Asia Economic Monthly: Shape of Asian exports recovery: L, U, V or W?

We expect the Asian exports downcycle to hit its lowest point in Q2, but the shape of recovery is uncertain.

- Export growth in Q2 will likely be worse than in Q1, but it should mark the cycle bottom.

- Our baseline forecast is for a modest U-shaped exports recovery with a 50% probability, but a double dip (W) can’t be ruled out.

- If Asian economies can achieve a soft landing, intra-Asian trade could serve as a cushion against faltering demand from outside the region.

Asia’s export downturn has been going on for over a year, but the worst is expected to pass soon. On average, export growth in Q2 will likely be worse than in Q1, but it should mark the cycle bottom. Exports were pummeled by the steep China slowdown in 2022 due to the country’s zero-Covid strategy and property downturn, a collapse in semiconductor shipments amid weakening work-from-home PC demand, a slump in goods demand in developed markets as consumers spent more on services than goods after reopening, and weaker commodity demand from upstream firms due to inventory losses. As these headwinds fade, Asia’s export growth may also stabilize.

Over the past year, exports of semiconductors & electronics, chemicals and electrical machinery have declined. In contrast, exports of transport equipment and petroleum products held up. By destination, exports to China have weakened the most, followed by the US and EU, while exports to ASEAN and the rest of the world have held up.

Beyond Q2, we see two main factors supporting Asian exports:

Chips: We expect semiconductor shipments to decline by 20% year-over-year in Q2 and then begin a recovery towards a 2% y-o-y decline by Q4 before growing again by 9% y-o-y in mid-2024. The pickup will first come from inventory restocking, followed by increased demand for consumer verticals, mainly smartphones and PCs. A production cut from Korean memory firms should also lift memory prices from Q3.

China: We expect the drag from China to ease in H2. While the reopening initially led to the release of pent-up demand for services, the pass-through to property investment will likely only happen in H2. Asia’s exports are historically more sensitive to China’s investment demand than to China’s consumption. We forecast China’s real import demand to be 0.7% y-o-y in H1, 4.0% in H2, and 4.8% in 2024, up from the 6.0% contraction in 2022.

We forecast a few different scenarios for the shape that Asia’s exports recovery will take. Our baseline forecast is for a modest U-shaped recovery with a 50% probability. In this scenario, Asia’s exports bottom out in Q2 and will see a steady pickup in H2.

Weaker-than-expected final demand in the US caused by a hard landing, however, could result in a double dip (W-shape) in Asia’s export cycle, which we predict with a 30% probability. In this scenario, the tech cycle should still improve due to inventory demand, but not enough to offset the drag from softening US demand.

Our next scenario is for a sharp recovery (V-shape) with a 15% probability, led by a faster-than-expected rebound in semiconductor exports, a turnaround in China’s goods demand and US firms’ rebuilding of inventories.

The least likely outcome (L-shape) with a 5% probability, would be the result of a lackluster export sector as a sustained recovery in China demand fails to materialize, and US and Europe demand disappoint.

Within Asia, exports from tech clusters such as Korea and Singapore dipped sharply in H2 2022, while exports from Indonesia, Malaysia and India held up relatively well. As the tech cycle improves and US-China growth trends diverge, the impact across Asian economies’ exports will likely differ. Different economies have different sensitivities to final demand from the US and Europe, or G2. Weaker G2 demand will have a more significant negative impact on the southern parts of Asia, including Thailand, India and the Philippines.

Intra-Asian trade has also risen in recent years, mainly for intermediate products, but also for goods that directly relate to final demand. If Asian economies can achieve a soft landing, intra-Asian trade could serve as a cushion against faltering demand from developed markets.

Although export growth is expected to recover beyond Q2, domestic final demand in Asia will continue to weaken in the second half of the year, per our growth cycle framework. Equipment investment demand will likely moderate on elevated economic uncertainty, while slowing job gains will temper private consumption demand. The softer aggregate demand in Asia should support an accommodative monetary policy stance, especially as disinflationary factors gain further traction.

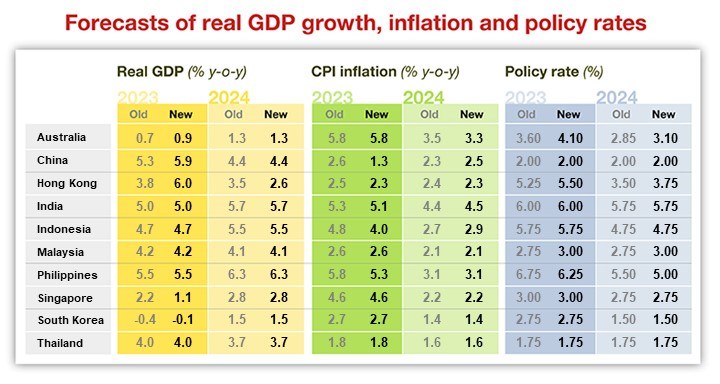

For more on our 2023 growth projections, read our full report.

Contributor

Sonal Varma

Chief Economist, India and Asia ex-Japan

Si Ying Toh

Economist, Asia ex-Japan

Disclaimer

This content has been prepared by Nomura solely for information purposes, and is not an offer to buy or sell or provide (as the case may be) or a solicitation of an offer to buy or sell or enter into any agreement with respect to any security, product, service (including but not limited to investment advisory services) or investment. The opinions expressed in the content do not constitute investment advice and independent advice should be sought where appropriate.The content contains general information only and does not take into account the individual objectives, financial situation or needs of a person. All information, opinions and estimates expressed in the content are current as of the date of publication, are subject to change without notice, and may become outdated over time. To the extent that any materials or investment services on or referred to in the content are construed to be regulated activities under the local laws of any jurisdiction and are made available to persons resident in such jurisdiction, they shall only be made available through appropriately licenced Nomura entities in that jurisdiction or otherwise through Nomura entities that are exempt from applicable licensing and regulatory requirements in that jurisdiction. For more information please go to https://www.nomuraholdings.com/policy/terms.html.