut rates in April and August, when we expect more evidence of growth weakness.

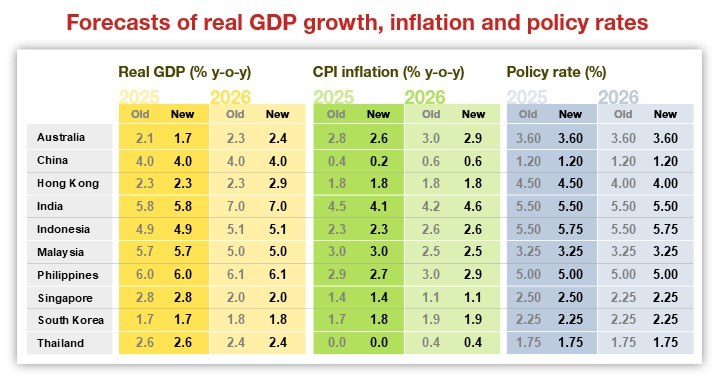

For more on our growth projections, read our full report.

Ting Lu, Euben Paracuelles, Charnon Boonnuch, Aurodeep Nandi, Jeong Woo Park, Jing Wang, Nabila Amani, Harrington Zhang and Yiru Chen also contributed to this article.

Contributor

Sonal Varma

Chief Economist, India and Asia ex-Japan

Si Ying Toh

Economist, Asia ex-Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.